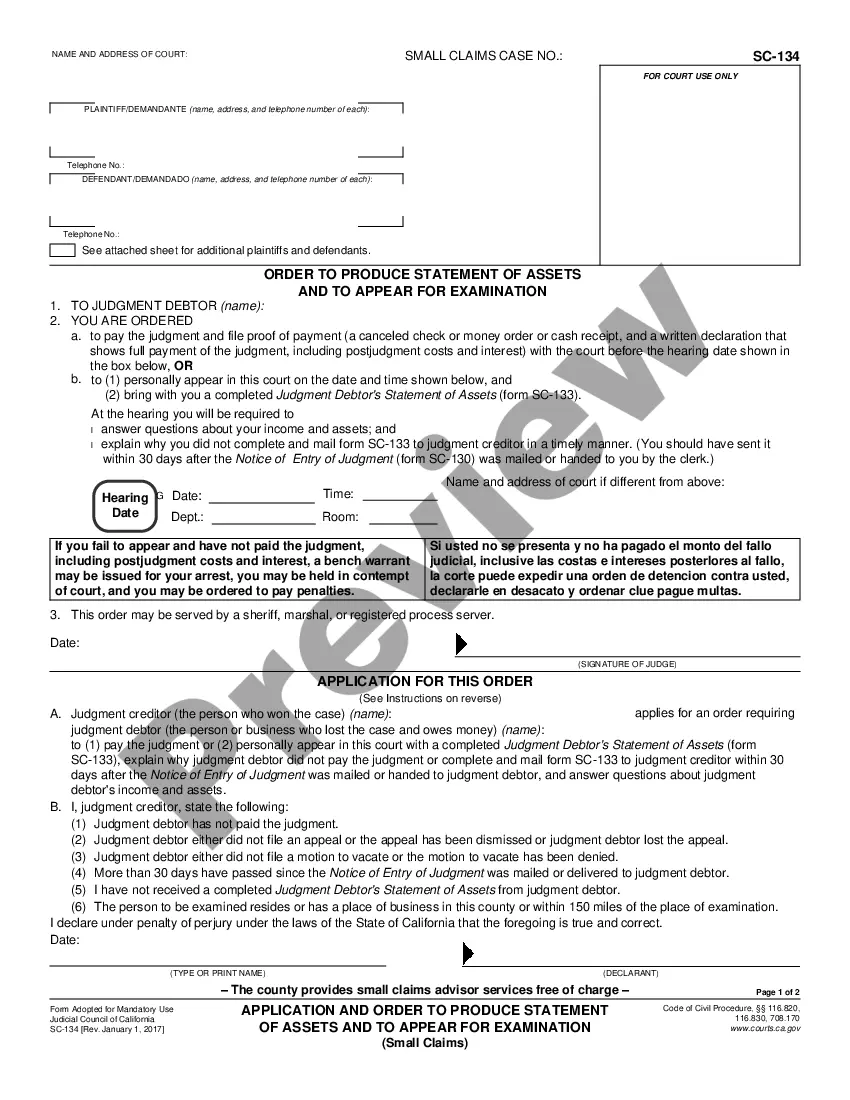

This is a model Judgment form, a Judgment Debtor^s Statement of Assets. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding. USLF control number CA-SC-133

Clovis California Judgment Debtor's Statement of Assets

Description

How to fill out California Judgment Debtor's Statement Of Assets?

If you have previously availed yourself of our service, sign in to your account and preserve the Clovis California Judgment Debtor's Statement of Assets on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment schedule.

If this is your initial interaction with our service, adhere to these straightforward steps to obtain your file.

You have consistent access to every document you have acquired: you can locate it in your profile within the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to promptly find and save any template for your personal or business needs!

- Confirm you’ve located a suitable document. Examine the description and utilize the Preview option, if available, to verify if it satisfies your requirements. If it does not suit you, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use PayPal to finalize the transaction.

- Obtain your Clovis California Judgment Debtor's Statement of Assets. Choose the file format for your document and store it on your device.

- Complete your document. Print it or utilize online editing tools to fill it out and sign it digitally.

Form popularity

FAQ

Law enforcement can seize any type of property. They can seize physical property like cars, boats, weapons, cash, drugs, drug paraphernalia, houses, and other real property. They may also seize non-physical property such as bank accounts, royalties, and proceeds from crimes.

In California, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest -- or to the debtor's personal property -- things like jewelry, art, antiques, and other valuables. (In some states, judgment liens can be attached to personal property only.)

The main ways to legally avoid appearing at a debtor examination are to pay off the debt or reach a settlement with the creditor that provides a way for paying back the debt. You also may be able to avoid the examination by filing for bankruptcy, which will trigger an automatic stay of collection efforts.

How do I collect my money? If you know where the Judgment Debtor banks, you can ask the Sheriff to collect money from their account (bank account levy). If you know where the Judgment Debtor works, the Sheriff can collect 25% of the debtor's wages each pay period until your judgment is paid in full (wage garnishment).

'Debtor' refers not only to a goods and services client but also to someone who borrowed money from a bank or lender. For example, if you take a loan to buy your house, then you are a debtor in the sense of borrower, while the bank holding your mortgage is considered to be the creditor.

Bank customers are debtors if they have a loan or owe the bank. Customers that buy goods or services and pay on the spot are not debtors. However, customers of companies that provide goods or services can be debtors if they are allowed to make payment at a later date.

Therefore, you must know which of your assets can be seized by a judgment creditor....Assets that creditors can seize Bank accounts. Investment accounts. Inheritances. Assets owned by your spouse. Personal homes (different from state to state) Rental properties. Vehicles. Business equipment.

Debtors are people or companies that owe you money. They are also known as your 'accounts receivable'. When somebody owes you an amount, it's basically just a promise to pay the amount back with interest. With debtors, they are considered your asset because you can collect this money whenever you want.

However, exempt property in a California bankruptcy is generally described as: Your main vehicle. Your home. Personal everyday items. Retirement accounts, pensions, and 401(k) plans. Burial plots. Federal benefit programs. Health aids. Household goods.

You can use an information subpoena to find a judgment debtor's assets. You can use the pre-printed questions on the subpoena or write your own questions. The Small Claims Court Clerk may provide you an information subpoena for a small fee, you can also find this on the internet for free.