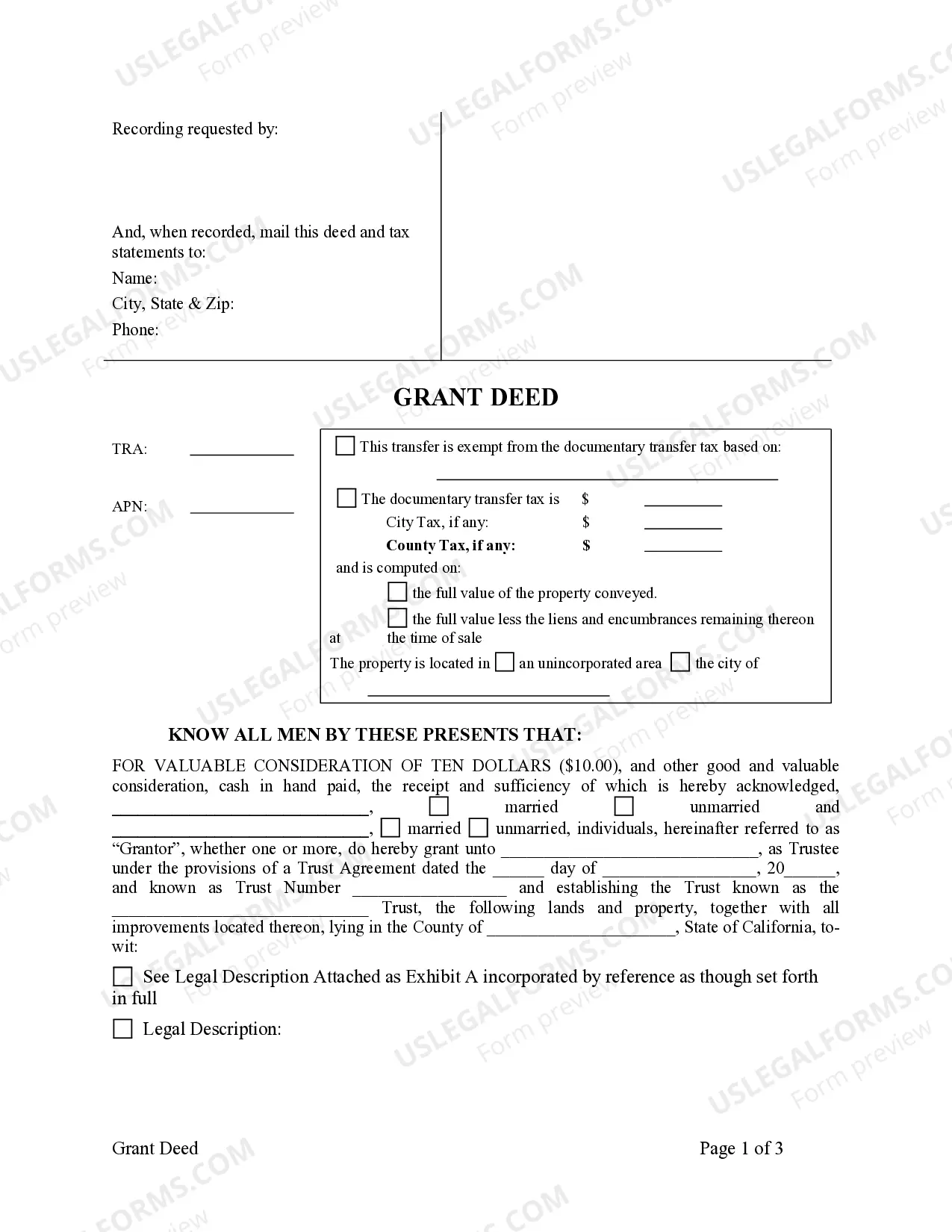

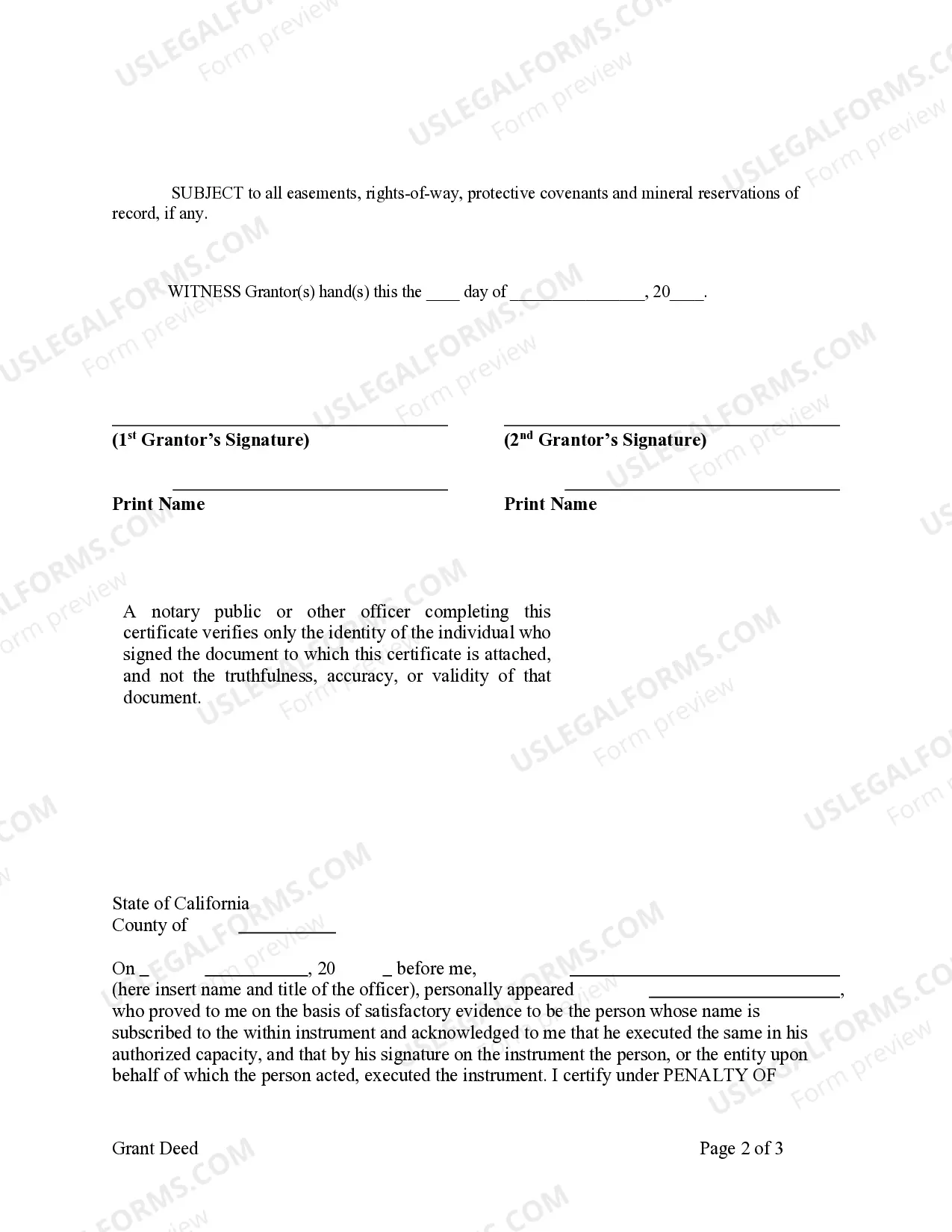

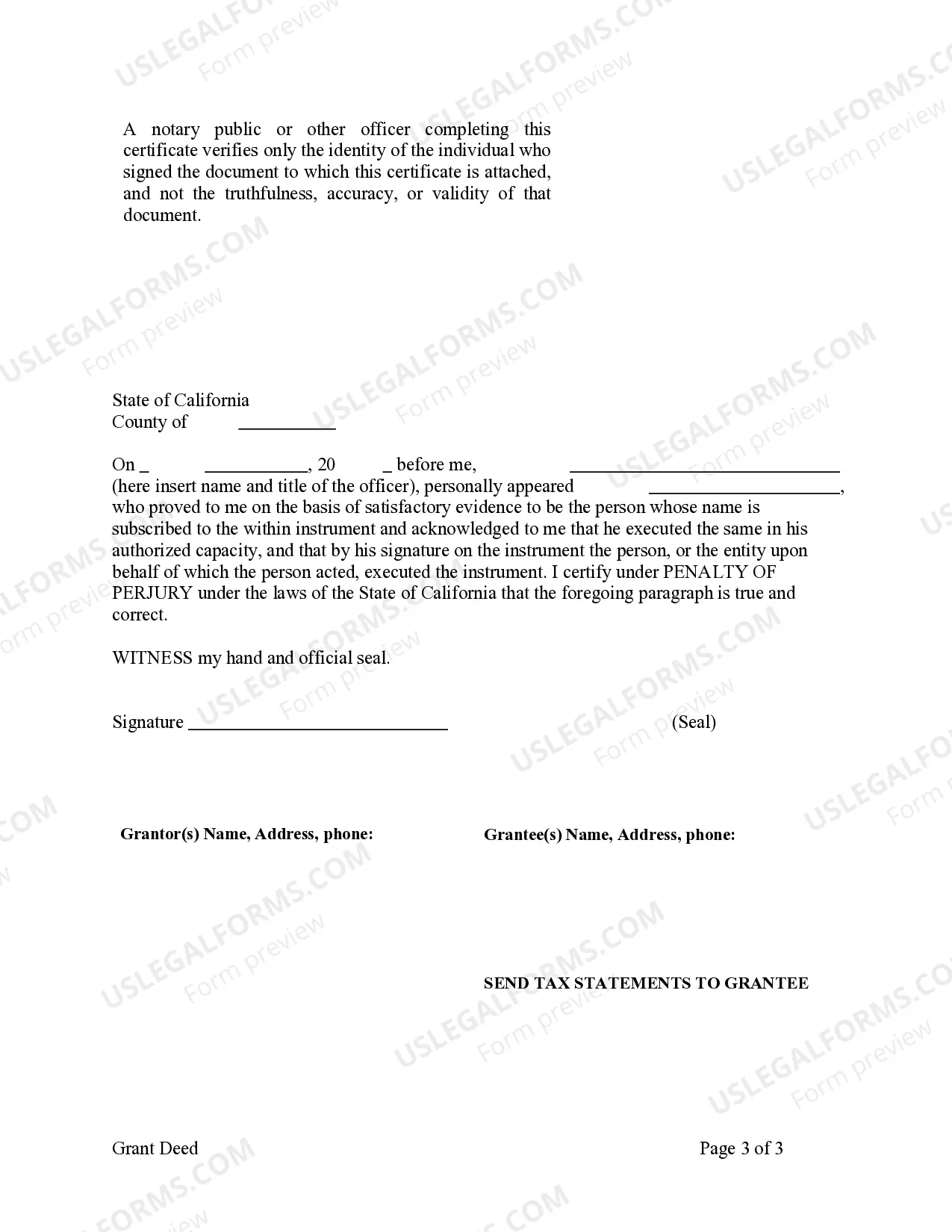

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

A Garden Grove California Grant Deed — Two Individuals to a Trust is a legally binding document used to transfer ownership of real estate from two individuals to a trust. This type of deed is commonly used when individuals wish to transfer their property to a trust for estate planning purposes or to protect their assets. The granter(s), or the individuals transferring the property, will execute the deed, transferring their rights, title, and interest in the property to the trust. The granter(s) must be the current owners of the property and have the legal capacity to transfer it. The trust, on the other hand, acts as the grantee, or the recipient of the property. This type of deed offers numerous benefits, including probate avoidance, asset protection, and efficient estate planning. By transferring the property to a trust, the granter(s) can ensure a smooth transition of ownership upon their death or incapacitation. It also allows the property to bypass probate, saving time, money, and maintaining privacy for the granter(s) and their beneficiaries. Garden Grove California Grant Deed types may include: 1. Revocable Living Trust Deed: This type of grant deed allows the granter(s) to retain control and ownership of the property during their lifetime. They have the ability to amend or revoke the trust, and upon their death, the property automatically passes to the designated beneficiaries. 2. Irrevocable Living Trust Deed: With this grant deed, the granter(s) transfers all ownership and control of the property to an irrevocable trust. Once executed, the granter(s) cannot make any changes or revoke the trust. This type of trust provides additional asset protection benefits and may be useful for Medicaid planning or minimizing estate taxes. 3. Testamentary Trust Deed: This grant deed is created as part of a will and takes effect upon the granter(s)’ death. The property is transferred to the trust, which then distributes the assets according to the terms of the will. It allows for more flexibility in estate planning and ensures that the property is managed and distributed as per the granter(s)’ wishes. 4. Special Needs Trust Deed: This type of grant deed establishes a trust specifically designed to provide for the financial needs and support of individuals with special needs. The trust holds the property and manages the assets for the benefit of the individual, without affecting their eligibility for government assistance programs. It's crucial to consult a qualified attorney experienced in estate planning and real estate law to assist with the preparation and execution of a Garden Grove California Grant Deed — Two Individuals to a Trust. The attorney will ensure that the deed is properly drafted, executed, and recorded, safeguarding the granter(s) and their beneficiaries' interests.A Garden Grove California Grant Deed — Two Individuals to a Trust is a legally binding document used to transfer ownership of real estate from two individuals to a trust. This type of deed is commonly used when individuals wish to transfer their property to a trust for estate planning purposes or to protect their assets. The granter(s), or the individuals transferring the property, will execute the deed, transferring their rights, title, and interest in the property to the trust. The granter(s) must be the current owners of the property and have the legal capacity to transfer it. The trust, on the other hand, acts as the grantee, or the recipient of the property. This type of deed offers numerous benefits, including probate avoidance, asset protection, and efficient estate planning. By transferring the property to a trust, the granter(s) can ensure a smooth transition of ownership upon their death or incapacitation. It also allows the property to bypass probate, saving time, money, and maintaining privacy for the granter(s) and their beneficiaries. Garden Grove California Grant Deed types may include: 1. Revocable Living Trust Deed: This type of grant deed allows the granter(s) to retain control and ownership of the property during their lifetime. They have the ability to amend or revoke the trust, and upon their death, the property automatically passes to the designated beneficiaries. 2. Irrevocable Living Trust Deed: With this grant deed, the granter(s) transfers all ownership and control of the property to an irrevocable trust. Once executed, the granter(s) cannot make any changes or revoke the trust. This type of trust provides additional asset protection benefits and may be useful for Medicaid planning or minimizing estate taxes. 3. Testamentary Trust Deed: This grant deed is created as part of a will and takes effect upon the granter(s)’ death. The property is transferred to the trust, which then distributes the assets according to the terms of the will. It allows for more flexibility in estate planning and ensures that the property is managed and distributed as per the granter(s)’ wishes. 4. Special Needs Trust Deed: This type of grant deed establishes a trust specifically designed to provide for the financial needs and support of individuals with special needs. The trust holds the property and manages the assets for the benefit of the individual, without affecting their eligibility for government assistance programs. It's crucial to consult a qualified attorney experienced in estate planning and real estate law to assist with the preparation and execution of a Garden Grove California Grant Deed — Two Individuals to a Trust. The attorney will ensure that the deed is properly drafted, executed, and recorded, safeguarding the granter(s) and their beneficiaries' interests.