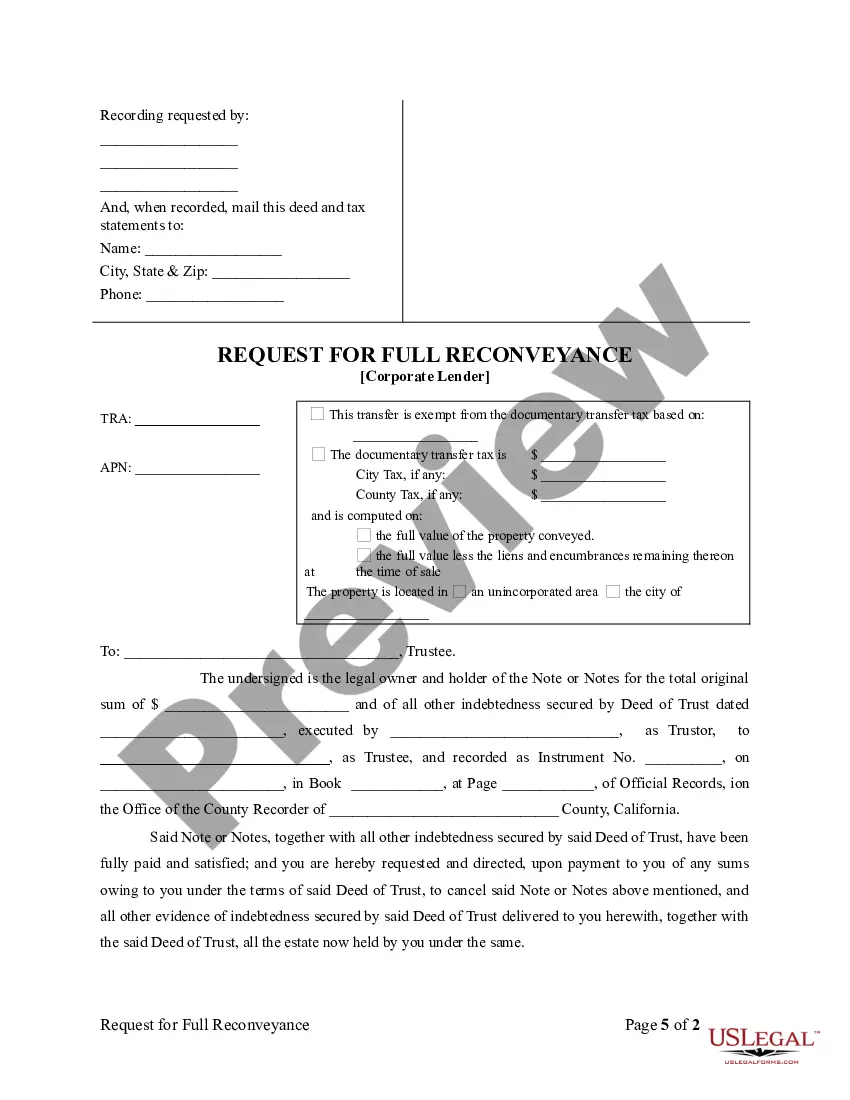

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Corporation (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123E

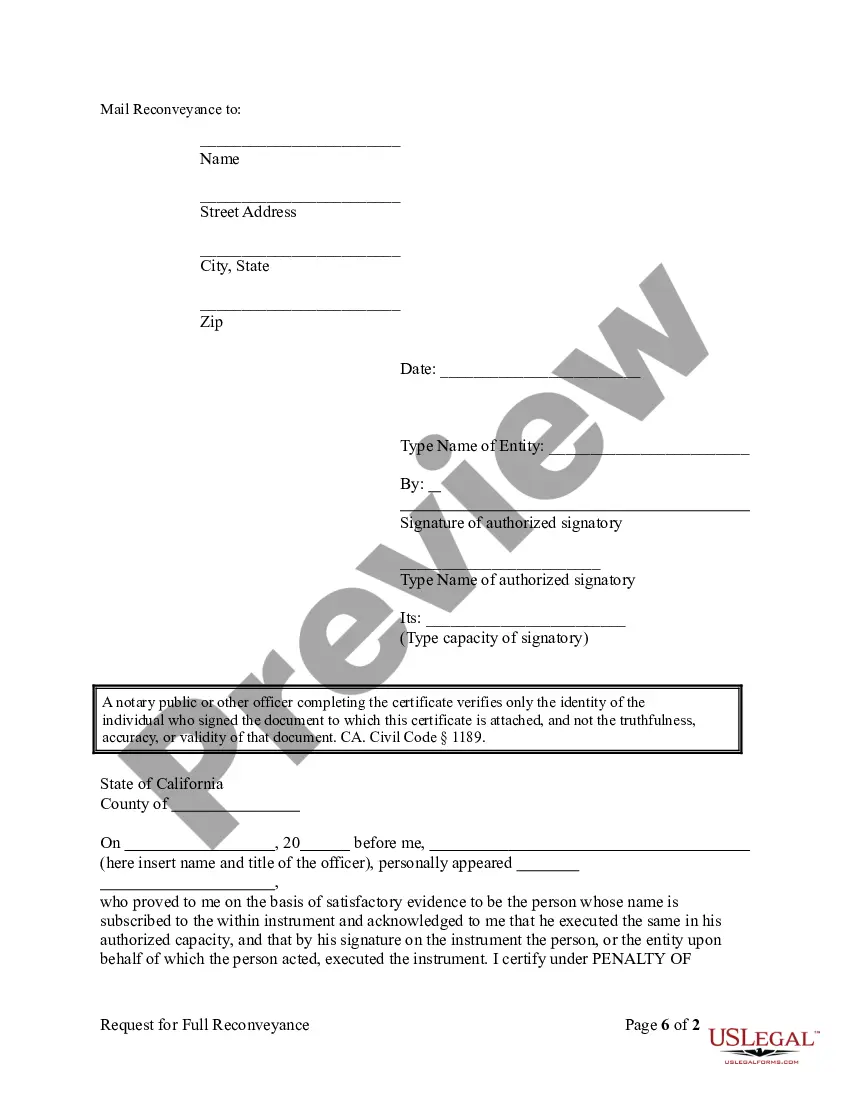

Title: Temecula California Request for Re conveyance of Deed of Trust by Corporation: Explained Introduction: In Temecula, California, individuals and corporations may find themselves needing to execute a Request for Re conveyance of Deed of Trust. This legal document plays a crucial role in the release of the lien on a property title once a loan has been fully repaid. In this article, we will delve into the details of a Temecula California Request for Re conveyance of Deed of Trust by Corporation, discussing its purpose, process, and the potential variations that may exist. Keywords: Temecula California, Request for Re conveyance, Deed of Trust, Corporation I. Understanding the Purpose of a Temecula California Request for Re conveyance of Deed of Trust by Corporation: A. Necessity of Re conveyance: When a corporation borrows funds and pledges a property as security, a Deed of Trust is typically created. This document allows a lender (beneficiary) to place a lien on the property until the loan is fully repaid. Once the loan has been settled, the corporation must request a reconveyance to release the lien. B. Transferring Title: Re conveyance is crucial for conveying clear title ownership back to the corporation since the lender's claim is no longer valid after loan repayment. C. Ensuring Legal Clarity: Executing a Request for Re conveyance of Deed of Trust by Corporation provides legal evidence that the corporation has repaid its loan and holds rightful ownership of the property. II. Process of Filing a Temecula California Request for Re conveyance of Deed of Trust by Corporation: A. Gathering Documents: The corporation must collect all relevant documents, including the original Deed of Trust, promissory note, and proof of loan repayment. B. Drafting the Request: The corporation, either through its legal representative or an attorney, prepares a formal Request for Re conveyance. This document includes essential information such as names of the parties involved, property details, loan repayment details, and legal descriptions. C. Notarization and Signature: The authorized representative of the corporation must sign the Request in the presence of a notary public to ensure its validity. D. Decoration: The corporation submits the signed Request for Re conveyance along with the original Deed of Trust to the county recorder's office in Temecula, California, for recording and analysis. E. Notification to Beneficiary: Once recorded, a copy of the recorded Re conveyance is sent to the lender (beneficiary) to notify them about the release of the lien. III. Types of Temecula California Request for Re conveyance of Deed of Trust by Corporation: While there may not be distinct variations in the Request for Re conveyance itself, different circumstances and scenarios can affect the process. Some potential types include: A. Standard Request for Re conveyance by Corporation: This is the typical scenario where a corporation has fulfilled its loan obligation and requests the reconveyance. B. Request for Re conveyance during a Merger or Acquisition: In cases where a corporation merges with or acquires another entity, a reconveyance may be required to ensure the transfer of the lien-free property. C. Request for Re conveyance due to Loan Assumption: If a corporation assumes an existing loan on a property, it may need to execute a Request for Re conveyance to release any prior liens. Conclusion: A Temecula California Request for Re conveyance of Deed of Trust by Corporation plays a crucial role in releasing the lien on a property title once a loan has been fully repaid. By understanding its purpose, the filing process, and the potential variations that may occur, corporations can navigate this legal process effectively and ensure clarity of ownership.Title: Temecula California Request for Re conveyance of Deed of Trust by Corporation: Explained Introduction: In Temecula, California, individuals and corporations may find themselves needing to execute a Request for Re conveyance of Deed of Trust. This legal document plays a crucial role in the release of the lien on a property title once a loan has been fully repaid. In this article, we will delve into the details of a Temecula California Request for Re conveyance of Deed of Trust by Corporation, discussing its purpose, process, and the potential variations that may exist. Keywords: Temecula California, Request for Re conveyance, Deed of Trust, Corporation I. Understanding the Purpose of a Temecula California Request for Re conveyance of Deed of Trust by Corporation: A. Necessity of Re conveyance: When a corporation borrows funds and pledges a property as security, a Deed of Trust is typically created. This document allows a lender (beneficiary) to place a lien on the property until the loan is fully repaid. Once the loan has been settled, the corporation must request a reconveyance to release the lien. B. Transferring Title: Re conveyance is crucial for conveying clear title ownership back to the corporation since the lender's claim is no longer valid after loan repayment. C. Ensuring Legal Clarity: Executing a Request for Re conveyance of Deed of Trust by Corporation provides legal evidence that the corporation has repaid its loan and holds rightful ownership of the property. II. Process of Filing a Temecula California Request for Re conveyance of Deed of Trust by Corporation: A. Gathering Documents: The corporation must collect all relevant documents, including the original Deed of Trust, promissory note, and proof of loan repayment. B. Drafting the Request: The corporation, either through its legal representative or an attorney, prepares a formal Request for Re conveyance. This document includes essential information such as names of the parties involved, property details, loan repayment details, and legal descriptions. C. Notarization and Signature: The authorized representative of the corporation must sign the Request in the presence of a notary public to ensure its validity. D. Decoration: The corporation submits the signed Request for Re conveyance along with the original Deed of Trust to the county recorder's office in Temecula, California, for recording and analysis. E. Notification to Beneficiary: Once recorded, a copy of the recorded Re conveyance is sent to the lender (beneficiary) to notify them about the release of the lien. III. Types of Temecula California Request for Re conveyance of Deed of Trust by Corporation: While there may not be distinct variations in the Request for Re conveyance itself, different circumstances and scenarios can affect the process. Some potential types include: A. Standard Request for Re conveyance by Corporation: This is the typical scenario where a corporation has fulfilled its loan obligation and requests the reconveyance. B. Request for Re conveyance during a Merger or Acquisition: In cases where a corporation merges with or acquires another entity, a reconveyance may be required to ensure the transfer of the lien-free property. C. Request for Re conveyance due to Loan Assumption: If a corporation assumes an existing loan on a property, it may need to execute a Request for Re conveyance to release any prior liens. Conclusion: A Temecula California Request for Re conveyance of Deed of Trust by Corporation plays a crucial role in releasing the lien on a property title once a loan has been fully repaid. By understanding its purpose, the filing process, and the potential variations that may occur, corporations can navigate this legal process effectively and ensure clarity of ownership.