Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

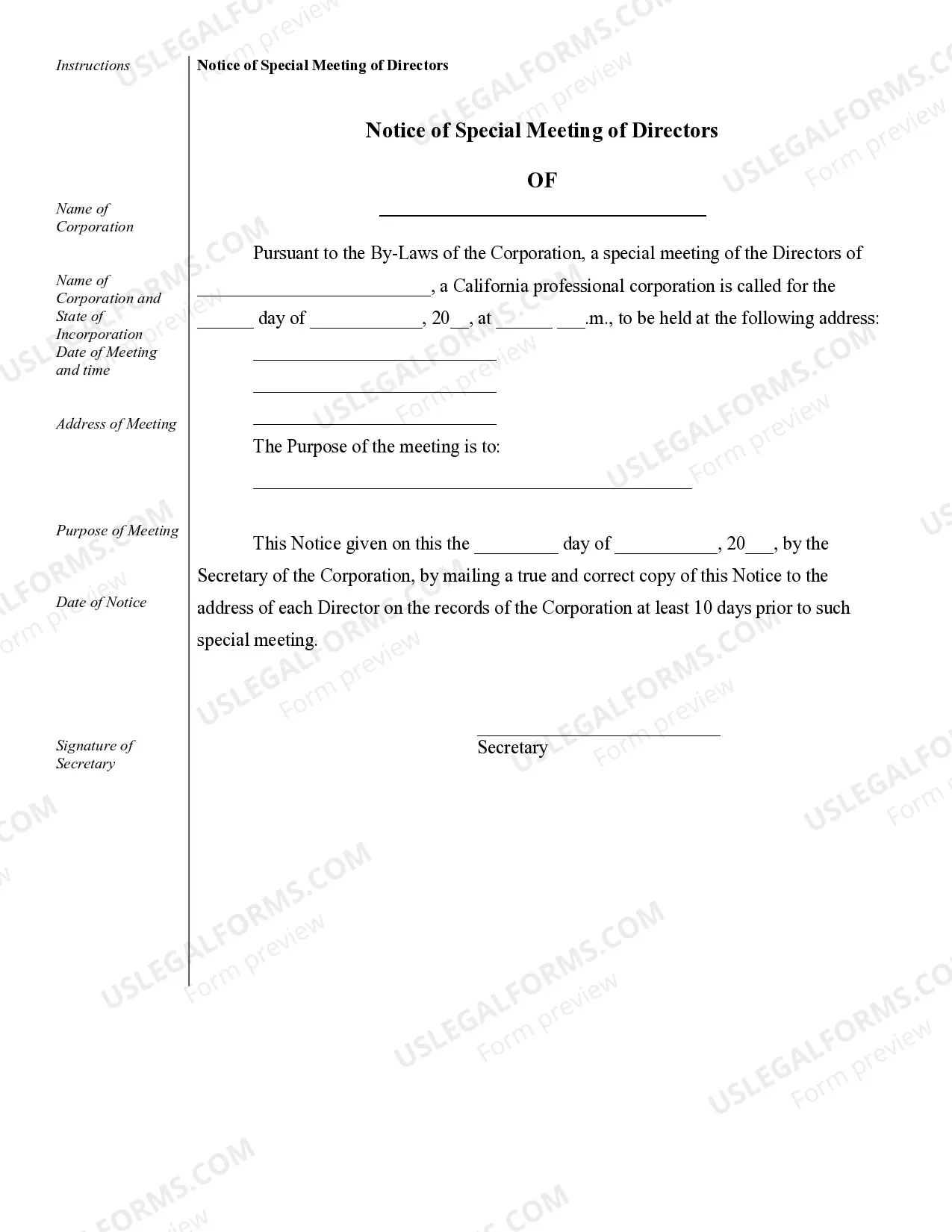

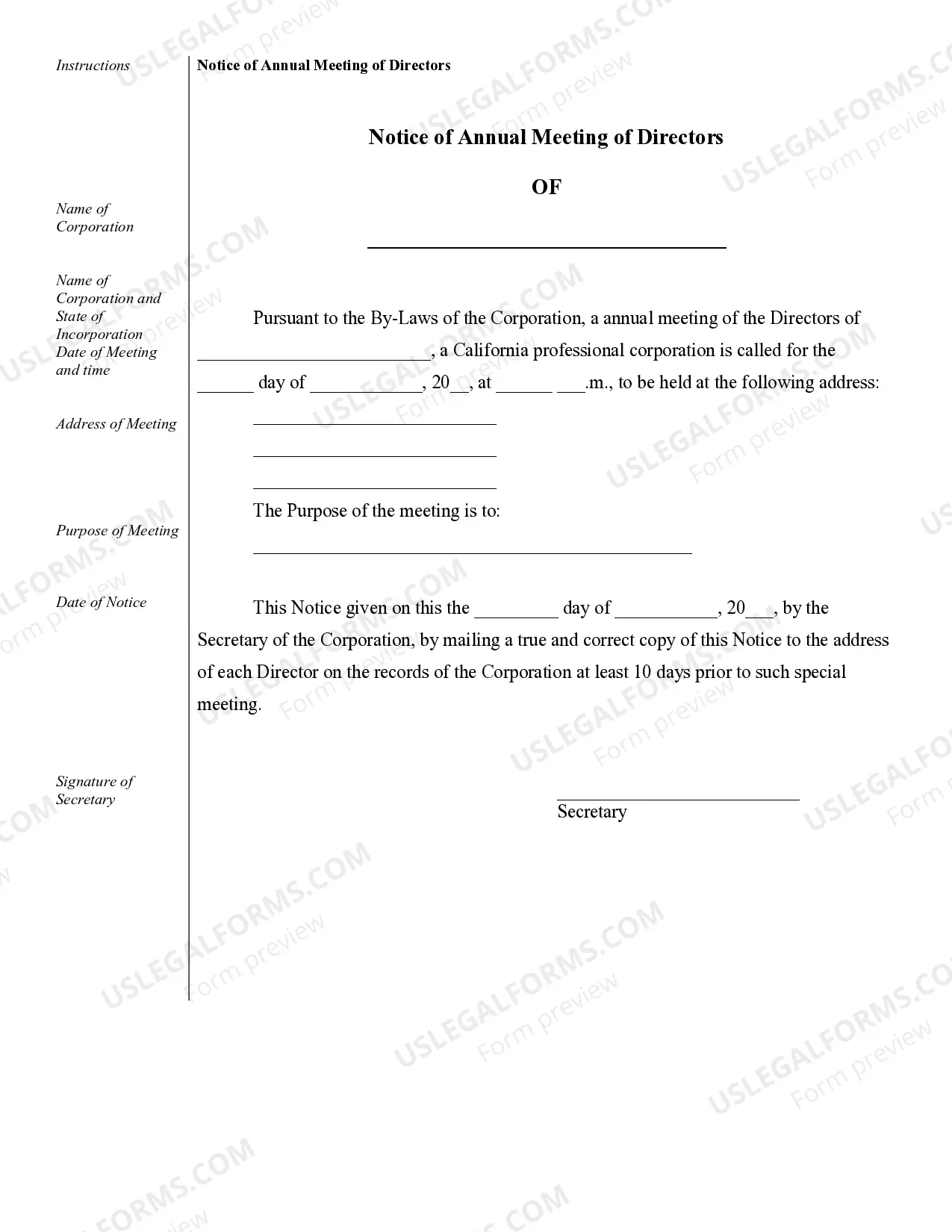

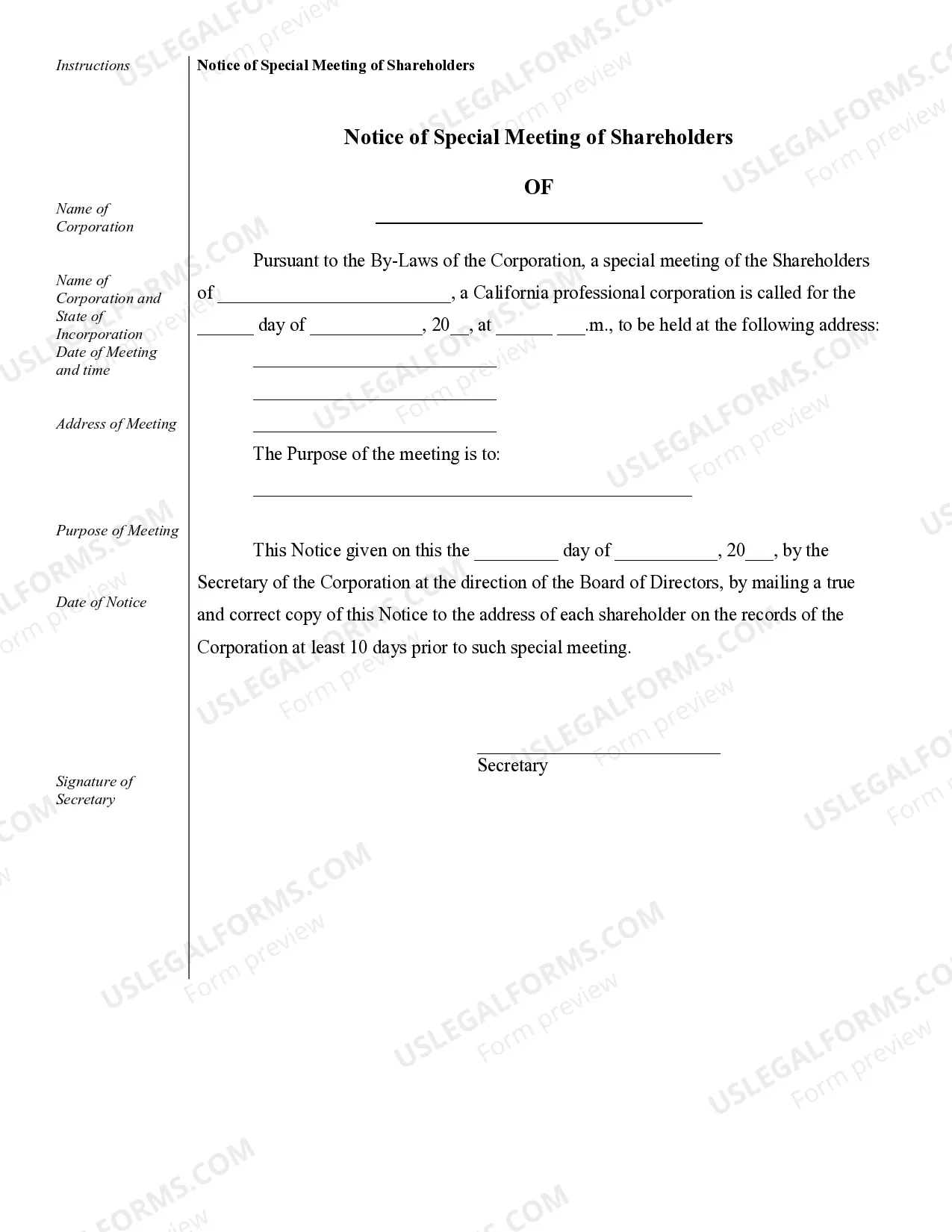

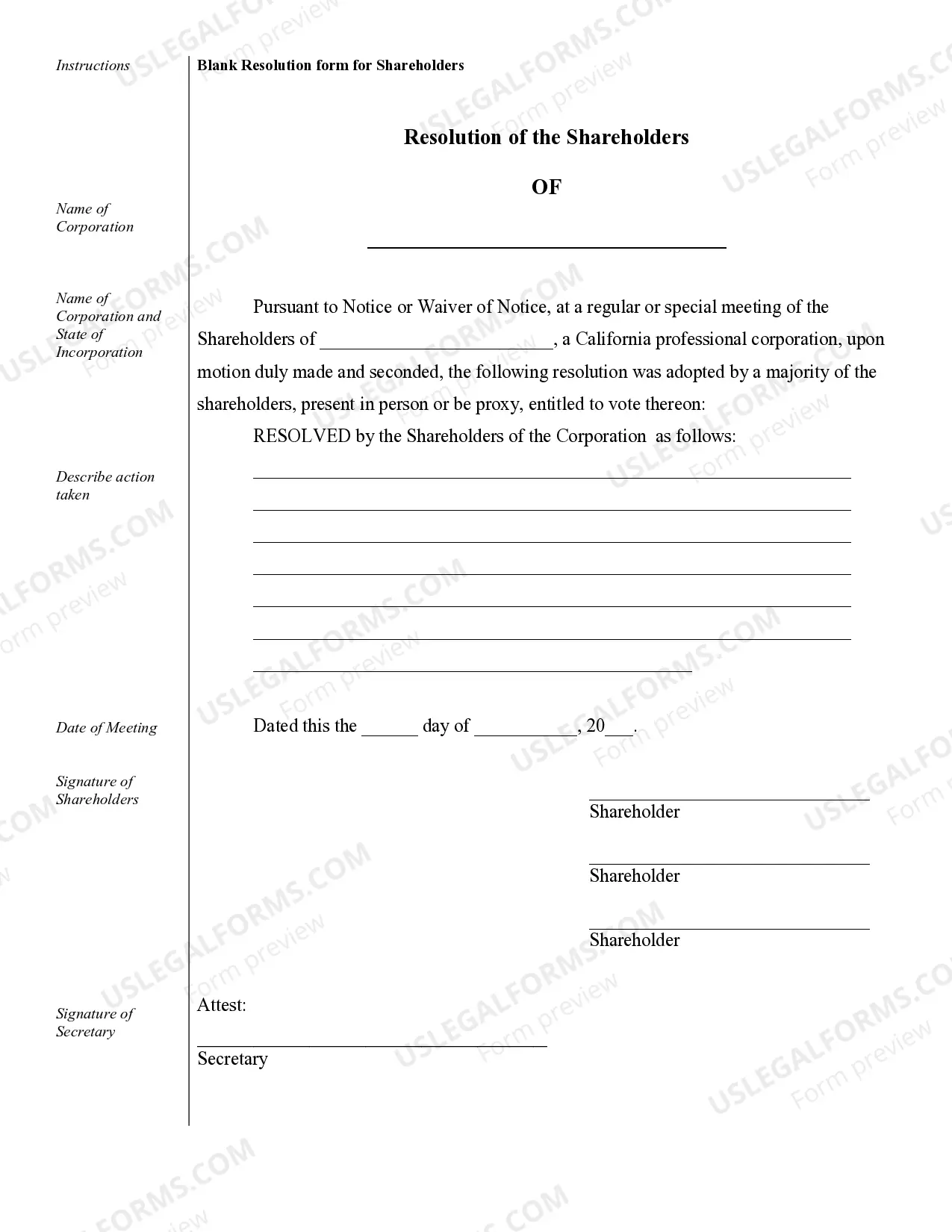

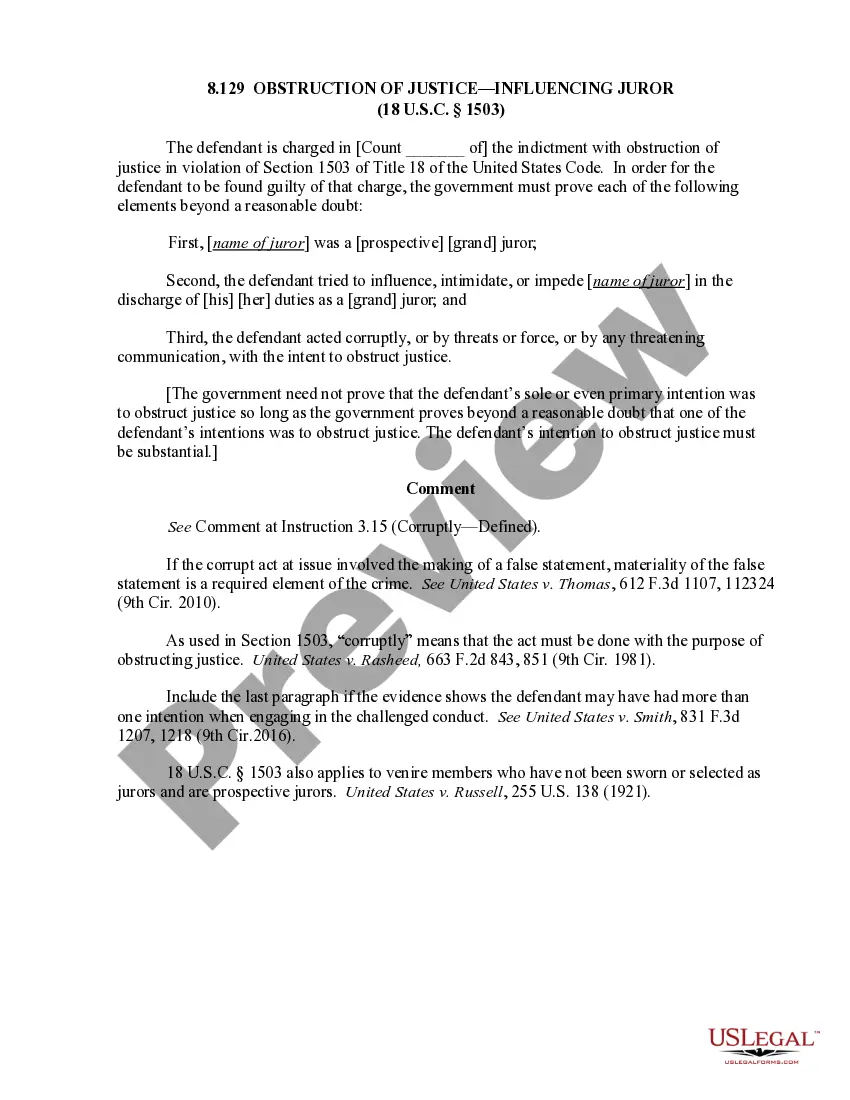

West Covina Sample Corporate Records for a California Professional Corporation play a crucial role in maintaining the legal and financial integrity of the business. These records serve as official documentation and evidence of the corporation's activities, decisions, and compliance with state regulations. In the vast pool of corporate records that a California Professional Corporation is required to maintain, a few key records stand out: 1. Articles of Incorporation: This essential document outlines the corporation's basic information, such as its name, purpose, registered agent, and initial directors. It is filed with the California Secretary of State, establishing the corporation as a separate legal entity. 2. Bylaws: The corporate bylaws set forth the internal rules and procedures that govern the corporation's operations. It covers topics like director and officer roles, shareholder meetings, voting procedures, and corporate decision-making processes. 3. Meeting Minutes: Meeting minutes document the discussions, actions, and resolutions made during corporate meetings, such as board of directors or shareholder meetings. These records serve as proof that the corporation conducted business in line with legal requirements and have a significant impact on potential legal disputes or audits. 4. Stock Certificate Ledger: For corporations that issue stocks, this record chronicles the issuance and transfer of shares and provides clarity on the ownership structure of the corporation. It tracks important details like shareholder names, the number of shares held, and dates of issuance or transfers. 5. Financial Statements: Corporations are required to maintain accurate financial statements, including balance sheets, income statements, and cash flow statements. These records provide an overview of the corporation's financial health, performance, and compliance with generally accepted accounting principles. 6. Annual Reports: A California Professional Corporation must file an annual report with the Secretary of State. This report outlines essential information about the corporation's operations, such as its address, officers, directors, and any changes to its stock structure. 7. Tax Records: Corporations must keep records of all tax-related documents, including federal and state tax returns, tax payments, and any correspondence with tax authorities. It is crucial for West Covina businesses to understand the significance of maintaining these corporate records meticulously. Failure to maintain accurate and up-to-date records can result in legal consequences, financial penalties, or loss of corporate liability protection. Therefore, it is advisable for West Covina Professional Corporations to seek professional assistance or consult with legal experts to ensure compliance with the specific record-keeping requirements mandated by the state of California.