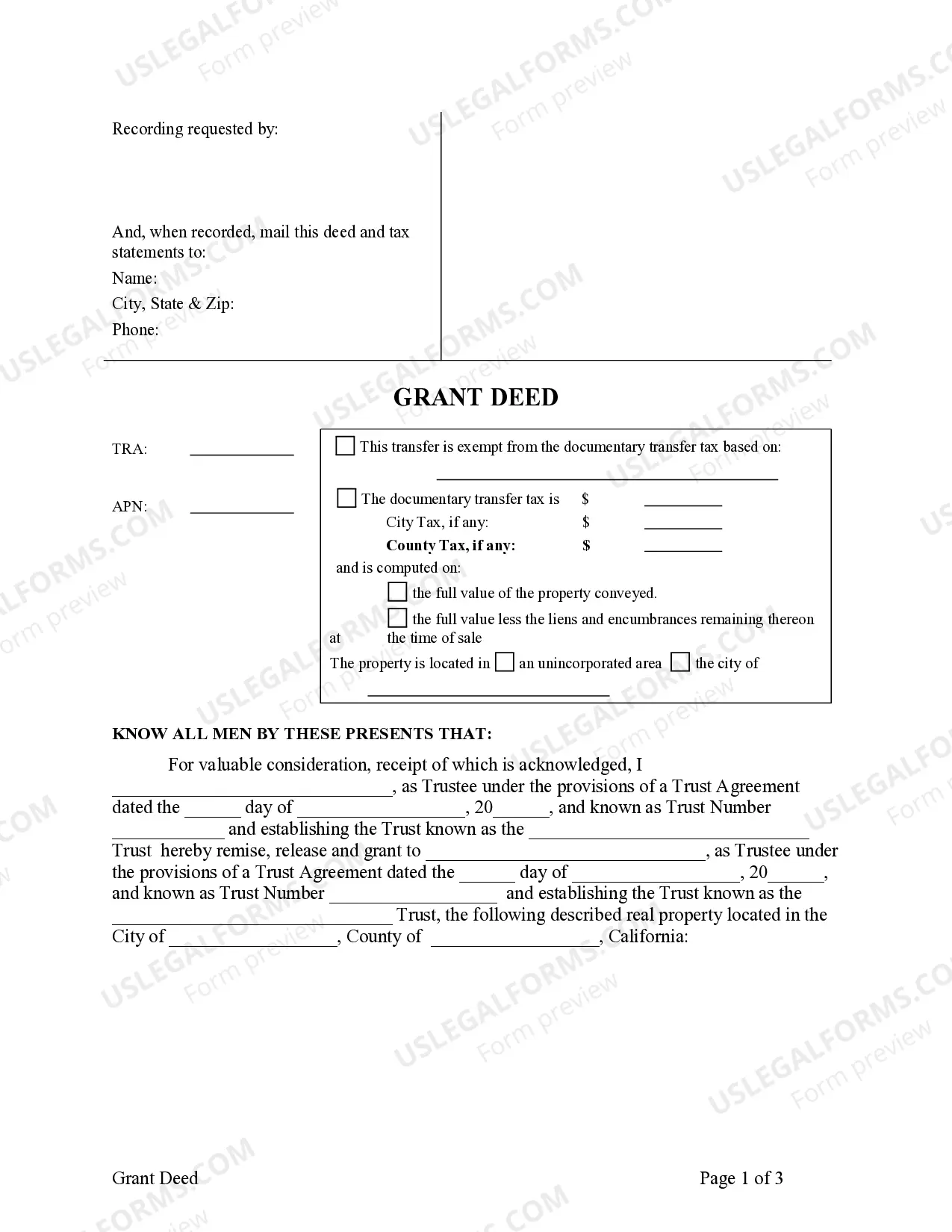

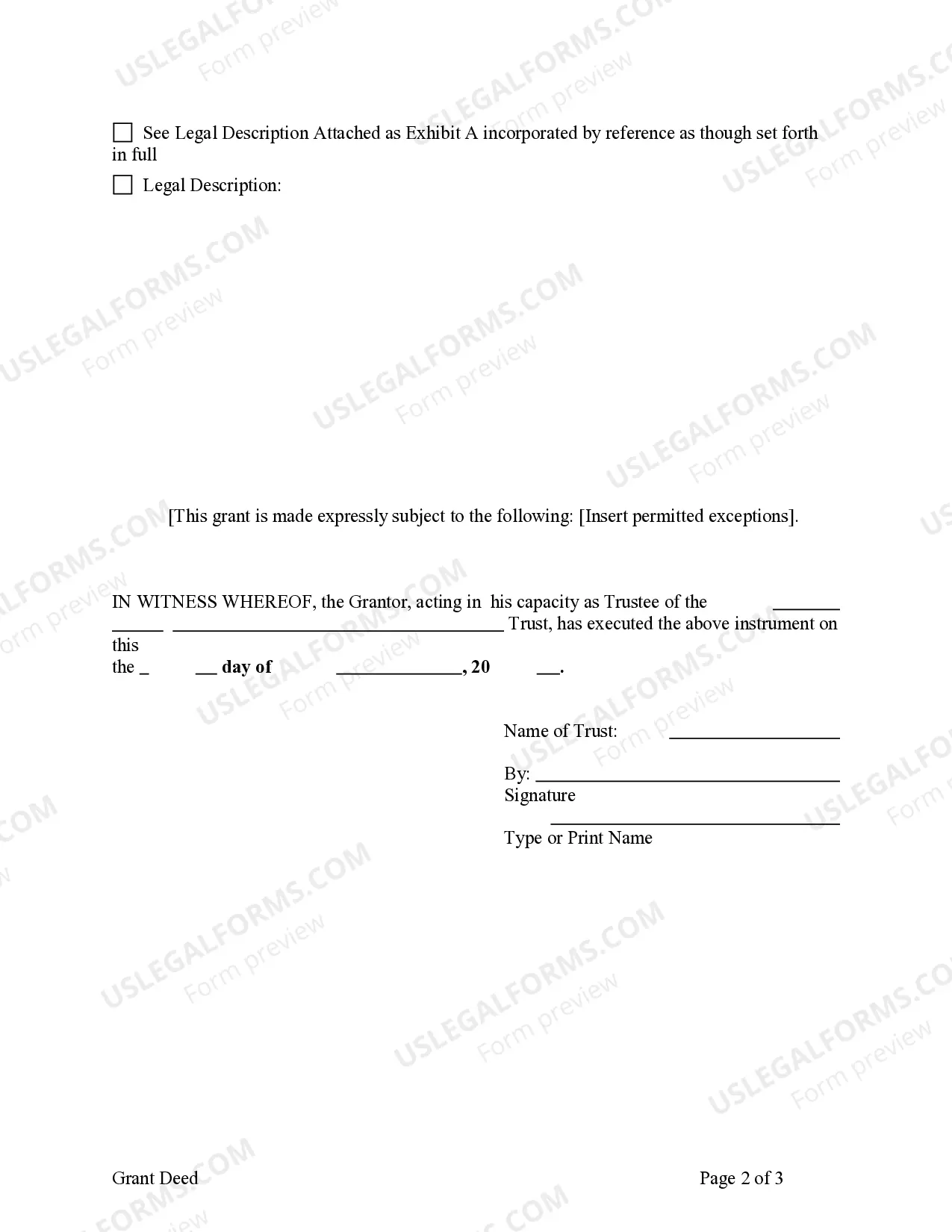

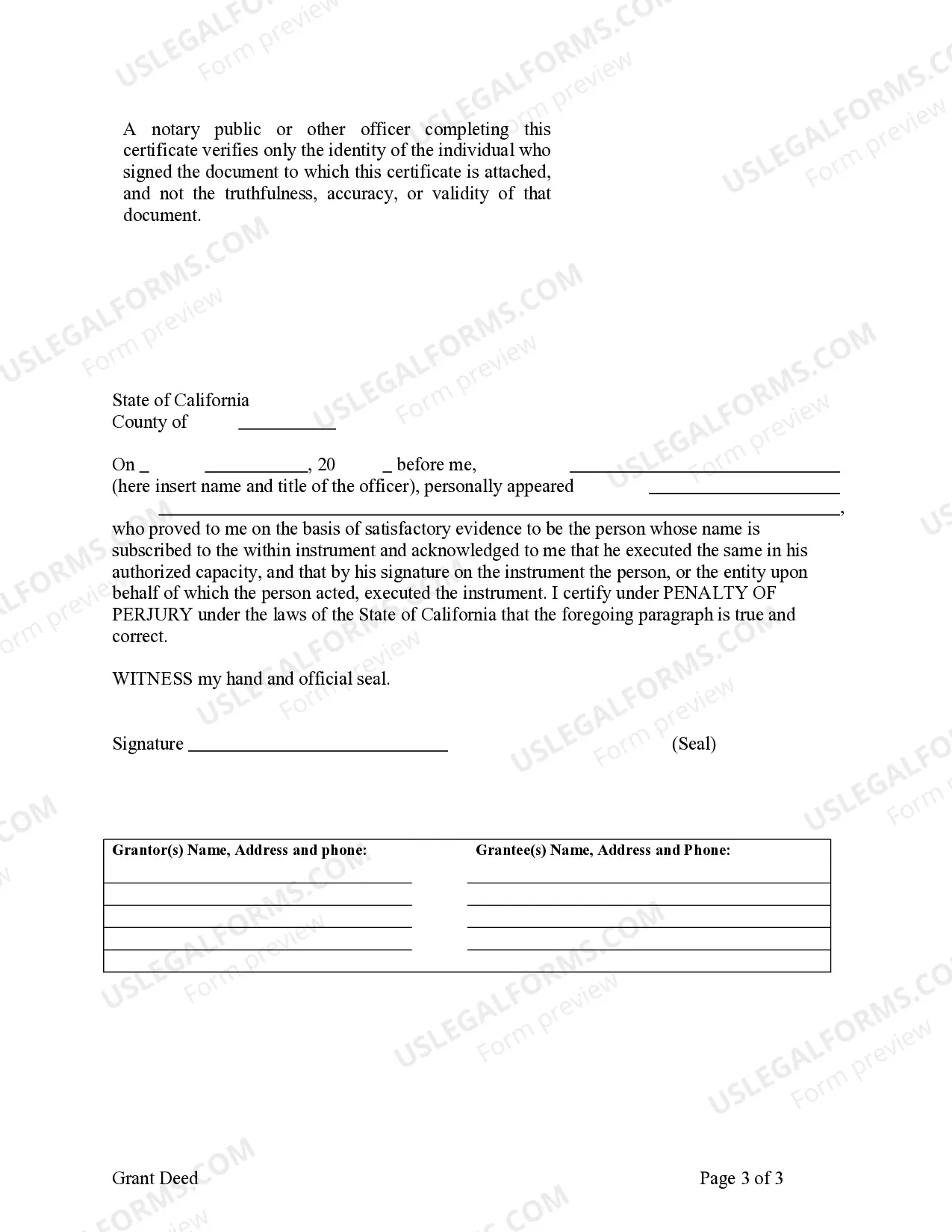

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

A Grant Deed — Living Trust to Living Trust in Clovis, California is a legal document that allows for the transfer of real property from one living trust to another living trust. This type of deed is commonly used in estate planning and asset protection strategies. By utilizing a Grant Deed — Living Trust to Living Trust, individuals can effectively transfer their real property holdings into a living trust for various purposes, such as probate avoidance, privacy, and control over the distribution of assets upon their passing. There are different variations of the Grant Deed — Living Trust to Living Trust that individuals in Clovis, California may encounter: 1. Revocable Living Trust Grant Deed: This type of deed involves the transfer of property from one revocable living trust to another revocable living trust. Revocable living trusts are a common estate planning tool used to manage assets during an individual's lifetime and distribute them after their death. 2. Irrevocable Living Trust Grant Deed: In this case, the transfer occurs between irrevocable living trusts. Unlike revocable living trusts, which can be modified or revoked by the granter, irrevocable living trusts are generally set in stone and cannot be easily altered. This type of transfer is often done for asset protection and tax planning purposes. 3. Testamentary Living Trust Grant Deed: This type of deed involves the transfer of property from a testamentary living trust to another living trust. A testamentary living trust is created through a last will and testament and takes effect only upon the granter's death. This allows for the smooth transition of assets to the designated trust beneficiaries while avoiding the probate process. Overall, the Grant Deed — Living Trust to Living Trust in Clovis, California is a crucial legal tool for individuals seeking to manage and protect their real property holdings within the framework of a living trust. It is always recommended seeking professional legal advice when considering these types of transactions to ensure compliance with state laws and to address individual circumstances accurately.A Grant Deed — Living Trust to Living Trust in Clovis, California is a legal document that allows for the transfer of real property from one living trust to another living trust. This type of deed is commonly used in estate planning and asset protection strategies. By utilizing a Grant Deed — Living Trust to Living Trust, individuals can effectively transfer their real property holdings into a living trust for various purposes, such as probate avoidance, privacy, and control over the distribution of assets upon their passing. There are different variations of the Grant Deed — Living Trust to Living Trust that individuals in Clovis, California may encounter: 1. Revocable Living Trust Grant Deed: This type of deed involves the transfer of property from one revocable living trust to another revocable living trust. Revocable living trusts are a common estate planning tool used to manage assets during an individual's lifetime and distribute them after their death. 2. Irrevocable Living Trust Grant Deed: In this case, the transfer occurs between irrevocable living trusts. Unlike revocable living trusts, which can be modified or revoked by the granter, irrevocable living trusts are generally set in stone and cannot be easily altered. This type of transfer is often done for asset protection and tax planning purposes. 3. Testamentary Living Trust Grant Deed: This type of deed involves the transfer of property from a testamentary living trust to another living trust. A testamentary living trust is created through a last will and testament and takes effect only upon the granter's death. This allows for the smooth transition of assets to the designated trust beneficiaries while avoiding the probate process. Overall, the Grant Deed — Living Trust to Living Trust in Clovis, California is a crucial legal tool for individuals seeking to manage and protect their real property holdings within the framework of a living trust. It is always recommended seeking professional legal advice when considering these types of transactions to ensure compliance with state laws and to address individual circumstances accurately.