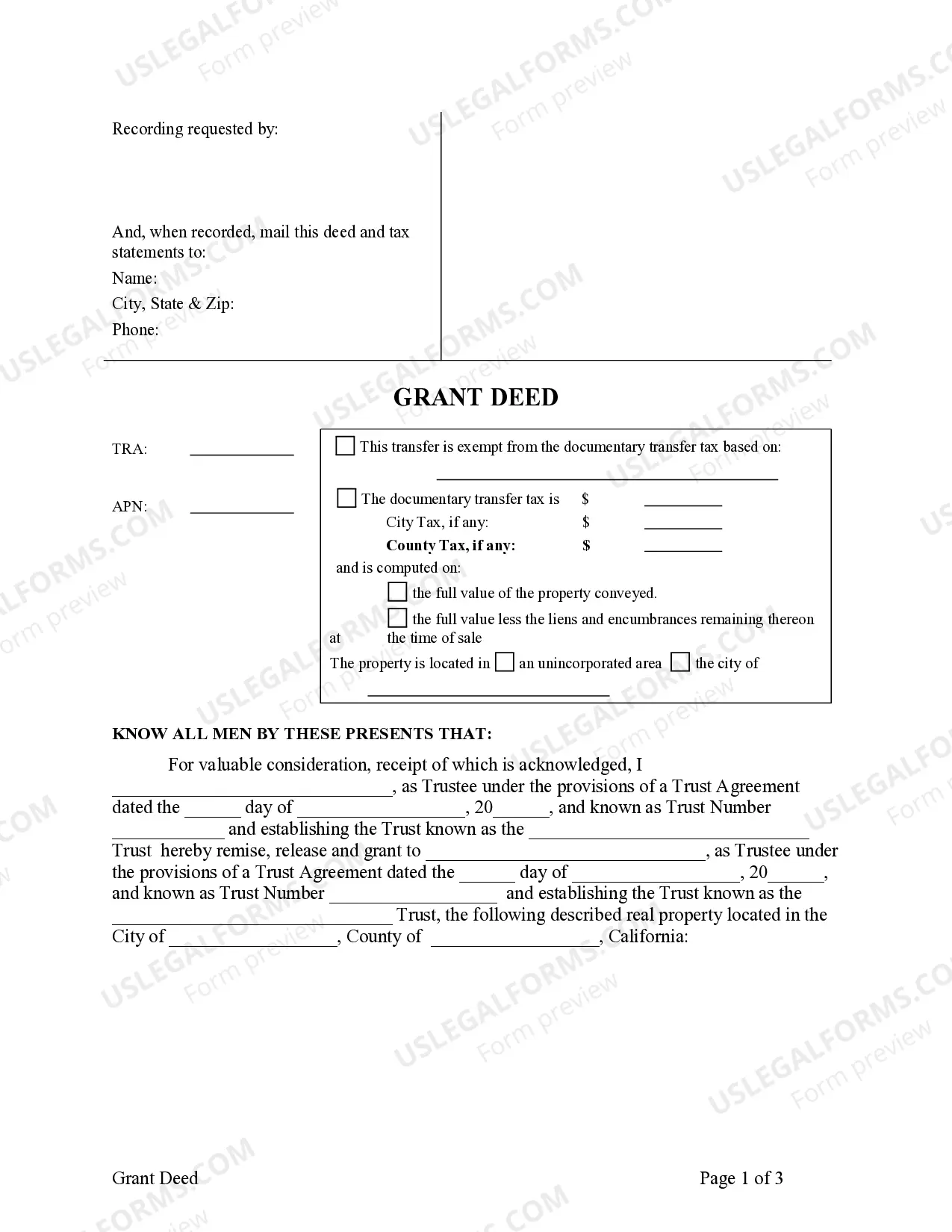

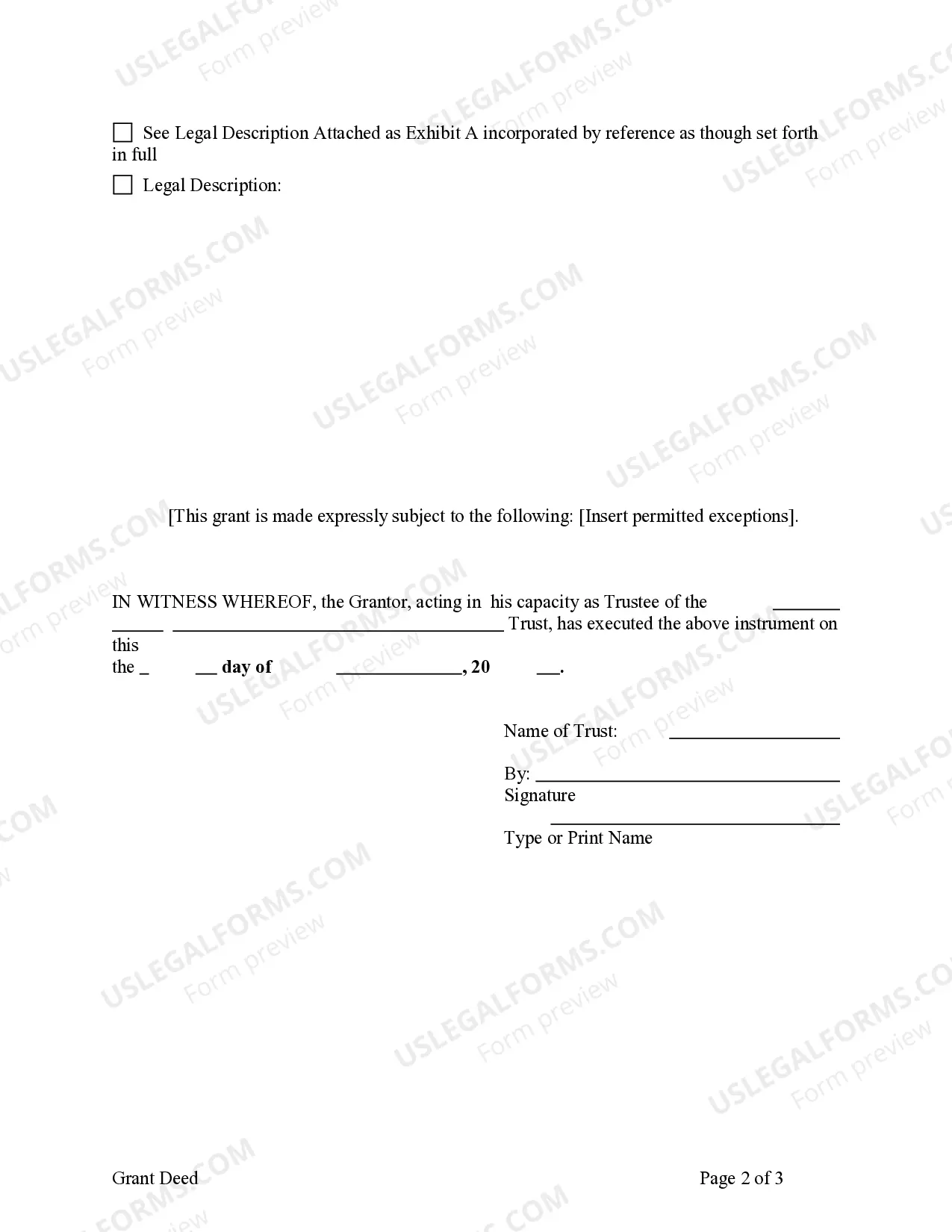

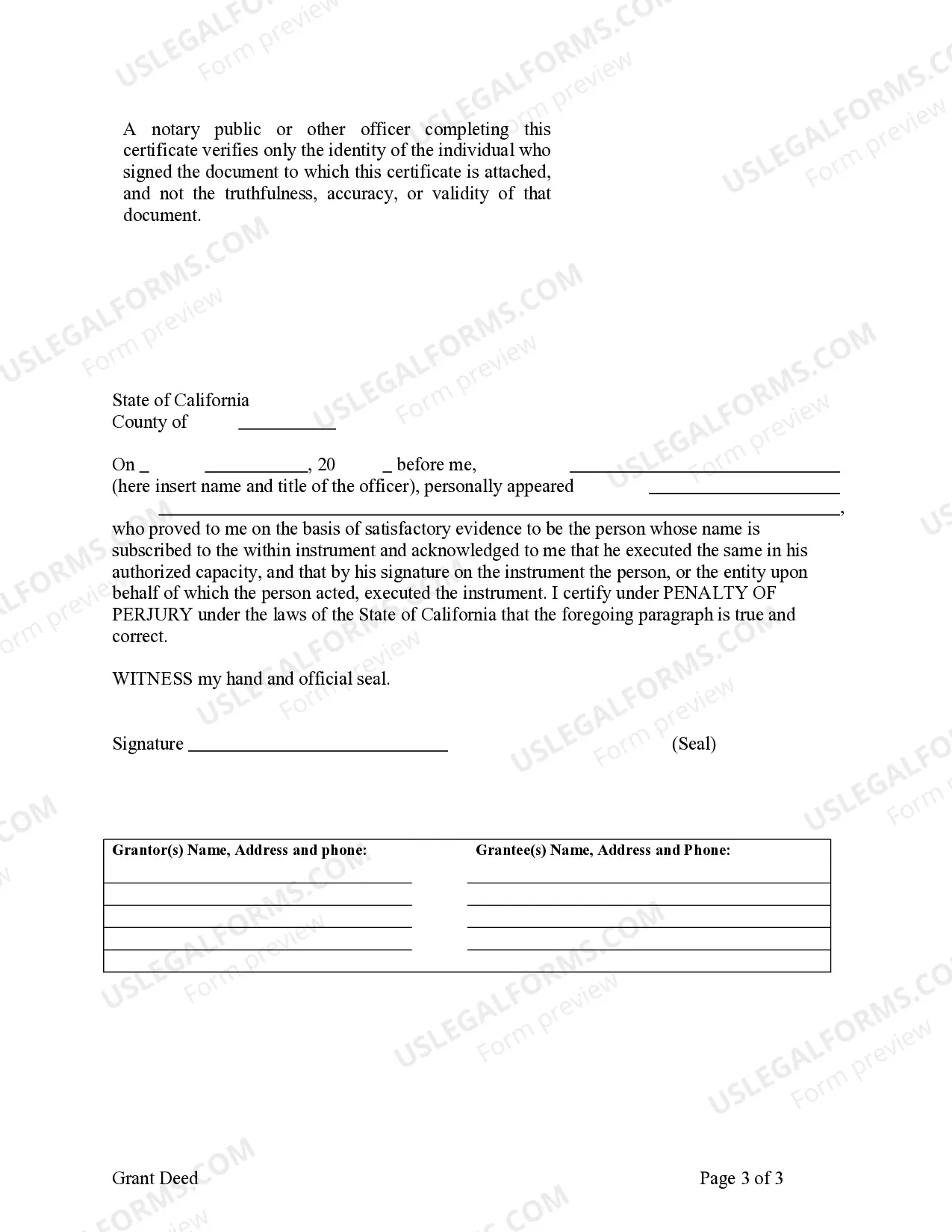

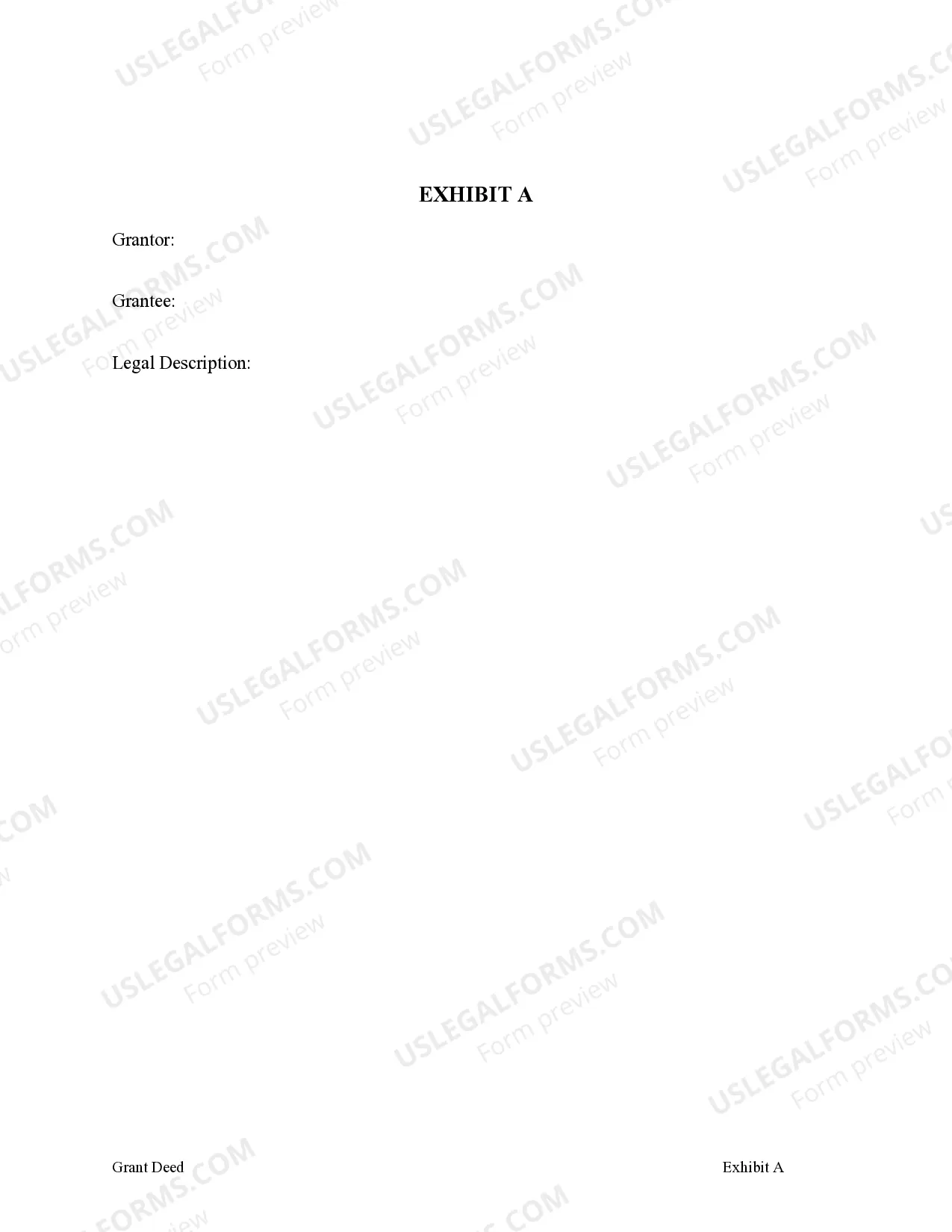

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

Chula Vista California Grant Deed — Living Trust to Living Trust: A Comprehensive Overview In Chula Vista, California, a grant deed is a legal document used to transfer real estate ownership from one party (known as the granter) to another (known as the grantee). When a grant deed is combined with a living trust, it becomes a powerful tool for transferring property while avoiding probate and ensuring a seamless transition of assets. In a Chula Vista California Grant Deed — Living Trust to Living Trust, the property owner (granter) transfers ownership of their real estate into their own living trust, whereby they become both the granter and grantee. Essentially, this means that they are transferring the property from their individual name to their living trust, of which they are the trustee. This process allows for greater control over the property and enables a smooth transition of ownership in the event of incapacitation or death. By utilizing a living trust, property owners can benefit from the flexibility and privacy it provides, while also avoiding probate court proceedings. Probate can be a time-consuming and expensive process, but with a well-structured living trust, heirs can bypass it altogether, saving time and money. The Chula Vista California Grant Deed — Living Trust to Living Trust offers several variations to cater to different circumstances and needs. Some common types of grant deeds that can be used in combination with a living trust include: 1. Joint Grant Deed to Living Trust: This type of grant deed is ideal for married couples or business partners who want to transfer property into a joint living trust. It allows both parties to retain control over the property during their lifetime while ensuring a seamless transfer to the surviving spouse or designated beneficiaries upon their passing. 2. Revocable Grant Deed to Living Trust: This grant deed contains language indicating that the granter reserves the right to revoke or make changes to the living trust at any time during their lifetime. It provides flexibility for the granter and allows them to control the property until their passing or incapacitation. 3. Irrevocable Grant Deed to Living Trust: In this type of grant deed, the granter relinquishes all control and ownership rights over the property, transferring it fully and permanently to the living trust. The granter cannot make any changes to the living trust once the transfer is complete, making it a useful tool for asset protection or estate planning purposes. 4. Special Warranty Grant Deed to Living Trust: This form of grant deed offers some protection to the grantee against any defects or claims arising only during the granter's ownership period. It ensures that the granter did not incur any encumbrances on the property, except those mentioned in the deed. In conclusion, a Chula Vista California Grant Deed — Living Trust to Living Trust is an essential legal instrument for individuals or couples looking to efficiently transfer real estate assets while avoiding probate. By utilizing various types of grant deeds that align with their specific needs, property owners can take advantage of the benefits provided by a living trust, such as asset protection, privacy, and seamless distribution of assets.