This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Substitution of Trustee, Request for Reconveyance and Reconveyance (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123D

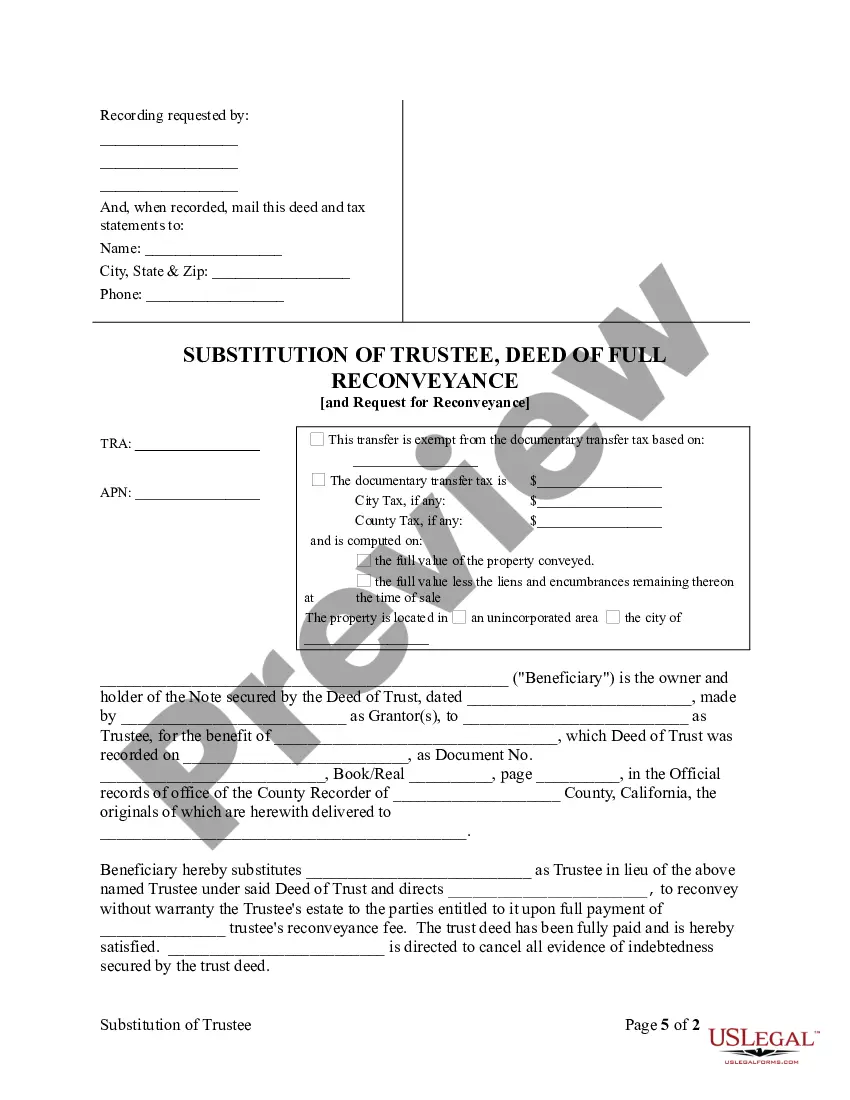

Title: Santa Clarita California Substitution of Trustee, Request for Re conveyance, and Re conveyance Explained Introduction: In Santa Clarita, California, property owners occasionally encounter situations where they need to transfer the responsibilities of a trustee, request reconveyance of a property title, or complete the process of reconveyance. This detailed description will walk you through the concept of these three important terms, outlining their relevance and procedures involved. It will also shed light on the different types of Santa Clarita California Substitution of Trustee, Request for Re conveyance, and Re conveyance. 1. Substitution of Trustee: The Substitution of Trustee refers to the process of changing the trustee on a property deed of trust. This typically occurs when the original trustee, appointed during the creation of the trust, is unable or unwilling to continue fulfilling their duties. Key parties involved in this process include the trust or (property owner), the beneficiary (lender), and the new trustee. The Substitution of Trustee is crucial for ensuring compliance with legal requirements and securing the trust or's and beneficiary's interests. Different types of Substitution of Trustee include: a) Voluntary Substitution of Trustee: This type occurs when all parties, including the current trustee, the trust or, and the beneficiary, mutually agree on the substitution and proceed with the necessary paperwork. b) Involuntary Substitution of Trustee: An involuntary substitution occurs when circumstances arise that necessitate the removal of the current trustee, such as their death, incapacity, or a breach of trust. This type may require legal action or court intervention. 2. Request for Re conveyance: A Request for Re conveyance is a formal request made by a trust or to the trustee, acknowledging that the terms of a trust deed have been satisfied. It is an essential step towards releasing the deed of trust lien on the property. Once the loan or mortgage secured by the deed of trust is fully paid, the trust or can request reconveyance to ensure the property title is cleared of any financial encumbrances. This process includes: a) Submitting a Request: The trust or must complete and submit a notarized Request for Re conveyance form to the trustee, affirming that all loan obligations have been met. b) Review and Verification: The trustee reviews the request, verifies the information, and examines the records to confirm the debt has been paid in full. c) Re conveyance Deed: Upon verification, the trustee prepares a Re conveyance Deed, formally releasing the property from the lien. This document is recorded with the County Recorder's Office, reflecting the change in ownership status. 3. Re conveyance: Re conveyance is the final step in the process where the trustee formally transfers the full legal title of the property back to the trust or, ensuring the property is free and clear of the lien. The trustee acknowledges that the debt has been satisfied, resulting in the release of the security instrument (deed of trust). This process involves: a) Trustee's Deed Upon Sale: In cases where the property is sold or transferred through foreclosure, the trustee issues a Trustee's Deed Upon Sale to the new owner, conveying the property title. b) Release of Lien: The trustee records the Re conveyance Deed with the County Recorder's Office, officially releasing the lien, and updating public records to reflect the trust or's full ownership rights. Conclusion: Understanding the Santa Clarita California Substitution of Trustee, Request for Re conveyance, and Re conveyance processes is essential for property owners. Whether experiencing voluntary or involuntary changes to trustee roles, completing the Request for Re conveyance, or obtaining the Re conveyance Deed, these steps help protect homeowners' interests while ensuring the smooth transfer of property ownership.Title: Santa Clarita California Substitution of Trustee, Request for Re conveyance, and Re conveyance Explained Introduction: In Santa Clarita, California, property owners occasionally encounter situations where they need to transfer the responsibilities of a trustee, request reconveyance of a property title, or complete the process of reconveyance. This detailed description will walk you through the concept of these three important terms, outlining their relevance and procedures involved. It will also shed light on the different types of Santa Clarita California Substitution of Trustee, Request for Re conveyance, and Re conveyance. 1. Substitution of Trustee: The Substitution of Trustee refers to the process of changing the trustee on a property deed of trust. This typically occurs when the original trustee, appointed during the creation of the trust, is unable or unwilling to continue fulfilling their duties. Key parties involved in this process include the trust or (property owner), the beneficiary (lender), and the new trustee. The Substitution of Trustee is crucial for ensuring compliance with legal requirements and securing the trust or's and beneficiary's interests. Different types of Substitution of Trustee include: a) Voluntary Substitution of Trustee: This type occurs when all parties, including the current trustee, the trust or, and the beneficiary, mutually agree on the substitution and proceed with the necessary paperwork. b) Involuntary Substitution of Trustee: An involuntary substitution occurs when circumstances arise that necessitate the removal of the current trustee, such as their death, incapacity, or a breach of trust. This type may require legal action or court intervention. 2. Request for Re conveyance: A Request for Re conveyance is a formal request made by a trust or to the trustee, acknowledging that the terms of a trust deed have been satisfied. It is an essential step towards releasing the deed of trust lien on the property. Once the loan or mortgage secured by the deed of trust is fully paid, the trust or can request reconveyance to ensure the property title is cleared of any financial encumbrances. This process includes: a) Submitting a Request: The trust or must complete and submit a notarized Request for Re conveyance form to the trustee, affirming that all loan obligations have been met. b) Review and Verification: The trustee reviews the request, verifies the information, and examines the records to confirm the debt has been paid in full. c) Re conveyance Deed: Upon verification, the trustee prepares a Re conveyance Deed, formally releasing the property from the lien. This document is recorded with the County Recorder's Office, reflecting the change in ownership status. 3. Re conveyance: Re conveyance is the final step in the process where the trustee formally transfers the full legal title of the property back to the trust or, ensuring the property is free and clear of the lien. The trustee acknowledges that the debt has been satisfied, resulting in the release of the security instrument (deed of trust). This process involves: a) Trustee's Deed Upon Sale: In cases where the property is sold or transferred through foreclosure, the trustee issues a Trustee's Deed Upon Sale to the new owner, conveying the property title. b) Release of Lien: The trustee records the Re conveyance Deed with the County Recorder's Office, officially releasing the lien, and updating public records to reflect the trust or's full ownership rights. Conclusion: Understanding the Santa Clarita California Substitution of Trustee, Request for Re conveyance, and Re conveyance processes is essential for property owners. Whether experiencing voluntary or involuntary changes to trustee roles, completing the Request for Re conveyance, or obtaining the Re conveyance Deed, these steps help protect homeowners' interests while ensuring the smooth transfer of property ownership.