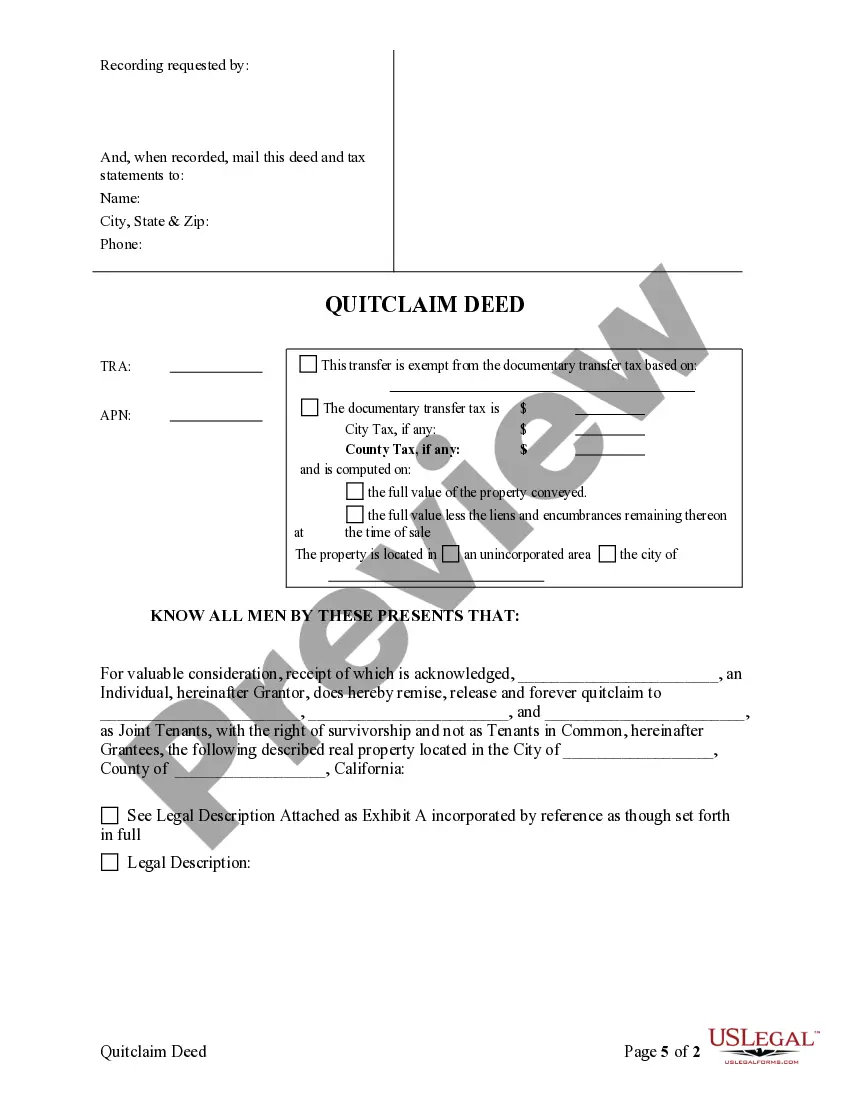

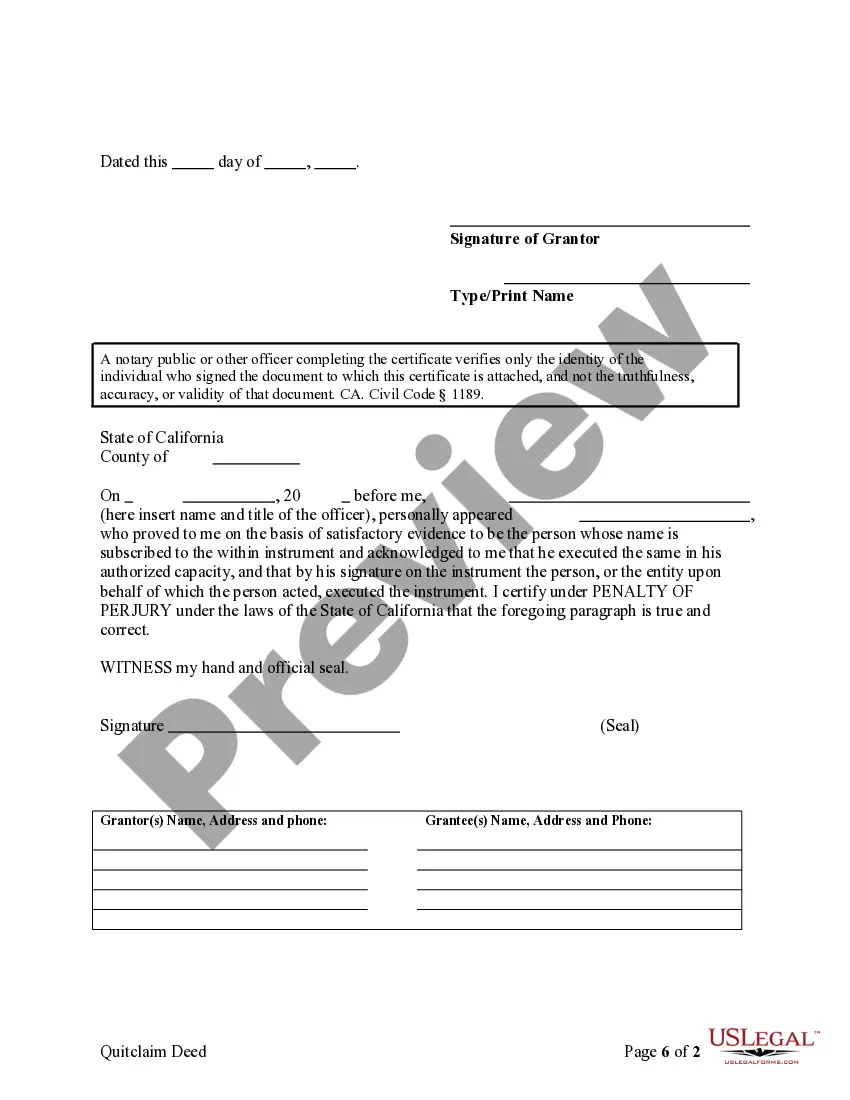

This form is a Quitclaim Deed where the grantor is one individual and the grantees are three individuals holding title as joint tenants.

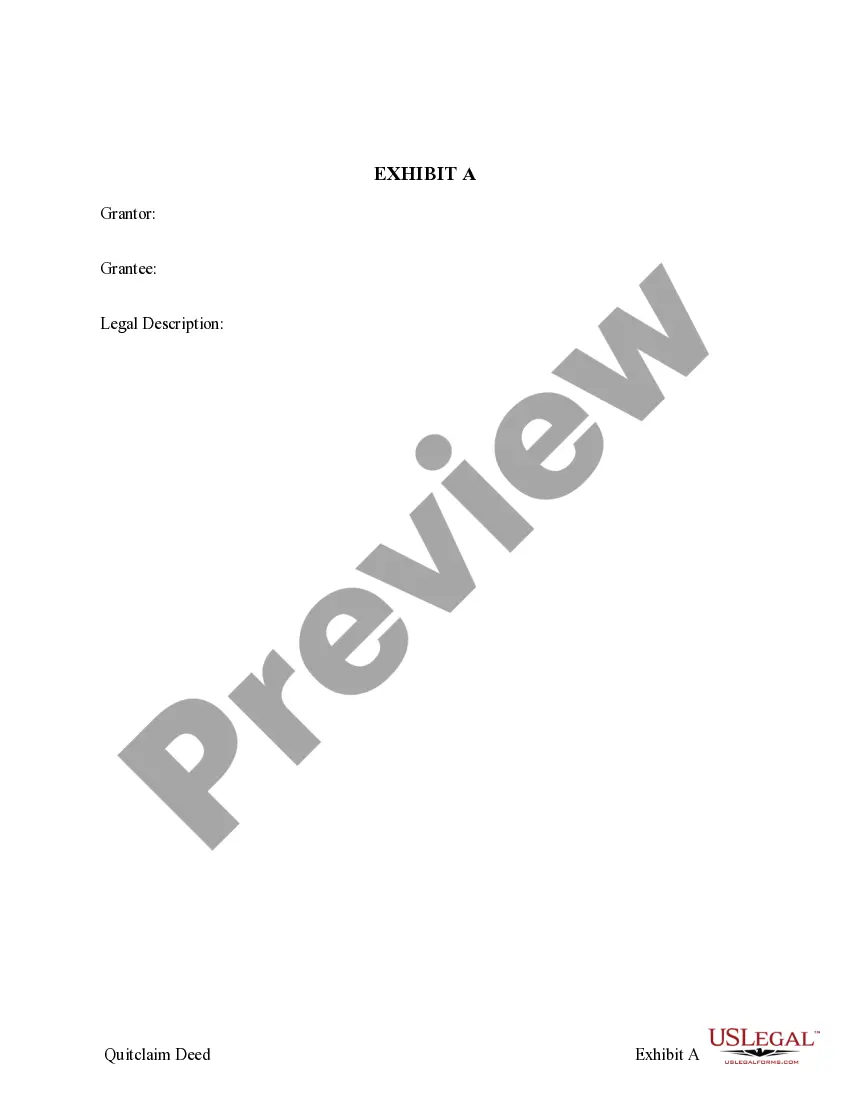

A Sacramento California Quitclaim Deed from one Individual to Three Individuals as Joint Tenants is a legal document used to transfer ownership of a property located in Sacramento, California, from one individual to a group of three individuals who will hold the property as joint tenants. This type of quitclaim deed ensures that all three individuals have equal rights and ownership interests in the property. In a joint tenancy arrangement, each individual has an undivided interest in the property, meaning they all share equal access and rights to the entire property rather than specific portions. When one joint tenant passes away, their interest automatically transfers to the remaining joint tenants, ensuring a seamless transfer of ownership. Some keywords that are relevant to this topic include: 1. Sacramento California: Represents the specific location where the property is situated, referring to the state of California and the city of Sacramento. 2. Quitclaim Deed: A legal document used to transfer the ownership of real property without making any guarantees or warranties about the property's title. 3. Individual to Three Individuals: Describes the transfer of ownership from a single individual to a group of three individuals. 4. Joint Tenants: Refers to the type of ownership arrangement where multiple individuals hold an undivided interest in the property, sharing equal access and rights. It's important to note that while the Sacramento California Quitclaim Deed from one Individual to Three Individuals as Joint Tenants is a common type of transfer, there may be different variations or specific circumstances that require different types of quitclaim deeds, such as: 1. Sacramento California Quitclaim Deed with Rights of Survivorship: This type of deed adds a provision that ensures the property's ownership automatically passes to the surviving joint tenants upon the death of one joint tenant, bypassing the probate process. 2. Sacramento California Quitclaim Deed from Individuals to Joint Tenants: In this scenario, more than one individual is transferring their ownership interests to a newly established joint tenancy, rather than a single individual transferring to an existing group of joint tenants. 3. Sacramento California Quitclaim Deed from One Individual to Three Individuals as Tenants in Common: This type of deed specifies that the three individuals will hold the property as tenants in common, where each person has a specific and divisible share of ownership, and there is no right of survivorship.