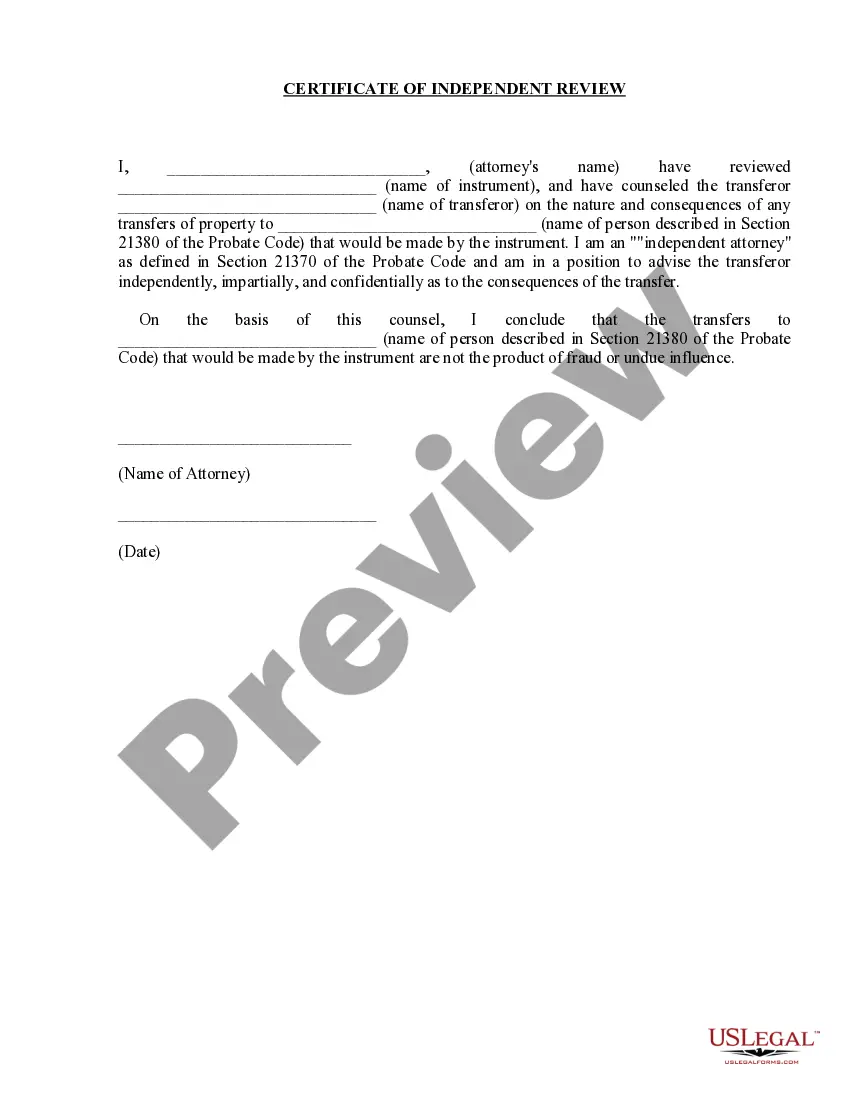

The Alameda California Certificate of Independent Review for Do native Transfers is a legal document that plays a significant role in the transfer of assets or property. The certificate ensures that the process of transferring assets occurs with legal compliance and transparency. It specifically pertains to do native transfers, which are transfers of property made as gifts or donations. The Alameda California Certificate of Independent Review for Do native Transfers serves as proof that the transfer is conducted in accordance with the various laws and regulations governing such transactions in the state of California. It provides assurance to all parties involved that there are no hidden agendas or conflicts of interest affecting the transfer process. This certificate acts as an independent verification and protects the rights of both the donor and the recipient. Keywords: Alameda California, Certificate of Independent Review, do native transfers, legal document, transfer of assets, property, compliance, transparency, gifts, donations, proof, laws, regulations, conflicts of interest, independent verification, rights, donor, recipient. Different types of Alameda California Certificate of Independent Review for Do native Transfers may include: 1. Personal Property Transfer Certificate: This type of certificate specifically deals with the transfer of personal belongings or non-real estate items, such as artwork, jewelry, or collectibles. 2. Real Estate Transfer Certificate: This certificate is applicable when the transfer involves the transfer of real estate properties, including land, homes, or commercial buildings. 3. Financial Asset Transfer Certificate: This type of certificate focuses on the transfer of financial assets, such as stocks, bonds, mutual funds, or any other investment instruments. 4. Charitable Donation Transfer Certificate: This certificate is used exclusively for transfers made to charitable organizations or foundations. It ensures compliance with the relevant tax laws and regulations governing such donations. These different types of certificates serve to address the specific nature of the transfer and provide a comprehensive review process tailored to each particular transaction.

Alameda California Certificate of Independent Review for Donative Transfers

Description

How to fill out Alameda California Certificate Of Independent Review For Donative Transfers?

If you are looking for a relevant form, it’s extremely hard to choose a more convenient service than the US Legal Forms site – probably the most considerable online libraries. With this library, you can get thousands of document samples for organization and personal purposes by types and regions, or key phrases. With the advanced search option, getting the latest Alameda California Certificate of Independent Review for Donative Transfers is as easy as 1-2-3. In addition, the relevance of each document is verified by a group of skilled attorneys that regularly check the templates on our platform and update them based on the latest state and county demands.

If you already know about our system and have a registered account, all you need to get the Alameda California Certificate of Independent Review for Donative Transfers is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you want. Read its description and utilize the Preview feature (if available) to see its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to discover the appropriate file.

- Affirm your choice. Choose the Buy now button. Next, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Select the format and download it on your device.

- Make modifications. Fill out, modify, print, and sign the received Alameda California Certificate of Independent Review for Donative Transfers.

Every single template you add to your profile does not have an expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra duplicate for editing or creating a hard copy, you can return and export it once more at any moment.

Make use of the US Legal Forms professional library to get access to the Alameda California Certificate of Independent Review for Donative Transfers you were seeking and thousands of other professional and state-specific samples on one platform!