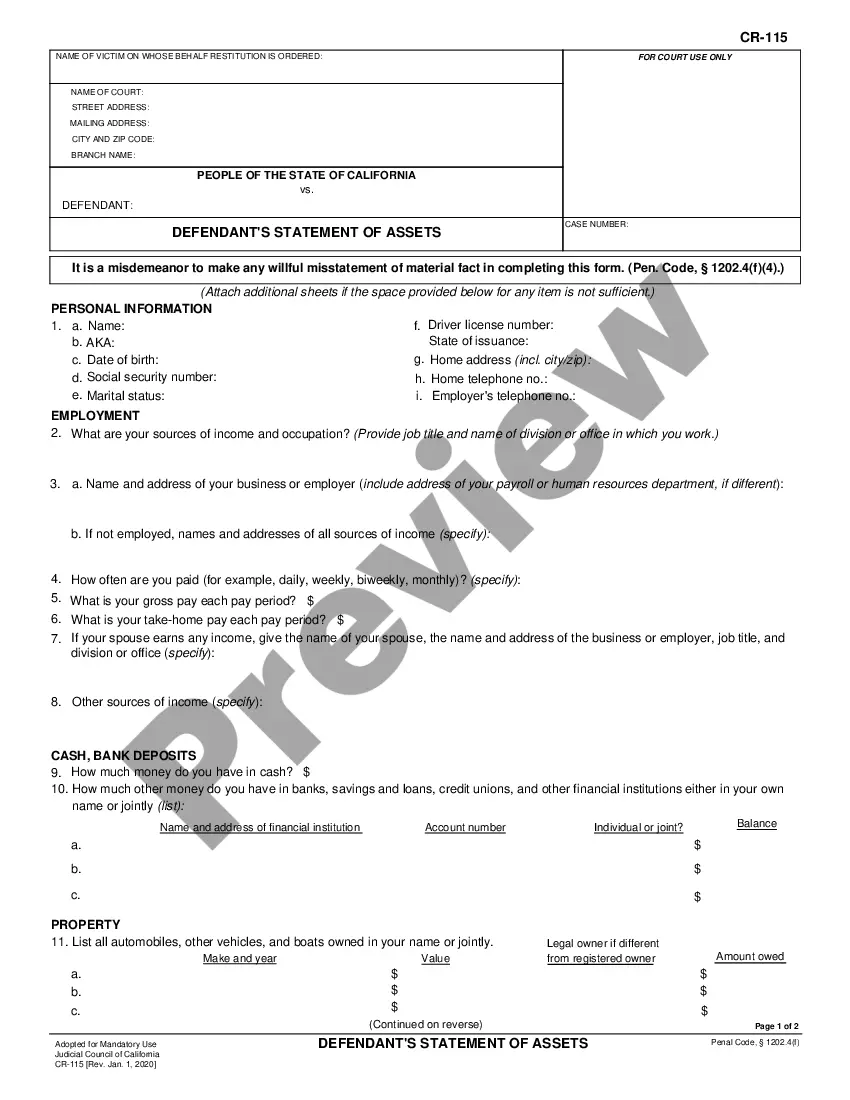

This is a model Judgment form, a Judgment Debtor^s Statement of Assets. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding. USLF control number CA-SC-133

A Fullerton California Judgment Debtor's Statement of Assets is a legal document required by the court system to assist in the collection of a judgment against a debtor. When a judgment is issued in favor of a creditor, the debtor may be required to complete this statement, providing details about their assets, income, and financial obligations. This document aims to help the creditor determine the feasibility of collecting the judgment and establishes a framework for the enforcement process. Several types of Fullerton California Judgment Debtor's Statement of Assets may exist depending on the stage of the enforcement process or the specific requirements set by the court. These types include: 1. Initial Judgment Debtor's Statement of Assets: This is typically the first statement filed by the debtor after the judgment is entered against them. It requires a detailed listing of all assets, including real estate, vehicles, bank accounts, investments, personal belongings, and other valuable possessions. The debtor must also disclose sources of income, employment details, and other financial obligations. 2. Supplemental Judgment Debtor's Statement of Assets: This statement is usually requested when the initial statement does not provide sufficient information or when circumstances change after the judgment is entered. Debtors must provide updated information on additional assets acquired, changes in income, modifications to financial obligations, or any other relevant changes since the last statement. 3. Amended Judgment Debtor's Statement of Assets: If the debtor realizes any inaccuracies or omissions in the previously submitted statement, they may file an amended version to rectify the errors or provide additional information. This statement ensures that the most up-to-date and accurate asset information is available for the creditor's assessment. 4. Post-Judgment Interrogatories: This is another method of seeking information from the debtor rather than a specific statement form. The creditor's attorney prepares a set of written questions inquiring about the debtor's assets, income, expenses, and any other relevant financial details. The debtor is legally obligated to respond truthfully and thoroughly within a specified time frame. The Fullerton California Judgment Debtor's Statement of Assets plays a crucial role in the enforcement of judgments and enables creditors to evaluate the financial viability of collecting the debt. It ensures both transparency and fairness in the process, ultimately facilitating the resolution of outstanding debts while upholding the rights of both the debtor and the creditor.