Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

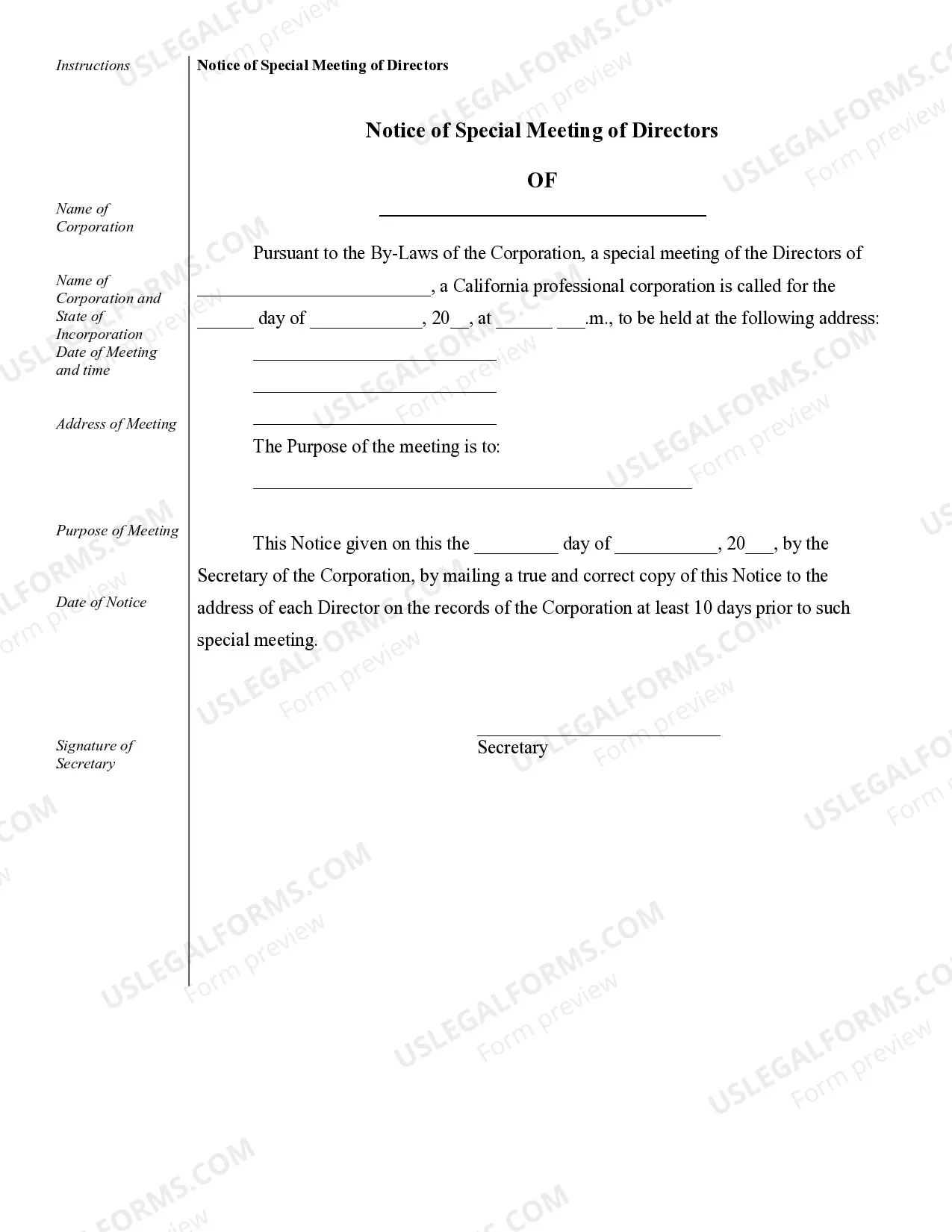

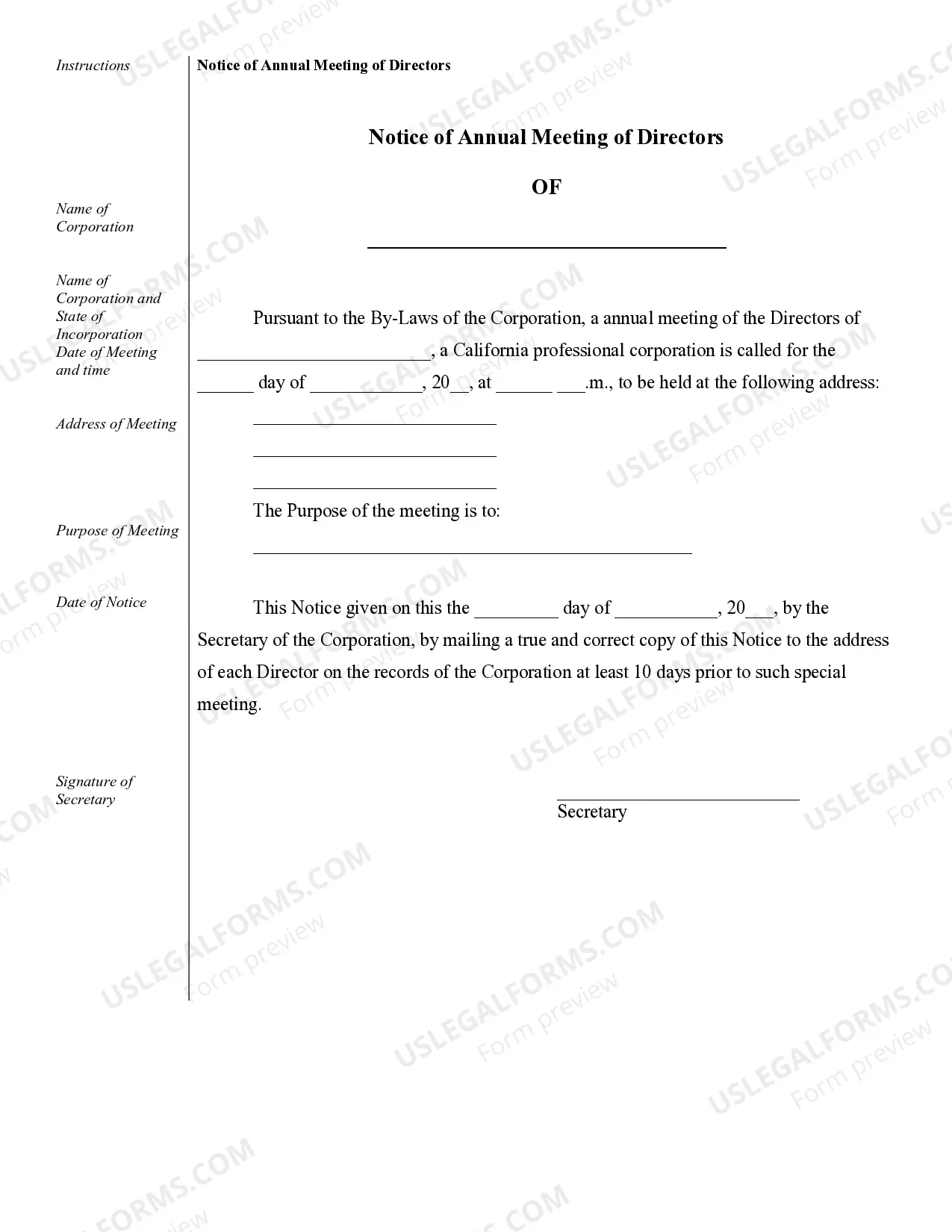

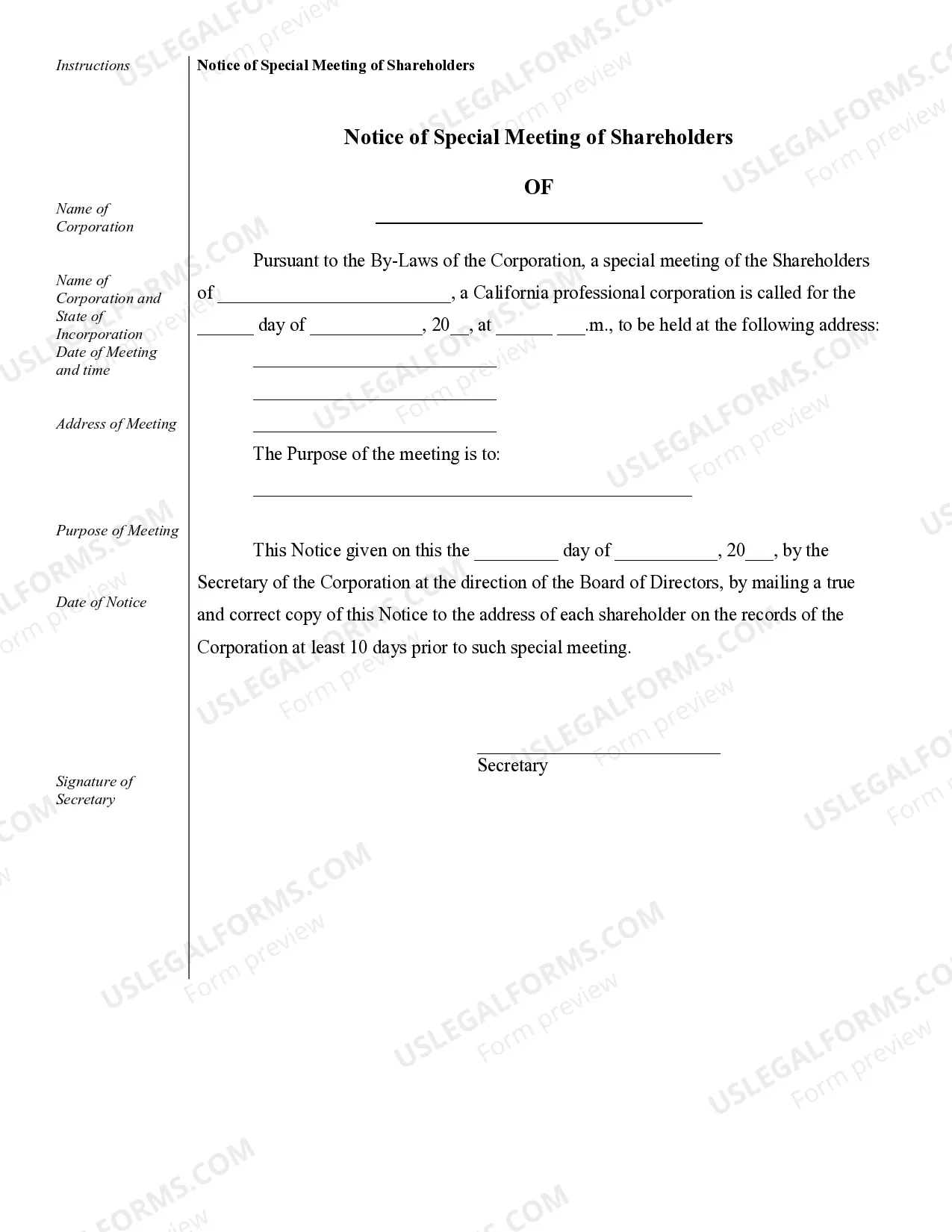

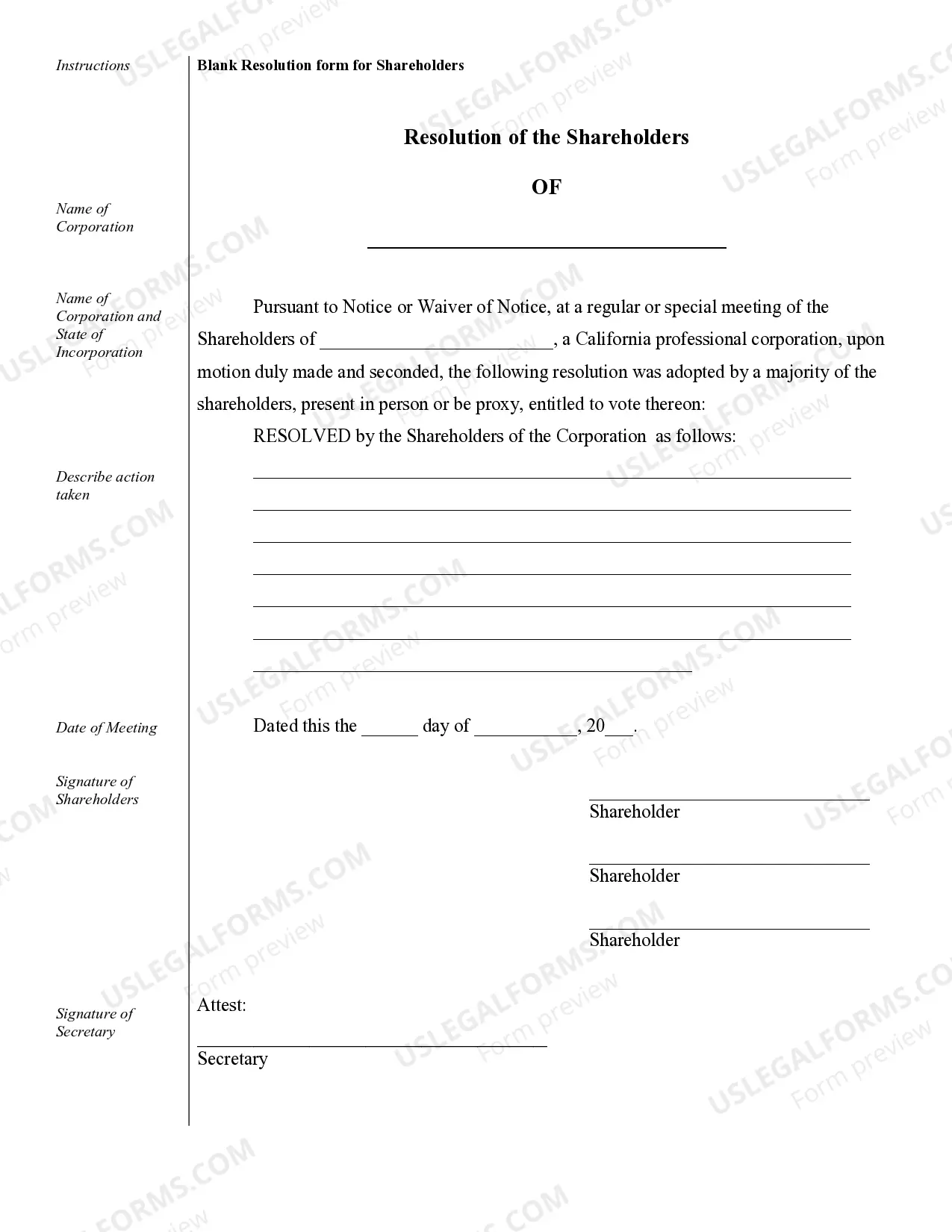

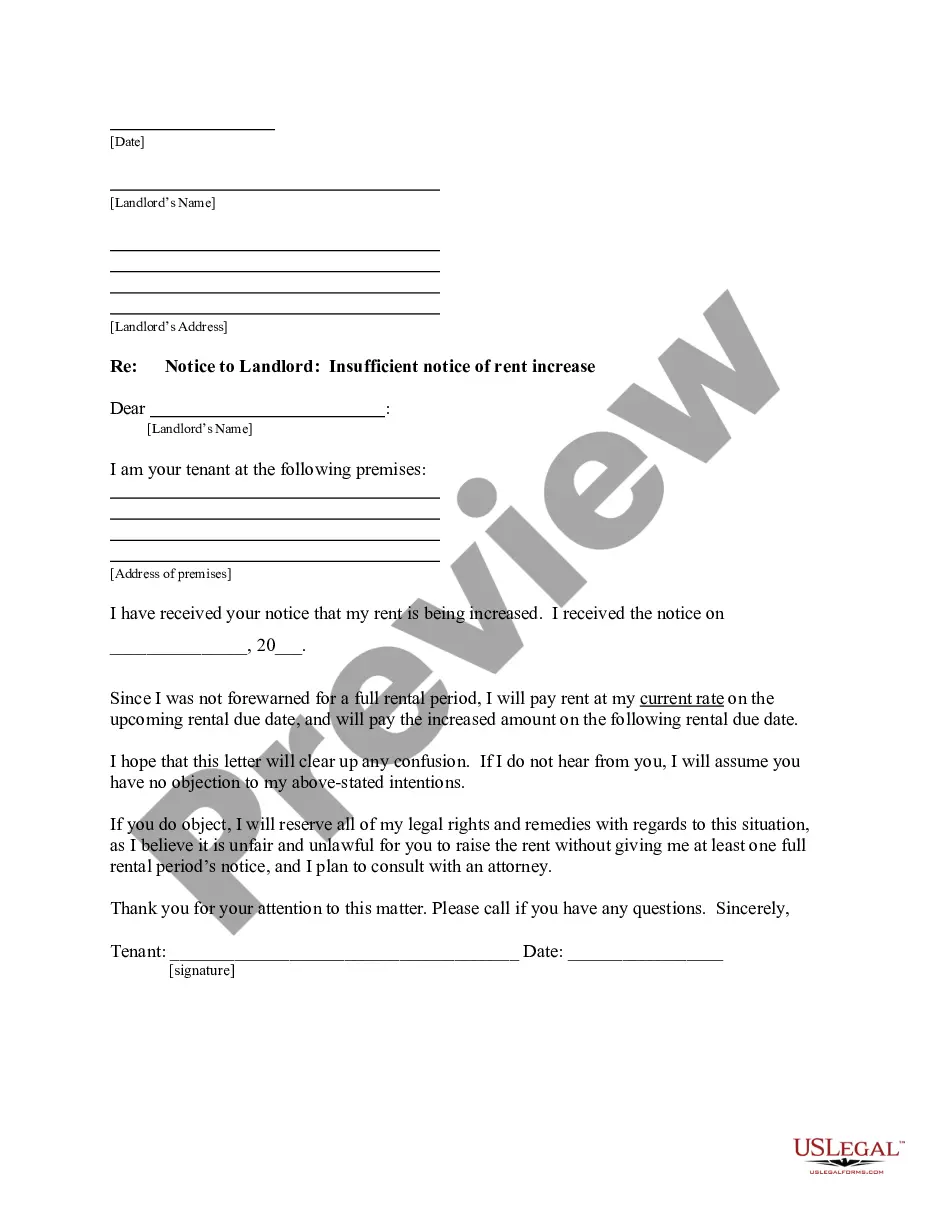

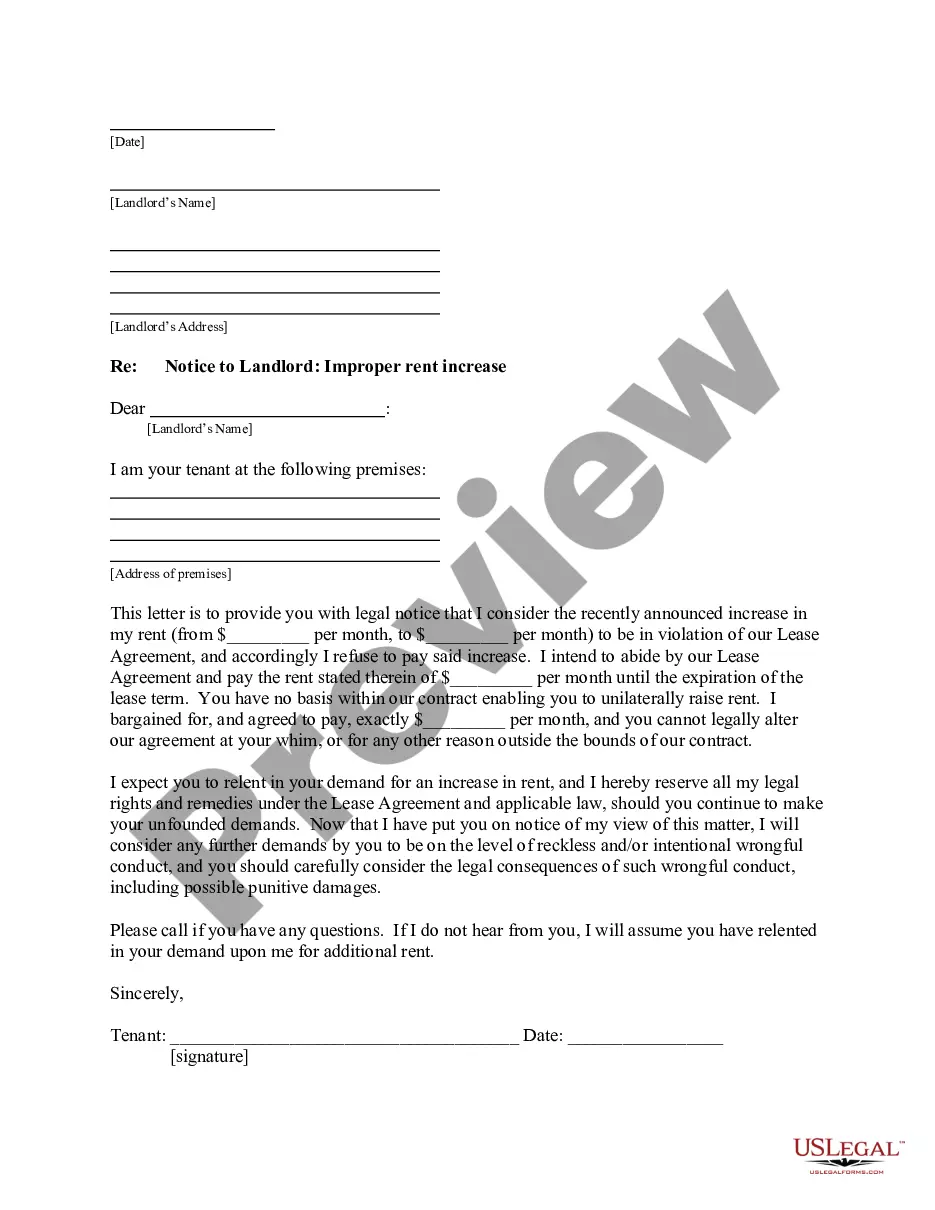

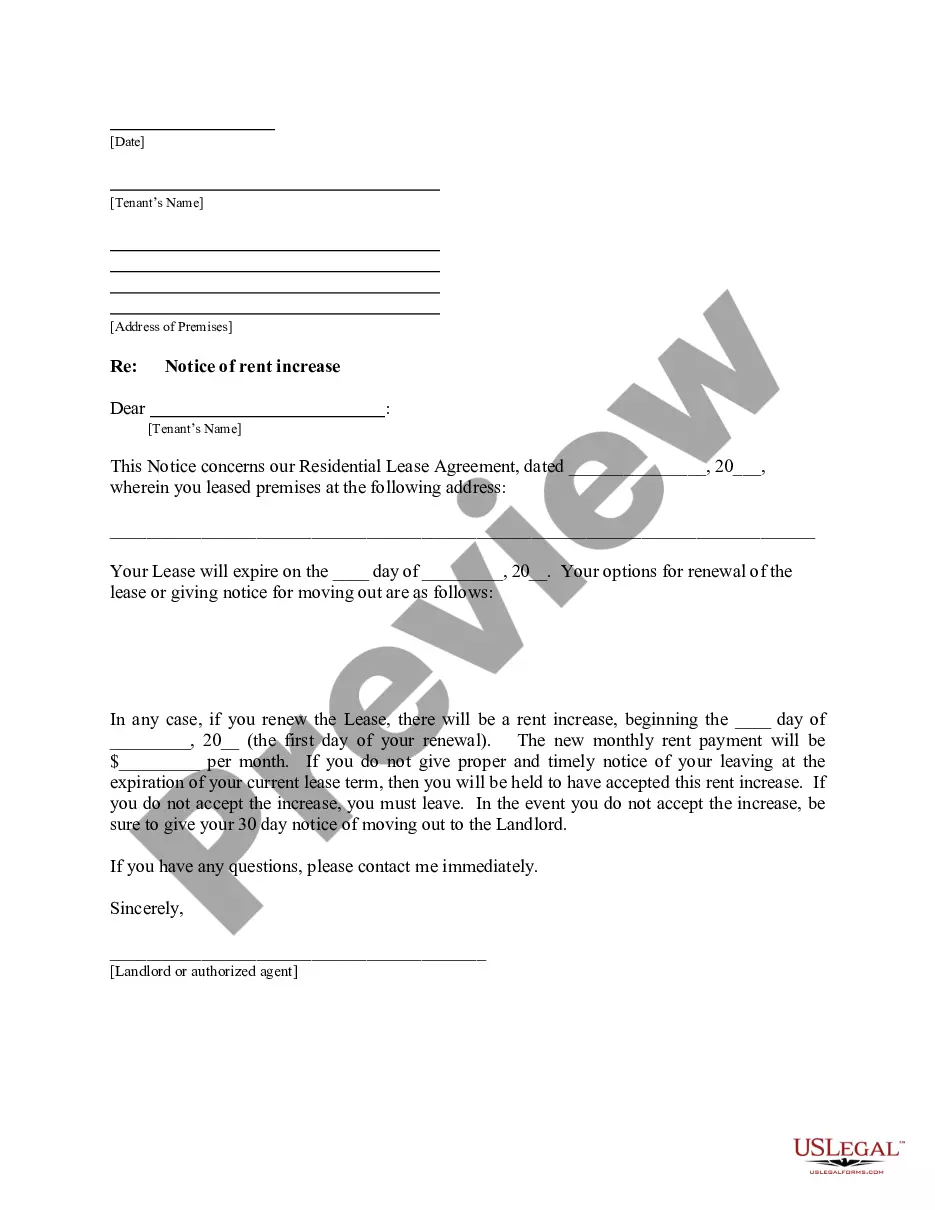

Visalia Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive record of the activities, operations, and legal aspects of a professional corporation based in Visalia, California. These records are crucial for maintaining transparency, legal compliance, and preserving corporate history. The following are some key types of Visalia Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: These records include the formation document filed with the California Secretary of State, which establishes the existence of the professional corporation. It includes information such as the corporate name, purpose, duration, principal place of business, and names and addresses of incorporates and initial directors. 2. Bylaws: Bylaws serve as the internal rules and regulations that govern the corporation's operations. They outline procedures for meetings, appointment of officers, voting, and other corporate matters. 3. Shareholder Agreements: Shareholder agreements define the rights, responsibilities, and obligations of the corporation's shareholders. These agreements can cover issues like share transfers, buy-sell provisions, dividend policies, and control of the corporation. 4. Minutes of Meetings: Detailed records of the minutes of directors, shareholders, and committee meetings should be maintained. These records document discussions, decisions, and resolutions passed during these meetings. 5. Stock Certificates: Stock certificates are issued to shareholders, indicating their ownership of shares in the corporation. Sample stock certificates should be included in the corporate records to maintain a clear record of ownership. 6. Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, should be included in the corporate records. These records provide an overview of the corporation's financial health and performance. 7. Annual Reports: Annual reports summarize the professional corporation's activities, financial status, achievements, and challenges during a specific fiscal year. This report is often submitted to the California Secretary of State. 8. Contracts and Agreements: Any significant contracts or agreements entered into by the professional corporation, such as lease agreements, client contracts, or vendor agreements, should be included in the corporate records. 9. Licenses and Permits: Professional corporations often require specific licenses and permits operating legally. Copies of these licenses and permits should be included in the corporate records. 10. Tax Records: Any tax-related documents, including tax returns, payroll records, and correspondence with tax authorities, should be maintained to ensure compliance with California tax laws. It is crucial for a California Professional Corporation based in Visalia to maintain accurate and up-to-date corporate records to comply with state regulations, protect shareholders' interests, and establish a strong corporate governance framework. These records provide valuable evidence in the event of an audit, legal dispute, or corporate transaction.Visalia Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive record of the activities, operations, and legal aspects of a professional corporation based in Visalia, California. These records are crucial for maintaining transparency, legal compliance, and preserving corporate history. The following are some key types of Visalia Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: These records include the formation document filed with the California Secretary of State, which establishes the existence of the professional corporation. It includes information such as the corporate name, purpose, duration, principal place of business, and names and addresses of incorporates and initial directors. 2. Bylaws: Bylaws serve as the internal rules and regulations that govern the corporation's operations. They outline procedures for meetings, appointment of officers, voting, and other corporate matters. 3. Shareholder Agreements: Shareholder agreements define the rights, responsibilities, and obligations of the corporation's shareholders. These agreements can cover issues like share transfers, buy-sell provisions, dividend policies, and control of the corporation. 4. Minutes of Meetings: Detailed records of the minutes of directors, shareholders, and committee meetings should be maintained. These records document discussions, decisions, and resolutions passed during these meetings. 5. Stock Certificates: Stock certificates are issued to shareholders, indicating their ownership of shares in the corporation. Sample stock certificates should be included in the corporate records to maintain a clear record of ownership. 6. Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, should be included in the corporate records. These records provide an overview of the corporation's financial health and performance. 7. Annual Reports: Annual reports summarize the professional corporation's activities, financial status, achievements, and challenges during a specific fiscal year. This report is often submitted to the California Secretary of State. 8. Contracts and Agreements: Any significant contracts or agreements entered into by the professional corporation, such as lease agreements, client contracts, or vendor agreements, should be included in the corporate records. 9. Licenses and Permits: Professional corporations often require specific licenses and permits operating legally. Copies of these licenses and permits should be included in the corporate records. 10. Tax Records: Any tax-related documents, including tax returns, payroll records, and correspondence with tax authorities, should be maintained to ensure compliance with California tax laws. It is crucial for a California Professional Corporation based in Visalia to maintain accurate and up-to-date corporate records to comply with state regulations, protect shareholders' interests, and establish a strong corporate governance framework. These records provide valuable evidence in the event of an audit, legal dispute, or corporate transaction.