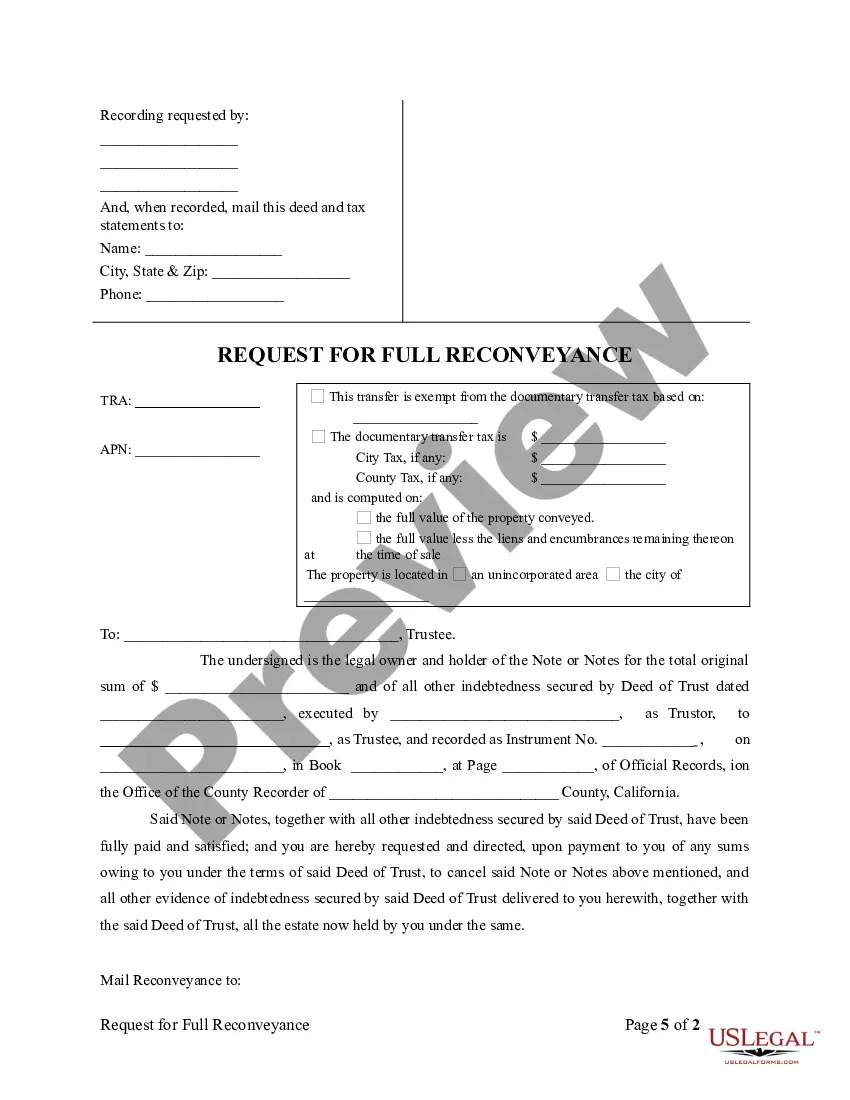

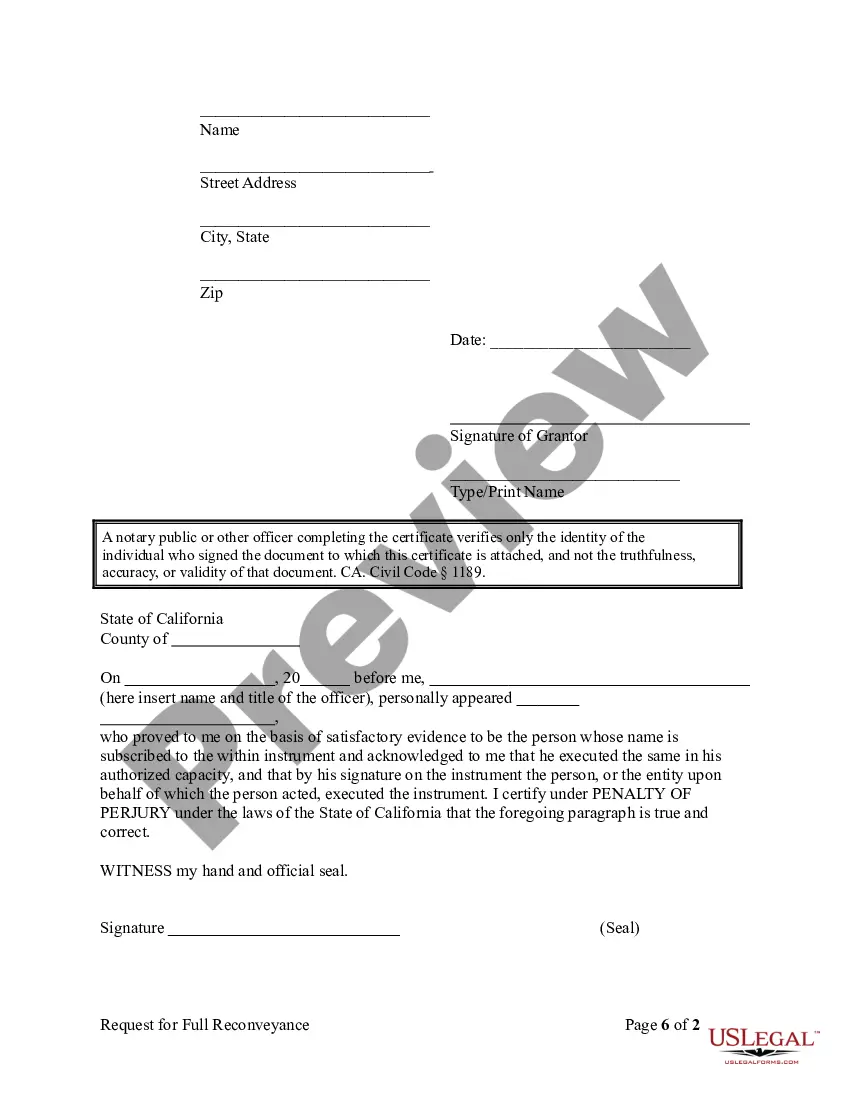

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Individual (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123F

Title: Orange California Request for Re conveyance of Deed of Trust by Individual: Understanding the Process & How to Submit Your Request Keywords: Orange California, Request for Re conveyance, Deed of Trust, Individual, Process, Submit, Mortgage Lender, Beneficiary, Promissory Note, Certificate of Satisfaction, Property Ownership Introduction: In Orange, California, homeowners who have successfully paid off their mortgage can request a reconveyance of their deed of trust. This process ensures that the mortgage lender acknowledges the full repayment of the loan and releases the lien on the property. This comprehensive guide will explain the details of the request for reconveyance process, the relevant parties involved, and the necessary steps to submit your request successfully. Types of Orange California Request for Re conveyance of Deed of Trust by Individual: 1. Preliminary Request for Re conveyance: — This type of request is typically an inquiry initiated by the homeowner to confirm the outstanding balance on their mortgage prior to requesting a formal reconveyance. 2. Formal Request for Re conveyance: — This type of request is made once the homeowner has successfully paid off their mortgage and desires to obtain and record a reconveyance deed to clear the property's title of the mortgage lien entirely. The Process of Requesting a Re conveyance of Deed of Trust by Individual: 1. Complete the Re conveyance Request Form: — Obtain the official request form provided by the mortgage lender or title company involved in the initial transaction. Fill in all the required details accurately and ensure that your personal information, loan number, and property address are correctly stated. 2. Gather Supporting Documents: — Prepare supporting documents such as a copy of the original promissory note and a copy of the last recorded deed of trust. These documents serve as evidence of your loan repayment and property ownership. 3. Contact the Mortgage Lender/Beneficiary: — Reach out to the mortgage lender or the current beneficiary named on the deed of trust. Inquire about their specific requirements, any additional documentation needed, and their preferred method of submitting the reconveyance request package. 4. Pay Any Required Fees: — Some lenders or title companies may require payment of fees associated with the reconveyance process. These fees typically cover document preparation, notary services, and recording fees. Ensure you comply with all fee requirements in a timely manner. 5. Submit the Request Package: — Compile all the necessary documents and submit the reconveyance request package to the mortgage lender or title company as directed. It is crucial to follow their instructions carefully and keep copies of all the submitted documents for your records. Conclusion: Orange California homeowners who have fulfilled their mortgage obligations can enjoy the benefits of a reconveyance of deed of trust. By following this guide and understanding the specific requirements set by your mortgage lender or title company, you can successfully submit your request, ensuring a seamless transfer of property ownership free of any liens or encumbrances. Remember to stay organized, consult professionals when needed, and retain copies of all important documents throughout the reconveyance process.Title: Orange California Request for Re conveyance of Deed of Trust by Individual: Understanding the Process & How to Submit Your Request Keywords: Orange California, Request for Re conveyance, Deed of Trust, Individual, Process, Submit, Mortgage Lender, Beneficiary, Promissory Note, Certificate of Satisfaction, Property Ownership Introduction: In Orange, California, homeowners who have successfully paid off their mortgage can request a reconveyance of their deed of trust. This process ensures that the mortgage lender acknowledges the full repayment of the loan and releases the lien on the property. This comprehensive guide will explain the details of the request for reconveyance process, the relevant parties involved, and the necessary steps to submit your request successfully. Types of Orange California Request for Re conveyance of Deed of Trust by Individual: 1. Preliminary Request for Re conveyance: — This type of request is typically an inquiry initiated by the homeowner to confirm the outstanding balance on their mortgage prior to requesting a formal reconveyance. 2. Formal Request for Re conveyance: — This type of request is made once the homeowner has successfully paid off their mortgage and desires to obtain and record a reconveyance deed to clear the property's title of the mortgage lien entirely. The Process of Requesting a Re conveyance of Deed of Trust by Individual: 1. Complete the Re conveyance Request Form: — Obtain the official request form provided by the mortgage lender or title company involved in the initial transaction. Fill in all the required details accurately and ensure that your personal information, loan number, and property address are correctly stated. 2. Gather Supporting Documents: — Prepare supporting documents such as a copy of the original promissory note and a copy of the last recorded deed of trust. These documents serve as evidence of your loan repayment and property ownership. 3. Contact the Mortgage Lender/Beneficiary: — Reach out to the mortgage lender or the current beneficiary named on the deed of trust. Inquire about their specific requirements, any additional documentation needed, and their preferred method of submitting the reconveyance request package. 4. Pay Any Required Fees: — Some lenders or title companies may require payment of fees associated with the reconveyance process. These fees typically cover document preparation, notary services, and recording fees. Ensure you comply with all fee requirements in a timely manner. 5. Submit the Request Package: — Compile all the necessary documents and submit the reconveyance request package to the mortgage lender or title company as directed. It is crucial to follow their instructions carefully and keep copies of all the submitted documents for your records. Conclusion: Orange California homeowners who have fulfilled their mortgage obligations can enjoy the benefits of a reconveyance of deed of trust. By following this guide and understanding the specific requirements set by your mortgage lender or title company, you can successfully submit your request, ensuring a seamless transfer of property ownership free of any liens or encumbrances. Remember to stay organized, consult professionals when needed, and retain copies of all important documents throughout the reconveyance process.