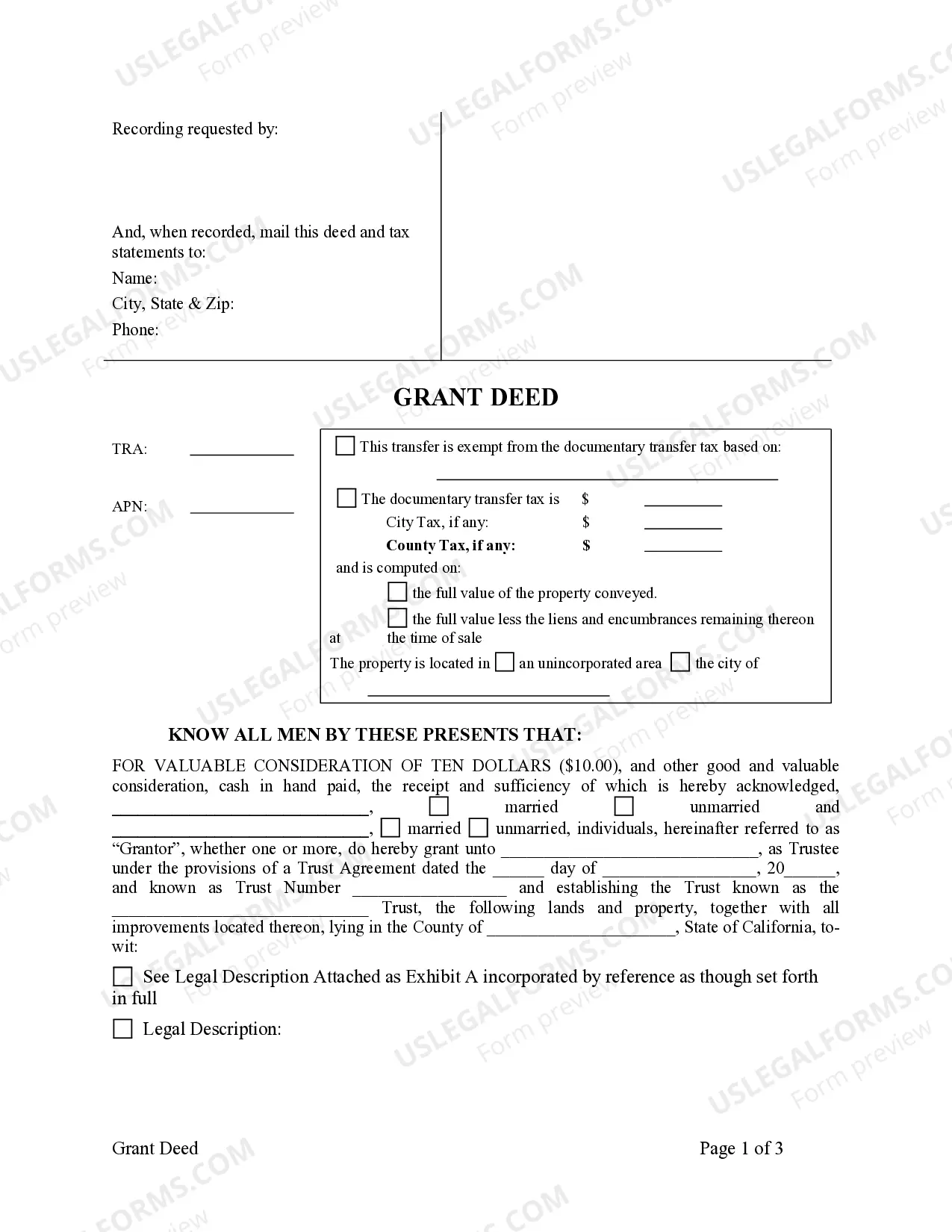

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

A Thousand Oaks California Grant Deed — Two Individuals to a Trust refers to a legal document used in real estate transactions within the city of Thousand Oaks, California. This deed is specifically designed for situations where two individuals transfer ownership of a property to a trust. By doing so, the property ownership is placed under the control and management of the trust, ensuring its continued ownership and potentially providing certain tax benefits or estate planning advantages. In Thousand Oaks, there are various types of Grant Deeds — Two Individuals to a Trust that can be utilized, depending on the specific circumstances of the property transfer. Some of these variations may include: 1. Joint Tenancy Grant Deed to a Trust: In this scenario, two individuals, often spouses or domestic partners, transfer their ownership interests in a property to a trust created by them. By establishing joint tenancy, both parties hold an equal and undivided interest in the property, and should one party pass away, the surviving party would automatically inherit the deceased's share. 2. Tenancy in Common Grant Deed to a Trust: Unlike joint tenancy, this type of grant deed allows two individuals to retain individual shares of ownership within the trust. Each person can own a specific percentage or share of the property, enabling them to pass on their portion according to their own estate plan, instead of automatically transferring it to the other party. 3. Community Property with Right of Survivorship Grant Deed to a Trust: This grant deed is specifically applicable to married couples in California who wish to transfer their property ownership to a trust. It allows for the creation of a community property trust where both spouses have an equal and undivided interest in the property, and upon the death of one spouse, the surviving spouse automatically inherits the entire property. 4. Life Estate Grant Deed to a Trust: This type of grant deed involves two individuals transferring their ownership interest in a property to a trust but retaining the right to live in or use the property for the remainder of their lives. After the death of the last surviving individual named in the deed, the property ownership is fully transferred to the trust. Thousand Oaks California Grant Deeds — Two Individuals to a Trust play a crucial role in estate planning and ensuring the smooth transfer of property ownership within the city. It is essential to consult with a qualified attorney or real estate professional to understand the specific requirements and implications of each type of grant deed mentioned above, tailored to your unique circumstances.A Thousand Oaks California Grant Deed — Two Individuals to a Trust refers to a legal document used in real estate transactions within the city of Thousand Oaks, California. This deed is specifically designed for situations where two individuals transfer ownership of a property to a trust. By doing so, the property ownership is placed under the control and management of the trust, ensuring its continued ownership and potentially providing certain tax benefits or estate planning advantages. In Thousand Oaks, there are various types of Grant Deeds — Two Individuals to a Trust that can be utilized, depending on the specific circumstances of the property transfer. Some of these variations may include: 1. Joint Tenancy Grant Deed to a Trust: In this scenario, two individuals, often spouses or domestic partners, transfer their ownership interests in a property to a trust created by them. By establishing joint tenancy, both parties hold an equal and undivided interest in the property, and should one party pass away, the surviving party would automatically inherit the deceased's share. 2. Tenancy in Common Grant Deed to a Trust: Unlike joint tenancy, this type of grant deed allows two individuals to retain individual shares of ownership within the trust. Each person can own a specific percentage or share of the property, enabling them to pass on their portion according to their own estate plan, instead of automatically transferring it to the other party. 3. Community Property with Right of Survivorship Grant Deed to a Trust: This grant deed is specifically applicable to married couples in California who wish to transfer their property ownership to a trust. It allows for the creation of a community property trust where both spouses have an equal and undivided interest in the property, and upon the death of one spouse, the surviving spouse automatically inherits the entire property. 4. Life Estate Grant Deed to a Trust: This type of grant deed involves two individuals transferring their ownership interest in a property to a trust but retaining the right to live in or use the property for the remainder of their lives. After the death of the last surviving individual named in the deed, the property ownership is fully transferred to the trust. Thousand Oaks California Grant Deeds — Two Individuals to a Trust play a crucial role in estate planning and ensuring the smooth transfer of property ownership within the city. It is essential to consult with a qualified attorney or real estate professional to understand the specific requirements and implications of each type of grant deed mentioned above, tailored to your unique circumstances.