Concord California Description of Employee's Job Duties for Workers' Compensation Concord, California is a city located in Contra Costa County, known for its diverse industries and vibrant workforce. As an employer in Concord, it is crucial to understand the specific job duties of your employees for workers' compensation purposes. This ensures compliance with the state's regulations and helps protect both employees and employers in the event of an injury or illness on the job. Here are some relevant keywords and types of job duties that may be included in a Concord California Description of Employee's Job Duties for Workers' Compensation: 1. Construction Worker: A construction worker in Concord may have job duties such as operating heavy machinery, handling tools, performing physical labor, and adhering to safety guidelines while working on construction sites. 2. Office Employee: An office employee in Concord may have job duties related to administrative tasks, including answering phone calls, managing paperwork, using computer software, and ensuring a safe and ergonomic workspace. 3. Retail Worker: A retail worker's job duties in Concord may involve customer service, stocking shelves, operating cash registers, handling merchandise, and maintaining a clean and organized store. 4. Healthcare Professional: Healthcare professionals in Concord, including nurses, doctors, and medical assistants, may have job duties such as providing patient care, administering medications, conducting medical procedures, and maintaining medical records. 5. Warehouse Employee: Warehouse employees in Concord may have job duties like packing, unpacking, loading, unloading, operating forklifts, tracking inventory, and ensuring workplace safety protocols. 6. Restaurant Staff: Restaurant staff in Concord, such as servers, chefs, and kitchen assistants, may have job duties that include taking orders, cooking meals, cleaning surfaces, serving food, and handling cash transactions. It is essential to tailor the description of job duties to the specific role within your organization. This ensures that employees understand their responsibilities and employers have a comprehensive understanding of potential workers' compensation claims related to those duties. Remember to consult with legal and HR professionals to ensure accurate and up-to-date job descriptions compliant with California laws.

Concord California Description of Employee's Job Duties for Workers' Compensation

Description

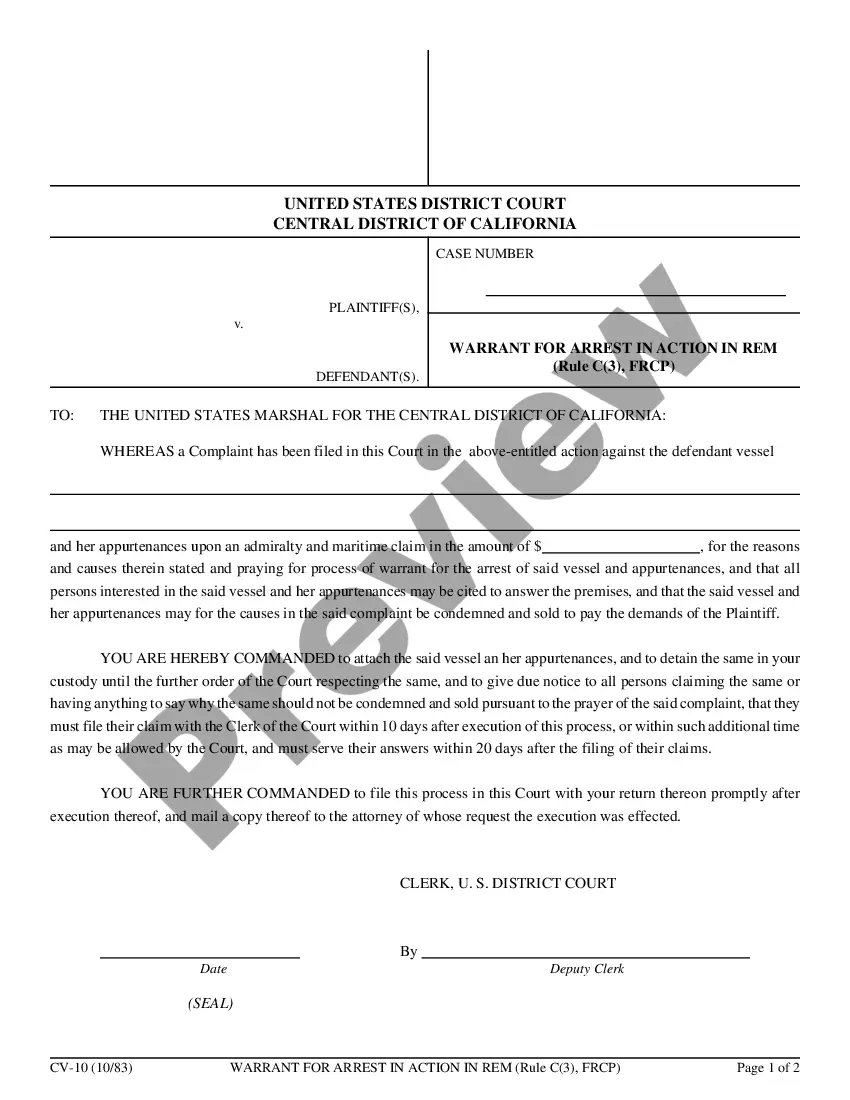

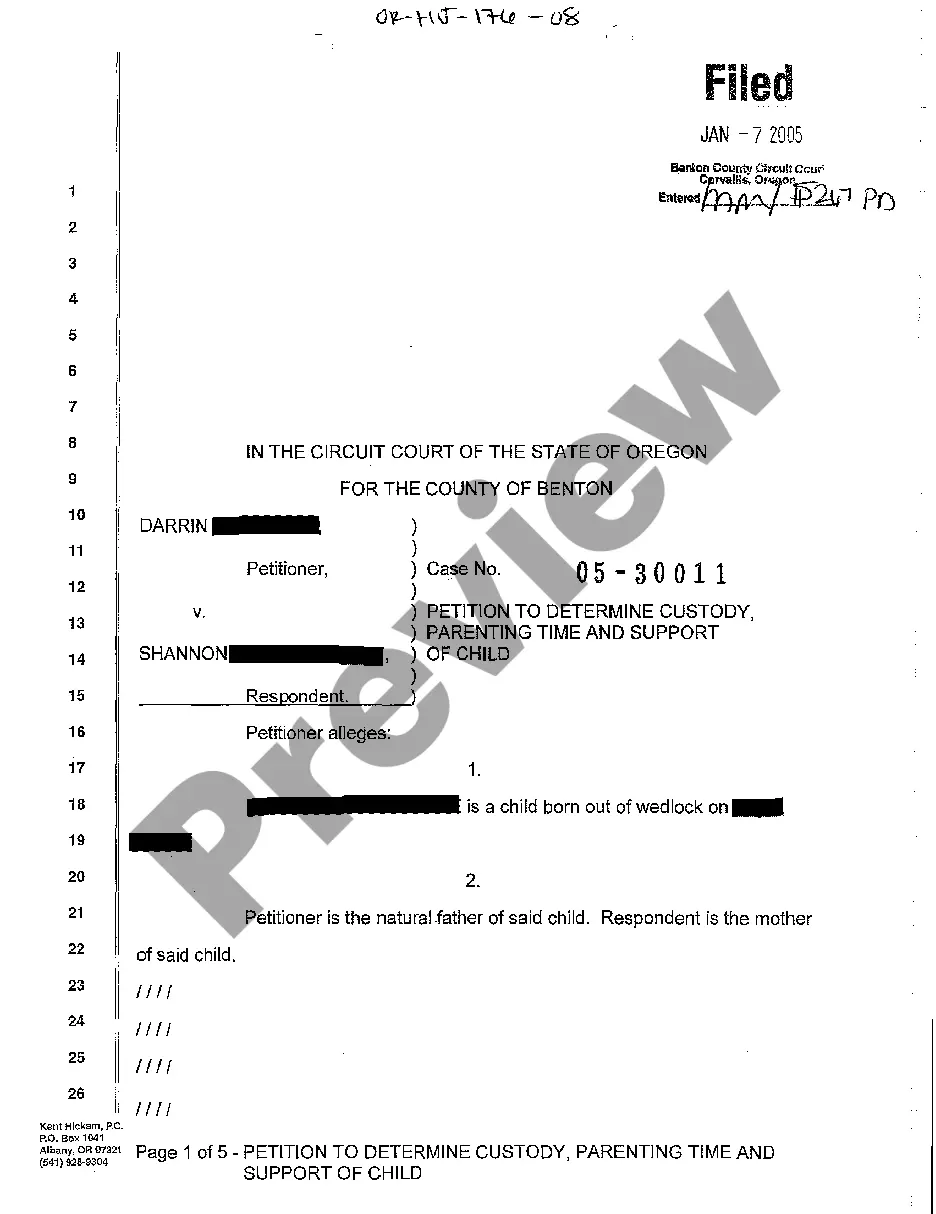

How to fill out Concord California Description Of Employee's Job Duties For Workers' Compensation?

Utilize the US Legal Forms to gain immediate access to any form template you need.

Our valuable website, featuring numerous documents, makes it easy to locate and acquire nearly any document sample you desire.

You can download, complete, and approve the Concord California Description of Employee's Job Responsibilities for Workers' Compensation within minutes, instead of spending countless hours searching online for the appropriate template.

Using our library is an excellent method to enhance the security of your document submissions.

If you haven't created a profile yet, follow the instructions outlined below.

Locate the form you need. Ensure that it's the form you intended to find: verify its title and description, and utilize the Preview feature when available. If not, use the Search bar to find the correct one.

- Our experienced attorneys frequently review all documents to ensure that the templates are applicable for specific regions and comply with new laws and regulations.

- How can you access the Concord California Description of Employee's Job Responsibilities for Workers' Compensation.

- If you possess a subscription, simply Log In to your account. The Download button will show up on all the samples you view.

- Moreover, you can retrieve all the previously saved files in the My documents section.

Form popularity

FAQ

Under California worker' compensation law, an employer cannot terminate a person's employment just because they sustained an injury on the job or decided to file a workers' comp claim.

If your employer cannot give you work that meets the work restrictions, the claims administrator must pay temporary total disability benefits (see Chapter 5). If you have questions or need help, use the resources in Chapter 10. Don't delay, because there are deadlines for taking action to protect your rights.

Workers' Compensation Rights for Independent Contractors in California. Independent contractors are not eligible for workers' compensation coverage; employers are not required by state law to purchase coverage for independent contractors.

A. No, under the labor law she is considered an employee. An employee is defined as someone you engage or permit to work. Even though your niece is part of your family, she is considered an employee and you, as the employer, must provide Workers' Compensation Insurance to cover her in case of a work-related injury.

The Division of Workers' Compensation (DWC) announces that the 2022 minimum and maximum temporary total disability (TTD) rates will increase on January 1, 2022. The minimum TTD rate will increase from $203.44 to $230.95 and the maximum TTD rate will increase from $1,356.31 to $1,539.71 per week.

The member who wishes to opt-out of the service must sign a waiver stating that they qualify for this opt-out service. Signed waivers will remain in effect and remove workers' compensation protection until there is a written withdrawal.

Employer policy regarding worker benefits Your employer is not required by any law to continue your benefits unless you have a union contract or another written contract.

As a result, California employers are required by law to have workers' compensation insurance, even if they have only one employee. And, if your employees get hurt or sick because of work, you are required to pay for workers' compensation benefits.

2-Year Benefit Limit for Most Cases In the typical workers' compensation claim filed in California, benefits can be provided for 104 weeks or 2 years' worth. The 104 weeks of benefits can be parceled out across 5 years, though, if you do not need to use all 104 weeks consecutively.

Q. Who is required to purchase workers' compensation insurance? A: All California employers must provide workers' compensation benefits to their employees under California Labor Code Section 3700. If a business employs one or more employees, then it must satisfy the requirement of the law.