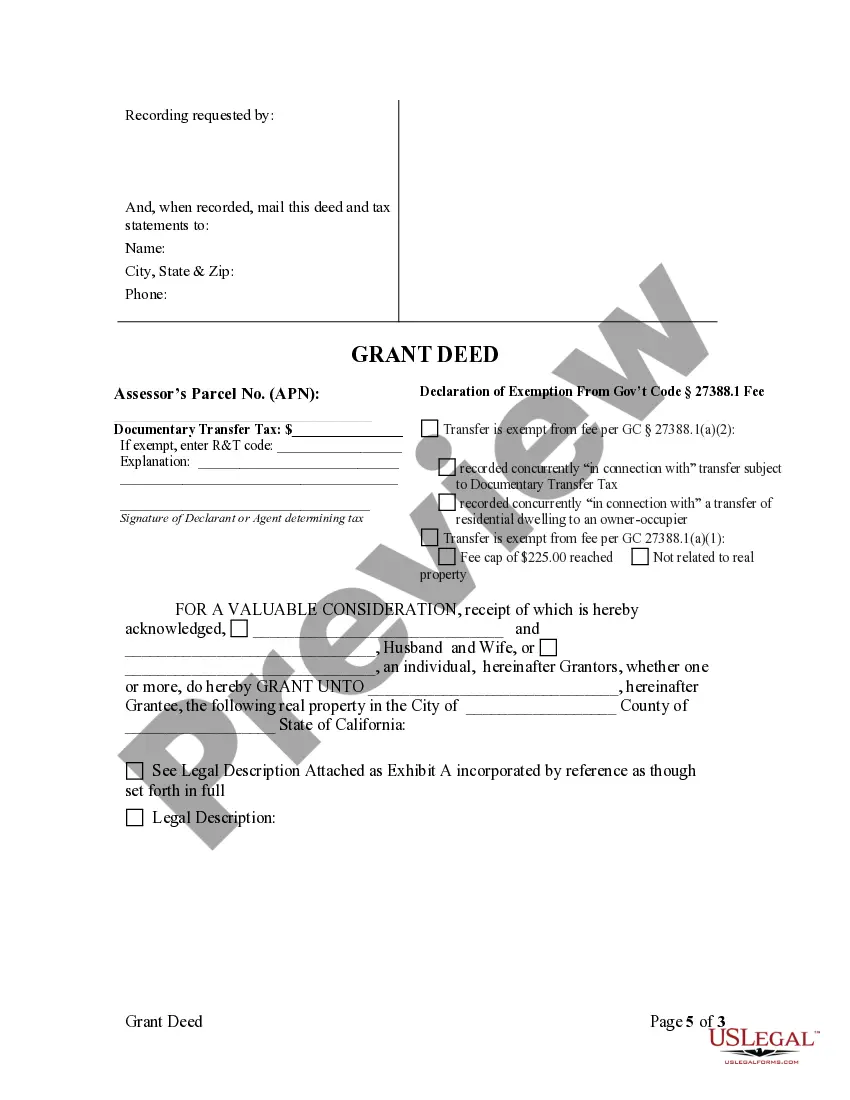

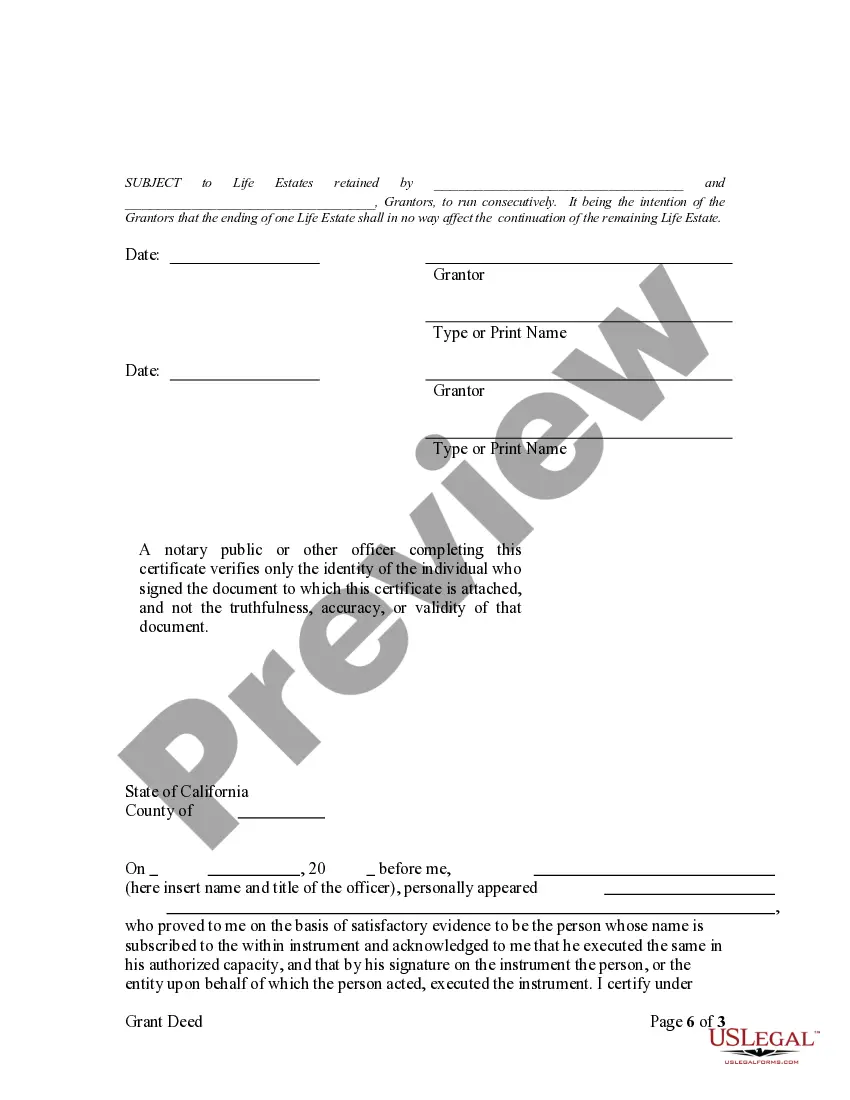

This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate

Description

How to fill out California Grant Deed - Parents To Child With Reservation Of Life Estate?

Are you seeking a trustworthy and cost-effective provider of legal forms to purchase the Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish guidelines for living together with your partner or a bundle of forms to facilitate your separation or divorce through the judicial system, we have it all. Our platform offers over 85,000 current legal document templates for individual and business use. All templates we provide access to are not generic and are tailored to meet the specifications of particular states and regions.

To obtain the form, you must Log In to your account, find the required form, and click the Download button beside it. Please note that you can download your previously acquired form templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account with great ease, but before that, ensure that you do the following.

You can now establish your account. Then select the subscription plan and continue to payment. Once the payment is processed, download the Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate in any available file format. You can revisit the website at any point and redownload the form free of charge.

Acquiring current legal forms has never been simpler. Try US Legal Forms now and put an end to wasting hours searching for legal documentation online.

- Verify that the Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate complies with the laws of your state and locality.

- Review the form’s description (if available) to understand who and what the form is suited for.

- Start your search again if the form is not suitable for your legal needs.

Form popularity

FAQ

Writing a life estate deed involves a few essential steps. Begin by clearly defining the property and the parties involved, particularly for a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate. You must state the life estate holder's rights and any conditions. Using US Legal Forms can simplify this process by providing templates and guidance tailored to your needs.

Filling out a California grant deed is a straightforward process. Start by obtaining the appropriate form, which is suitable for a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate. Next, include the names of the grantor and grantee, the property description, and any relevant reservations. Ensure you sign the deed before a notary to complete the process.

Selling a house with a life estate deed can be complex. The life tenant, in this case, the original owner, retains the right to live in the home for life, which may limit their ability to sell the property. If you hold a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate, you can consider options to sell, but it often requires consent from all parties. Utilizing the right services, like USLegalForms, can help you navigate these complexities in real estate transactions.

A reserving life estate deed is a legal document that transfers property to another person while allowing the original owner to retain living rights for their lifetime. In a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate, this type of deed ensures that parents can pass their property to their child, yet still reside in it. This strategy helps manage inheritance and can provide tax benefits as well. Overall, it creates a smooth transition of property ownership while protecting the original owner's living situation.

When a life estate is reserved, it means that the person granting the property retains the right to live in and use the property for the rest of their life. In the context of a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate, this allows parents to transfer ownership to their child while still enjoying occupancy. This arrangement ensures that the parents maintain their home and security while passing on their property. Therefore, the child becomes the future owner once the life estate ends.

A life estate deed can come with several drawbacks that you should consider. The life tenant cannot sell or transfer the property without the consent of the remainderman, which can limit financial flexibility. Additionally, the life estate does not shield the property from creditors, and future tax obligations may arise. Understanding these implications is crucial, and resources like US Legal Forms can guide you through creating a secure Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate.

In Texas, the life tenant, or the person who has been granted the life estate, retains ownership rights to the property for their lifetime. Once that person passes away, the property is passed on to the remainderman. Utilizing legal tools such as a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate can provide clarity and structure to this arrangement.

Navigating a life estate can be complex, but there are a few options available. Renegotiating the terms or establishing a trust can provide alternative management strategies. If you are considering a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate, consulting with a legal expert can help clarify your options and facilitate a smoother transition.

In Massachusetts, the person holding the life estate has the right to use and control the property during their lifetime. Upon their death, ownership transfers to the remainderman, who is often a family member or another designated individual. This arrangement can be set up through a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate, enabling parents to retain some control while passing the property down.

The best way to transfer property from parent to child is by utilizing a Garden Grove California Grant Deed - Parents to Child with Reservation of Life Estate. This strategy helps clarify ownership rights and provides legal protection for both parties. To ensure compliance with all regulations, consider engaging a legal professional who specializes in estate planning.