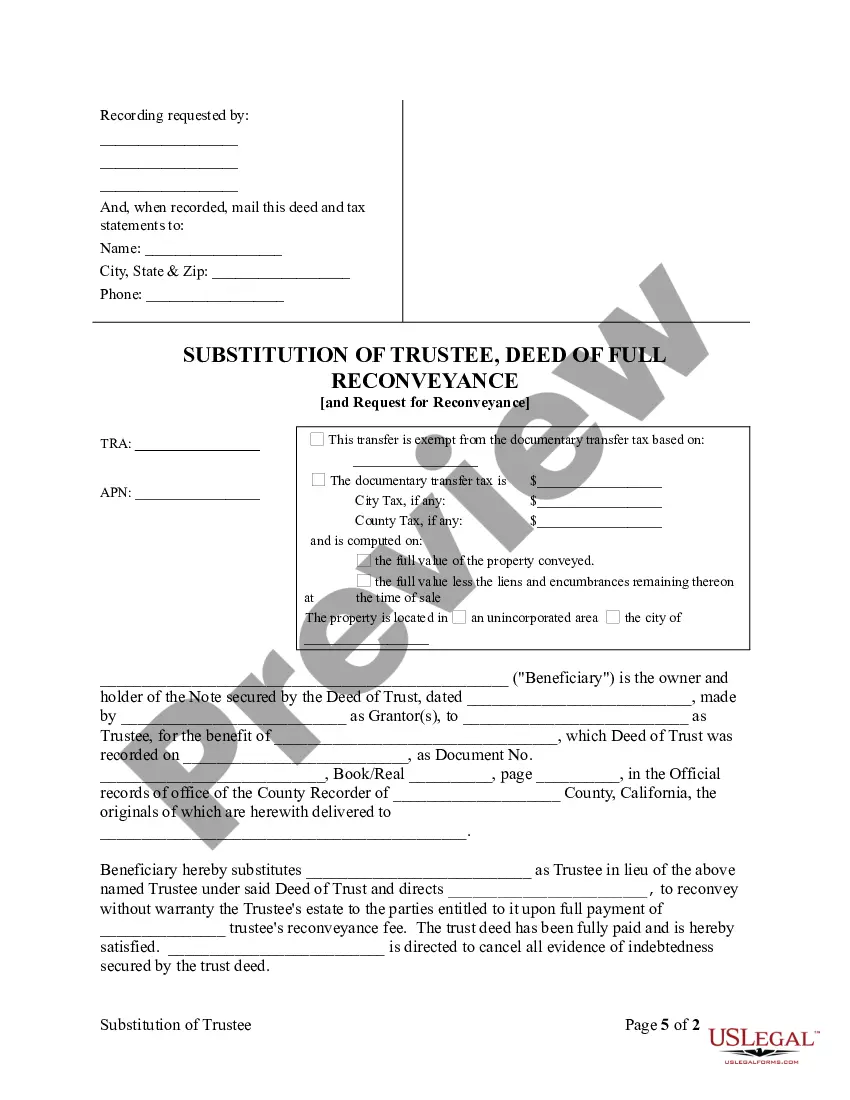

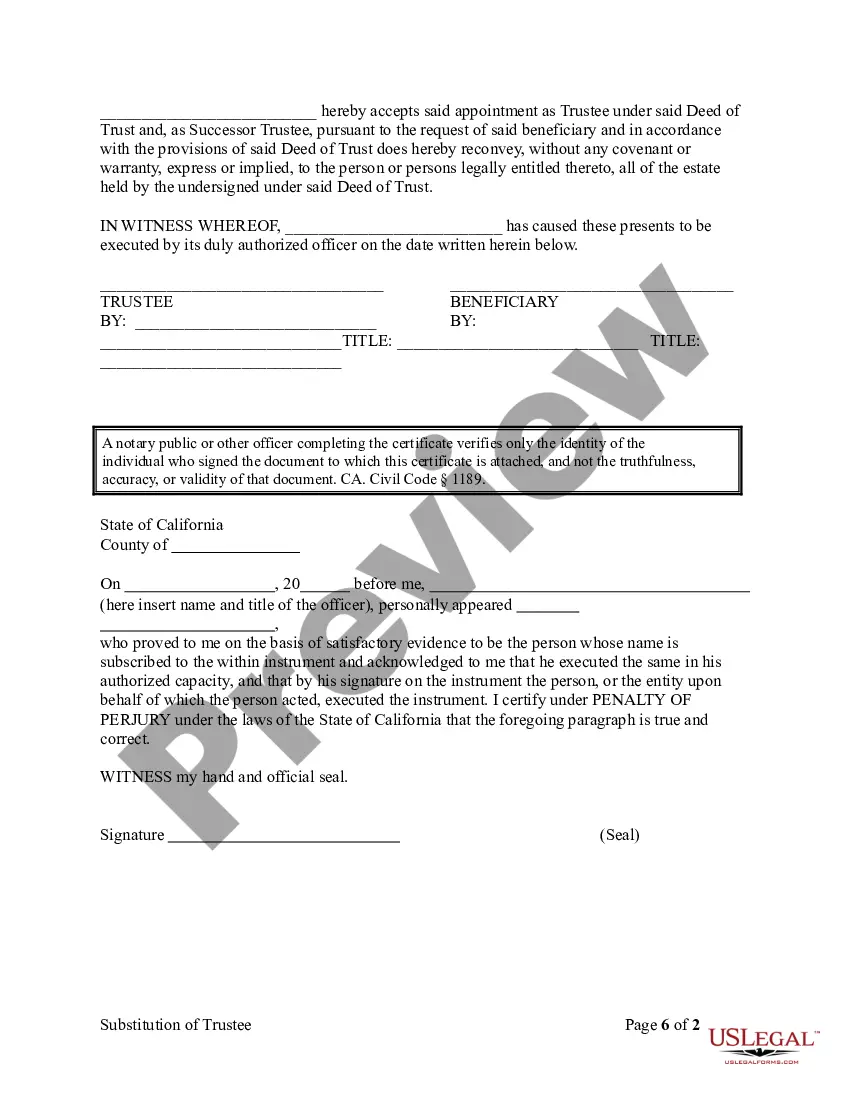

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Substitution of Trustee, Request for Reconveyance and Reconveyance (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123D

Contra Costa California Substitution of Trustee, Request for Re conveyance, and Re conveyance are important legal documents related to mortgage loan transactions in Contra Costa County, California. These documents play a crucial role in transferring the title of a property from the lender (beneficiary) to the borrower (trust or) once the mortgage loan is paid off in full. Here is a detailed description of each document: 1. Contra Costa California Substitution of Trustee: The Substitution of Trustee is a legal document used to replace the current trustee of a property with a new trustee. This document is typically prepared when there is a change in the lender or beneficiary of the mortgage loan. It ensures that the new trustee has the legal authority to act on behalf of the lender in the event of default or foreclosure. The Substitution of Trustee must be recorded with the County Recorder's Office in Contra Costa County to be effective. Keywords: Contra Costa California Substitution of Trustee, trustee replacement, legal document, lender change, beneficiary change, County Recorder's Office, Contra Costa County. 2. Request for Re conveyance: A Request for Re conveyance is a formal request made by the borrower or trust or to the lender or trustee to release the lien placed on the property when the mortgage loan is fully repaid. This document declares that all obligations under the loan agreement have been fulfilled and requests the trustee to reconvey the property title to the borrower, free from the lender's lien. Once the reconveyance is executed, the lender's interest in the property is extinguished, and the borrower becomes the sole owner. Keywords: Request for Re conveyance, lien release, mortgage loan repayment, loan fulfillment, trustee request, property title, lender's lien, borrower's ownership. 3. Re conveyance: Re conveyance is the final step in the mortgage loan repayment process. It is the legal process of transferring the property title from the lender to the borrower once the loan is satisfied. The trustee, upon receiving the Request for Re conveyance, executes a Re conveyance Deed or a Release Deed. This document acknowledges that the borrower has fulfilled their loan obligations and releases all claims the lender may have had on the property. The Re conveyance Deed is then recorded with the County Recorder's Office, officially transferring the title of the property to the borrower. Keywords: Re conveyance, property title transfer, mortgage loan repayment completion, Re conveyance Deed, Release Deed, loan fulfillment, County Recorder's Office. Additional types or variations of Contra Costa California Substitution of Trustee, Request for Re conveyance, and Re conveyance may exist depending on the specific circumstances of the mortgage loan transaction. It is always recommended consulting with a professional, such as a real estate attorney or a title company, to ensure compliance with local laws and to properly execute these documents.Contra Costa California Substitution of Trustee, Request for Re conveyance, and Re conveyance are important legal documents related to mortgage loan transactions in Contra Costa County, California. These documents play a crucial role in transferring the title of a property from the lender (beneficiary) to the borrower (trust or) once the mortgage loan is paid off in full. Here is a detailed description of each document: 1. Contra Costa California Substitution of Trustee: The Substitution of Trustee is a legal document used to replace the current trustee of a property with a new trustee. This document is typically prepared when there is a change in the lender or beneficiary of the mortgage loan. It ensures that the new trustee has the legal authority to act on behalf of the lender in the event of default or foreclosure. The Substitution of Trustee must be recorded with the County Recorder's Office in Contra Costa County to be effective. Keywords: Contra Costa California Substitution of Trustee, trustee replacement, legal document, lender change, beneficiary change, County Recorder's Office, Contra Costa County. 2. Request for Re conveyance: A Request for Re conveyance is a formal request made by the borrower or trust or to the lender or trustee to release the lien placed on the property when the mortgage loan is fully repaid. This document declares that all obligations under the loan agreement have been fulfilled and requests the trustee to reconvey the property title to the borrower, free from the lender's lien. Once the reconveyance is executed, the lender's interest in the property is extinguished, and the borrower becomes the sole owner. Keywords: Request for Re conveyance, lien release, mortgage loan repayment, loan fulfillment, trustee request, property title, lender's lien, borrower's ownership. 3. Re conveyance: Re conveyance is the final step in the mortgage loan repayment process. It is the legal process of transferring the property title from the lender to the borrower once the loan is satisfied. The trustee, upon receiving the Request for Re conveyance, executes a Re conveyance Deed or a Release Deed. This document acknowledges that the borrower has fulfilled their loan obligations and releases all claims the lender may have had on the property. The Re conveyance Deed is then recorded with the County Recorder's Office, officially transferring the title of the property to the borrower. Keywords: Re conveyance, property title transfer, mortgage loan repayment completion, Re conveyance Deed, Release Deed, loan fulfillment, County Recorder's Office. Additional types or variations of Contra Costa California Substitution of Trustee, Request for Re conveyance, and Re conveyance may exist depending on the specific circumstances of the mortgage loan transaction. It is always recommended consulting with a professional, such as a real estate attorney or a title company, to ensure compliance with local laws and to properly execute these documents.