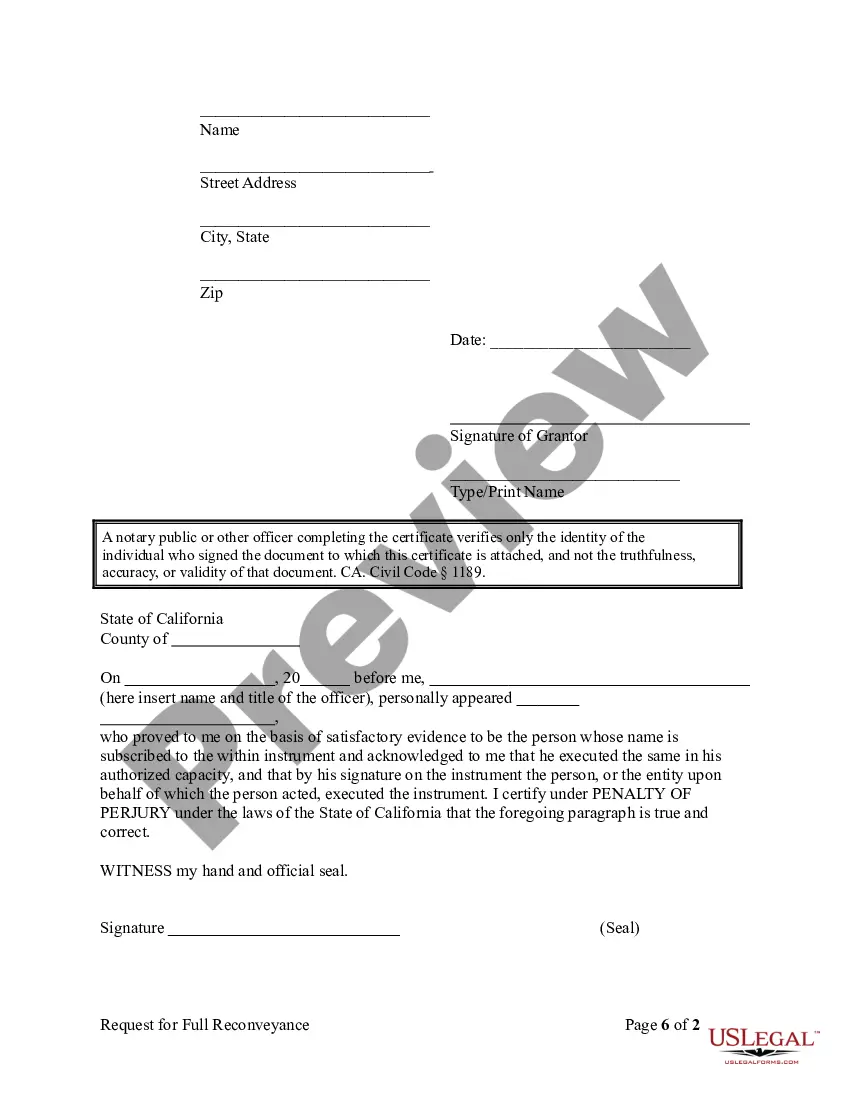

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Individual (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123F

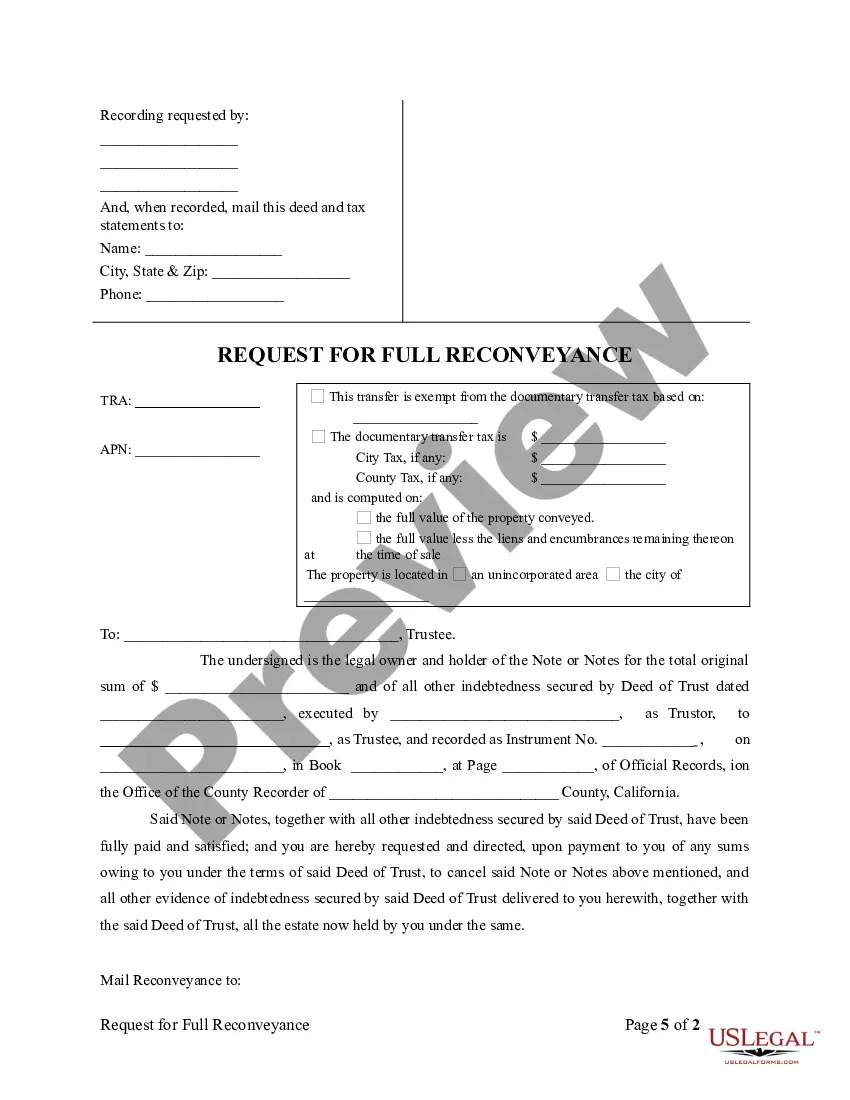

Title: Understanding the Riverside California Request for Re conveyance of Deed of Trust by an Individual Introduction: In Riverside, California, property owners who have successfully paid off their mortgage or trust deed owe it to themselves to familiarize themselves with the process of reconveyance. A Request for Re conveyance of Deed of Trust by an Individual is an essential legal document that enables property owners to regain full control over their property title. This article provides a detailed description of this request, its significance, and outlines different types of Riverside California Requests for Re conveyance of Deed of Trust by an Individual. 1. What is a Request for Re conveyance of Deed of Trust? A Request for Re conveyance of Deed of Trust is a legal document filed by a property owner to release the lien against their property. When a property owner pays off their mortgage or trust deed, this document is used to inform the lender that the debt has been fully satisfied, and the lender has fulfilled its obligation by conveying the title back to the property owner. 2. The Importance of a Re conveyance Request: The Re conveyance of Deed of Trust is crucial for property owners as it serves to clear any encumbrances on the property title. By filing this document, the property owner demonstrates legal proof that they have satisfied their debt, ensuring the property can be sold, refinanced, or transferred without any unresolved liens or claims. 3. Types of Riverside California Requests for Re conveyance of Deed of Trust by an Individual: a. Full Re conveyance Request: This is the most common type of reconveyance request, filed when the property owner has paid off the mortgage or trust deed in full, with no outstanding balance. b. Partial Re conveyance Request: In cases where the loan has been partially paid off, property owners can file a partial reconveyance request. This removes the lien on the specific portion of the property that has been paid. c. Substitution of Trustee Request: Property owners may file this type of request to substitute the current trustee with another individual or entity who will handle the reconveyance process. 4. Required Documents for Re conveyance: To file a Riverside California Request for Re conveyance of Deed of Trust by an Individual, the following documents are typically necessary: — Original Deeothersus— - Promissory Note or Proof of Satisfaction — Recorded Trustee's Deed upon Sale (if applicable) Re conveyancece Fee (varies based on county) Conclusion: Understanding the Riverside California Request for Re conveyance of Deed of Trust by an Individual is essential for property owners who have paid off their mortgage or trust deed. By filing this request, they can reclaim full control over their property title, ensuring a hassle-free transfer or refinancing process. Different types of reconveyance requests cater to specific circumstances, allowing property owners to address their unique needs efficiently.Title: Understanding the Riverside California Request for Re conveyance of Deed of Trust by an Individual Introduction: In Riverside, California, property owners who have successfully paid off their mortgage or trust deed owe it to themselves to familiarize themselves with the process of reconveyance. A Request for Re conveyance of Deed of Trust by an Individual is an essential legal document that enables property owners to regain full control over their property title. This article provides a detailed description of this request, its significance, and outlines different types of Riverside California Requests for Re conveyance of Deed of Trust by an Individual. 1. What is a Request for Re conveyance of Deed of Trust? A Request for Re conveyance of Deed of Trust is a legal document filed by a property owner to release the lien against their property. When a property owner pays off their mortgage or trust deed, this document is used to inform the lender that the debt has been fully satisfied, and the lender has fulfilled its obligation by conveying the title back to the property owner. 2. The Importance of a Re conveyance Request: The Re conveyance of Deed of Trust is crucial for property owners as it serves to clear any encumbrances on the property title. By filing this document, the property owner demonstrates legal proof that they have satisfied their debt, ensuring the property can be sold, refinanced, or transferred without any unresolved liens or claims. 3. Types of Riverside California Requests for Re conveyance of Deed of Trust by an Individual: a. Full Re conveyance Request: This is the most common type of reconveyance request, filed when the property owner has paid off the mortgage or trust deed in full, with no outstanding balance. b. Partial Re conveyance Request: In cases where the loan has been partially paid off, property owners can file a partial reconveyance request. This removes the lien on the specific portion of the property that has been paid. c. Substitution of Trustee Request: Property owners may file this type of request to substitute the current trustee with another individual or entity who will handle the reconveyance process. 4. Required Documents for Re conveyance: To file a Riverside California Request for Re conveyance of Deed of Trust by an Individual, the following documents are typically necessary: — Original Deeothersus— - Promissory Note or Proof of Satisfaction — Recorded Trustee's Deed upon Sale (if applicable) Re conveyancece Fee (varies based on county) Conclusion: Understanding the Riverside California Request for Re conveyance of Deed of Trust by an Individual is essential for property owners who have paid off their mortgage or trust deed. By filing this request, they can reclaim full control over their property title, ensuring a hassle-free transfer or refinancing process. Different types of reconveyance requests cater to specific circumstances, allowing property owners to address their unique needs efficiently.