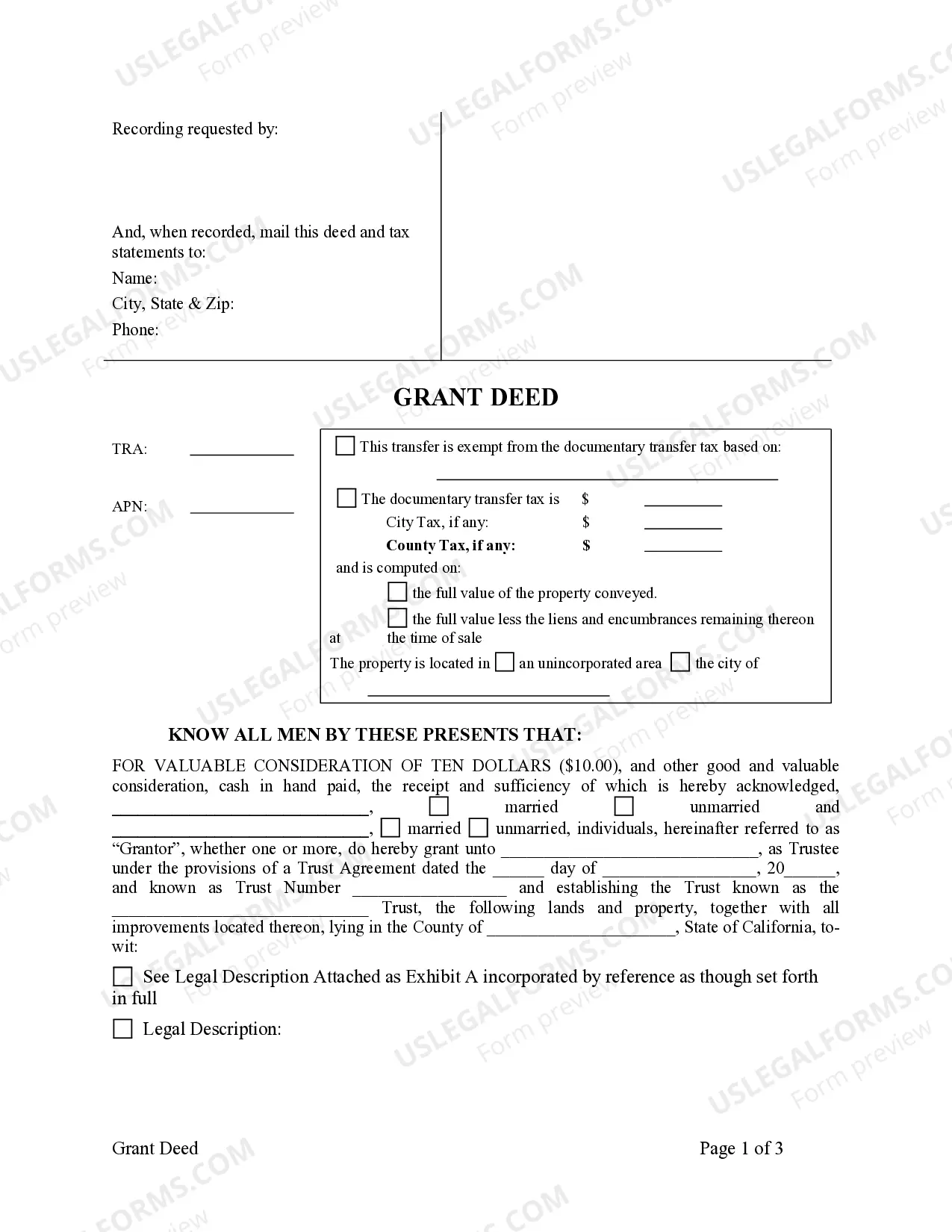

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

A Contra Costa California Grant Deed — Two Individuals to a Trust is a legal document that facilitates the transfer of property ownership from two individuals to a trust in Contra Costa County, California. This type of grant deed is commonly utilized for estate planning purposes and offers numerous advantages for property owners looking to protect their assets and ensure a seamless transfer to their designated beneficiaries. The Contra Costa California Grant Deed — Two Individuals to a Trust provides a secure and legally binding means to transfer property ownership without the need for probate court involvement. By establishing a trust, property owners can avoid the time-consuming and expensive probate process, ensuring a more efficient transfer of assets to their trust beneficiaries. There are several variations of the Contra Costa California Grant Deed — Two Individuals to a Trust, each serving different purposes based on the specific circumstances of the property owners. These variations include: 1. Revocable Living Trust Grant Deed: This type of grant deed allows property owners to establish a revocable living trust, which enables them to retain control over the assets transferred to the trust during their lifetime. With a revocable living trust, individuals have the flexibility to amend, modify, or revoke the trust as needed, providing added flexibility and control over their assets. 2. Irrevocable Trust Grant Deed: An irrevocable trust grant deed is different from a revocable living trust since it cannot be modified or revoked once established, except under limited circumstances. Property owners who opt for an irrevocable trust grant deed typically do so to protect their assets from creditors, minimize estate taxes, or ensure the preservation of assets for future generations. 3. Family Trust Grant Deed: A family trust grant deed is commonly utilized when multiple family members wish to transfer their property into a single trust. This helps consolidate the management and distribution of assets, ensuring a smooth transition of property ownership among family members and offering potential tax benefits. 4. Testamentary Trust Grant Deed: A testamentary trust grant deed becomes effective upon the death of the property owner, as specified in their will. This type of grant deed allows individuals to designate how their assets will be distributed among their beneficiaries, providing peace of mind and control over the posthumous distribution of their property. In summary, a Contra Costa California Grant Deed — Two Individuals to a Trust provides a comprehensive legal framework for individuals seeking to transfer property ownership to a trust. By utilizing different variations of this grant deed, individuals can customize their estate planning strategy to meet their specific needs while protecting their assets and ensuring a seamless transfer to their desired beneficiaries.