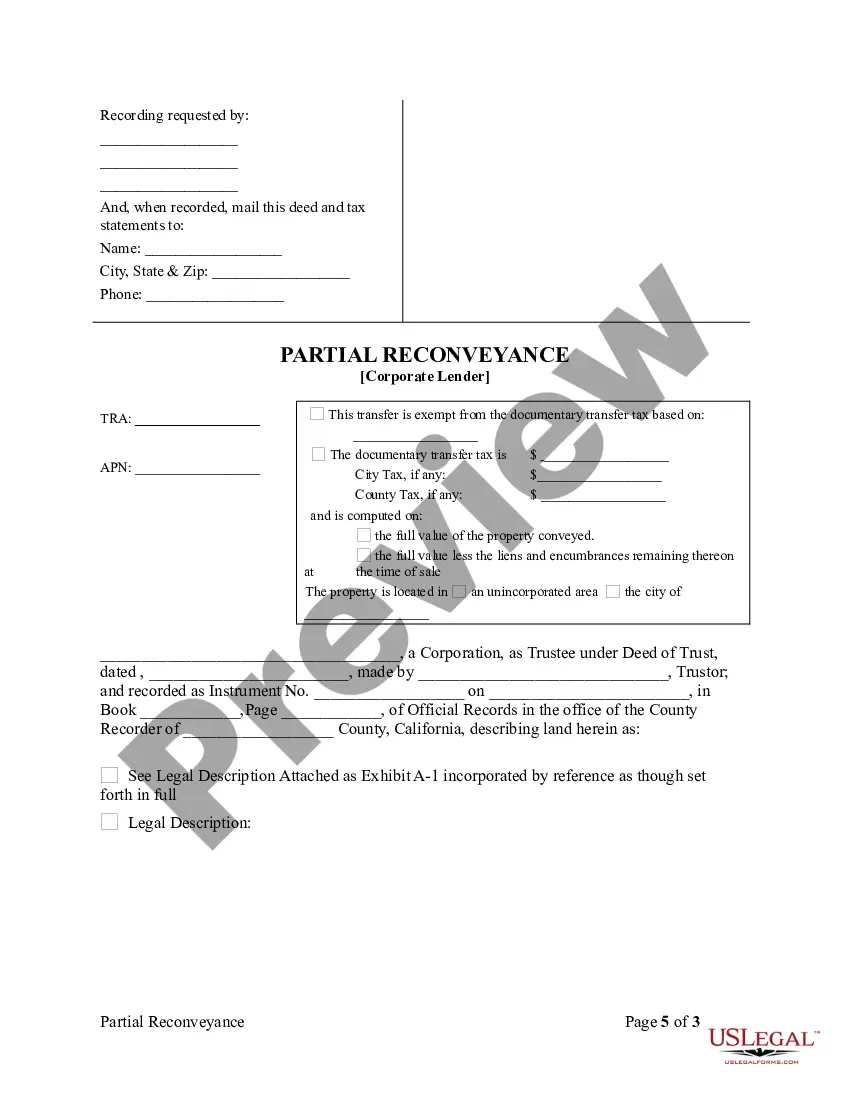

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Chico California Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out California Partial Release Of Property From Deed Of Trust For Corporation?

If you’ve previously accessed our service, Log In to your account and download the Chico California Partial Release of Property From Deed of Trust for Corporation onto your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have perpetual access to all documents you have purchased: you can find them in your profile under the My documents section whenever you require to reuse them. Leverage the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Confirm you have found the correct document. Review the description and use the Preview feature, if available, to verify if it meets your needs. If it’s not appropriate, utilize the Search option above to find the correct one.

- Purchase the template. Press the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Chico California Partial Release of Property From Deed of Trust for Corporation. Select the file format for your document and store it on your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

A quitclaim deed is a legal document that allows a trustee to transfer their interest in a property to an individual without ensuring the property's marketable title. This type of deed is often used in family transactions or when the title is being cleared. When dealing with the complexities of property transfers, a platform like USLegalForms can help demystify the process related to the Chico California Partial Release of Property From Deed of Trust for Corporation.

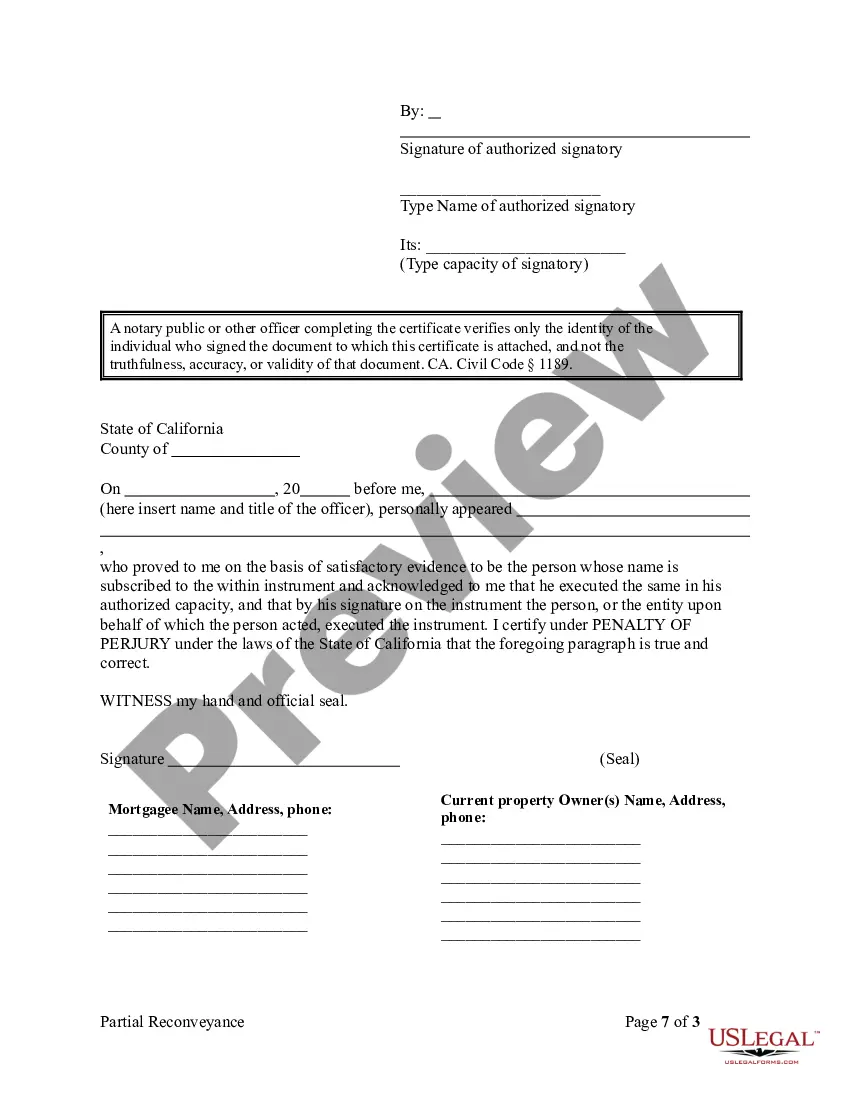

To transfer property from a trust to an individual in California, follow a straightforward process. You need to draft a deed that specifies the transfer and have the trustee sign it. After that, record the deed with the county to make the transfer official. For a smooth experience, refer to USLegalForms, which can guide you through the Chico California Partial Release of Property From Deed of Trust for Corporation.

Transferring property out of a trust in California involves creating a new deed that reflects the transfer. The trustee must sign this deed to complete the process legally. Once the deed is signed, you must record it with the county recorder's office. For those looking to understand the details better, USLegalForms offers resources to address the Chico California Partial Release of Property From Deed of Trust for Corporation.

Yes, you can transfer property from a trust to an individual. This process typically involves executing a deed that officially documents the transfer. It is essential to follow the legal requirements of California to ensure the transfer is valid. For guidance, consider using a service like USLegalForms, which can assist you in navigating the Chico California Partial Release of Property From Deed of Trust for Corporation.

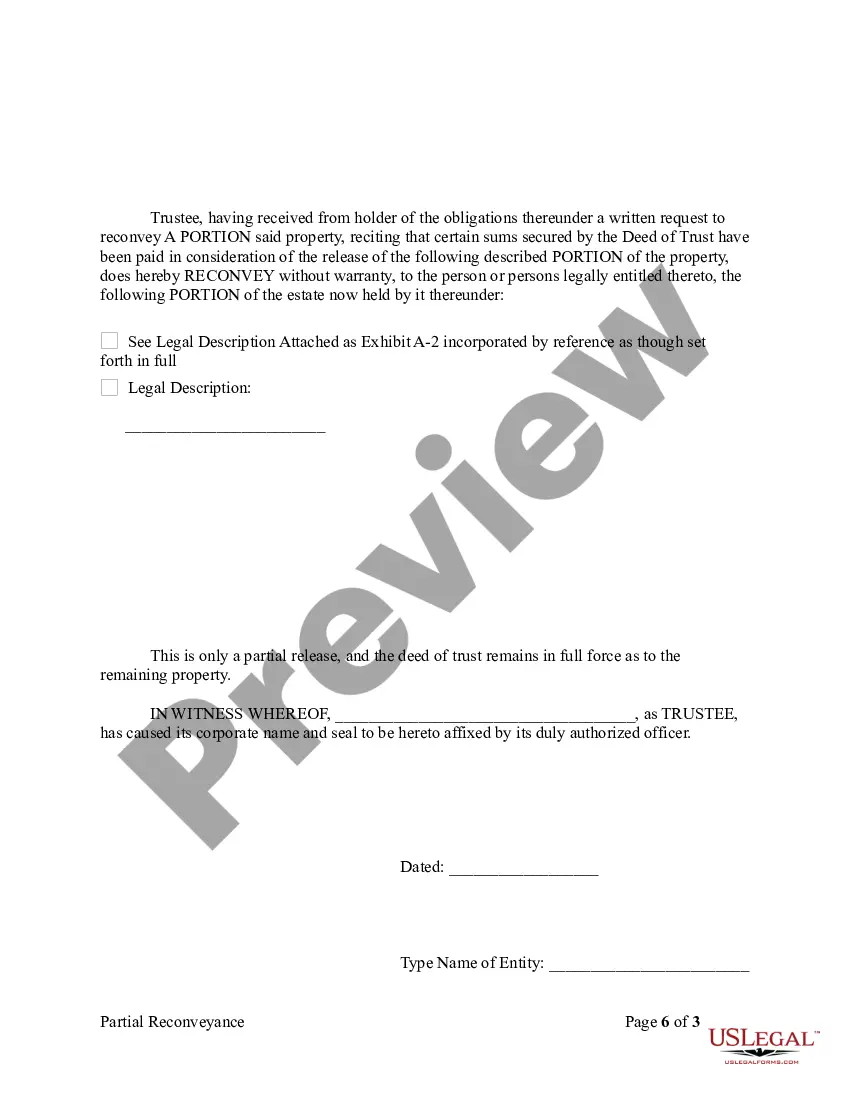

A partial release works by executing a legal document that specifies which section of the property is being released from the deed of trust. For corporations in Chico, California, this process involves filing the deed of partial release with public records, ensuring that the released property is no longer tied to the obligations of the original deed. This can streamline financial flexibility and improve asset management for businesses.

A partial release of a deed is the official act of releasing a portion of the property covered by a deed from the obligations of a deed of trust. This is particularly useful for corporations in Chico, California, as it allows them to sell, transfer, or leverage portions of their property without the entire deed being affected. Understanding this process can help businesses make informed real estate decisions.

A release deed serves to relinquish a claim or right in property, effectively removing a lien or interest from a title. It is executed by the pertinent party and then filed with the county recorder, helping to clarify ownership. This document is particularly beneficial in real estate transactions involving multiple parties. For more information, consult uslegalforms for details on the Chico California Partial Release of Property From Deed of Trust for Corporation.

To remove a co-owner from a property deed in California, you must create a new deed that legally excludes the co-owner’s name. The new deed requires both owners' signatures, along with notarization. After execution, file the new deed with the county recorder to update the public record. For questions and guidance, uslegalforms offers comprehensive support, including insights into Chico California Partial Release of Property From Deed of Trust for Corporation.

A partial release is typically included during refinancing, property sales, or if a borrower wants to sell a part of the property but keep the mortgage on the remainder. This process can also occur in cases of asset division during a divorce. Understanding these scenarios can help you navigate property changes smoothly. For further guidance, see uslegalforms for information relevant to the Chico California Partial Release of Property From Deed of Trust for Corporation.

In a partial release of a mortgage, the grantor is typically the borrower who is releasing a portion of the property from the mortgage lien. This action may occur when a separate portion of the property is sold or transferred without settling the entire mortgage. Understanding this role can clarify your responsibilities as a borrower. For more detailed documentation, check out uslegalforms, particularly for the Chico California Partial Release of Property From Deed of Trust for Corporation.