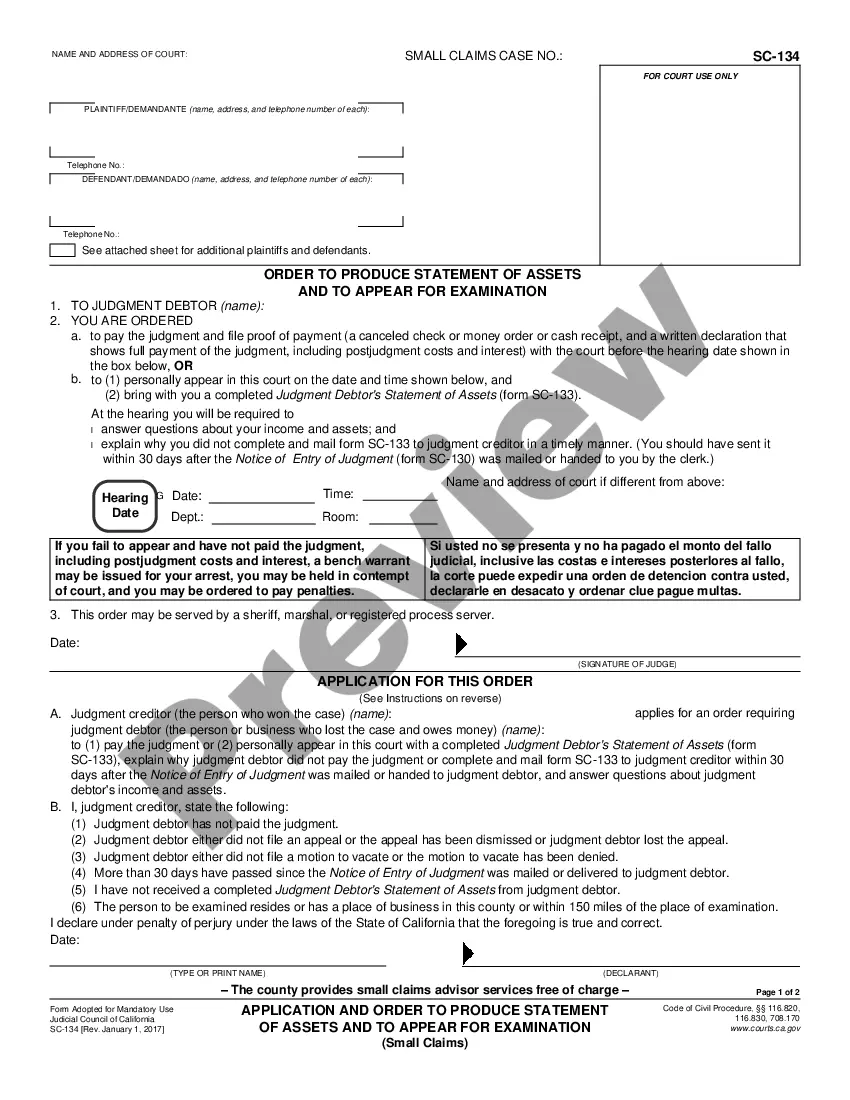

This is a model Judgment form, a Judgment Debtor^s Statement of Assets. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding. USLF control number CA-SC-133

Los Angeles California Judgment Debtor's Statement of Assets

Description

How to fill out California Judgment Debtor's Statement Of Assets?

Are you seeking a trustworthy and budget-friendly legal forms provider to purchase the Los Angeles California Judgment Debtor's Statement of Assets? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a set of documents to facilitate your separation or divorce through the legal system, we have you covered. Our website offers over 85,000 current legal document templates for personal and business applications. All templates we provide are tailored to meet the requirements of individual states and counties.

To obtain the document, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it. Please remember that you can access your previously purchased form templates anytime in the My documents section.

Are you unfamiliar with our website? No problem. You can create an account with remarkable ease, but first, ensure you do the following.

Now you can set up your account. Then select your subscription option and proceed with payment. Once your payment is complete, download the Los Angeles California Judgment Debtor's Statement of Assets in any available format. You can revisit the website whenever needed and redownload the document at no cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting hours searching for legal papers online for good.

- Verify if the Los Angeles California Judgment Debtor's Statement of Assets aligns with the laws of your state and local jurisdiction.

- Review the form’s specifications (if available) to understand who and what the document is suitable for.

- Reinitiate the search if the template does not suit your specific circumstances.

Form popularity

FAQ

How a Debt Collector Gets Access to Your Bank Account. A debt collector gains access to your bank account through a legal process called garnishment. If one of your debts goes unpaid, a creditor?or a debt collector that it hires?may obtain a court order to freeze your bank account and pull out money to cover the debt.

You can use an information subpoena to find a judgment debtor's assets. You can use the pre-printed questions on the subpoena or write your own questions. The Small Claims Court Clerk may provide you an information subpoena for a small fee, you can also find this on the internet for free.

'Debtor' refers not only to a goods and services client but also to someone who borrowed money from a bank or lender. For example, if you take a loan to buy your house, then you are a debtor in the sense of borrower, while the bank holding your mortgage is considered to be the creditor.

Debtors are people or companies that owe you money. They are also known as your 'accounts receivable'. When somebody owes you an amount, it's basically just a promise to pay the amount back with interest. With debtors, they are considered your asset because you can collect this money whenever you want.

You must: Complete an Abstract of Judgment (EJ-001). Have it issued by the clerk and pay the issuance fee by submitting the document to the court location where your case was filed or you may also submit the document by eFile. Give the original issued Abstract to the County Recorder and pay their recording fee.

To do this, fill out an EJ-001 Abstract of Judgment form and take it to the clerk's office. After the clerk stamps it, record it at the County Recorder's Office in the county where the property is located.

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130. Revised: September 1, 2020. View EJ-130 Writ of Execution form.

If your judgment has already expired, you should consult an attorney before taking any action. California judgments last for 10 years from the date they were entered. If you win a judgment issued by a federal court, you may start collecting right away.

Bank customers are debtors if they have a loan or owe the bank. Customers that buy goods or services and pay on the spot are not debtors. However, customers of companies that provide goods or services can be debtors if they are allowed to make payment at a later date.

The MC 012 is used to keep a running total of all costs, credits/payments, and interest accrued after. the final Entry of Judgment. Number 1. a) I claim the following costs after Judgment incurred within the last two years. 1) Complete if you filed an Abstract of Judgment (Form EJ-001).