This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Corporation (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123E

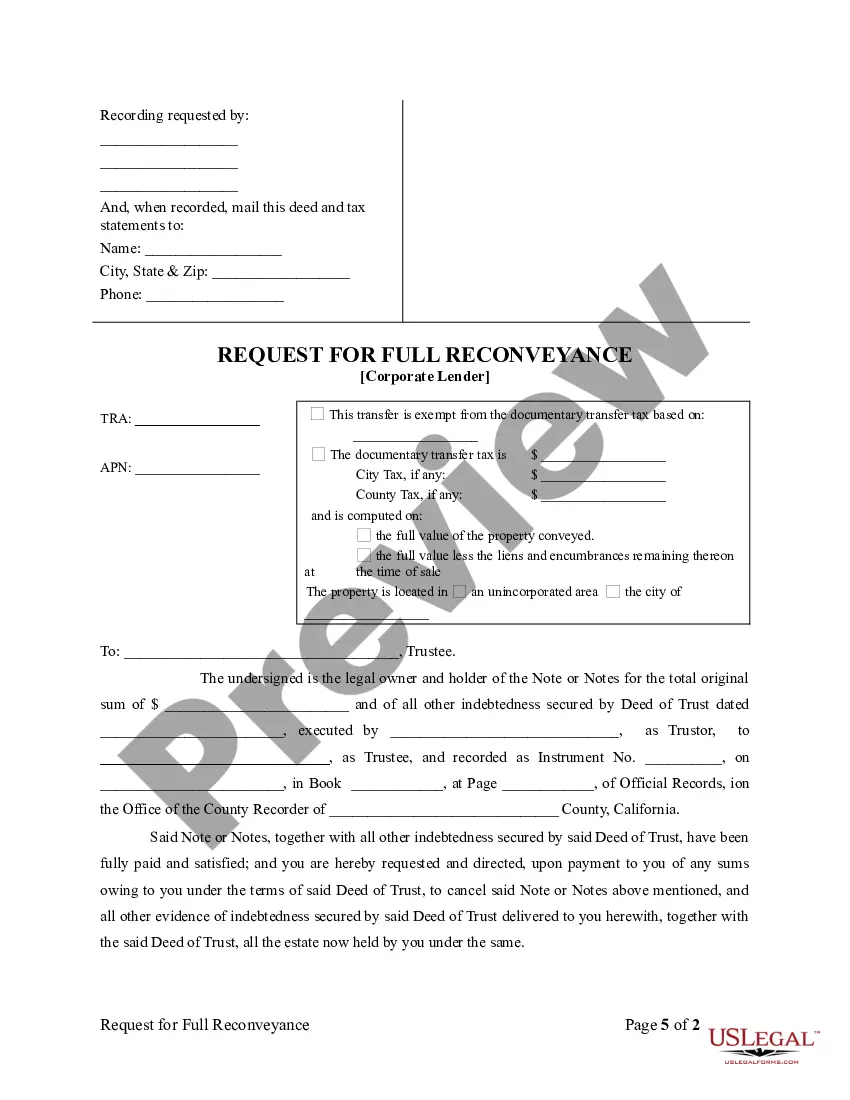

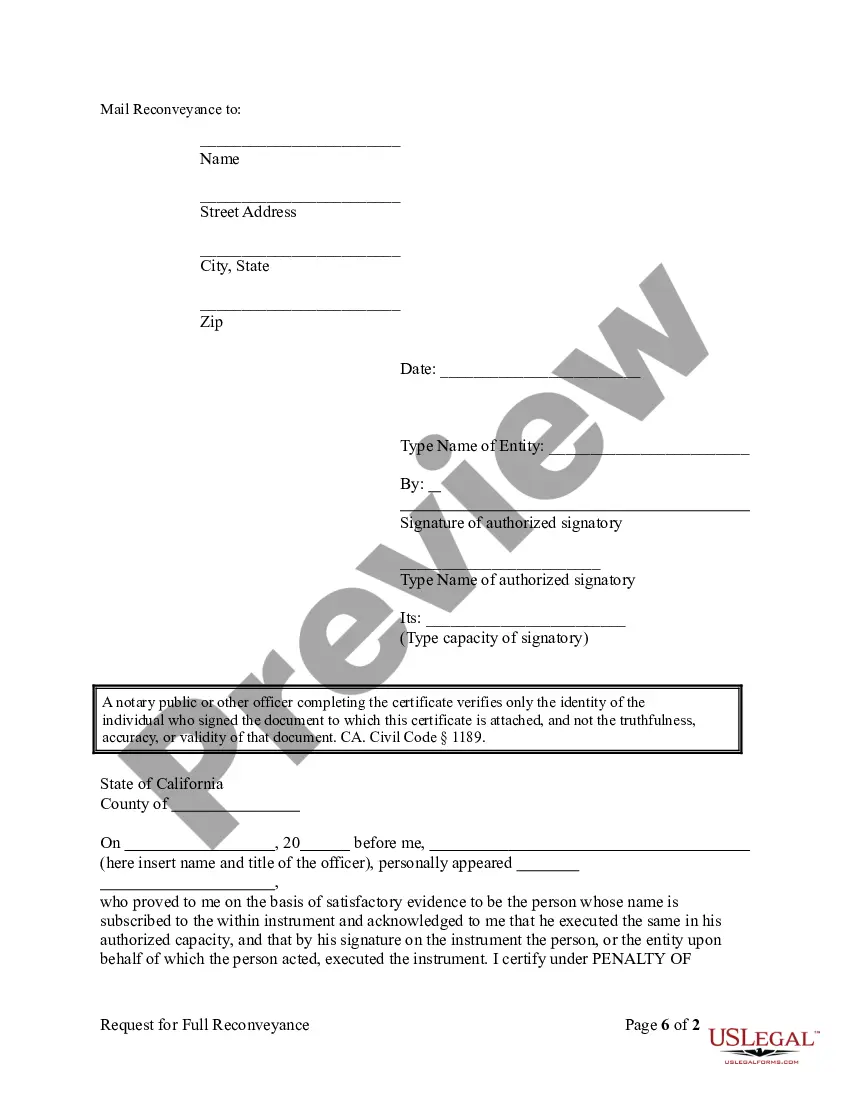

Title: Victorville California Request for Re conveyance of Deed of Trust by Corporation — A Comprehensive Guide Keywords: Victorville California, Request for Re conveyance, Deed of Trust, Corporation, Property, Mortgage Loan Introduction: A Victorville California Request for Re conveyance of Deed of Trust by Corporation is an official document used to transfer the ownership rights of a property back to the borrower, represented by a corporation, after fulfilling all terms and conditions of a mortgage loan. This detailed guide aims to provide valuable insights into the meaning, process, and types of Victorville California Request for Re conveyance of Deed of Trust by Corporation. I. Understanding Victorville California Request for Re conveyance: 1. Deed of Trust: Explaining the concept of a deed of trust, which is a legal document that secures a loan against a property as collateral. 2. Re conveyance: Describing the purpose of reconveyance, which is to release the property owner from their mortgage obligation once the loan has been fully paid. II. The Role of a Corporation in Requesting Re conveyance: 1. Corporate Borrower: Discussing the significance of a corporation as the borrower of the mortgage loan, and their rights and responsibilities in the reconveyance process. 2. Corporation Authorization: Highlighting the need for a corporation's authorized representative to request a reconveyance on behalf of the corporation. III. Components of a Victorville California Request for Re conveyance: 1. Legal Description: Outlining the precise details of the property, including its address, APN (Assessor's Parcel Number), and legal description. 2. Recording Information: Providing instructions on how to accurately provide the recording information, including the original deed of trust, loan number, and the name of the beneficiary. 3. Date of Satisfaction: Explaining the significance of accurately entering the date when the loan was paid in full. 4. Notary Acknowledgment: Emphasizing the requirement of notarization to validate the reconveyance request. IV. Types of Victorville California Request for Re conveyance of Deed of Trust by Corporation: 1. Full Re conveyance: Explaining the process of requesting a full reconveyance when the loan has been fully repaid and the property ownership is to be transferred entirely. 2. Partial Re conveyance: Describing circumstances where only a portion of the loan has been paid and a partial reconveyance is necessary. 3. Assignment of Deed of Trust: Discussing situations where a corporation assigns its interest in a deed of trust to another entity, necessitating a reconveyance. Conclusion: A Victorville California Request for Re conveyance of Deed of Trust by Corporation is a crucial legal document that marks the completion of a mortgage loan for a corporation. By understanding the process and types of reconveyance, corporation representatives can ensure a smooth transition of property ownership, allowing for further financial opportunities. It is essential to consult with legal professionals or title companies to accurately file a request for reconveyance.Title: Victorville California Request for Re conveyance of Deed of Trust by Corporation — A Comprehensive Guide Keywords: Victorville California, Request for Re conveyance, Deed of Trust, Corporation, Property, Mortgage Loan Introduction: A Victorville California Request for Re conveyance of Deed of Trust by Corporation is an official document used to transfer the ownership rights of a property back to the borrower, represented by a corporation, after fulfilling all terms and conditions of a mortgage loan. This detailed guide aims to provide valuable insights into the meaning, process, and types of Victorville California Request for Re conveyance of Deed of Trust by Corporation. I. Understanding Victorville California Request for Re conveyance: 1. Deed of Trust: Explaining the concept of a deed of trust, which is a legal document that secures a loan against a property as collateral. 2. Re conveyance: Describing the purpose of reconveyance, which is to release the property owner from their mortgage obligation once the loan has been fully paid. II. The Role of a Corporation in Requesting Re conveyance: 1. Corporate Borrower: Discussing the significance of a corporation as the borrower of the mortgage loan, and their rights and responsibilities in the reconveyance process. 2. Corporation Authorization: Highlighting the need for a corporation's authorized representative to request a reconveyance on behalf of the corporation. III. Components of a Victorville California Request for Re conveyance: 1. Legal Description: Outlining the precise details of the property, including its address, APN (Assessor's Parcel Number), and legal description. 2. Recording Information: Providing instructions on how to accurately provide the recording information, including the original deed of trust, loan number, and the name of the beneficiary. 3. Date of Satisfaction: Explaining the significance of accurately entering the date when the loan was paid in full. 4. Notary Acknowledgment: Emphasizing the requirement of notarization to validate the reconveyance request. IV. Types of Victorville California Request for Re conveyance of Deed of Trust by Corporation: 1. Full Re conveyance: Explaining the process of requesting a full reconveyance when the loan has been fully repaid and the property ownership is to be transferred entirely. 2. Partial Re conveyance: Describing circumstances where only a portion of the loan has been paid and a partial reconveyance is necessary. 3. Assignment of Deed of Trust: Discussing situations where a corporation assigns its interest in a deed of trust to another entity, necessitating a reconveyance. Conclusion: A Victorville California Request for Re conveyance of Deed of Trust by Corporation is a crucial legal document that marks the completion of a mortgage loan for a corporation. By understanding the process and types of reconveyance, corporation representatives can ensure a smooth transition of property ownership, allowing for further financial opportunities. It is essential to consult with legal professionals or title companies to accurately file a request for reconveyance.