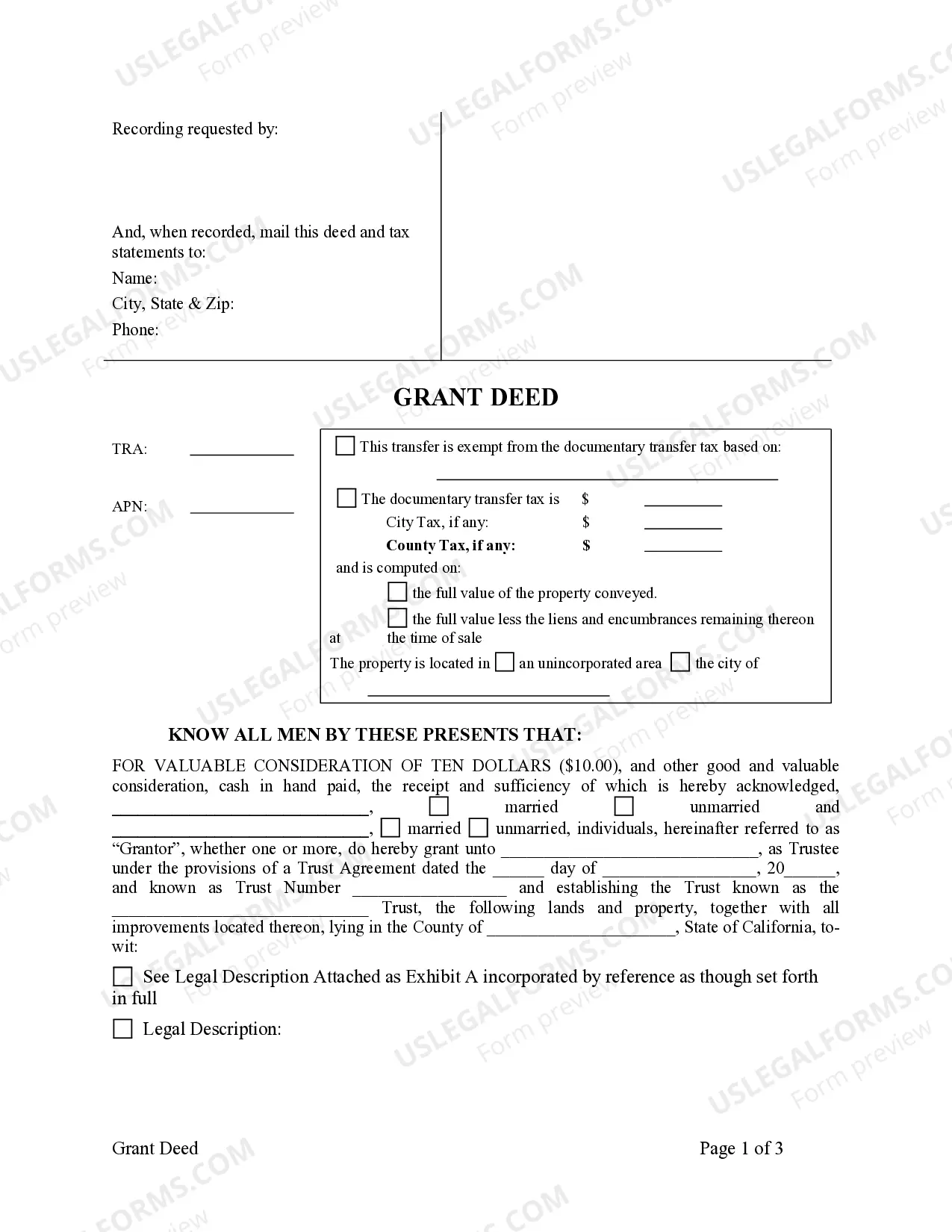

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

A Sacramento California Grant Deed — Two Individuals to a Trust is a legal document used to transfer ownership of real property located in Sacramento, California from two individuals (the granters) to a trust. This type of deed is commonly used when individuals want to transfer their property into a trust for estate planning or asset protection purposes. The Sacramento California Grant Deed — Two Individuals to a Trust is an important tool for effectively transferring property while maintaining control and safeguarding assets. It is essential to ensure the proper execution of this deed to comply with California state laws and regulations. Here are some relevant types of Sacramento California Grant Deeds — Two Individuals to a Trust: 1. Revocable Living Trust: In this type of trust arrangement, the individuals retain control over the property during their lifetime and have the power to amend or revoke the trust. Upon their death, the property is transferred to designated beneficiaries, avoiding probate. 2. Irrevocable Trust: With an irrevocable trust, the granters permanently transfer ownership and control of the property to the trust. Once assets are transferred, the granters generally no longer have legal rights or control over the property. 3. Testamentary Trust: Unlike a revocable or irrevocable trust, a testamentary trust is established through a will. This means that the transfer of property into the trust occurs only upon the death of the granters. 4. Special Needs Trust: This type of trust is specifically designed to provide for the ongoing care and financial support of an individual with special needs or disabilities. Property transferred into this trust allows for the preservation of government benefits the individual may be entitled to. 5. Charitable Remainder Trust: In a charitable remainder trust, the granters transfer property to the trust, retaining an income interest from the trust for a set period or their entire life. After their death or the specified period, the remaining assets are distributed to charitable organizations. When executing a Sacramento California Grant Deed — Two Individuals to a Trust, it is crucial to consult a qualified attorney to ensure compliance with all legal requirements and to fully understand the implications of the transfer. This document is an integral part of estate planning and enables individuals to preserve and protect their property while maintaining control and addressing their specific needs and intentions.A Sacramento California Grant Deed — Two Individuals to a Trust is a legal document used to transfer ownership of real property located in Sacramento, California from two individuals (the granters) to a trust. This type of deed is commonly used when individuals want to transfer their property into a trust for estate planning or asset protection purposes. The Sacramento California Grant Deed — Two Individuals to a Trust is an important tool for effectively transferring property while maintaining control and safeguarding assets. It is essential to ensure the proper execution of this deed to comply with California state laws and regulations. Here are some relevant types of Sacramento California Grant Deeds — Two Individuals to a Trust: 1. Revocable Living Trust: In this type of trust arrangement, the individuals retain control over the property during their lifetime and have the power to amend or revoke the trust. Upon their death, the property is transferred to designated beneficiaries, avoiding probate. 2. Irrevocable Trust: With an irrevocable trust, the granters permanently transfer ownership and control of the property to the trust. Once assets are transferred, the granters generally no longer have legal rights or control over the property. 3. Testamentary Trust: Unlike a revocable or irrevocable trust, a testamentary trust is established through a will. This means that the transfer of property into the trust occurs only upon the death of the granters. 4. Special Needs Trust: This type of trust is specifically designed to provide for the ongoing care and financial support of an individual with special needs or disabilities. Property transferred into this trust allows for the preservation of government benefits the individual may be entitled to. 5. Charitable Remainder Trust: In a charitable remainder trust, the granters transfer property to the trust, retaining an income interest from the trust for a set period or their entire life. After their death or the specified period, the remaining assets are distributed to charitable organizations. When executing a Sacramento California Grant Deed — Two Individuals to a Trust, it is crucial to consult a qualified attorney to ensure compliance with all legal requirements and to fully understand the implications of the transfer. This document is an integral part of estate planning and enables individuals to preserve and protect their property while maintaining control and addressing their specific needs and intentions.