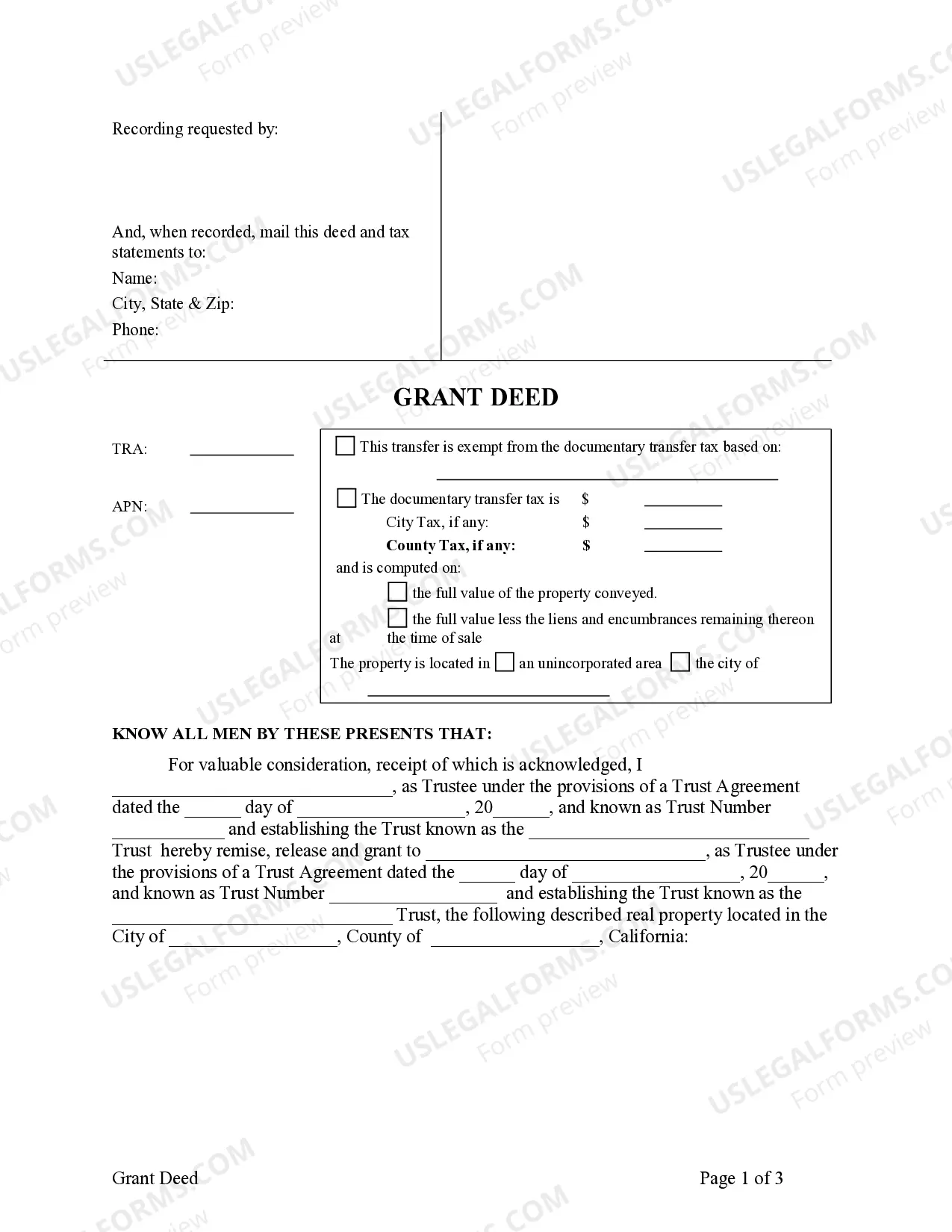

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

Inglewood California Grant Deed — Living Trust to Living Trust: Understanding the Basics Keywords: Inglewood California, Grant Deed, Living Trust, Living Trust to Living Trust, Property Transfer Description: The Inglewood California Grant Deed — Living Trust to Living Trust is a legal document that facilitates the transfer of real property from one living trust to another living trust in Inglewood, California. It is an essential tool for individuals and families who wish to transfer their property while ensuring its protection and smooth transition. A Grant Deed is a commonly used legal instrument that transfers ownership or title of a property from one party to another. It signifies that the transferor, or the person transferring the property, has the legal right to do so and guarantees that there are no undisclosed encumbrances or restrictions on the property. When it comes to transferring property within a living trust, the process involves creating and executing a new Grant Deed that transfers ownership from the original trust to the new trust. This is often done to update or modify trust terms, designate new trustees, or consolidate multiple trusts. There are different types of Inglewood California Grant Deed — Living Trust to Living Trust, depending on the specific circumstances and goals of the property owners. Some common variations include: 1. Revocable Living Trust to Revocable Living Trust: This type of transfer occurs when individuals or families decide to modify their existing living trust or merge separate trusts into one comprehensive trust. It typically happens due to changes in personal circumstances, such as marriage, divorce, or the birth of a child, or as part of long-term estate planning strategies. 2. Irrevocable Living Trust to Revocable Living Trust: This transfer may be necessary when the creators of an irrevocable living trust want to make changes or transfer assets into a new revocable living trust. It requires careful consideration of tax implications and may require additional legal steps. 3. Revocable Living Trust to Irrevocable Living Trust: This type of transfer involves converting a revocable living trust, which allows for modifications and revocation, into an irrevocable living trust, which typically provides greater asset protection and tax benefits. It is often done to safeguard assets from creditors, minimize estate taxes, or qualify for long-term care assistance. It's crucial to consult with an experienced attorney or estate planner specialized in Inglewood, California, to navigate through the legal complexities and ensure compliance with state laws and regulations. This will help individuals and families execute the Inglewood California Grant Deed — Living Trust to Living Trust accurately and secure their property transfer within the framework of their unique goals and objectives.