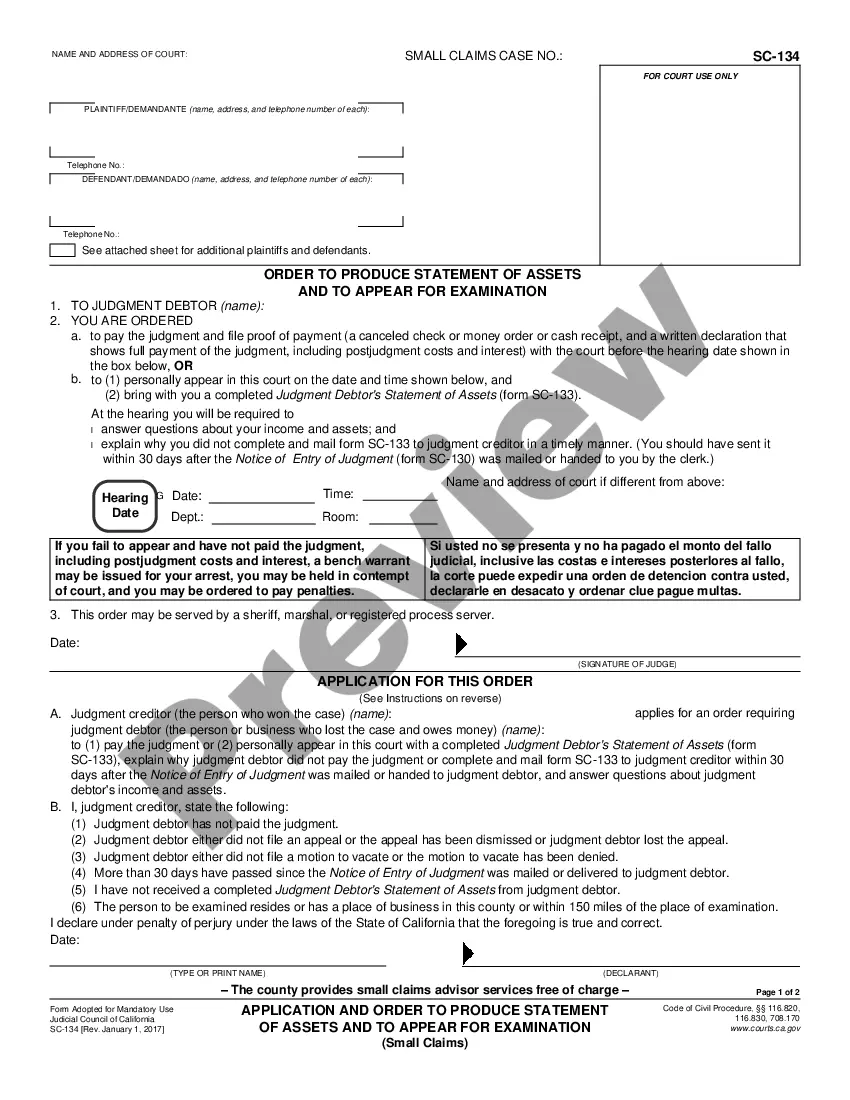

This is a model Judgment form, a Judgment Debtor^s Statement of Assets. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding. USLF control number CA-SC-133

Contra Costa California Judgment Debtor's Statement of Assets

Description

How to fill out California Judgment Debtor's Statement Of Assets?

If you are looking for an authentic form, it’s incredibly challenging to select a more suitable platform than the US Legal Forms website – likely the most extensive collections available on the internet.

Here you can discover a wide variety of form examples for commercial and personal objectives sorted by categories and regions, or keywords.

With our excellent search functionality, locating the latest Contra Costa California Judgment Debtor's Statement of Assets is as straightforward as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the format and download it to your device.

- Additionally, the significance of each document is validated by a team of experienced attorneys who consistently examine the templates on our site and update them according to the latest state and local requirements.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Contra Costa California Judgment Debtor's Statement of Assets is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have located the form you need. Review its details and utilize the Preview option (if available) to examine its contents. If it doesn’t fulfill your needs, use the Search feature at the top of the page to find the desired document.

- Verify your selection. Hit the Buy now button. Following that, select the preferred payment plan and provide details to create an account.

Form popularity

FAQ

Step 1: Obtain a Writ of Execution.Step 1a: Complete the Writ of Execution (EJ-130) form.Step 1b: Adding Costs and Interest (optional)Step 1c: Obtain a File-Endorsed Copy of Your Judgment.Step 1d: File Your Documents.Step 2: Complete the Application for Earnings Withholding Order.Step 3: Have Your Documents Served.

When you win a lawsuit, you can collect the total amount of the judgment entered by the court, plus any costs incurred after judgment and accrued interest on the total amount. To have costs and interest added to the amount owed, you must file and serve a Memorandum of Costs After Judgment (MC-012).

A prevailing party who claims costs must serve and file a memorandum of costs within 15 days after the date of service of the notice of entry of judgment or dismissal by the clerk under Code of Civil Procedure section 664.5 or the date of service of written notice of entry of judgment or dismissal, or within 180 days

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130.

Money judgments automatically expire (run out) after 10 years. To prevent this from happening, the creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

Filing Your Request The completed Form CV-24 (Affidavit and Request for Issuance of Writ of Execution) must be e-filed as the lead document using the ?Affidavit and Request for Issuance of Writ of Execution? event.The completed Form CV-23 Writ of Execution must be submitted as an attachment to the CV-24 Affidavit.

Collecting the Judgment 30 days after the debtor was served you can obtain a Writ of Execution (EJ-130). If the debtor does not file a motion to vacate the judgment in those 30 days, then your California judgment is finalized and you can begin collecting.

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130. Revised: September 1, 2020. View EJ-130 Writ of Execution form.

How do I collect my money? If you know where the Judgment Debtor banks, you can ask the Sheriff to collect money from their account (bank account levy). If you know where the Judgment Debtor works, the Sheriff can collect 25% of the debtor's wages each pay period until your judgment is paid in full (wage garnishment).

The MC 012 is used to keep a running total of all costs, credits/payments, and interest accrued after. the final Entry of Judgment. Number 1. a) I claim the following costs after Judgment incurred within the last two years. 1) Complete if you filed an Abstract of Judgment (Form EJ-001).