This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

Oxnard California Grant Deed - Parents to Child with Reservation of Life Estate

Description

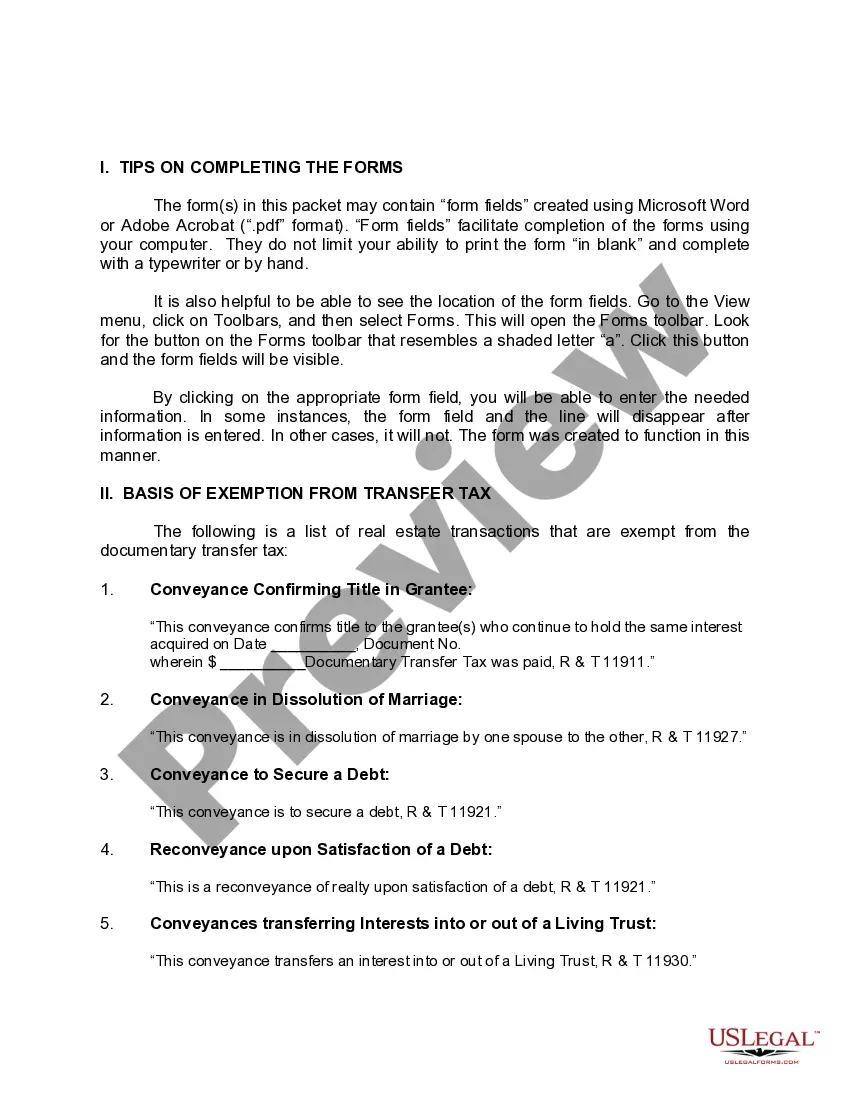

How to fill out California Grant Deed - Parents To Child With Reservation Of Life Estate?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s a digital collection of over 85,000 legal forms for both personal and professional requirements and various real circumstances.

All the documents are adequately classified by usage area and jurisdiction, making it as simple and swift as ABC to locate the Oxnard California Grant Deed - Parents to Child with Reservation of Life Estate.

Maintaining paperwork organized and compliant with legal standards is extremely crucial. Utilize the US Legal Forms library to have essential document templates for any needs readily available!

- Examine the Preview mode and form description.

- Ensure you have selected the correct one that fulfills your needs and complies with your local jurisdiction requirements.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one.

- Purchase the document.

Form popularity

FAQ

Yes, you can inherit your parents' house in California, but the process may involve probate unless they have set up appropriate estate planning mechanisms. If a property is transferred using a Grant Deed - Parents to Child with Reservation of Life Estate, it may simplify the transition. Always consider consulting with a legal professional to understand your options and avoid potential challenges.

The Prop 19 loophole allows certain exemptions in property tax assessments for family transfers in California. This means parents can transfer their primary residence to their children without reassessing property taxes, provided certain conditions are met. Using a Grant Deed - Parents to Child with Reservation of Life Estate can help navigate this loophole efficiently.

Yes, California recognizes life estate deeds. This legal tool allows the owner to retain usage rights for their lifetime while transferring the property to another party, such as a child. Utilizing a Grant Deed - Parents to Child with Reservation of Life Estate can provide security and clarity in property ownership transitions.

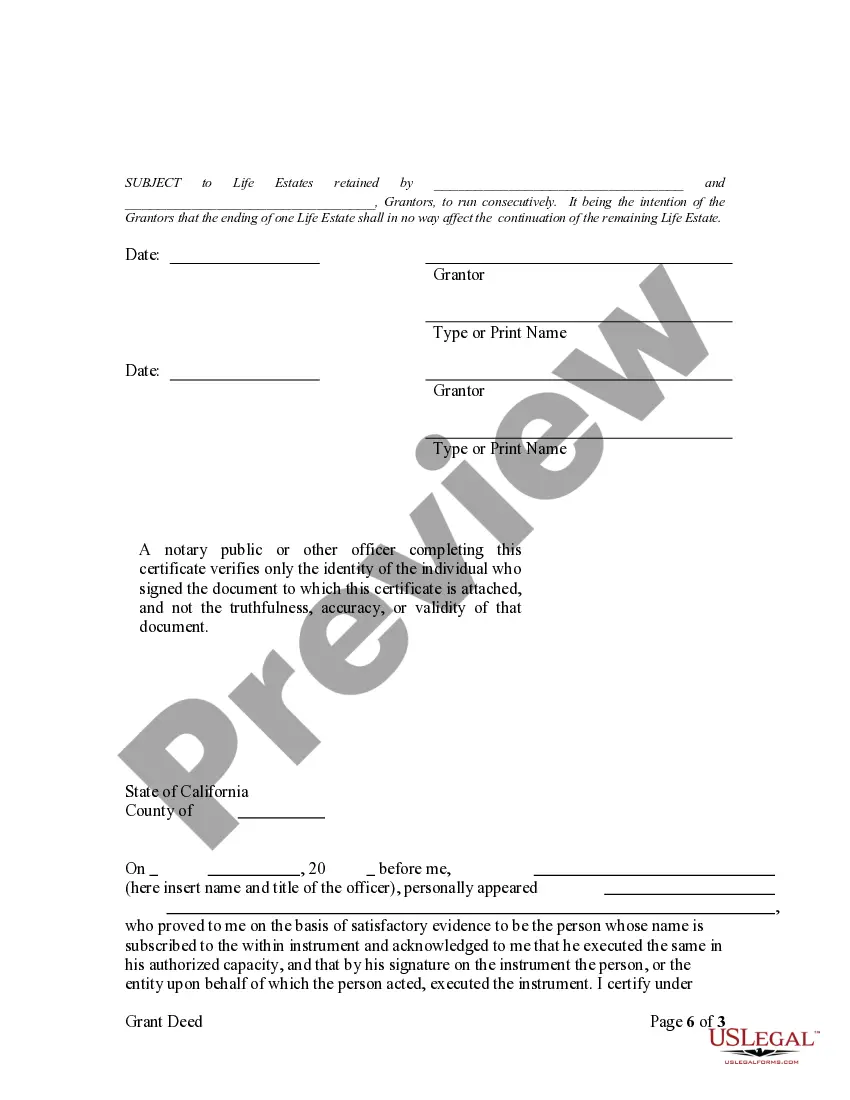

To pass property from parent to child in California, you typically execute a Grant Deed. This deed must be signed, notarized, and recorded with the county. Specifically, if you incorporate a life estate, the parent can retain rights to the property while effectively transferring ownership to the child.

The best way to transfer property from parent to child in Oxnard is often through a Grant Deed. This approach allows for clear title transfer while potentially retaining a life estate for the parent. Using a Grant Deed - Parents to Child with Reservation of Life Estate can offer benefits such as avoiding probate and ensuring your wishes are honored.

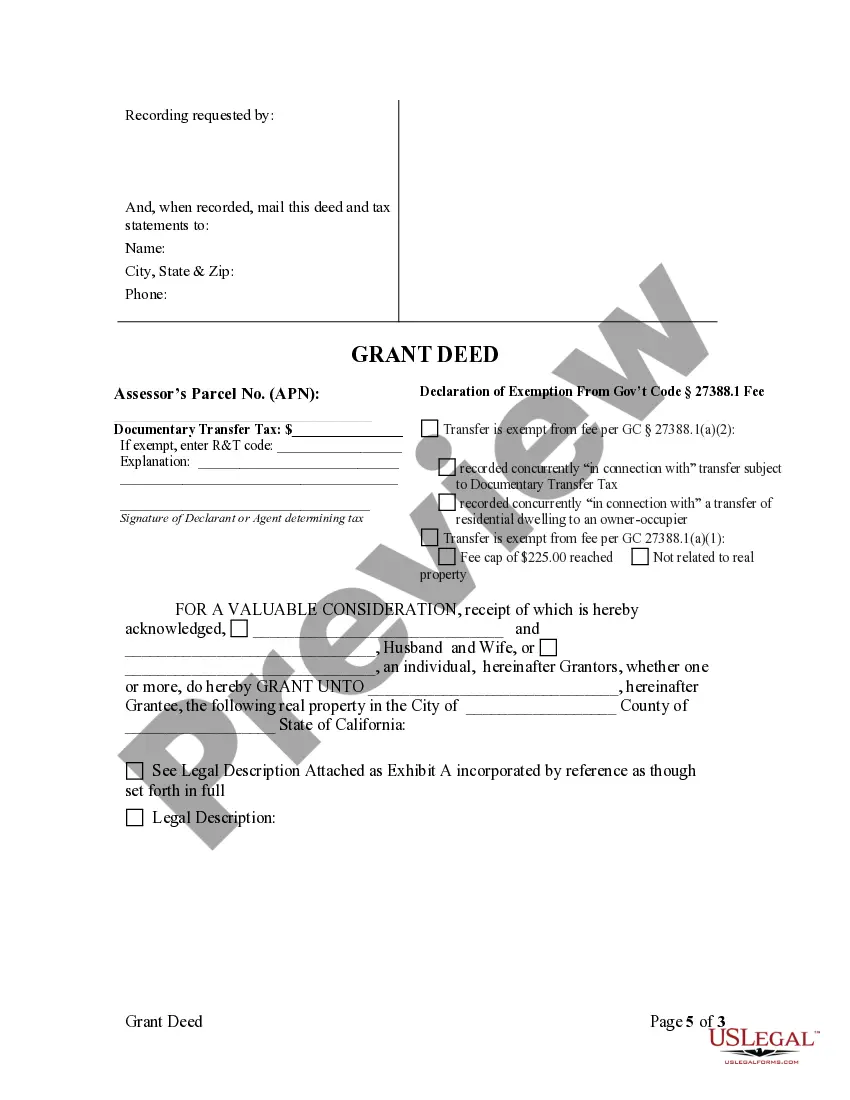

To create a valid grant deed in California, the document must include the names of the grantor and grantee, a legal description of the property, and the grantor's signature. The deed should also state the intent to transfer ownership. For accuracy and legal protection, consider using resources from US Legal Forms for your Oxnard California Grant Deed - Parents to Child with Reservation of Life Estate.

In a life estate, the life tenant is typically responsible for property taxes, as they maintain possession and enjoyment of the property. However, the remainderman should be aware of any potential tax implications, as the life tenant's actions can affect it. Consequently, understanding tax obligations is essential when dealing with an Oxnard California Grant Deed - Parents to Child with Reservation of Life Estate.

In California, who inherits property after death largely depends on whether the deceased left a will. If there is a will, the estate follows its instructions. If there is no will, property distribution follows state intestacy laws, which may benefit surviving spouse, children, or other relatives. Properly utilizing an Oxnard California Grant Deed - Parents to Child with Reservation of Life Estate can simplify this process.

In a life estate, the current occupant holds rights to live in the property for their lifetime, but they do not own it outright. Instead, the property is ultimately owned by a remainderman, the designated heir, who will inherit the property after the death of the life tenant. Understanding these roles is crucial in the context of an Oxnard California Grant Deed - Parents to Child with Reservation of Life Estate.

In California, a life estate allows a person to use and live on a property for their lifetime, after which the property passes to a designated heir. The owner of a life estate cannot sell or mortgage the property without the consent of the heir. This arrangement provides a useful estate planning tool to ensure property stays within the family, particularly in Oxnard. Explore US Legal Forms for templates related to life estates.