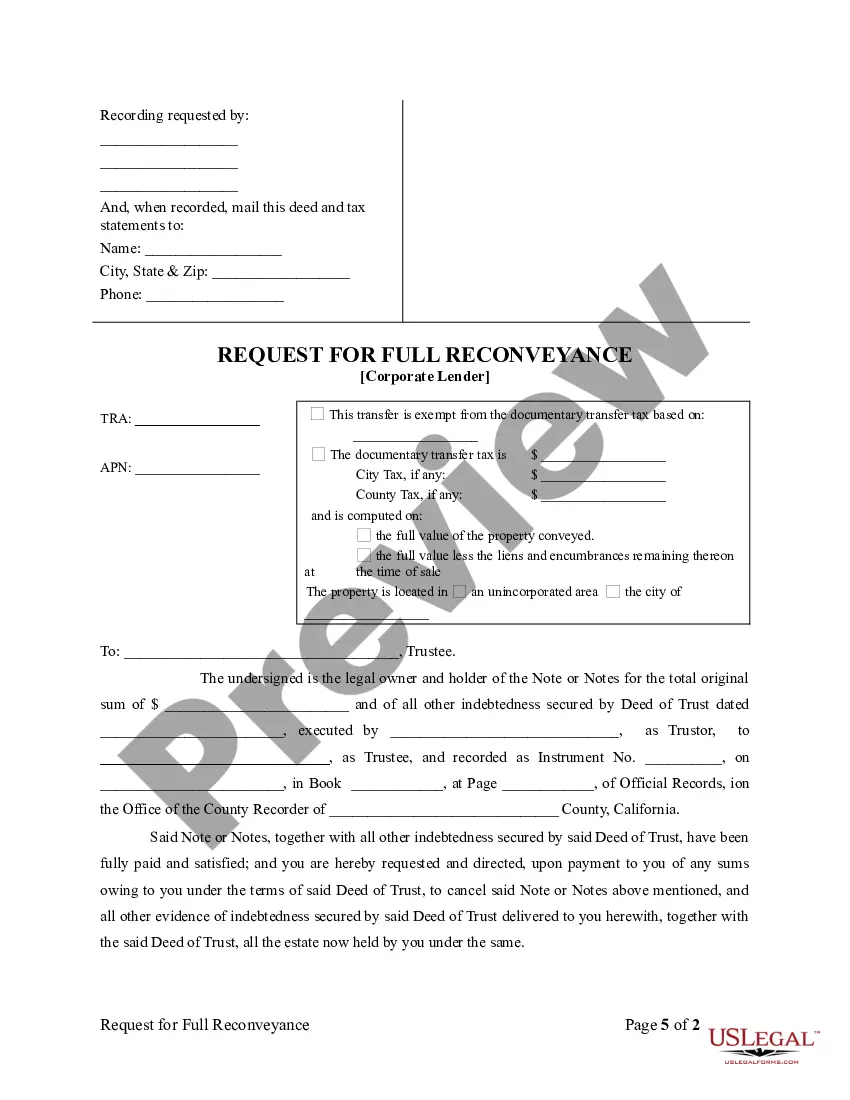

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Corporation (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123E

Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation

Description

How to fill out California Request For Reconveyance Of Deed Of Trust By Corporation?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly platform with an extensive collection of documents simplifies the process of locating and acquiring nearly any document sample you require.

You can download, complete, and authorize the Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation in just a few minutes, rather than spending hours online searching for the appropriate template.

Using our selection is a great method to enhance the security of your document filing.

Access the page with the template you require. Ensure it is the template you were hoping to find: review its title and description, and utilize the Preview feature if accessible. Otherwise, use the Search bar to locate the suitable one.

Initiate the downloading process. Select Buy Now and choose your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Our experienced attorneys frequently review all documents to confirm that the templates are pertinent for a specific area and comply with current laws and regulations.

- How can you obtain the Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation.

- If you already possess an account, simply Log In to your account. The Download button will appear on all the documents you view.

- Furthermore, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the steps below.

Form popularity

FAQ

To obtain a deed of reconveyance, you can start by contacting the lender who held your mortgage. If you are making a Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation, be sure to request this document after fulfilling all payment obligations. If the lender is unresponsive, consider reaching out to legal services or organizations that specialize in real estate transactions. Services like USLegalForms can assist you in creating the necessary documents to facilitate this process.

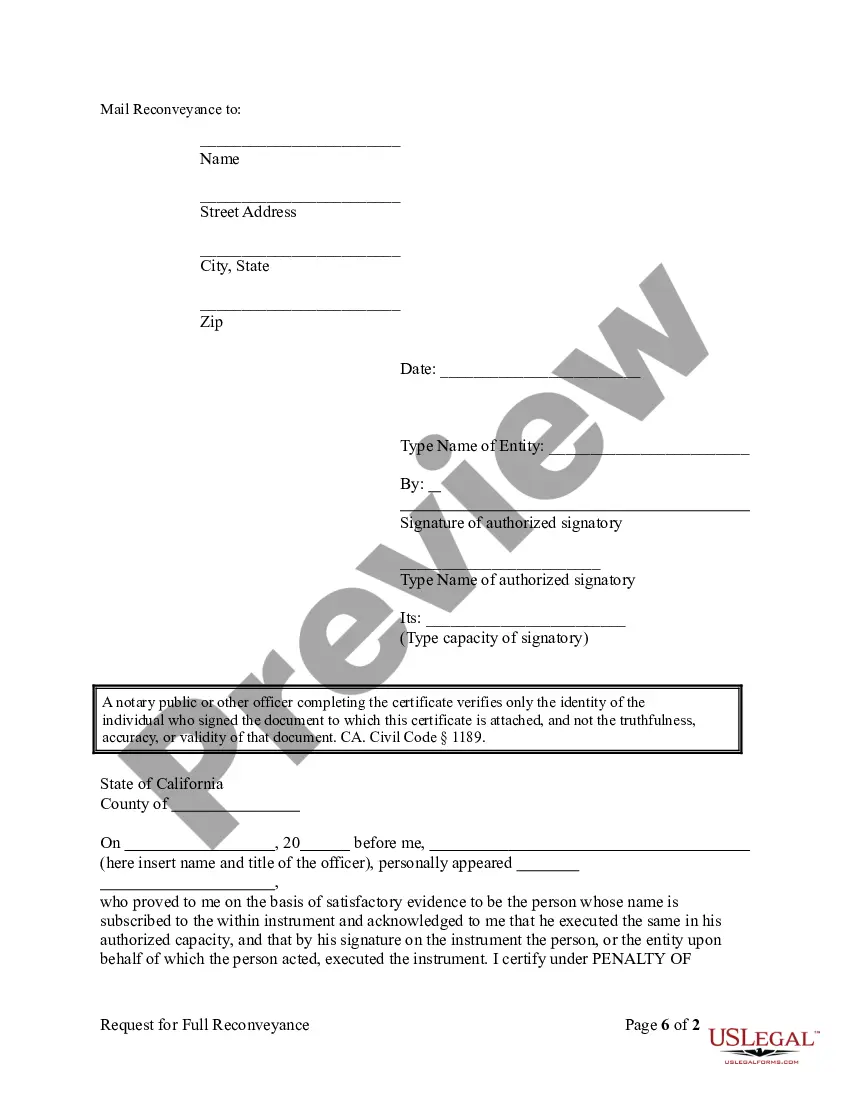

To reconvey a deed of trust in California, the lender must prepare and sign a deed of reconveyance. For anyone dealing with the Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation, it is essential to properly fill out the required form and submit it to the county recorder’s office. Filing this document is a vital step in releasing any claims against the property. Consider using platforms like USLegalForms for templates and guidance throughout this process.

You can obtain a copy of your deed in California by visiting the county recorder's office or checking their website for online access options. The request may require you to provide specific details about the property, such as the address and parcel number. Additionally, if your situation involves a Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation, platforms like US Legal Forms can help you navigate the necessary procedures efficiently.

To obtain a copy of a trust document in California, you typically need to contact the trustee managing that trust. If you are a beneficiary or have legal standing, you should receive a copy upon request. Additionally, when dealing with complex matters like a Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation, using legal forms from US Legal Forms can streamline your experience.

After purchasing a home, you can obtain your deed by contacting the county recorder's office in Thousand Oaks, California. The office keeps records of all property transactions, including deeds. You may also consider submitting a request for reconveyance of the deed of trust by corporation to ensure that your ownership is officially recognized. Using platforms like US Legal Forms can simplify this process.

The rescission of a trust deed involves canceling or voiding the deed, returning both parties to their original positions as if the transaction had not occurred. This may occur due to fraud, misrepresentation, or mutual agreement between the parties. It’s crucial to understand the implications of the Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation when considering rescission, as it can impact future transactions and obligations.

A deed of trust can be deemed invalid in California for several reasons, including improper execution, lack of necessary parties' signatures, or if it does not meet statutory requirements. Additionally, if a corporation is involved, it must adhere to specific regulations to avoid complications. Always remember that understanding the nuances of the Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation can help you avoid pitfalls and maintain valid agreements.

To record a deed of trust in California, start by completing the necessary forms, ensuring they include all required signatures and notary acknowledgment. Next, take your documents to your county recorder's office, where you will submit them for recording. Keep in mind that the Thousand Oaks California Request for Reconveyance of Deed of Trust by Corporation can simplify the process of managing your real estate obligations and provide clarity regarding ownership.

Typically, the lender or their authorized representative prepares the reconveyance document. This individual is responsible for ensuring all information is accurate and that the Request for Reconveyance of Deed of Trust by Corporation is filed correctly. If you're navigating this process, consider using US Legal Forms for reliable templates that simplify documentation.

To obtain a copy of your deed of trust in California, you can request it from the county recorder's office where the property is located. Alternatively, you may find it online through the county's official website. Utilizing US Legal Forms can help you gather the necessary information and ensure you follow the right procedures.