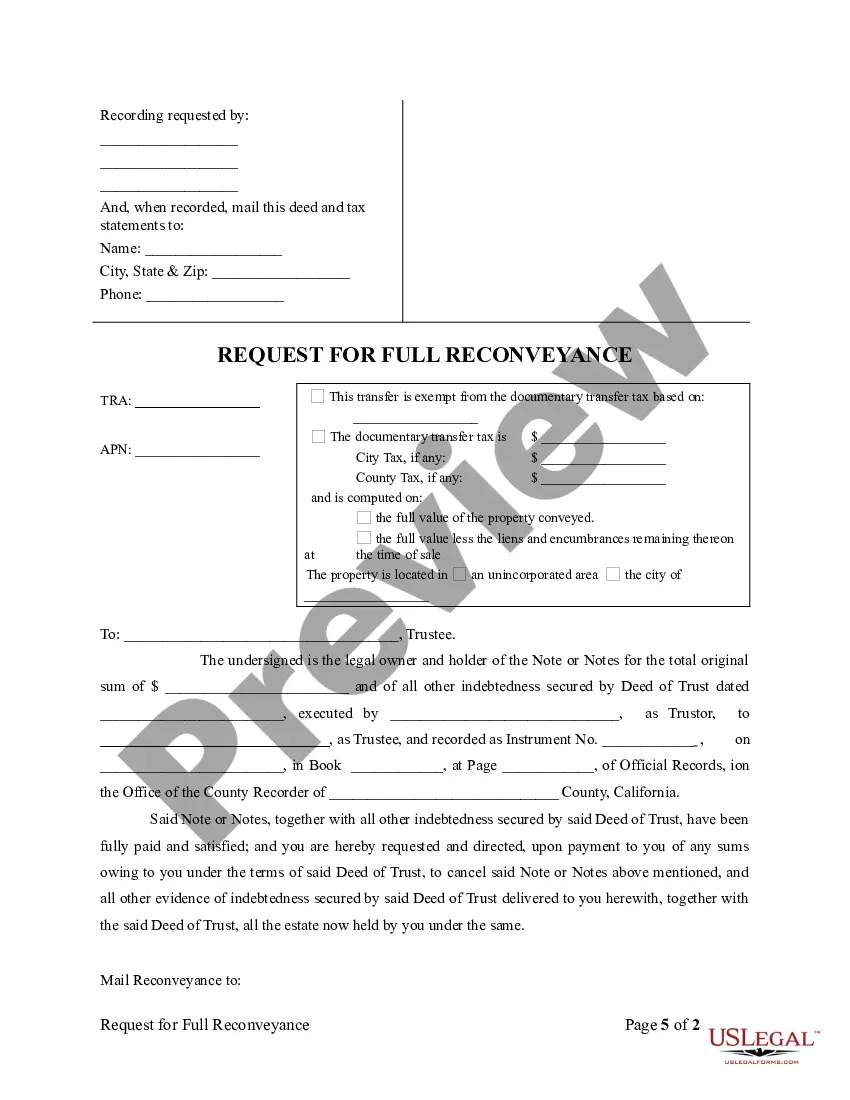

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Individual (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123F

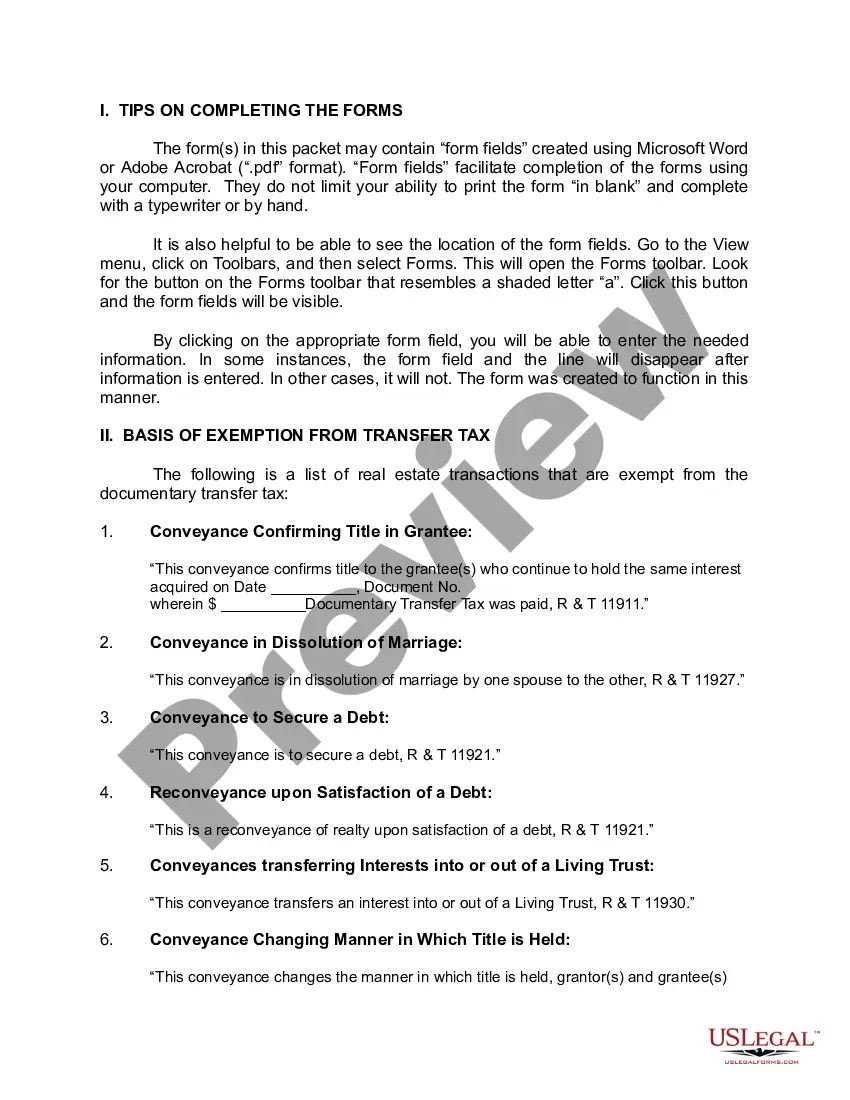

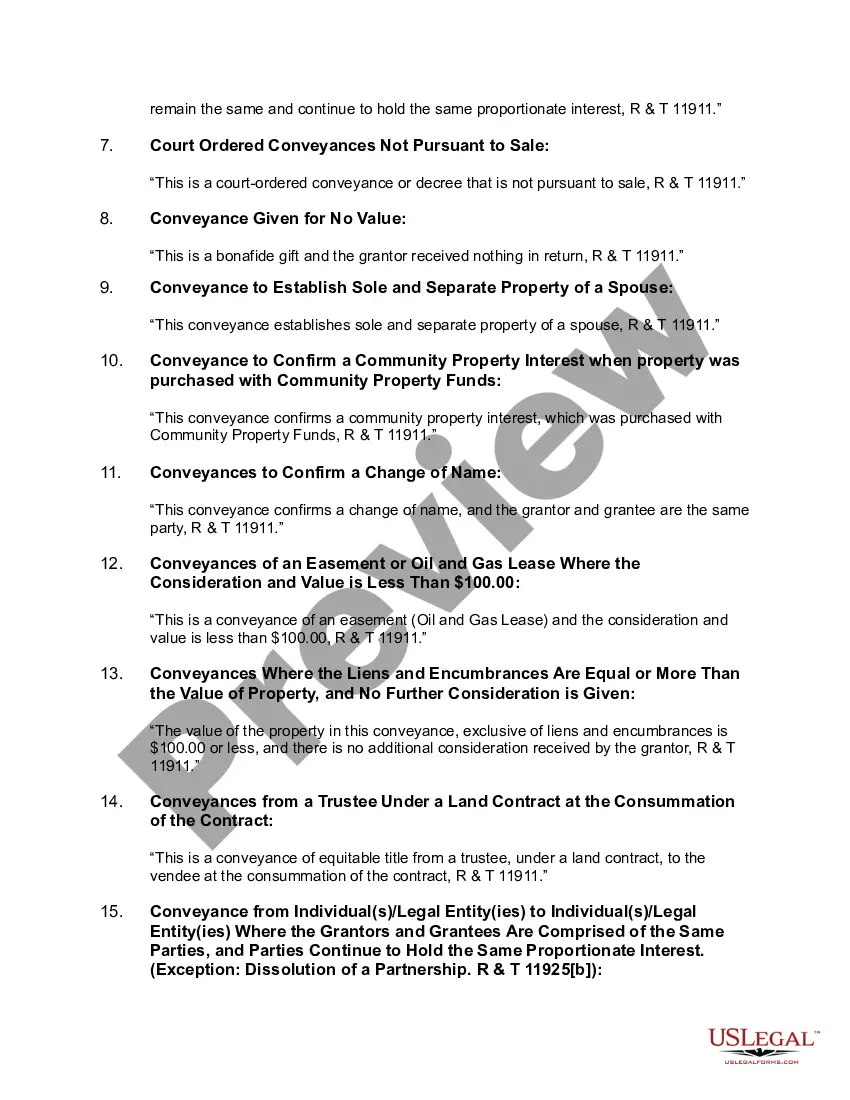

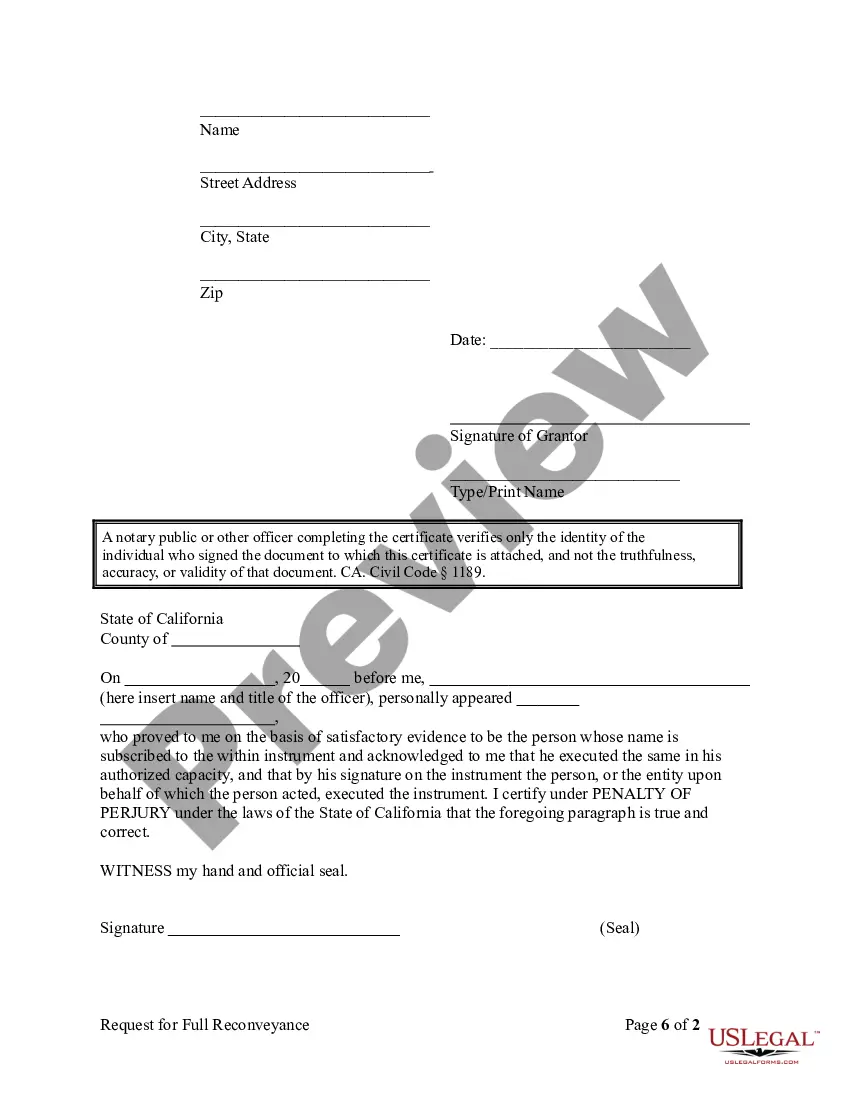

Title: Understanding Burbank California Request for Re conveyance of Deed of Trust by Individual Keywords: Burbank California, Request for Re conveyance, Deed of Trust, Individual, requirements, process, documentation, notary, promissory note, encumbrance, lien Introduction: The Burbank California Request for Re conveyance of Deed of Trust by Individual is an essential legal document that signifies the release of a property from a loan or mortgage obligation. This article aims to provide an in-depth understanding of this process, including its purpose, requirements, documentation, and necessary steps to ensure a successful reconveyance. Types of Burbank California Request for Re conveyance of Deed of Trust by Individual: 1. Full Re conveyance of Deed of Trust: This type of reconveyance is applicable when the borrower has fulfilled all the obligations associated with the loan, including complete repayment of the loan amount, interest, and other relevant charges. 2. Partial Re conveyance of Deed of Trust: In some cases, borrowers may choose to pay off a portion of the loan, resulting in a partial reconveyance. This type of reconveyance is implemented when the individual has made substantial payments but still has a remaining balance to be settled. Requirements for Burbank California Request for Re conveyance of Deed of Trust by Individual: To initiate the process of requesting a reconveyance of deed of trust in Burbank, California, certain requirements must be fulfilled. These include but are not limited to: 1. Loan Repayment: The individual must have successfully repaid the loan amount, along with any accrued interest, as stipulated in the original loan agreement. 2. Promissory Note: The original promissory note signed by the borrower serves as evidence of the loan and typically outlines the repayment terms, interest rate, and other essential details. 3. Title Reports: The borrower may need to provide an updated title report to verify their ownership of the property and ensure there are no outstanding liens or encumbrances on the property. 4. Trust Deed or Mortgage: The original trust deed or mortgage agreement, which outlines the legal framework of the loan, should be available as supporting documentation. Process of Requesting Re conveyance: 1. Obtain the Required Forms: Contact your lender or mortgage service to acquire the specific request forms for reconveyance. These forms are often available online or can be obtained from the lender's office. 2. Complete the Request Form: Accurately fill out the necessary details in the provided form. Include personal information, loan details, legal property description, and any other relevant information requested. 3. Attach Supporting Documentation: Along with the request form, include all the requisite documents, such as the original promissory note, trust deed, and title reports. 4. Notarization: Ensure that the request form is notarized by a certified notary public, confirming the authenticity of the signature. 5. Submitting the Request: Send the completed request form and supporting documentation to the lender or appropriate authority via certified mail. Retain copies of all submitted documents for personal records. Conclusion: Understanding the process and requirements involved in the Burbank California Request for Re conveyance of Deed of Trust by Individual is crucial for a smooth and successful completion of the process. By providing the necessary documentation and following the specified steps, individuals can effectively release their properties from mortgage obligations, granting them complete ownership.Title: Understanding Burbank California Request for Re conveyance of Deed of Trust by Individual Keywords: Burbank California, Request for Re conveyance, Deed of Trust, Individual, requirements, process, documentation, notary, promissory note, encumbrance, lien Introduction: The Burbank California Request for Re conveyance of Deed of Trust by Individual is an essential legal document that signifies the release of a property from a loan or mortgage obligation. This article aims to provide an in-depth understanding of this process, including its purpose, requirements, documentation, and necessary steps to ensure a successful reconveyance. Types of Burbank California Request for Re conveyance of Deed of Trust by Individual: 1. Full Re conveyance of Deed of Trust: This type of reconveyance is applicable when the borrower has fulfilled all the obligations associated with the loan, including complete repayment of the loan amount, interest, and other relevant charges. 2. Partial Re conveyance of Deed of Trust: In some cases, borrowers may choose to pay off a portion of the loan, resulting in a partial reconveyance. This type of reconveyance is implemented when the individual has made substantial payments but still has a remaining balance to be settled. Requirements for Burbank California Request for Re conveyance of Deed of Trust by Individual: To initiate the process of requesting a reconveyance of deed of trust in Burbank, California, certain requirements must be fulfilled. These include but are not limited to: 1. Loan Repayment: The individual must have successfully repaid the loan amount, along with any accrued interest, as stipulated in the original loan agreement. 2. Promissory Note: The original promissory note signed by the borrower serves as evidence of the loan and typically outlines the repayment terms, interest rate, and other essential details. 3. Title Reports: The borrower may need to provide an updated title report to verify their ownership of the property and ensure there are no outstanding liens or encumbrances on the property. 4. Trust Deed or Mortgage: The original trust deed or mortgage agreement, which outlines the legal framework of the loan, should be available as supporting documentation. Process of Requesting Re conveyance: 1. Obtain the Required Forms: Contact your lender or mortgage service to acquire the specific request forms for reconveyance. These forms are often available online or can be obtained from the lender's office. 2. Complete the Request Form: Accurately fill out the necessary details in the provided form. Include personal information, loan details, legal property description, and any other relevant information requested. 3. Attach Supporting Documentation: Along with the request form, include all the requisite documents, such as the original promissory note, trust deed, and title reports. 4. Notarization: Ensure that the request form is notarized by a certified notary public, confirming the authenticity of the signature. 5. Submitting the Request: Send the completed request form and supporting documentation to the lender or appropriate authority via certified mail. Retain copies of all submitted documents for personal records. Conclusion: Understanding the process and requirements involved in the Burbank California Request for Re conveyance of Deed of Trust by Individual is crucial for a smooth and successful completion of the process. By providing the necessary documentation and following the specified steps, individuals can effectively release their properties from mortgage obligations, granting them complete ownership.