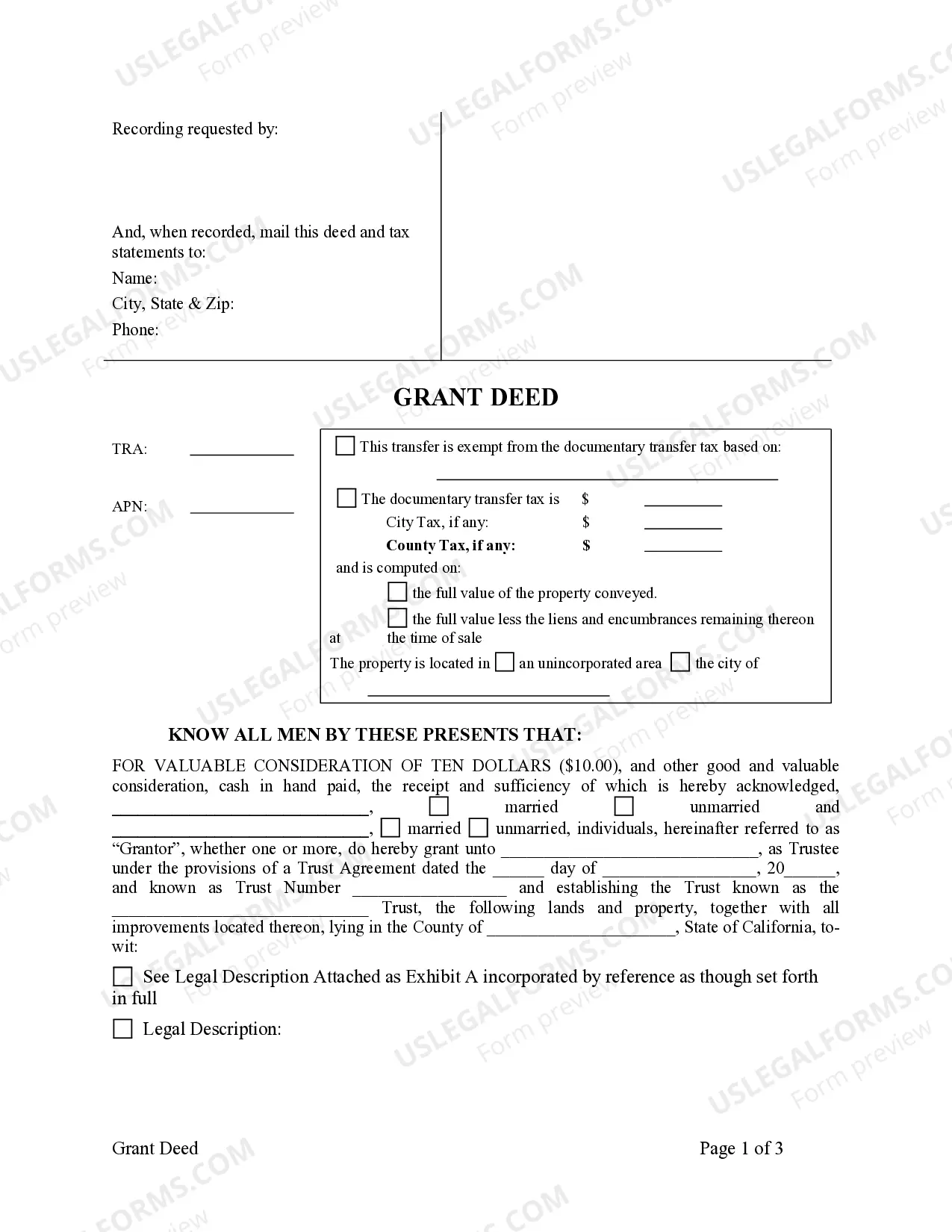

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

Antioch California Grant Deed — Two Individuals to a Trust: A Comprehensive Guide to Transferring Property Interests The Antioch California Grant Deed — Two Individuals to a Trust is a legal document that enables individuals to transfer their ownership interest in a property to a trust. This deed is specifically designed to cater to residents of Antioch, California, and follows the state laws and regulations governing property transfers. A grant deed is a common method of transferring property rights and is often utilized when ownership is being transferred to a trust. In this case, the granters (the two individuals) are relinquishing their interest in the property and granting it to a trust entity. The grantee will be the trust itself, acting as the new legal owner of the property. This particular type of grant deed offers several advantages for individuals looking to establish a trust. By transferring the property to a trust, it allows for proper estate planning, asset protection, and easy management of the property by the designated trustee. Additionally, it can help avoid the lengthy probate process, ensuring a smooth transfer of ownership to the beneficiaries specified within the trust. In Antioch, California, there are various types of Antioch California Grant Deed — Two Individuals to a Trust, including: 1. Revocable Living Trust Grant Deed: This type of grant deed allows the granters to retain control over the property during their lifetime, and they have the flexibility to modify or revoke the trust as they see fit. 2. Irrevocable Living Trust Grant Deed: With this grant deed, the transfer of property to the trust is permanent and cannot be easily modified or revoked by the granters. This type of trust is often used for asset protection and estate tax planning purposes. 3. Testamentary Living Trust Grant Deed: Unlike the previous types, this grant deed only takes effect upon the death of the granters. It is typically used in combination with a will, allowing the granters to have control over the property during their lifetime while ensuring a smooth transfer to the trust upon their passing. To complete an Antioch California Grant Deed — Two Individuals to a Trust, certain requirements must be met. These include providing a legal description of the property, identifying the granters and the trust beneficiaries, and obtaining the necessary signatures and notarization. It is crucial to seek professional legal advice and assistance while preparing and executing this grant deed to ensure compliance with all legal requirements and to protect your interests.