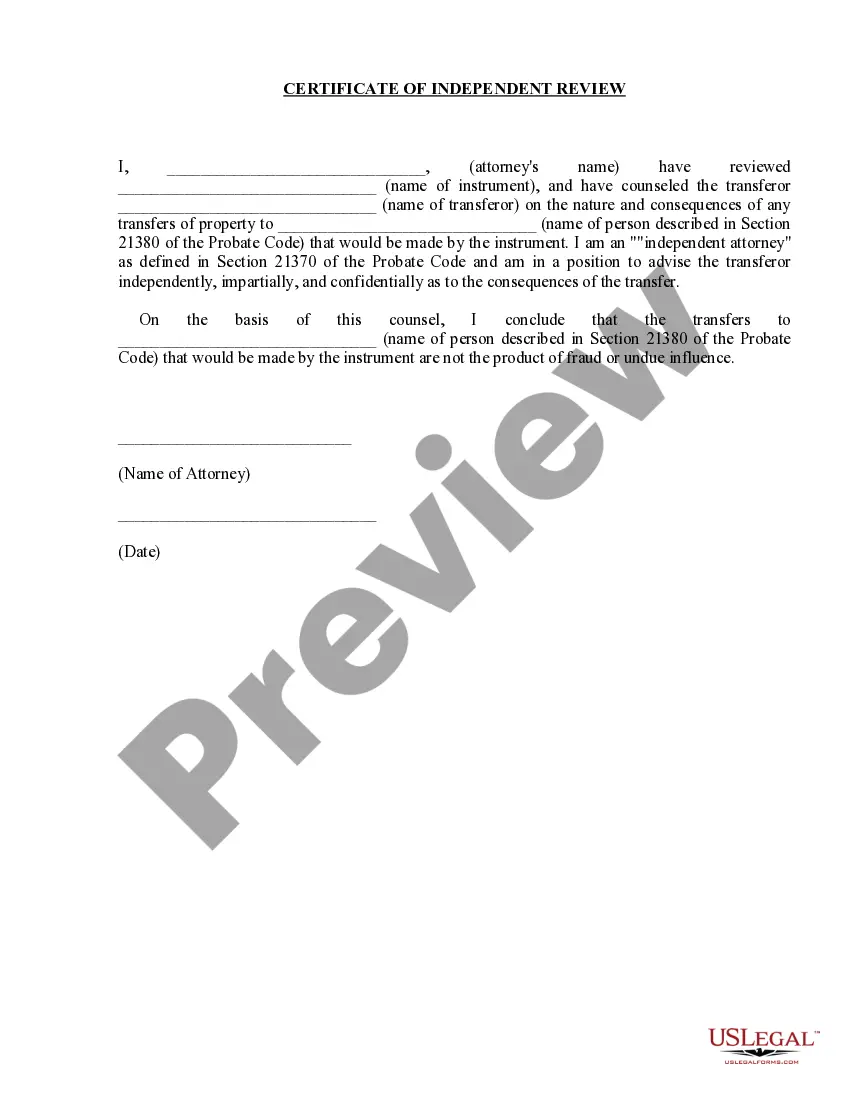

The Salinas California Certificate of Independent Review for Do native Transfers is a legal document that serves the purpose of safeguarding the integrity and legality of do native transfers in the city. This detailed description will outline the various types of certificates, their significance, and how they ensure the compliance of do native transfers with applicable laws. A Certificate of Independent Review is a mandatory requirement in Salinas, California, for certain types of do native transfers, including charitable donations, gifts, bequests, and trusts. It is designed to verify the legality and validity of the transfer, ensuring that it adheres to the provisions outlined by state laws, regulations, and the guidelines set forth by the California Department of Justice. The purpose of this certificate is twofold: to protect the interests of both the donor and the recipient of the donation, and to prevent any potential abuse, fraud, or undue influence during the transfer process. It serves as a legal assurance that the transfer is voluntarily made by the donor, without any external pressures or coercion. There are different types of Salinas California Certificates of Independent Review for Do native Transfers, each specifically tailored to different types of transfers. These may include: 1. Charitable Donation Certificate: This type of certificate is required when a donor wishes to make a charitable donation of any kind, whether it be monetary, property, or other assets. This certificate ensures that the charitable organization is legitimate, the donation is genuine, and both the donor and recipient comply with all applicable laws and regulations. 2. Will or Bequest Certificate: When a person wishes to include a bequest or donation in their will, they must obtain a Will or Bequest Certificate of Independent Review. This specific certificate ensures that the transfer aligns with the donor's intentions, is free from any undue influence, and complies with requirements for valid wills and testamentary documents. 3. Trust Certificate: In the case of do native transfers done through a trust, a Trust Certificate of Independent Review is necessary. Trusts can be complex legal arrangements, and this certificate verifies that the transfer complies with trust laws, including fiduciary duties, proper trustee administration, and beneficiary protection. 4. Gift Certificate: For non-charitable monetary or property gifts, a Gift Certificate of Independent Review is required. This certificate ensures that the gift is voluntarily given, without any hidden expectations or obligations, and is compliant with legal provisions pertaining to non-charitable gifts. Each of these certificates serves as a crucial safeguard for all parties involved in do native transfers, providing a transparent and legally compliant framework for the transfer process. By obtaining the appropriate certificate, donors can have peace of mind knowing that their intentions are properly fulfilled, while recipients can ensure the legitimacy and legality of the transferred assets or donations.

Salinas California Certificate of Independent Review for Donative Transfers

Description

How to fill out Salinas California Certificate Of Independent Review For Donative Transfers?

If you are looking for a legitimate form template, it’s tough to find a superior service than the US Legal Forms site – probably the most extensive libraries on the web.

With this collection, you can discover a wide array of form samples for business and personal purposes categorized by types and regions, or keywords.

With our enhanced search function, locating the latest Salinas California Certificate of Independent Review for Donative Transfers is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Specify the format and save it onto your system.

- Additionally, the validity of every record is confirmed by a team of experienced attorneys who routinely review the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to obtain the Salinas California Certificate of Independent Review for Donative Transfers is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions listed below.

- Ensure you have located the sample you require. Review its details and use the Preview feature to check its content. If it doesn’t fulfill your requirements, utilize the Search option at the top of the screen to find the right document.

- Confirm your choice. Click the Buy now button. Following that, select the desired pricing plan and provide information to create an account.

Form popularity

FAQ

As stated, you generally cannot get a letter of testamentary without entering probate in California. This process ensures the court's oversight of the estate's distribution and the validity of the will. However, for smaller estates, alternatives do exist that may simplify matters, such as using the Salinas California Certificate of Independent Review for Donative Transfers. Engaging with legal experts or platforms like US Legal Forms can provide clarity on your path forward.

In California, obtaining a letter of testamentary without initiating probate is typically not possible. Probate is necessary for the court to recognize your authority to manage the deceased's estate legally. However, if the estate meets specific criteria, alternatives like small estate procedures may apply. Consider utilizing services like US Legal Forms to understand your options and access helpful resources in navigating this process.

An alternative to a letter of testamentary is a small estate affidavit. This document allows you to claim assets without going through the full probate process, provided the estate qualifies under state law. Additionally, using the Salinas California Certificate of Independent Review for Donative Transfers can aid in transferring assets, minimizing administrative overhead. Always seek professional advice to determine the best option based on your unique situation.

Generally, you cannot obtain a letter of testamentary without initiating the probate process. Probate serves as the legal framework that allows for the distribution of a deceased person's assets. However, options like small estate affidavits exist for some situations, which may simplify the process. It's essential to consult with a legal expert to explore your options, including the Salinas California Certificate of Independent Review for Donative Transfers.

To order letters testamentary in Salinas, California, you must first file a petition with the probate court. This petition includes necessary documents such as the will, death certificate, and completed forms. Remember, the court will review these documents before issuing the letters, which legally appoint you as the executor of the estate. For detailed assistance, consider utilizing the US Legal Forms platform to access the required forms and guidance.

In California, the probate code outlines the requirements for creating a certificate of trust. This document is crucial for confirming the authority of a trustee in managing assets. When dealing with a Salinas California Certificate of Independent Review for Donative Transfers, understanding this code will help you ensure compliance and safeguard your wishes regarding asset transfers. You can always rely on platforms like USLegalForms to help you navigate these legal requirements smoothly.

The legal term independent review refers to the evaluation performed by an impartial third party. This process is designed to protect individuals involved in a transaction, particularly in cases of donative transfers. The Salinas California Certificate of Independent Review for Donative Transfers is an essential legal tool that reinforces this concept.

A certificate of independent review is an official document that certifies a fair evaluation of a donative transfer. This certificate serves to validate that the donor acted without coercion and understood the consequences of their decision. In Salinas, obtaining this certificate can be crucial for smooth and transparent transactions.

To fill out a California resale certificate, you must provide specific details such as the seller's information, the buyer's information, and a description of the items being purchased. Ensure you check the appropriate box indicating the use of the certificate for resale purposes. Remember, when involved in donative transfers, securing a Salinas California Certificate of Independent Review for Donative Transfers can help clarify your intentions.

An independent review process involves an unbiased evaluation of the circumstances surrounding a donative transfer. This includes assessing the intent of the donor and ensuring that all parties understand the implications of the transaction. Engaging in this process can enhance trust and transparency, particularly when obtaining a Salinas California Certificate of Independent Review for Donative Transfers.