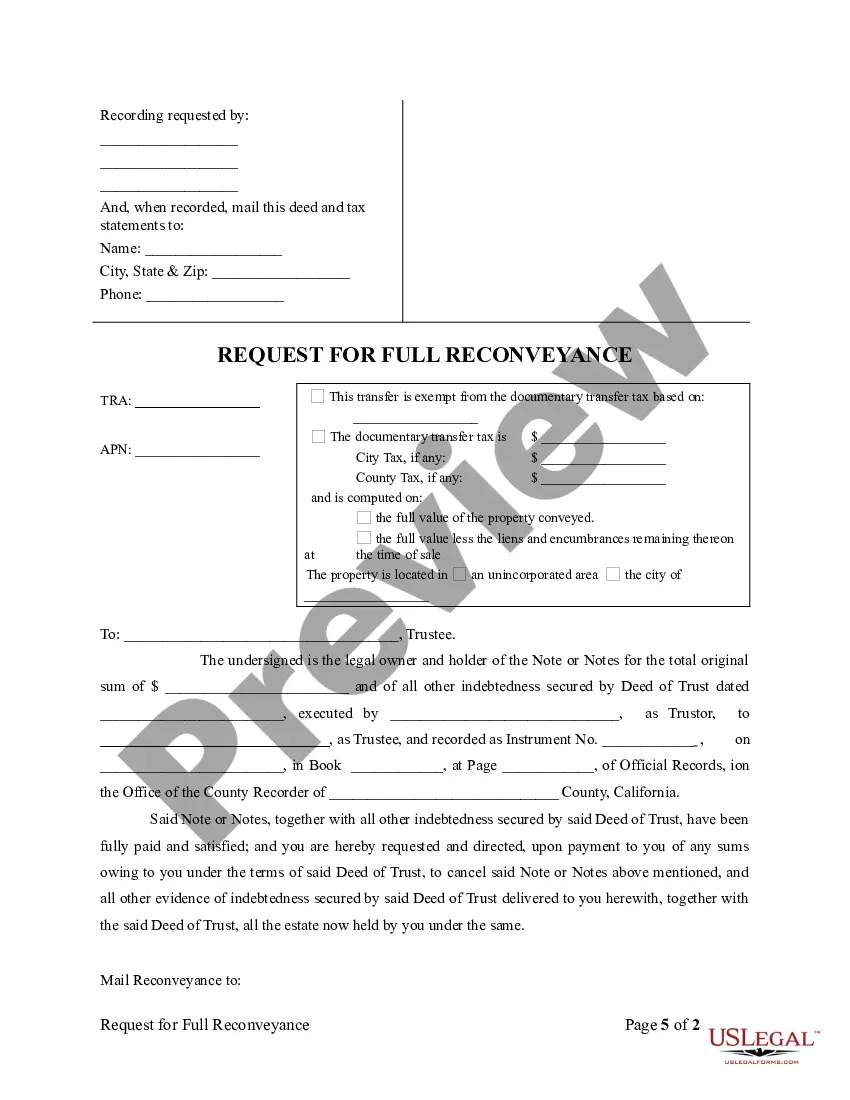

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Request for Reconveyance of Deed of Trust by Individual (Category: Mortgages and Deeds of Trust), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-S123F

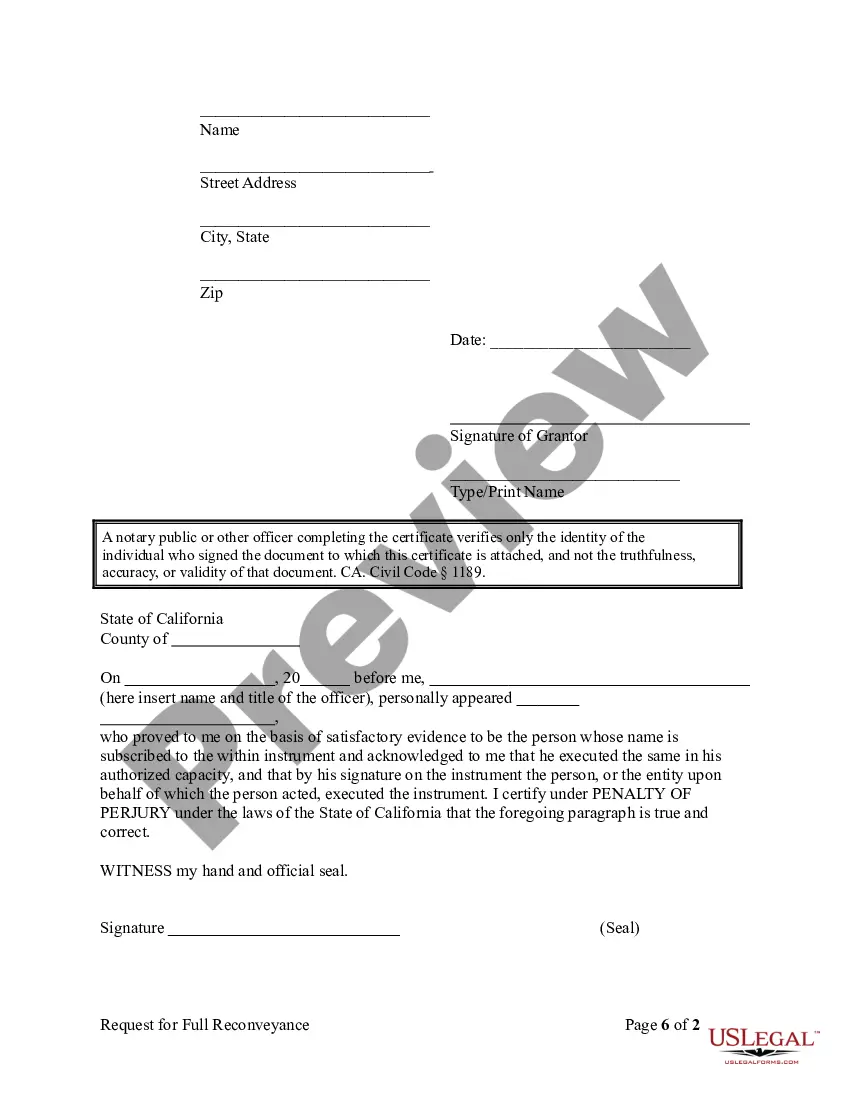

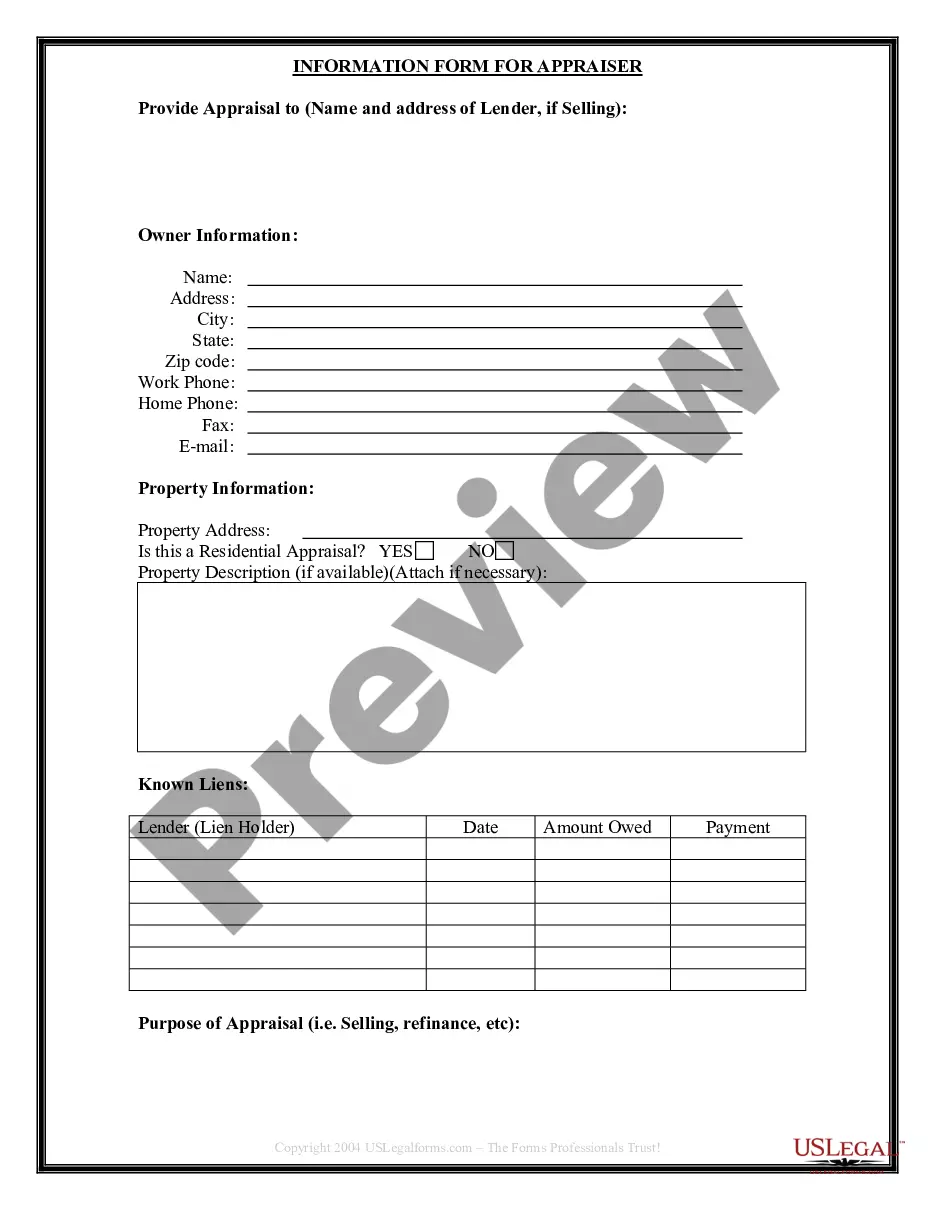

Title: Sunnyvale California Request for Re conveyance of Deed of Trust by Individual Keywords: Sunnyvale California, request for reconveyance, deed of trust, individual, legal document Introduction: In Sunnyvale, California, individuals seeking to reconvey their deed of trust have the option to submit a formal request for reconveyance. This legal document allows property owners to clear a mortgage lien from their property once they have fulfilled their obligations as specified in the deed of trust. Understanding the process is crucial for homeowners to complete the necessary steps correctly. This article aims to provide a detailed description of what a Sunnyvale California Request for Re conveyance of Deed of Trust by Individual entails. Types of Sunnyvale California Request for Re conveyance of Deed of Trust by Individual: 1. Full Payment Re conveyance: If an individual makes the final payment on their mortgage loan and successfully satisfies all obligations stated in the deed of trust, they can initiate a request for full payment reconveyance. This process officially releases the lien from the property, granting the owner full ownership rights without any encumbrances. 2. Loan Satisfaction Re conveyance: When an individual refinances their existing mortgage, they may request a loan satisfaction reconveyance. This type of reconveyance acknowledges the payment of the original loan through refinancing and transfers the lien from the previous lender to the refinancing lender. 3. Partial Release Re conveyance: In certain situations, property owners may need to request a partial release reconveyance. This occurs when they have paid off a portion of their mortgage or if a lien placed on the property is only applicable to a specific portion. A partial release reconveyance removes the lien from the specified portion of the property, granting the owner more flexibility. Submitting a Sunnyvale California Request for Re conveyance of Deed of Trust by Individual: 1. Gather Required Documents: To initiate the reconveyance process, the individual should collect all relevant documents, including the original deed of trust, promissory note, and any other supporting documentation. 2. Draft a Re conveyance Request: Prepare a formal letter addressed to the lender, requesting the reconveyance of the deed of trust. The letter should explain the reason for the reconveyance, provide relevant property details, and contain contact information for both the property owner and the lender. 3. Notarize the Request: To ensure authenticity, it is advisable to have the reconveyance request letter notarized. This step offers additional credibility to the document and helps streamline the overall process. 4. Submit the Request: Once notarized, the individual should submit the request to the lender or the designated trustee, along with any required fees and supporting documents. It is essential to retain copies of all submitted materials for personal records. Conclusion: Whether an individual seeks full payment reconveyance, loan satisfaction reconveyance, or partial release reconveyance, the process of completing a Sunnyvale California Request for Re conveyance of Deed of Trust by Individual involves gathering required documents, drafting a request, notarizing it, and submitting it to the lender/trustee. By following these steps, homeowners can remove mortgage liens, securing their property rights and achieving peace of mind.Title: Sunnyvale California Request for Re conveyance of Deed of Trust by Individual Keywords: Sunnyvale California, request for reconveyance, deed of trust, individual, legal document Introduction: In Sunnyvale, California, individuals seeking to reconvey their deed of trust have the option to submit a formal request for reconveyance. This legal document allows property owners to clear a mortgage lien from their property once they have fulfilled their obligations as specified in the deed of trust. Understanding the process is crucial for homeowners to complete the necessary steps correctly. This article aims to provide a detailed description of what a Sunnyvale California Request for Re conveyance of Deed of Trust by Individual entails. Types of Sunnyvale California Request for Re conveyance of Deed of Trust by Individual: 1. Full Payment Re conveyance: If an individual makes the final payment on their mortgage loan and successfully satisfies all obligations stated in the deed of trust, they can initiate a request for full payment reconveyance. This process officially releases the lien from the property, granting the owner full ownership rights without any encumbrances. 2. Loan Satisfaction Re conveyance: When an individual refinances their existing mortgage, they may request a loan satisfaction reconveyance. This type of reconveyance acknowledges the payment of the original loan through refinancing and transfers the lien from the previous lender to the refinancing lender. 3. Partial Release Re conveyance: In certain situations, property owners may need to request a partial release reconveyance. This occurs when they have paid off a portion of their mortgage or if a lien placed on the property is only applicable to a specific portion. A partial release reconveyance removes the lien from the specified portion of the property, granting the owner more flexibility. Submitting a Sunnyvale California Request for Re conveyance of Deed of Trust by Individual: 1. Gather Required Documents: To initiate the reconveyance process, the individual should collect all relevant documents, including the original deed of trust, promissory note, and any other supporting documentation. 2. Draft a Re conveyance Request: Prepare a formal letter addressed to the lender, requesting the reconveyance of the deed of trust. The letter should explain the reason for the reconveyance, provide relevant property details, and contain contact information for both the property owner and the lender. 3. Notarize the Request: To ensure authenticity, it is advisable to have the reconveyance request letter notarized. This step offers additional credibility to the document and helps streamline the overall process. 4. Submit the Request: Once notarized, the individual should submit the request to the lender or the designated trustee, along with any required fees and supporting documents. It is essential to retain copies of all submitted materials for personal records. Conclusion: Whether an individual seeks full payment reconveyance, loan satisfaction reconveyance, or partial release reconveyance, the process of completing a Sunnyvale California Request for Re conveyance of Deed of Trust by Individual involves gathering required documents, drafting a request, notarizing it, and submitting it to the lender/trustee. By following these steps, homeowners can remove mortgage liens, securing their property rights and achieving peace of mind.