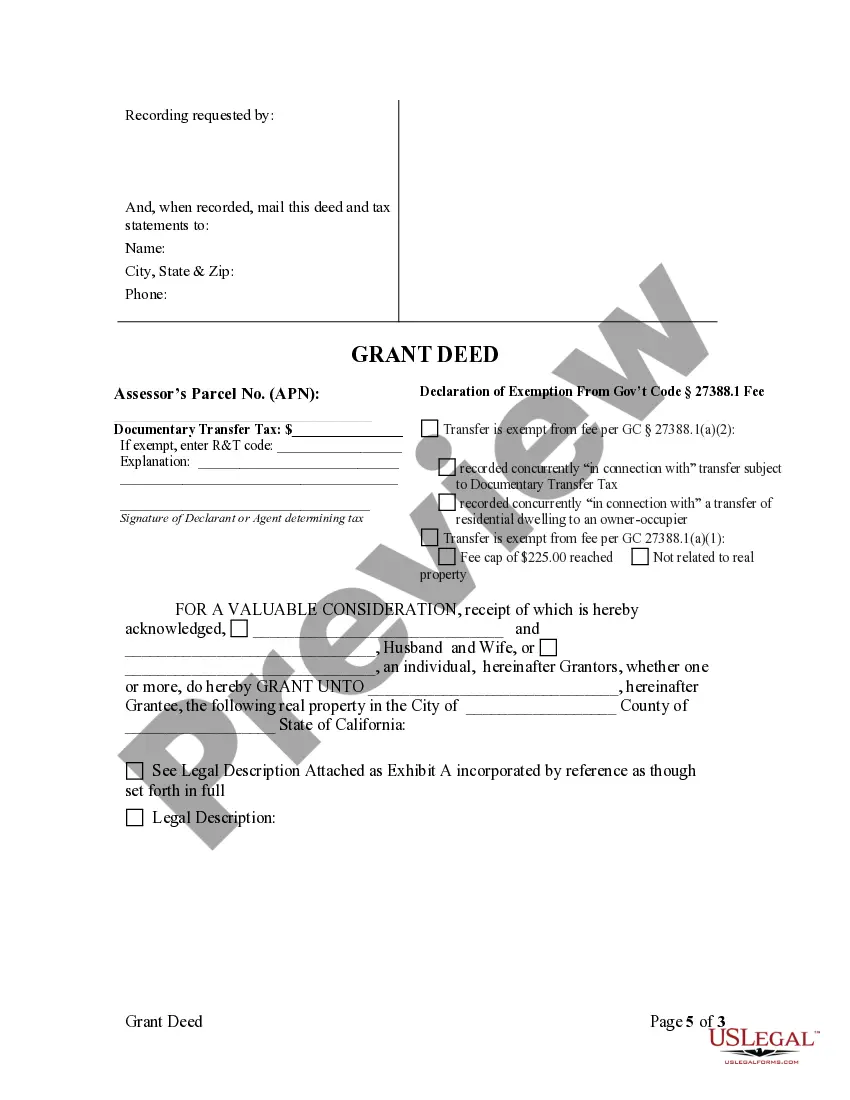

This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

Escondido California Grant Deed — Parents to Child with Reservation of Life Estate is a legal document used in real estate transactions to transfer ownership of a property from parents to their child, while also reserving a life estate for the parents. This type of deed allows the parents to retain the right to live in or use the property until their passing, after which full ownership transfers to the child. The Escondido California Grant Deed — Parents to Child with Reservation of Life Estate ensures a smooth transition of property ownership within a family, providing various benefits and advantages. By creating this legal document, the parents can secure their right to reside in their property for the remainder of their lives, allowing for stability and peace of mind. Simultaneously, it enables them to gift the property to their child, providing for an efficient transfer of assets while allowing for potential tax benefits. Additionally, by utilizing this grant deed in Escondido, California, the property undergoes a seamless and legally sound transfer without the need for probate, saving time and money for all parties involved. This can be particularly advantageous when considering the high costs and potential complications of going through the probate process. There are several variations of the Escondido California Grant Deed — Parents to Child with Reservation of Life Estate, including: 1. Traditional Grant Deed with Reservation of Life Estate: This is the standard form of the grant deed where the parents transfer full ownership of the property to the child while reserving a life estate for themselves. 2. Joint Tenancy Grant Deed with Reservation of Life Estate: This type of grant deed allows both parents, if married, to hold a joint tenancy interest in the property while reserving a life estate for their joint lives. Upon the passing of either parent, the surviving spouse retains the right to live in or use the property until their own passing, after which full ownership transfers to the child. 3. Separate Life Estates Grant Deed: In certain cases, the parents may wish to establish separate life estates instead of a joint life estate. This can be relevant if the parents have different life expectancies or prefer individual control over their respective life estate interests. 4. Enhanced Life Estate Deed (Lady Bird Deed): Sometimes referred to as a "Lady Bird Deed," this type of grant deed allows the parents to retain the right to sell, mortgage, or modify the property without the consent of the child, even after the parents conveyed the property to the child. This variant provides greater flexibility for the parents during their lifetime while still ensuring the property transfers to the child upon their passing. Overall, an Escondido California Grant Deed — Parents to Child with Reservation of Life Estate is a versatile legal tool that allows parents to transfer ownership of their property to their child while retaining a life estate, ensuring a smooth transition of assets while maintaining their rights and security.