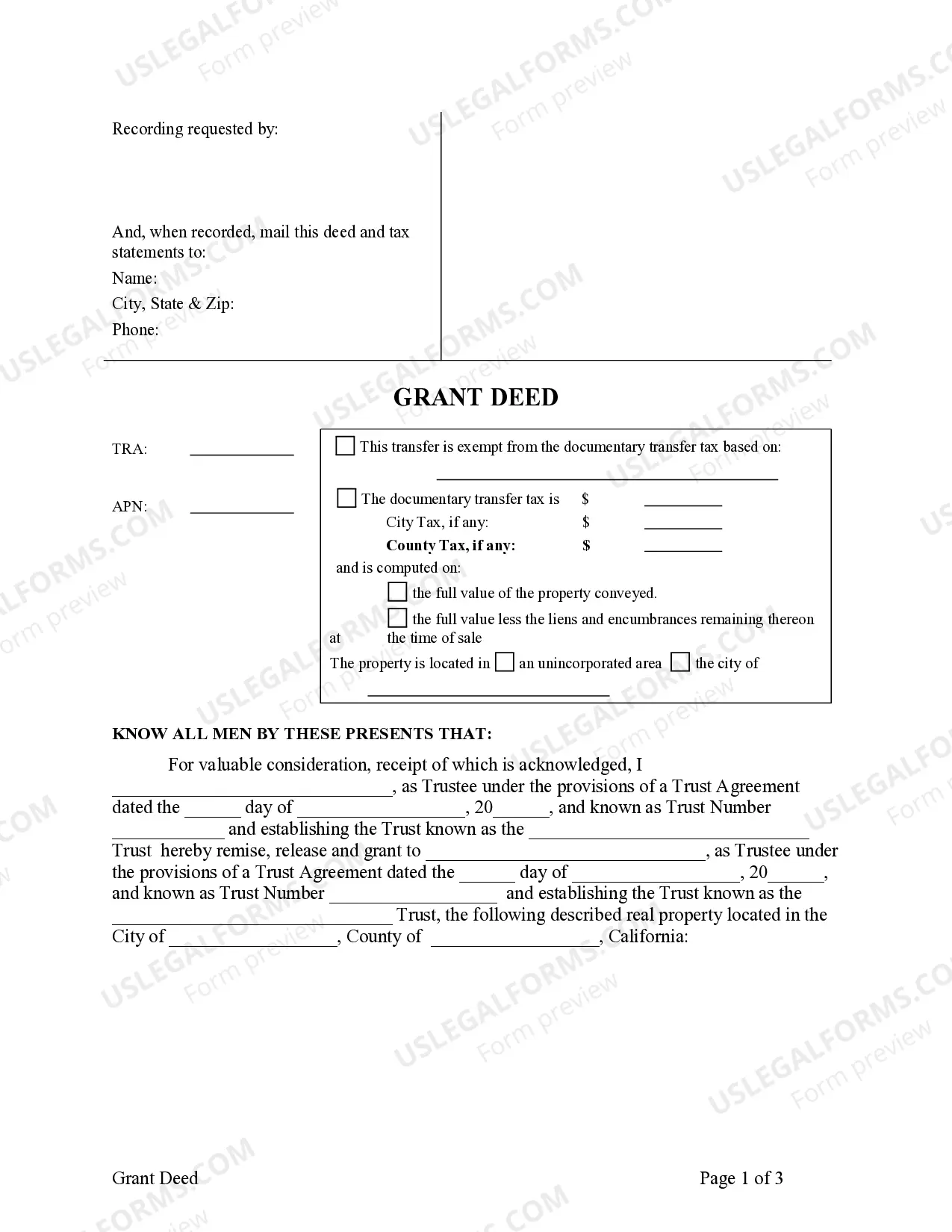

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

A Corona California Grant Deed — Living Trust to Living Trust is a legal document that allows for the transfer of real estate property from one living trust to another living trust. This type of grant deed is commonly used in estate planning to ensure the seamless transfer of property ownership while maintaining the assets' protection and avoiding probate. The Corona California Grant Deed — Living Trust to Living Trust provides several benefits for property owners looking to transfer their assets. By utilizing this type of deed, individuals can maintain control over their properties while minimizing the potential for disputes or complications in the future. The granter, the person initiating the transfer, can specify the terms, conditions, and restrictions for the property, ensuring that the intended recipient adheres to their wishes. There are several variations of the Corona California Grant Deed — Living Trust to Living Trust, each serving a specific purpose. They include: 1. Revocable Living Trust: This type of grant deed allows the granter to transfer the property to a revocable living trust, maintaining complete control and the ability to make changes or revoke the trust at any time. It offers flexibility and the opportunity to manage the property as desired during the granter's lifetime. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust ensures that the granter relinquishes all control and ownership rights to the property transferred. Once the property is placed in an irrevocable trust, it cannot be reclaimed or modified without the consent of the beneficiaries named in the trust. 3. Successor Living Trust: A successor living trust is established to serve as an alternative beneficiary in case the primary beneficiary named in the original living trust passes away or becomes incapacitated. This type of grant deed ensures the seamless transfer of property to the intended successor without going through probate. 4. Joint Living Trust: A joint living trust allows a married couple or domestic partners to combine their assets into a single trust. This grant deed ensures that both individuals have control and access to the property during their lifetime and guarantees a smooth transfer to the surviving spouse or partner upon the first granter's death. Overall, the Corona California Grant Deed — Living Trust to Living Trust provides a reliable and effective method for transferring property between living trusts. It offers individuals the opportunity to control their assets, protect their beneficiaries, and avoid the complexities and costs associated with probate. Seeking legal advice from an attorney specializing in estate planning is highly recommended ensuring the grant deed accurately reflects the granter's wishes and adheres to state-specific regulations.A Corona California Grant Deed — Living Trust to Living Trust is a legal document that allows for the transfer of real estate property from one living trust to another living trust. This type of grant deed is commonly used in estate planning to ensure the seamless transfer of property ownership while maintaining the assets' protection and avoiding probate. The Corona California Grant Deed — Living Trust to Living Trust provides several benefits for property owners looking to transfer their assets. By utilizing this type of deed, individuals can maintain control over their properties while minimizing the potential for disputes or complications in the future. The granter, the person initiating the transfer, can specify the terms, conditions, and restrictions for the property, ensuring that the intended recipient adheres to their wishes. There are several variations of the Corona California Grant Deed — Living Trust to Living Trust, each serving a specific purpose. They include: 1. Revocable Living Trust: This type of grant deed allows the granter to transfer the property to a revocable living trust, maintaining complete control and the ability to make changes or revoke the trust at any time. It offers flexibility and the opportunity to manage the property as desired during the granter's lifetime. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust ensures that the granter relinquishes all control and ownership rights to the property transferred. Once the property is placed in an irrevocable trust, it cannot be reclaimed or modified without the consent of the beneficiaries named in the trust. 3. Successor Living Trust: A successor living trust is established to serve as an alternative beneficiary in case the primary beneficiary named in the original living trust passes away or becomes incapacitated. This type of grant deed ensures the seamless transfer of property to the intended successor without going through probate. 4. Joint Living Trust: A joint living trust allows a married couple or domestic partners to combine their assets into a single trust. This grant deed ensures that both individuals have control and access to the property during their lifetime and guarantees a smooth transfer to the surviving spouse or partner upon the first granter's death. Overall, the Corona California Grant Deed — Living Trust to Living Trust provides a reliable and effective method for transferring property between living trusts. It offers individuals the opportunity to control their assets, protect their beneficiaries, and avoid the complexities and costs associated with probate. Seeking legal advice from an attorney specializing in estate planning is highly recommended ensuring the grant deed accurately reflects the granter's wishes and adheres to state-specific regulations.