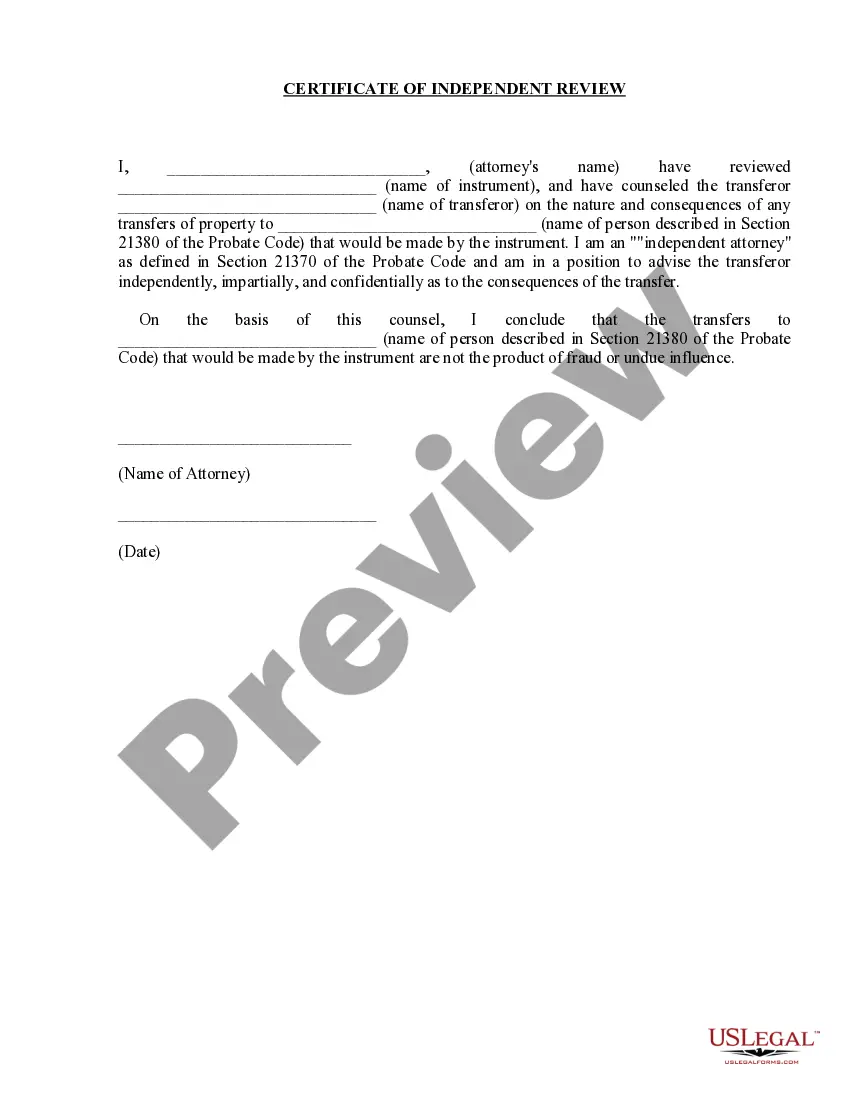

The Downey California Certificate of Independent Review for Do native Transfers is a legal document that ensures the transparency and fairness of do native transfers or gifts in the city of Downey, California. It acts as a protective measure for those involved in the transfer process, including donors, beneficiaries, and intermediaries. This certificate serves as proof that an independent review has been conducted regarding the specific do native transfer, ensuring that all parties involved fully comprehend the implications, consequences, and legalities associated with the transfer. It aims to prevent any potential inconsistencies, misunderstandings, or conflicts between the donor and the beneficiaries. The Downey California Certificate of Independent Review for Do native Transfers plays a crucial role in estate planning, charitable giving, and trusts. It encompasses various types of do native transfers, such as cash gifts, real estate transfers, stock transfers, and charitable contributions. Different types of Downey California Certificates of Independent Review for Do native Transfers may include: 1. Standard Certificate: This is the most common type of certificate used for general do native transfers, ensuring that the transfer adheres to legal requirements, such as appropriate documentation, consent, and understanding. 2. Charitable Contribution Certificate: Specifically designed for cases where a do native transfer involves charitable giving, this certificate verifies that the transfer is in compliance with tax regulations and follows the donor's intent. 3. Trust Certificate: Required for do native transfers involving trust funds, this certificate ensures that all parties involved are aware of and consent to the terms of the trust, protecting the interests of the beneficiaries and conforming to legal requirements. 4. Real Estate Transfer Certificate: Pertinent to the transfer of real estate properties, this certificate confirms that the transfer follows all local and state regulations, including property valuation, title transfers, and disclosures. 5. Stock Transfer Certificate: Essential for do native transfers involving stock or securities, this certificate validates that the transfer adheres to securities laws, reflects accurate stock valuation, and ensures compliance with any shareholder agreements. By obtaining the Downey California Certificate of Independent Review for Do native Transfers, all parties involved can ensure the legality, transparency, and fairness of the transfer process. It offers a layer of protection and peace of mind, safeguarding the interests of both the donor and the beneficiaries.

Downey California Certificate of Independent Review for Donative Transfers

Category:

State:

California

City:

Downey

Control #:

CA-PROB-01

Format:

Word;

Rich Text

Instant download

Description

This is used by an attorney who certifies that a donative transfer is free from fraud or undue influence.

The Downey California Certificate of Independent Review for Do native Transfers is a legal document that ensures the transparency and fairness of do native transfers or gifts in the city of Downey, California. It acts as a protective measure for those involved in the transfer process, including donors, beneficiaries, and intermediaries. This certificate serves as proof that an independent review has been conducted regarding the specific do native transfer, ensuring that all parties involved fully comprehend the implications, consequences, and legalities associated with the transfer. It aims to prevent any potential inconsistencies, misunderstandings, or conflicts between the donor and the beneficiaries. The Downey California Certificate of Independent Review for Do native Transfers plays a crucial role in estate planning, charitable giving, and trusts. It encompasses various types of do native transfers, such as cash gifts, real estate transfers, stock transfers, and charitable contributions. Different types of Downey California Certificates of Independent Review for Do native Transfers may include: 1. Standard Certificate: This is the most common type of certificate used for general do native transfers, ensuring that the transfer adheres to legal requirements, such as appropriate documentation, consent, and understanding. 2. Charitable Contribution Certificate: Specifically designed for cases where a do native transfer involves charitable giving, this certificate verifies that the transfer is in compliance with tax regulations and follows the donor's intent. 3. Trust Certificate: Required for do native transfers involving trust funds, this certificate ensures that all parties involved are aware of and consent to the terms of the trust, protecting the interests of the beneficiaries and conforming to legal requirements. 4. Real Estate Transfer Certificate: Pertinent to the transfer of real estate properties, this certificate confirms that the transfer follows all local and state regulations, including property valuation, title transfers, and disclosures. 5. Stock Transfer Certificate: Essential for do native transfers involving stock or securities, this certificate validates that the transfer adheres to securities laws, reflects accurate stock valuation, and ensures compliance with any shareholder agreements. By obtaining the Downey California Certificate of Independent Review for Do native Transfers, all parties involved can ensure the legality, transparency, and fairness of the transfer process. It offers a layer of protection and peace of mind, safeguarding the interests of both the donor and the beneficiaries.

How to fill out Downey California Certificate Of Independent Review For Donative Transfers?

If you’ve already used our service before, log in to your account and download the Downey California Certificate of Independent Review for Donative Transfers on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Downey California Certificate of Independent Review for Donative Transfers. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!