This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Individual (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123F

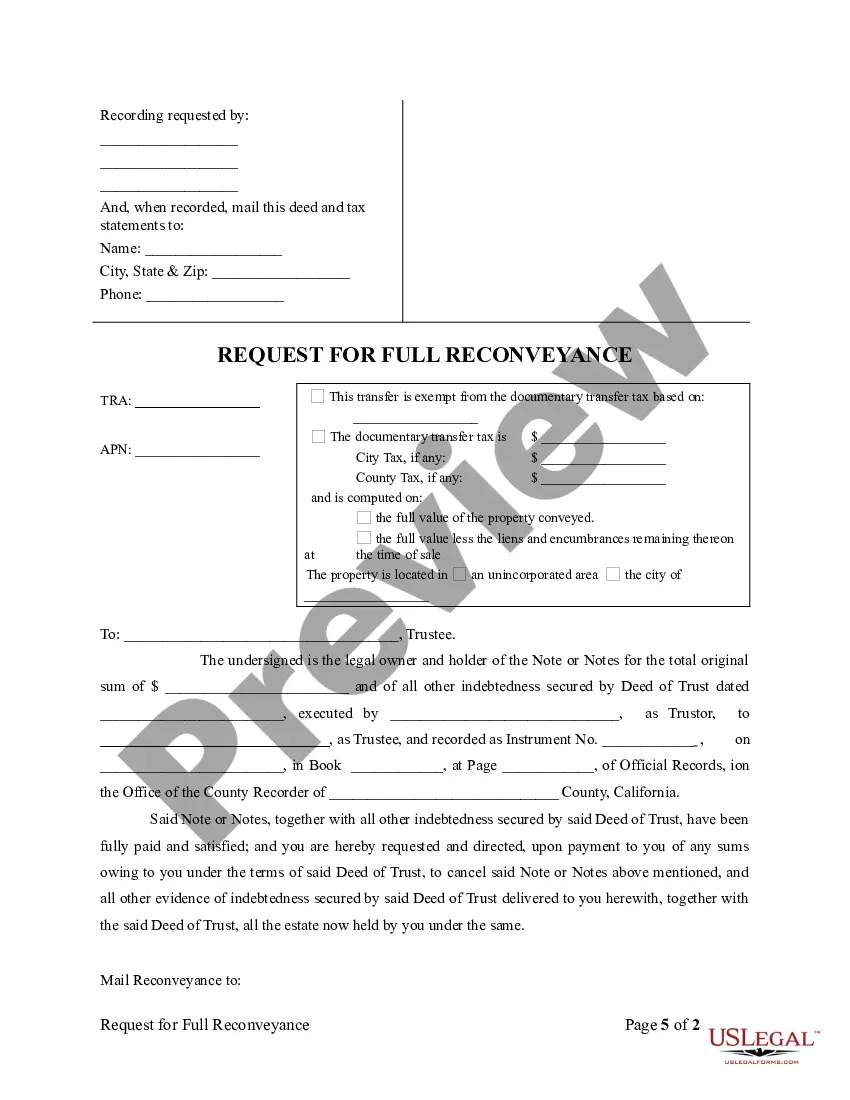

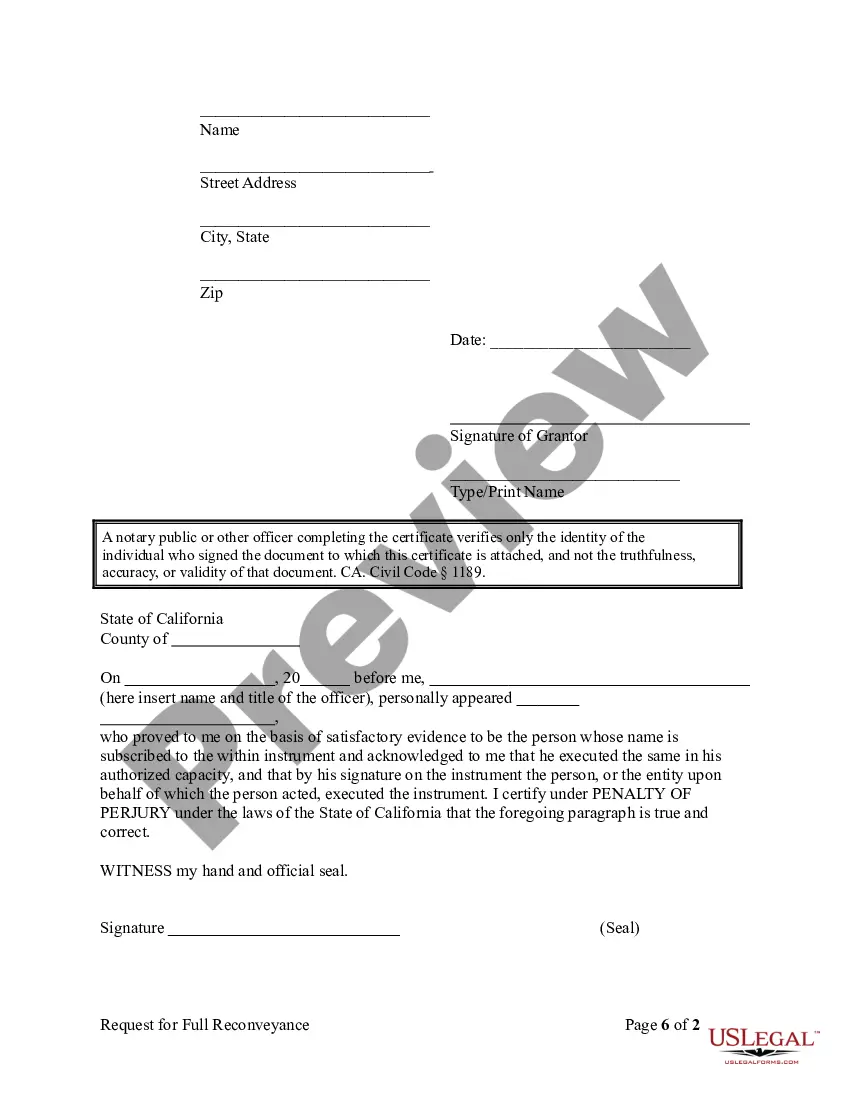

Elk Grove California Request for Re conveyance of Deed of Trust by Individual: A Comprehensive Guide Introduction: The Elk Grove California Request for Re conveyance of Deed of Trust by Individual is a legal process executed by a property owner to release their property from the mortgage or loan secured by a deed of trust. This detailed description aims to provide a comprehensive overview of what an Elk Grove resident needs to know about requesting a reconveyance of their deed of trust, including the types of requests available. Key Terms and Definitions: 1. Elk Grove, California: Elk Grove is a city located in Sacramento County, California. It is known for its suburban atmosphere and proximity to Sacramento, the capital city of California. 2. Re conveyance: Re conveyance is the act of releasing a property from the security interest of a deed of trust. It is usually executed by the trustee appointed in the deed of trust or a designated agent. 3. Deed of Trust: A deed of trust is a legal document that creates a security interest between a borrower and a lender. It serves as collateral for a mortgage or loan, safeguarding the lender's interest in the property until the loan is fully repaid. 4. Individual: In the context of an Elk Grove California Request for Re conveyance of Deed of Trust, an individual refers to a property owner requesting the release of their property from the mortgage or loan secured by a deed of trust. Types of Elk Grove California Request for Re conveyance of Deed of Trust by Individual: 1. Full Re conveyance: An individual submits a request for a full reconveyance when they have fully repaid their loan or mortgage. This request is typically made to the trustee or lender who holds the deed of trust. 2. Partial Re conveyance: In some cases, an individual may have repaid a portion of their loan or mortgage, allowing them to request a partial reconveyance of the property. This is done to release the portion of the property that has been fully paid off. 3. Re conveyance Due to Loan Modification or Refinance: An individual may request reconveyance of their deed of trust when they have undergone a loan modification or refinancing process. This typically occurs when the terms of the loan have been modified, resulting in a need to release the old deed of trust and create a new one. 4. Re conveyance Due to Sale or Transfer of Property: When an individual sells or transfers their property, they can request a reconveyance to release the property from the existing deed of trust. This ensures that the new owner's interests are protected. Step-by-Step Process for Requesting Elk Grove California Re conveyance of Deed of Trust by Individual: 1. Gather Necessary Documents: Collect all relevant documents, including the original deed of trust, promissory note, and any other loan-related paperwork. Have a copy of the title report or proof of ownership handy. 2. Contact Trustee or Lender: Reach out to the trustee or lender identified in the deed of trust to discuss the reconveyance process. They will guide you through the necessary requirements and paperwork. 3. Complete a Re conveyance Request Form: Obtain a reconveyance request form from the trustee or lender, and fill it out accurately and completely. Include all required details, such as property information, loan details, borrower's name, and contact information. 4. Attach Supporting Documents: Attach the necessary supporting documents, such as proof of loan repayment, release of lien or satisfaction of mortgage, loan modification agreement, or proof of property transfer. 5. Notarize the Request: Get the reconveyance request form notarized to add an extra layer of authenticity. 6. Submit the Request: Send the completed and notarized reconveyance request form, along with supporting documents, to the trustee or lender as instructed. Ensure you keep copies of everything for your records. 7. Follow Up and Confirm Completion: Contact the trustee or lender to confirm the receipt of your request and follow up regularly until the reconveyance process is complete. Obtain a reconveyance deed or reconveyance of deed of trust, which indicates the release of the property from the loan's security. Conclusion: The Elk Grove California Request for Re conveyance of Deed of Trust by Individual is an essential process for property owners looking to release their property from a mortgage or loan secured by a deed of trust. Understanding the types of requests available, gathering required documents, and following the step-by-step process will help ensure a successful reconveyance. It is advisable to consult legal professionals or experts experienced in real estate transactions to navigate this process accurately.Elk Grove California Request for Re conveyance of Deed of Trust by Individual: A Comprehensive Guide Introduction: The Elk Grove California Request for Re conveyance of Deed of Trust by Individual is a legal process executed by a property owner to release their property from the mortgage or loan secured by a deed of trust. This detailed description aims to provide a comprehensive overview of what an Elk Grove resident needs to know about requesting a reconveyance of their deed of trust, including the types of requests available. Key Terms and Definitions: 1. Elk Grove, California: Elk Grove is a city located in Sacramento County, California. It is known for its suburban atmosphere and proximity to Sacramento, the capital city of California. 2. Re conveyance: Re conveyance is the act of releasing a property from the security interest of a deed of trust. It is usually executed by the trustee appointed in the deed of trust or a designated agent. 3. Deed of Trust: A deed of trust is a legal document that creates a security interest between a borrower and a lender. It serves as collateral for a mortgage or loan, safeguarding the lender's interest in the property until the loan is fully repaid. 4. Individual: In the context of an Elk Grove California Request for Re conveyance of Deed of Trust, an individual refers to a property owner requesting the release of their property from the mortgage or loan secured by a deed of trust. Types of Elk Grove California Request for Re conveyance of Deed of Trust by Individual: 1. Full Re conveyance: An individual submits a request for a full reconveyance when they have fully repaid their loan or mortgage. This request is typically made to the trustee or lender who holds the deed of trust. 2. Partial Re conveyance: In some cases, an individual may have repaid a portion of their loan or mortgage, allowing them to request a partial reconveyance of the property. This is done to release the portion of the property that has been fully paid off. 3. Re conveyance Due to Loan Modification or Refinance: An individual may request reconveyance of their deed of trust when they have undergone a loan modification or refinancing process. This typically occurs when the terms of the loan have been modified, resulting in a need to release the old deed of trust and create a new one. 4. Re conveyance Due to Sale or Transfer of Property: When an individual sells or transfers their property, they can request a reconveyance to release the property from the existing deed of trust. This ensures that the new owner's interests are protected. Step-by-Step Process for Requesting Elk Grove California Re conveyance of Deed of Trust by Individual: 1. Gather Necessary Documents: Collect all relevant documents, including the original deed of trust, promissory note, and any other loan-related paperwork. Have a copy of the title report or proof of ownership handy. 2. Contact Trustee or Lender: Reach out to the trustee or lender identified in the deed of trust to discuss the reconveyance process. They will guide you through the necessary requirements and paperwork. 3. Complete a Re conveyance Request Form: Obtain a reconveyance request form from the trustee or lender, and fill it out accurately and completely. Include all required details, such as property information, loan details, borrower's name, and contact information. 4. Attach Supporting Documents: Attach the necessary supporting documents, such as proof of loan repayment, release of lien or satisfaction of mortgage, loan modification agreement, or proof of property transfer. 5. Notarize the Request: Get the reconveyance request form notarized to add an extra layer of authenticity. 6. Submit the Request: Send the completed and notarized reconveyance request form, along with supporting documents, to the trustee or lender as instructed. Ensure you keep copies of everything for your records. 7. Follow Up and Confirm Completion: Contact the trustee or lender to confirm the receipt of your request and follow up regularly until the reconveyance process is complete. Obtain a reconveyance deed or reconveyance of deed of trust, which indicates the release of the property from the loan's security. Conclusion: The Elk Grove California Request for Re conveyance of Deed of Trust by Individual is an essential process for property owners looking to release their property from a mortgage or loan secured by a deed of trust. Understanding the types of requests available, gathering required documents, and following the step-by-step process will help ensure a successful reconveyance. It is advisable to consult legal professionals or experts experienced in real estate transactions to navigate this process accurately.