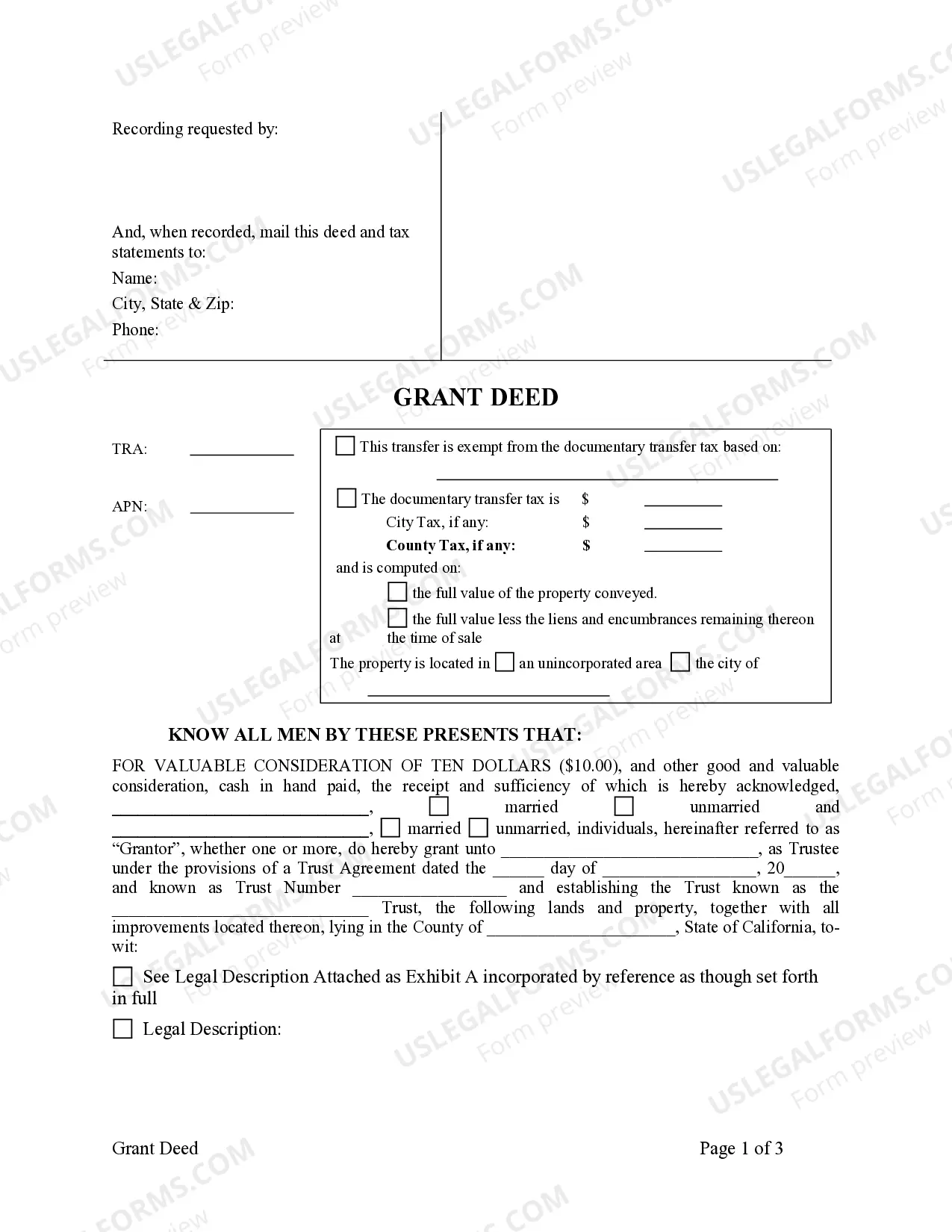

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

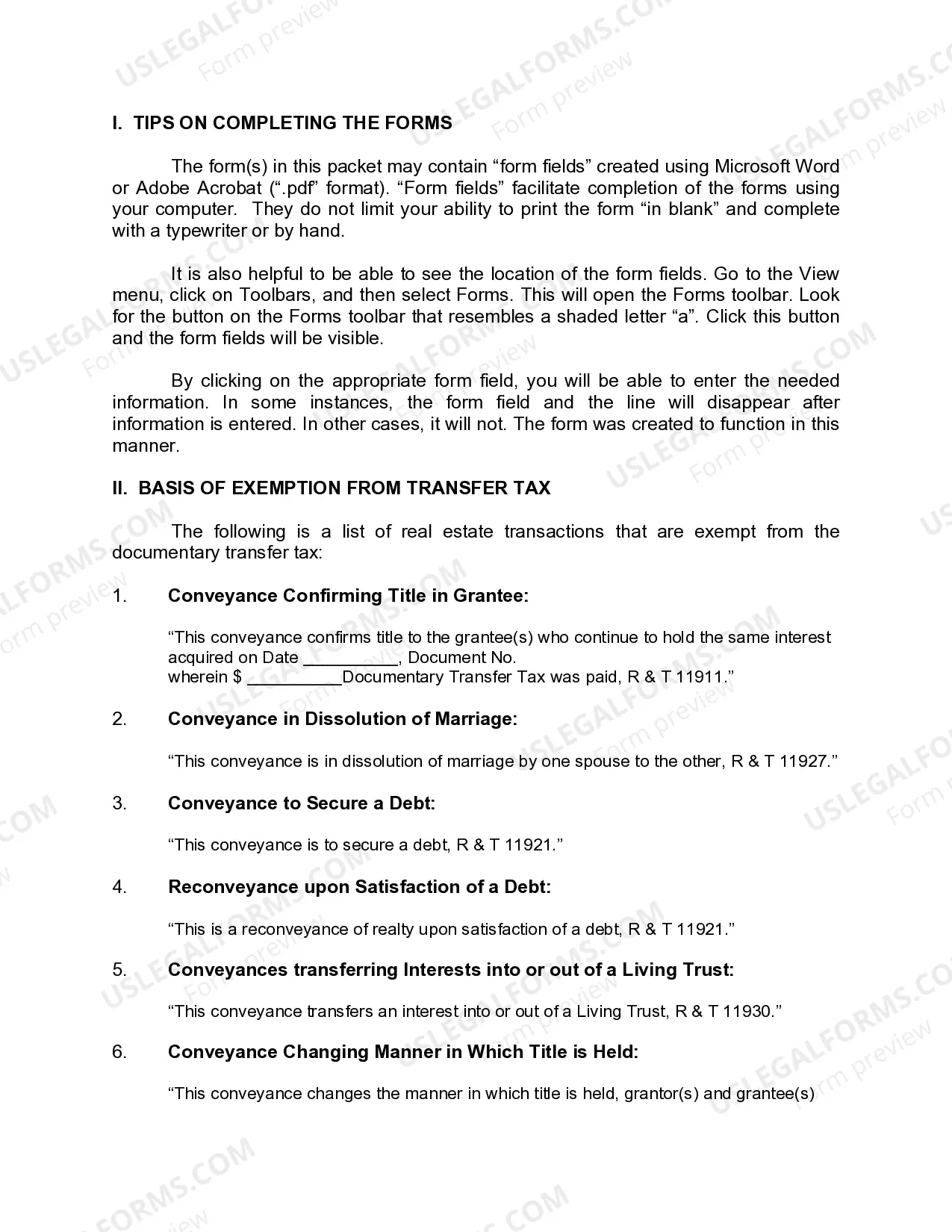

A Temecula California Grant Deed — Two Individuals to a Trust is a legal document that transfers ownership of real estate located in Temecula, California from two individuals to a trust. This type of deed is commonly used when individuals want to protect their property by placing it into a trust for estate planning purposes or to avoid probate. The grant deed serves as evidence of the transfer of ownership and is filed with the Riverside County Recorder's Office. It conveys the property without warranty, meaning that the granter (the individuals transferring the property) guarantees that they have the right to transfer it, but make no promises about the condition or title of the property. Different types of Temecula California Grant Deed — Two Individuals to a Trust may include: 1. Joint Tenancy with Right of Survivorship: This type of grant deed creates co-ownership of the property between two individuals, typically spouses or partners. In the event of the death of one owner, the surviving owner automatically inherits the deceased owner's share of the property. 2. Tenancy in Common: With this type of grant deed, two individuals jointly own the property, but each has a separate and transferable interest. Unlike joint tenancy, there is no right of survivorship, meaning that if one owner dies, their share of the property will pass to their heirs or beneficiaries as indicated in their estate plan. 3. Community Property: In California, married couples can hold property as community property. This type of grant deed transfers the ownership of the property to a trust, but preserves the community property ownership rights established by law. This means that both spouses have equal ownership and control over the property, and it will be subject to certain rules related to divorce or death. When executing a Temecula California Grant Deed — Two Individuals to a Trust, it is crucial to consult with an attorney or a trusted legal professional to ensure that the document meets all legal requirements and accurately reflects the intentions of the granters and the trust beneficiaries.A Temecula California Grant Deed — Two Individuals to a Trust is a legal document that transfers ownership of real estate located in Temecula, California from two individuals to a trust. This type of deed is commonly used when individuals want to protect their property by placing it into a trust for estate planning purposes or to avoid probate. The grant deed serves as evidence of the transfer of ownership and is filed with the Riverside County Recorder's Office. It conveys the property without warranty, meaning that the granter (the individuals transferring the property) guarantees that they have the right to transfer it, but make no promises about the condition or title of the property. Different types of Temecula California Grant Deed — Two Individuals to a Trust may include: 1. Joint Tenancy with Right of Survivorship: This type of grant deed creates co-ownership of the property between two individuals, typically spouses or partners. In the event of the death of one owner, the surviving owner automatically inherits the deceased owner's share of the property. 2. Tenancy in Common: With this type of grant deed, two individuals jointly own the property, but each has a separate and transferable interest. Unlike joint tenancy, there is no right of survivorship, meaning that if one owner dies, their share of the property will pass to their heirs or beneficiaries as indicated in their estate plan. 3. Community Property: In California, married couples can hold property as community property. This type of grant deed transfers the ownership of the property to a trust, but preserves the community property ownership rights established by law. This means that both spouses have equal ownership and control over the property, and it will be subject to certain rules related to divorce or death. When executing a Temecula California Grant Deed — Two Individuals to a Trust, it is crucial to consult with an attorney or a trusted legal professional to ensure that the document meets all legal requirements and accurately reflects the intentions of the granters and the trust beneficiaries.