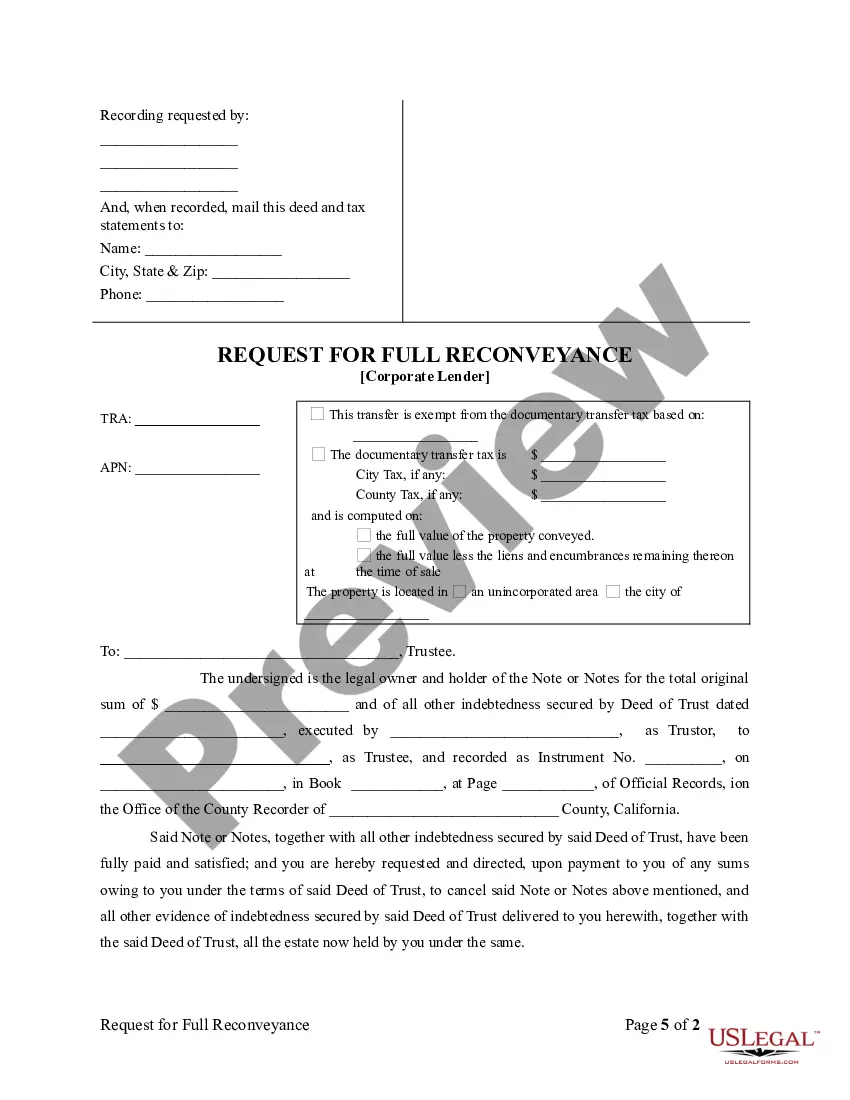

Request for Reconveyance of Deed of Trust by Corporation

Assignments Generally: Lenders,

or holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rules is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

California Law

Assignment: It is recommended that an assignment

be in writing and recorded.

Demand to Satisfy: If the trustee has failed

to execute and record, or cause to be recorded, the full reconveyance within

60 calendar days of satisfaction of the obligation, the beneficiary, upon

receipt of a written request by the trustor, shall execute and acknowledge

a document ... substituting itself or another as trustee and issue a full

reconveyance.

Recording Satisfaction: A certificate of

the discharge of a mortgage, and the proof or acknowledgment thereof, must

be recorded in the office of the county recorder in which the mortgage

is recorded.

Penalty: All damages which that person

may sustain by reason of the failure to record satisfaction shall require

that the violator forfeit to that person the sum of three hundred dollars

($300).

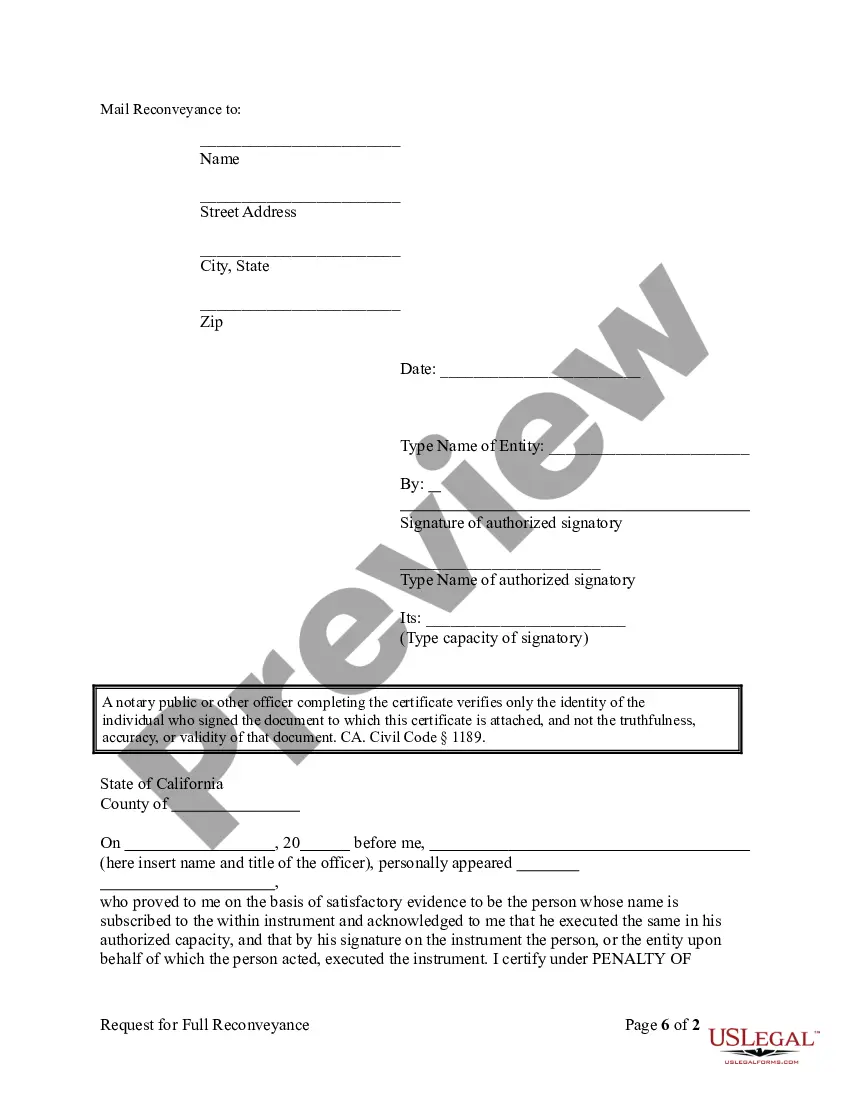

Acknowledgment: An assignment or satisfaction

must contain a proper California acknowledgment, or other acknowledgment

approved by Statute.

California Statutes

CIVIL CODE

DIVISION 3- OBLIGATIONS

TITLE 14- LIEN

Chapter 2- Mortgages

Article 1- Mortgages In General: SECTION

2920-2944.5

...

2939. A recorded mortgage must be discharged by

a certificate signed by the mortgagee, his personal representatives

or assigns, acknowledged or proved and certified as prescribed by the chapter

on "recording transfers," stating that the mortgage has been paid, satisfied,

or discharged. Reference shall be made in said certificate to the

book and page where the mortgage is recorded.

2939.5. Foreign executors, administrators and guardians may

satisfy mortgages upon the records of any county in this state, upon producing

and recording in the office of the county recorder of the county in which

such mortgage is recorded, a duly certified and authenticated copy of their

letters testamentary, or of administration or of guardianship, and which

certificate or authentication shall also recite that said letters have

not been revoked. For the purposes of this section, "guardian" includes

a foreign conservator, committee, or comparable fiduciary.

2940. A certificate of the discharge of a mortgage, and the

proof or acknowledgment thereof, must be recorded in the office of the

county recorder in which the mortgage is recorded.

2941. (a) Within 30 days after any mortgage has been

satisfied, the mortgagee or the assignee of the mortgagee shall execute

a certificate of the discharge thereof, as provided in Section 2939, and

shall record or cause to be recorded, except as provided in subdivision

(c), in the office of the county recorder in which the mortgage is recorded.

The mortgagee shall then deliver, upon the written request of the

mortgagor or the mortgagor's heirs, successors, or assignees, as the case

may be, the original note and mortgage to the person making the request.

(b) (1) When the obligation secured by any deed of

trust has been satisfied, the beneficiary or the assignee of the beneficiary

shall execute and deliver to the trustee the original note, deed of trust,

request for a full reconveyance, and other documents as may be necessary

to reconvey, or cause to be reconveyed, the deed of trust.

(A) The trustee shall execute the full reconveyance

and shall record or cause it to be recorded, except as provided in subdivision

(c), in the office of the county recorder in which the deed of trust is

recorded within 21 calendar days after receipt by the trustee of the original

note, deed of trust, request for a full reconveyance, the fee that may

be charged pursuant to subdivision (e), recorder's fees, and other documents

as may be necessary to reconvey, or cause to be reconveyed, the deed of

trust.

(B) The trustee shall deliver a copy of the reconveyance to the

beneficiary, its successor in interest, or its servicing agent, if known.

(C) Following execution and recordation of the full

reconveyance, upon receipt of a written request by the trustor or the trustor's

heirs, successors, or assignees, the trustee shall then deliver the original

note and deed of trust to the person making that request.

(2) If the trustee has failed to execute and record,

or cause to be recorded, the full reconveyance within 60 calendar days

of satisfaction of the obligation, the beneficiary, upon receipt of a written

request by the trustor or trustor's heirs, successor in interest, agent,

or assignee, shall execute and acknowledge a document pursuant to Section

2934a substituting itself or another as trustee and issue a full reconveyance.

(3) If a full reconveyance has not been executed and recorded

pursuant to either paragraph (1) or paragraph (2) within 75 calendar days

of satisfaction of the obligation, then a title insurance company may prepare

and record a release of the obligation. However, at least 10 days

prior to the issuance and recording of a full release pursuant to this

paragraph, the title insurance company shall mail by first-class mail with

postage prepaid, the intention to release the obligation to the trustee,

trustor, and beneficiary of record, or their successor in interest of record,

at the last known address.

(A) The release shall set forth:

(i) The name of the beneficiary.

(ii) The name of the trustor.

(iii) The recording reference to the deed of trust.

(iv) A recital that the obligation secured by the

deed of trust has been paid in full.

(v) The date and amount of payment.

(B) The release issued pursuant to this subdivision

shall be entitled to recordation and, when recorded, shall be deemed to

be the equivalent of a reconveyance of a deed of trust.

(4) Where an obligation secured by a deed of trust was paid

in full prior to July 1, 1989, and no reconveyance has been issued and

recorded by October 1, 1989, then a release of obligation as provided for

in paragraph (3) may be issued.

(5) Paragraphs (2) and (3) do not excuse the beneficiary

or the trustee from compliance with paragraph (1). Paragraph (3)

does not excuse the beneficiary from compliance with paragraph (2).

(6) In addition to any other remedy provided by law, a title

insurance company preparing or recording the release of the obligation

shall be liable to any party for damages, including attorneys' fees, which

any person may sustain by reason of the issuance and recording of the release,

pursuant to paragraphs (3) and (4).

(c) The mortgagee or trustee shall not record or cause

the certificate of discharge or full reconveyance to be recorded when any

of the following circumstances exists:

(1) The mortgagee or trustee has received written instructions

to the contrary from the mortgagor or trustor, or the owner of the land,

as the case may be, or from the owner of the obligation secured by the

deed of trust or his or her agent, or escrow.

(2) The certificate of discharge or full reconveyance

is to be delivered to the mortgagor or trustor, or the owner of the land,

as the case may be, through an escrow to which the mortgagor, trustor,

or owner is a party.

(3) When the personal delivery is not for the

purpose of causing recordation and when the certificate of discharge or

full reconveyance is to be personally delivered with receipt acknowledged

by the mortgagor or trustor or owner of the land, as the case may be, or

their agent if authorized by mortgagor or trustor or owner of the land.

(d) For the purposes of this section, the phrases

"cause to be recorded" and "cause it to be recorded" include, but are not

limited to, sending by certified mail with the United States Postal Service

or by an independent courier service using its tracking service that provides

documentation of receipt and delivery, including the signature of the recipient,

the full reconveyance or certificate of discharge in a recordable form,

together with payment for all required fees, in an envelope addressed to

the county recorder's office of the county in which the deed of trust or

mortgage is recorded. Within two business days from the day of receipt,

if received in recordable form together with all required fees, the county

recorder shall stamp and record the full reconveyance or certificate of

discharge. Compliance with this subdivision shall entitle the trustee

to the benefit of the presumption found in Section 641 of the Evidence

Code.

(e) The violation of this section shall make the violator

liable to the person affected by the violation for all damages which that

person may sustain by reason of the violation, and shall require that the

violator forfeit to that person the sum of three hundred dollars ($300).

However, a trustee acting in accordance with subdivision (c) shall not

be deemed a violator for purposes of this subdivision.

(f) (1) The trustee, beneficiary, or mortgagee may

charge a reasonable fee to the trustor or mortgagor, or the owner of the

land, as the case may be, for all services involved in the preparation,

execution, and recordation of the full reconveyance, including, but not

limited to, document preparation and forwarding services rendered to effect

the full reconveyance, and, in addition, may collect official fees.

This fee may be made payable no earlier than the opening of a bona fide

escrow or no more than 60 days prior to the full satisfaction of the obligation

secured by the deed of trust or mortgage.

(2) If the fee charged pursuant to this subdivision

does not exceed sixty-five dollars ($65), the fee is conclusively presumed

to be reasonable.

(g) For purposes of this section, "original" may include

an optically imaged reproduction when the following requirements are met:

(1) The trustee receiving the request for reconveyance

and executing the reconveyance as provided in subdivision (b) is an affiliate

or subsidiary of the beneficiary or an affiliate or subsidiary of the assignee

of the beneficiary, respectively.

(2) The optical image storage media used to store the

documentshall be nonerasable write once, read many (WORM) optical image

media that does not allow changes to the stored document.

(3) The optical image reproduction shall be made consistent

with the minimum standards of quality approved by either the National Institute

of Standards and Technology or the Association for Information and Image

Management.

(4) Written authentication identifying the optical

image reproduction as an unaltered copy of the note, deed of trust, or

mortgage shall be stamped or printed on the optical image reproduction.

(h) The amendments to this section enacted at the 1999-2000

Regular Session shall apply only to a mortgage or an obligation secured

by a deed of trust that is satisfied on or after January 1, 2001.

2941.5. Every person who willfully violates Section 2941 is

guilty of a misdemeanor punishable by fine of not less than fifty dollars

($50) nor more than four hundred dollars ($400), or by imprisonment in

the county jail for not to exceed six months, or by both such fine and

imprisonment. For purposes of this section, "willfully" means

simply a purpose or willingness to commit the act, or make the omission

referred to. It does not require an intent to violate the law, to injure

another, or to acquire any advantage.