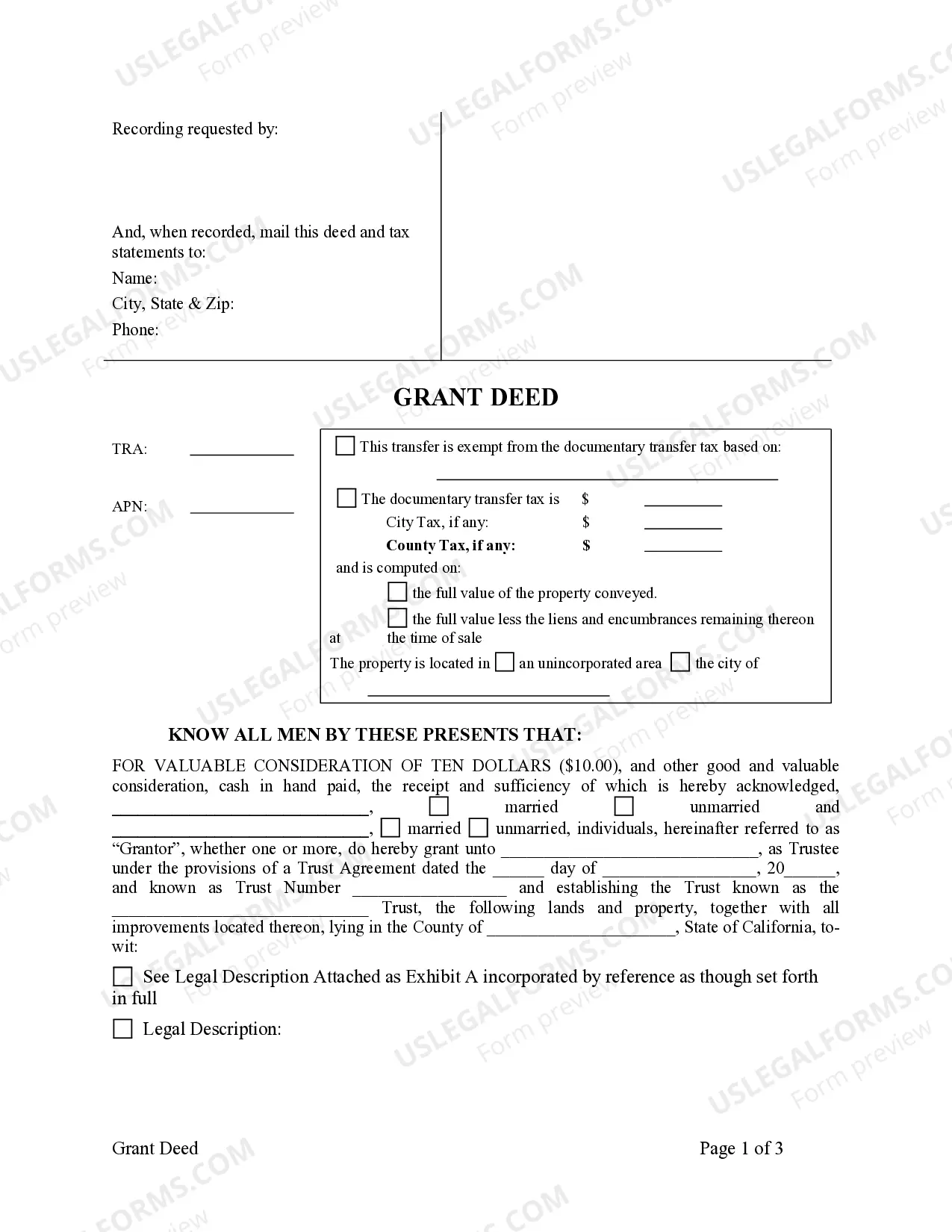

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

Fullerton California Grant Deed — Two Individuals to a Trust is a legal document used to transfer real estate ownership from two individuals to a trust entity. This type of deed ensures that the property is held and managed by the trust, rather than being individually owned. It is commonly used for estate planning and asset protection purposes. In Fullerton, California, there are several types of Fullerton Grant Deeds — Two Individuals to a Trust, including: 1. Revocable Living Trust Grant Deed: This type of grant deed establishes a revocable living trust, in which the property is transferred to the trust during the granter's lifetime. The granter retains control over the property and has the flexibility to revoke or amend the trust as desired. 2. Irrevocable Trust Grant Deed: This grant deed transfers the property to an irrevocable trust, wherein the granter permanently divests their ownership rights and relinquishes control over the property. This type of trust is often used for tax planning, charitable purposes, or long-term asset protection. 3. Testamentary Trust Grant Deed: In this case, the grant deed is executed within a will and takes effect upon the granter's death. The property will then be transferred to the trust, as specified in they will document. This type of trust ensures the proper distribution of assets according to the granter's testamentary wishes. 4. Special Needs Trust Grant Deed: Specifically designed for individuals with disabilities, this grant deed transfers the property to a trust that will provide for the needs of the beneficiary without jeopardizing their eligibility for government benefits. This type of trust ensures that the beneficiary can maintain their quality of life while still receiving essential assistance. 5. Land Trust Grant Deed: This grant deed allows two individuals to transfer real estate to a land trust, which provides privacy, asset protection, and centralized management. Land trusts can be useful for investors or landowners who wish to maintain anonymity or streamline property management. By using a Fullerton California Grant Deed — Two Individuals to a Trust, individuals can protect their assets, maintain control over their property, and ensure the smooth transition of ownership to a trust entity. It is advisable to consult with a qualified attorney or legal professional familiar with California laws and regulations when executing these types of deeds.