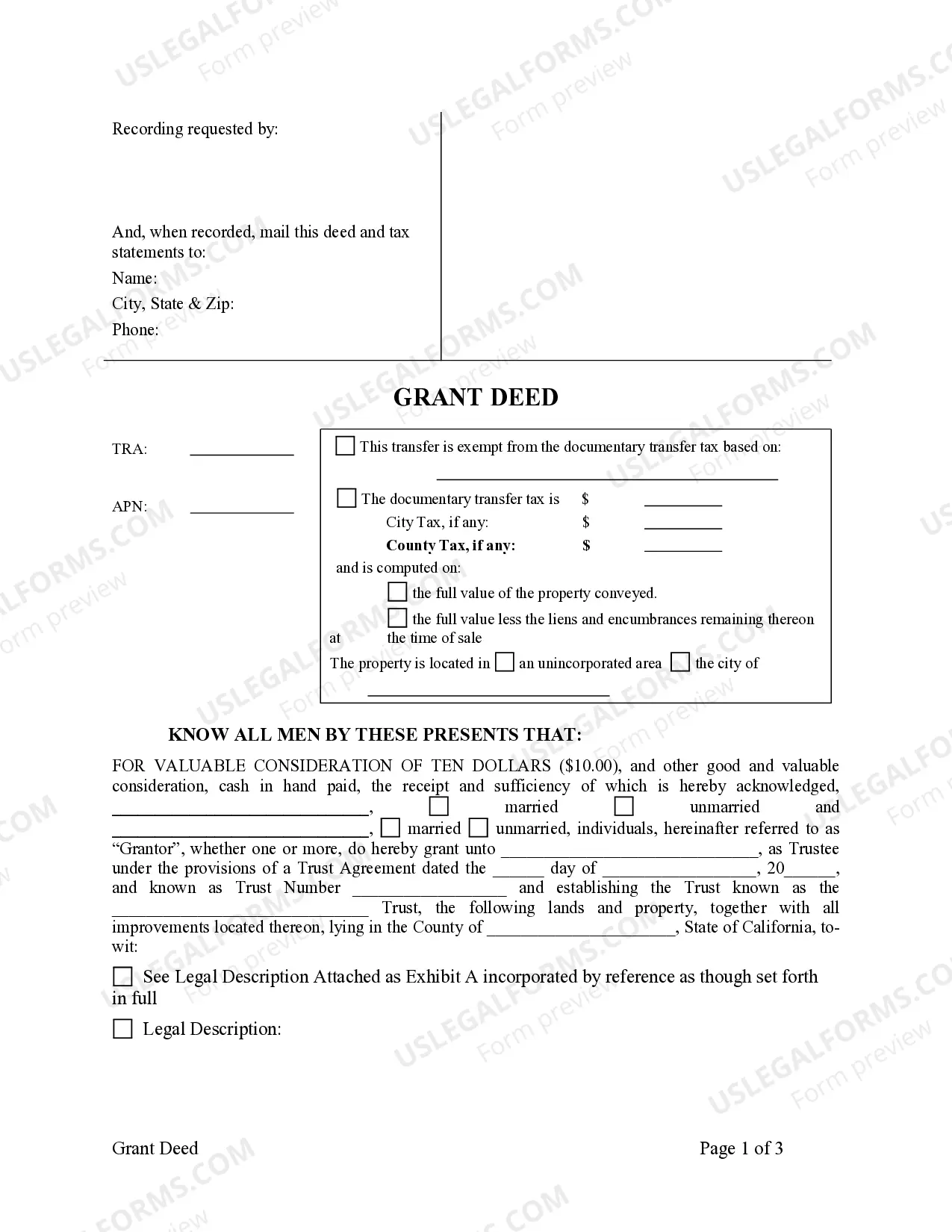

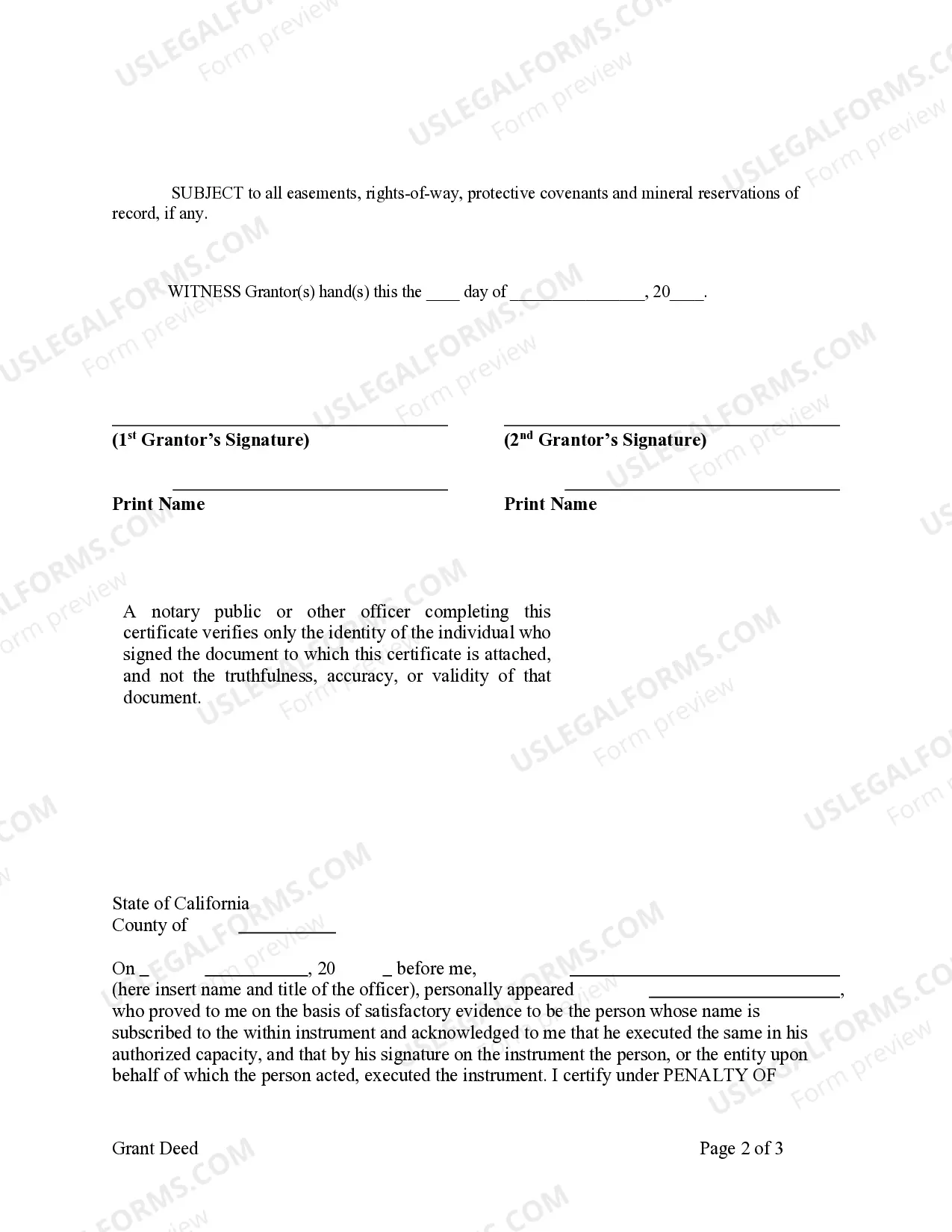

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

Alameda California Grant Deed - Two Individuals to a Trust

Description

How to fill out California Grant Deed - Two Individuals To A Trust?

Obtaining validated templates pertinent to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-life scenarios.

All the files are accurately organized by category of use and jurisdictional areas, making it as quick and simple as 123 to find the Alameda California Grant Deed - Two Individuals to a Trust.

By clicking the Buy Now button, choose the subscription plan that suits you. Creating an account is required to access the library's offerings.

- Ensure to review the Preview mode and document description.

- Confirm you have chosen the correct one that satisfies your needs and fully aligns with your regional jurisdiction requirements.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the right one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

The best way to transfer a property title between family members is through an Alameda California Grant Deed - Two Individuals to a Trust. This method ensures that the property is securely transferred while providing certain legal protections for all parties involved. By using a trust, you can simplify the transfer process and potentially avoid complications later on. Consider using a reliable platform like uslegalforms to navigate the necessary paperwork and ensure everything is done correctly.

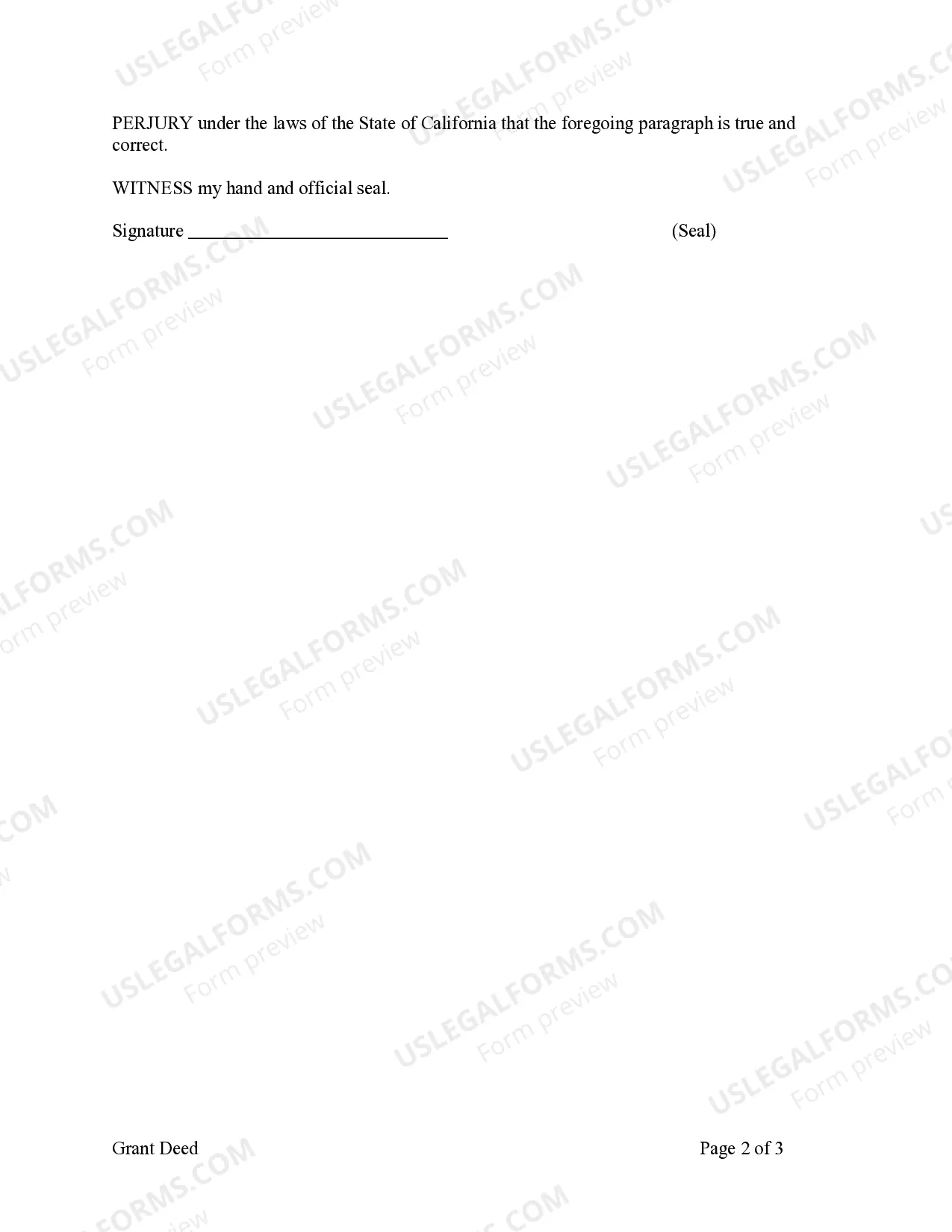

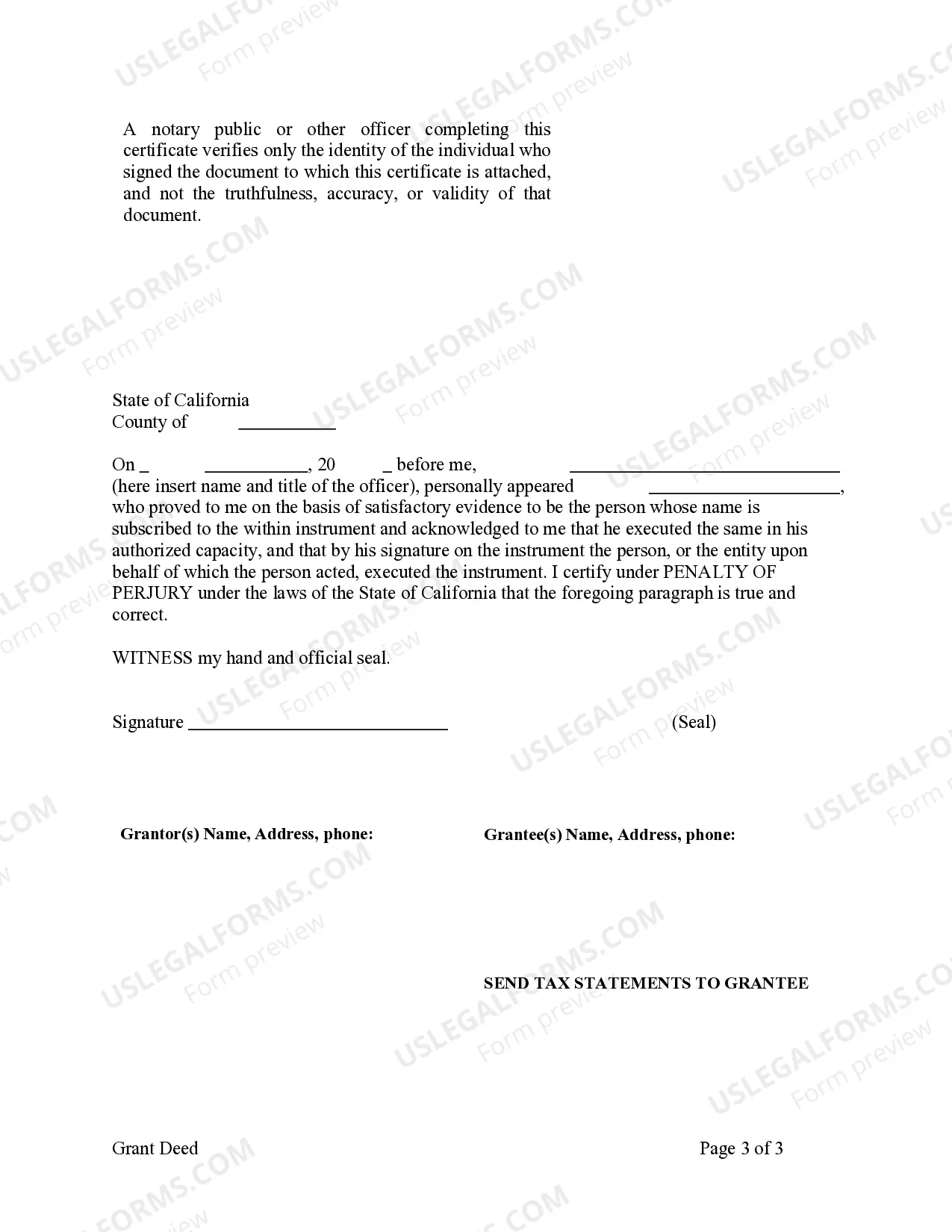

To put your property in a trust in California, you will first need to create the trust document, which outlines the terms and conditions of the trust. Next, specifically for the Alameda California Grant Deed - Two Individuals to a Trust, you will need to fill out a grant deed form that transfers the property into the trust's name. Ensure that you sign the deed and have it notarized to make the transfer official. Finally, file the completed grant deed with your county's recorder's office to make it part of the public record, thereby protecting your property within the trust.

To transfer a deed to a trust in California, start by completing an Alameda California Grant Deed - Two Individuals to a Trust that specifies the property details and the trust as the new owner. Once you have a properly executed deed, sign it in the presence of a notary. After notarization, submit the deed to the county recorder's office for official recording to finalize the transfer.

While placing your home in a trust can offer benefits, there are some disadvantages to consider. One issue may be the initial costs of setting up the trust, including legal fees for drafting the Alameda California Grant Deed - Two Individuals to a Trust. Additionally, once in a trust, you may face restrictions on future property sales or transfers without altering the trust agreement.

Transferring property to a trust in California involves creating a new Alameda California Grant Deed - Two Individuals to a Trust. You need to draft the deed, detailing the property and naming the trust as the new owner. After that, sign the deed and have it notarized. Finally, record the deed with the county recorder's office to complete the transfer.

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

How to Correct a Deed Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Grant Deeds are used to transfer title of real property. This is done at the time of purchase and can be later recorded to add or remove individual's names after purchase.