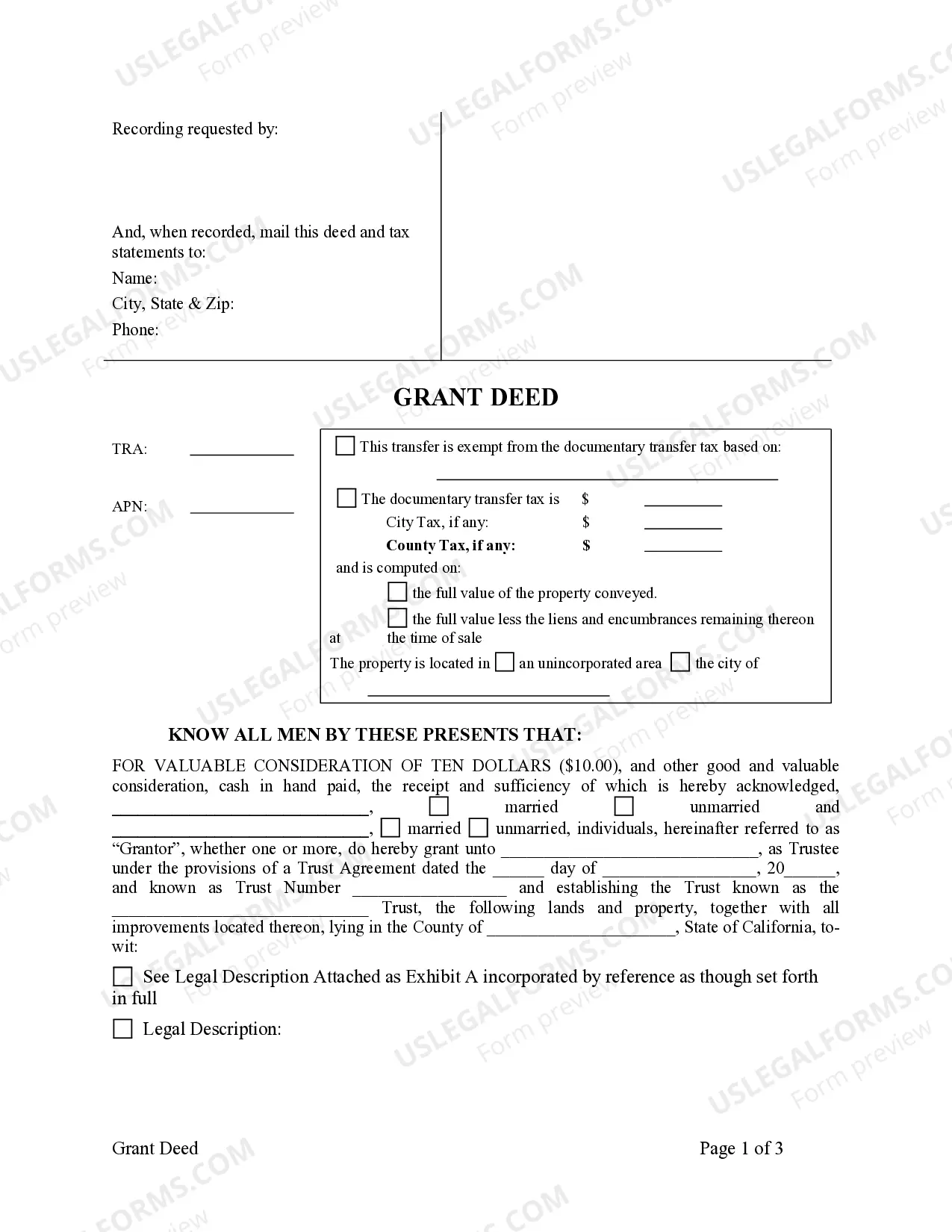

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

A San Jose California Grant Deed — Two Individuals to a Trust is a legal document that transfers ownership of a property from two individuals to a trust. This type of deed is commonly used when individuals wish to convey a property they own jointly to a trust that they have established, for various reasons like estate planning or asset protection. The grant deed is a legally binding instrument that guarantees the transfer of ownership rights from the granters (the two individuals) to the grantee (the trust). It includes specific information about the property being transferred, such as the legal description, assessor's parcel number, and address. There are several types of San Jose California Grant Deed — Two Individuals to a Trust, depending on the purpose and circumstances. These may include: 1. Revocable Living Trust Grant Deed — This type of grant deed is commonly used for estate planning purposes. It allows the individuals to transfer ownership of their property into a revocable living trust, which they can amend or revoke during their lifetimes. This provides flexibility and control over the trust assets without the need for probate upon the granters' death. 2. Irrevocable Trust Grant Deed — An irrevocable trust grant deed transfers ownership to an irrevocable trust, which means that the granters cannot easily amend or revoke the trust. This type of trust is often used for long-term wealth preservation and tax planning as it removes the property from the granters' estates, potentially reducing estate taxes. 3. Special Needs Trust Grant Deed — A special needs trust grant deed transfers ownership of the property to a trust created for the benefit of a disabled individual. This allows the granters to provide for the financial well-being of the disabled person while ensuring they do not lose access to government assistance programs. 4. Asset Protection Trust Grant Deed — An asset protection trust grant deed is designed to shield assets from potential creditors. By transferring ownership to an asset protection trust, the granters can protect the property from lawsuits, divorce settlements, or other financial liabilities. Regardless of the specific type, all San Jose California Grant Deed — Two Individuals to a Trust documents need to be notarized and filed with the county recorder's office to make the transfer official. It is crucial to consult with a qualified attorney or estate planning professional to ensure compliance with applicable laws and to address any specific needs or concerns.A San Jose California Grant Deed — Two Individuals to a Trust is a legal document that transfers ownership of a property from two individuals to a trust. This type of deed is commonly used when individuals wish to convey a property they own jointly to a trust that they have established, for various reasons like estate planning or asset protection. The grant deed is a legally binding instrument that guarantees the transfer of ownership rights from the granters (the two individuals) to the grantee (the trust). It includes specific information about the property being transferred, such as the legal description, assessor's parcel number, and address. There are several types of San Jose California Grant Deed — Two Individuals to a Trust, depending on the purpose and circumstances. These may include: 1. Revocable Living Trust Grant Deed — This type of grant deed is commonly used for estate planning purposes. It allows the individuals to transfer ownership of their property into a revocable living trust, which they can amend or revoke during their lifetimes. This provides flexibility and control over the trust assets without the need for probate upon the granters' death. 2. Irrevocable Trust Grant Deed — An irrevocable trust grant deed transfers ownership to an irrevocable trust, which means that the granters cannot easily amend or revoke the trust. This type of trust is often used for long-term wealth preservation and tax planning as it removes the property from the granters' estates, potentially reducing estate taxes. 3. Special Needs Trust Grant Deed — A special needs trust grant deed transfers ownership of the property to a trust created for the benefit of a disabled individual. This allows the granters to provide for the financial well-being of the disabled person while ensuring they do not lose access to government assistance programs. 4. Asset Protection Trust Grant Deed — An asset protection trust grant deed is designed to shield assets from potential creditors. By transferring ownership to an asset protection trust, the granters can protect the property from lawsuits, divorce settlements, or other financial liabilities. Regardless of the specific type, all San Jose California Grant Deed — Two Individuals to a Trust documents need to be notarized and filed with the county recorder's office to make the transfer official. It is crucial to consult with a qualified attorney or estate planning professional to ensure compliance with applicable laws and to address any specific needs or concerns.