Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

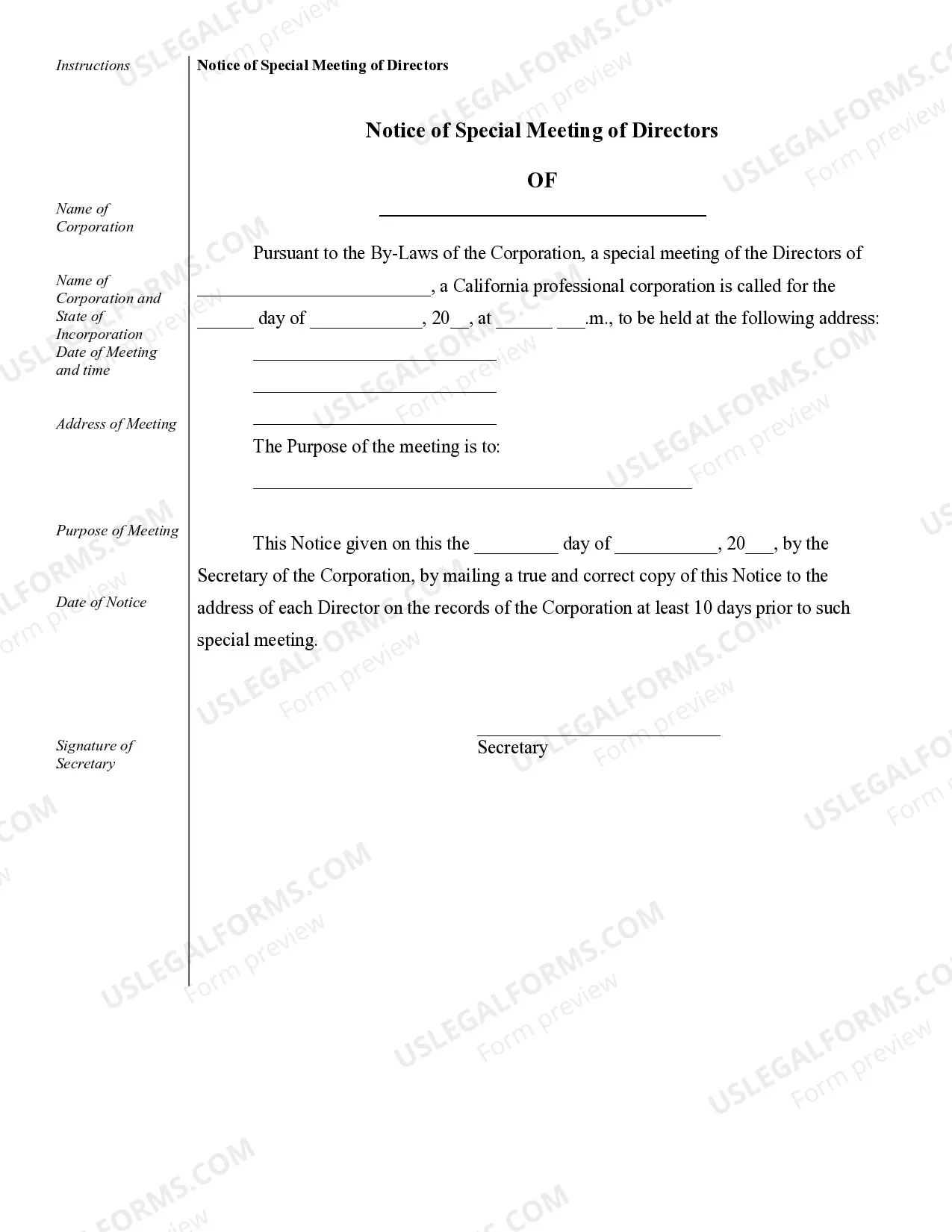

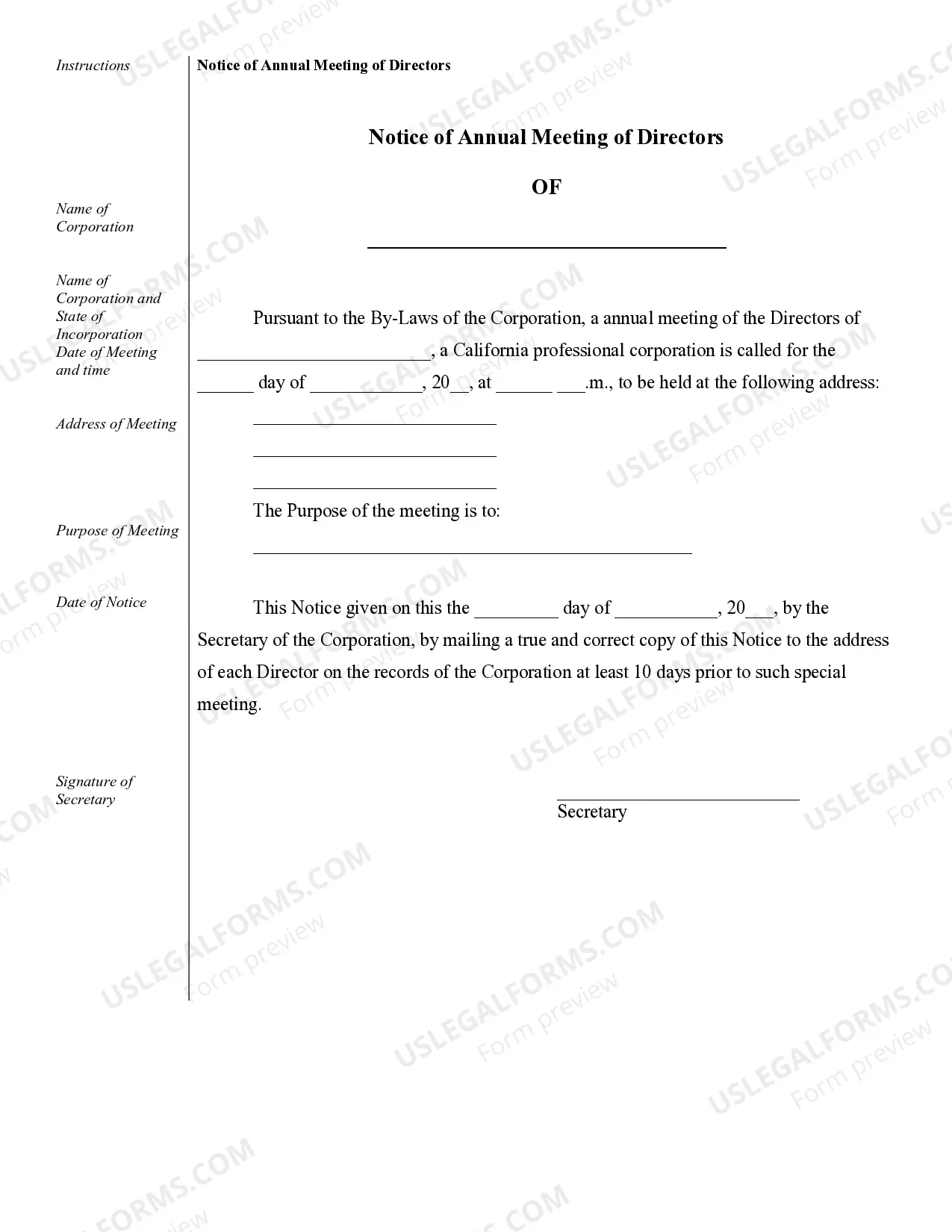

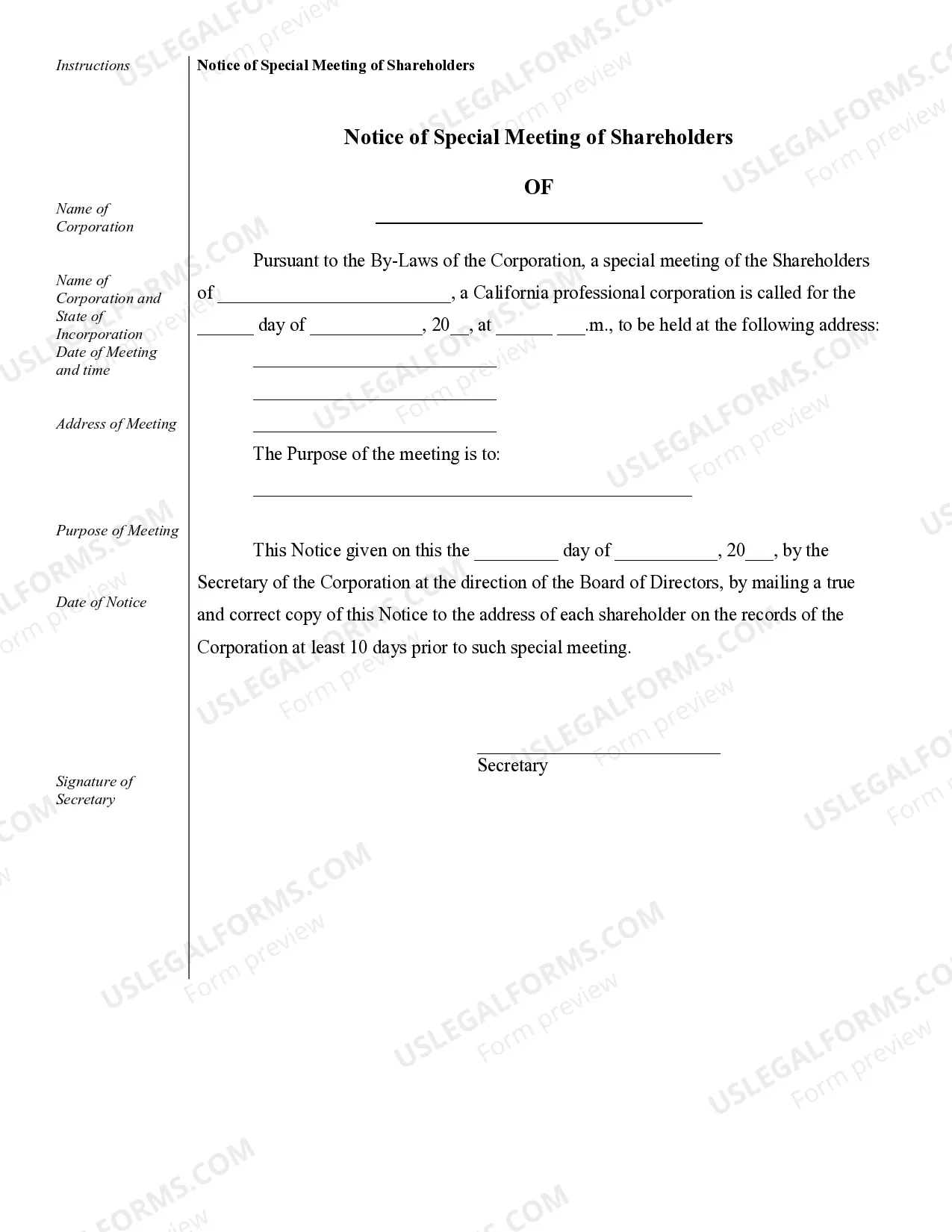

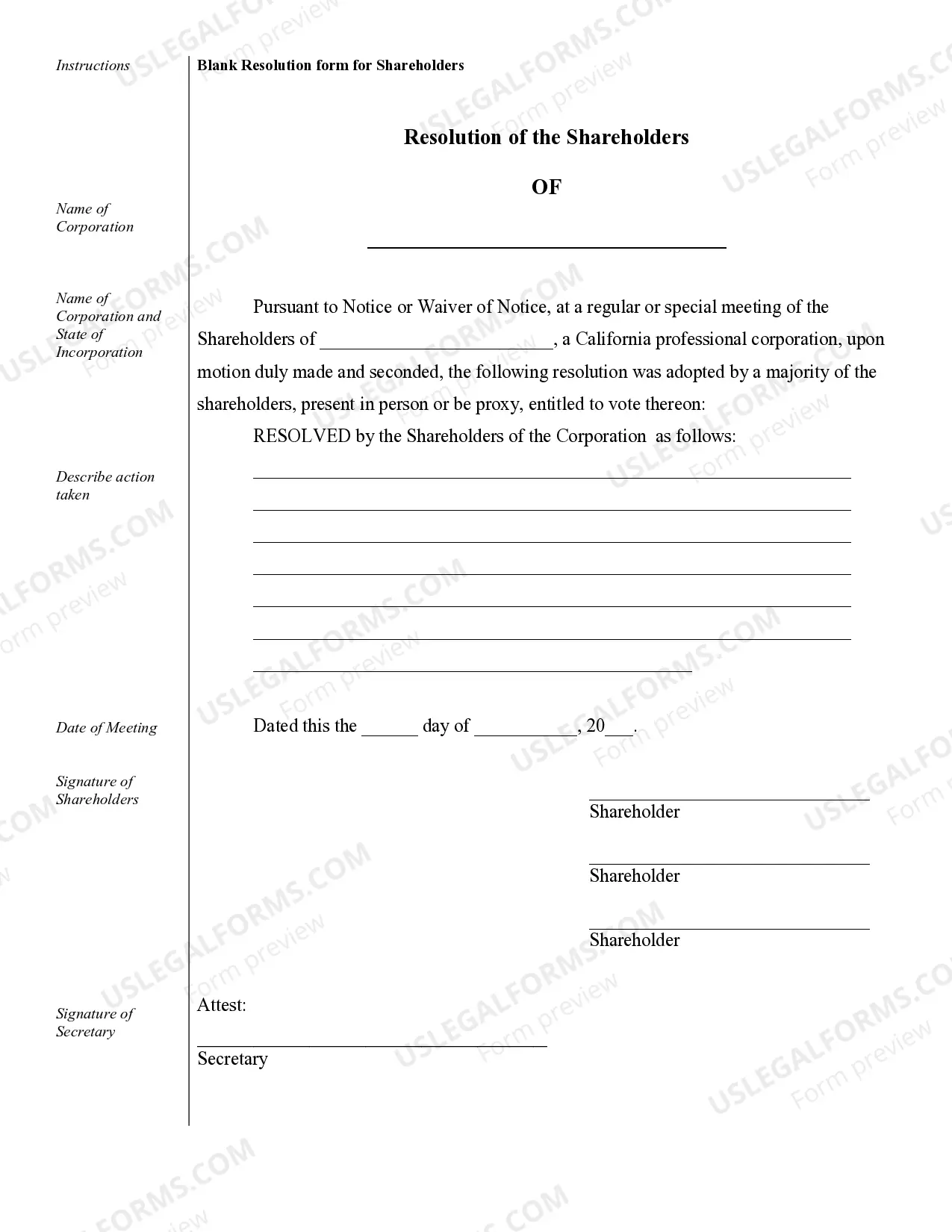

Title: Vista Sample Corporate Records for California Professional Corporations: A Comprehensive Overview Introduction: In the state of California, professional corporations are required to maintain proper documentation to ensure legal compliance and financial transparency. Vista Sample Corporate Records offer a valuable resource for understanding the different types of records essential for a California Professional Corporation. This article aims to provide a detailed description of these records, showcasing their importance and highlighting any different types available. 1. Articles of Incorporation: Articles of Incorporation are the initial legal documents filed with the California Secretary of State to establish a professional corporation. These articles typically define the purpose of the corporation, its duration, the initial shareholders' information, and the number of authorized shares. 2. Bylaws: Bylaws serve as rules and regulations governing the internal affairs of a California Professional Corporation. They outline procedures for shareholder meetings, appointment of directors and officers, voting rights, and other important corporate operations. Bylaws help ensure smooth and organized operation while conforming to legal requirements. 3. Shareholder Agreements: Shareholder agreements are contracts among the shareholders of a professional corporation, establishing rights, obligations, and restrictions concerning the shares and the overall management of the corporation. These agreements typically comprise provisions on stock transfers, voting rights, dispute resolution, buy-sell arrangements, and more. 4. Stock Certificates: Stock certificates represent ownership shares of a professional corporation. They document the number of shares held by individual shareholders and often include relevant details like shareholder names, issue dates, and unique identification numbers. Accurate and up-to-date stock certificates are crucial for maintaining proper ownership records. 5. Meeting Minutes: Meeting minutes are comprehensive summaries of board of directors, shareholder, and committee meetings. These minutes record discussions, decisions, resolutions, and voting outcomes, serving as a formal record for future reference. Accurate meeting minutes are necessary to demonstrate compliance with corporate formalities. 6. Financial Statements: Financial statements, including income statements, balance sheets, and cash flow statements, detail a California Professional Corporation's financial performance and position. These statements provide shareholders, directors, officers, and potential investors with insights into the company's financial health and overall performance. 7. Annual Reports: California Professional Corporations must file annual reports with the Secretary of State to maintain their legal status. These reports typically contain updates on the corporation's directors, officers, and registered agent information. Additionally, financial statements may be required along with this report. Different Types of Vista Sample Corporate Records for California Professional Corporations: Based on the available resources, it is important to note that Vista Sample Corporate Records may encompass variations and additional records, unique to specific professional corporation requirements. The mentioned records above serve as a general overview, and Vista may offer additional samples or templates tailored to various corporate needs. Conclusion: Vista Sample Corporate Records serve as valuable references for California Professional Corporations, helping them establish and maintain organized and legally compliant entities. Understanding the array of available records, including Articles of Incorporation, Bylaws, Shareholder Agreements, Stock Certificates, Meeting Minutes, Financial Statements, and Annual Reports, ensures proper documentation and fosters transparent corporate governance for professional corporations in California.Title: Vista Sample Corporate Records for California Professional Corporations: A Comprehensive Overview Introduction: In the state of California, professional corporations are required to maintain proper documentation to ensure legal compliance and financial transparency. Vista Sample Corporate Records offer a valuable resource for understanding the different types of records essential for a California Professional Corporation. This article aims to provide a detailed description of these records, showcasing their importance and highlighting any different types available. 1. Articles of Incorporation: Articles of Incorporation are the initial legal documents filed with the California Secretary of State to establish a professional corporation. These articles typically define the purpose of the corporation, its duration, the initial shareholders' information, and the number of authorized shares. 2. Bylaws: Bylaws serve as rules and regulations governing the internal affairs of a California Professional Corporation. They outline procedures for shareholder meetings, appointment of directors and officers, voting rights, and other important corporate operations. Bylaws help ensure smooth and organized operation while conforming to legal requirements. 3. Shareholder Agreements: Shareholder agreements are contracts among the shareholders of a professional corporation, establishing rights, obligations, and restrictions concerning the shares and the overall management of the corporation. These agreements typically comprise provisions on stock transfers, voting rights, dispute resolution, buy-sell arrangements, and more. 4. Stock Certificates: Stock certificates represent ownership shares of a professional corporation. They document the number of shares held by individual shareholders and often include relevant details like shareholder names, issue dates, and unique identification numbers. Accurate and up-to-date stock certificates are crucial for maintaining proper ownership records. 5. Meeting Minutes: Meeting minutes are comprehensive summaries of board of directors, shareholder, and committee meetings. These minutes record discussions, decisions, resolutions, and voting outcomes, serving as a formal record for future reference. Accurate meeting minutes are necessary to demonstrate compliance with corporate formalities. 6. Financial Statements: Financial statements, including income statements, balance sheets, and cash flow statements, detail a California Professional Corporation's financial performance and position. These statements provide shareholders, directors, officers, and potential investors with insights into the company's financial health and overall performance. 7. Annual Reports: California Professional Corporations must file annual reports with the Secretary of State to maintain their legal status. These reports typically contain updates on the corporation's directors, officers, and registered agent information. Additionally, financial statements may be required along with this report. Different Types of Vista Sample Corporate Records for California Professional Corporations: Based on the available resources, it is important to note that Vista Sample Corporate Records may encompass variations and additional records, unique to specific professional corporation requirements. The mentioned records above serve as a general overview, and Vista may offer additional samples or templates tailored to various corporate needs. Conclusion: Vista Sample Corporate Records serve as valuable references for California Professional Corporations, helping them establish and maintain organized and legally compliant entities. Understanding the array of available records, including Articles of Incorporation, Bylaws, Shareholder Agreements, Stock Certificates, Meeting Minutes, Financial Statements, and Annual Reports, ensures proper documentation and fosters transparent corporate governance for professional corporations in California.