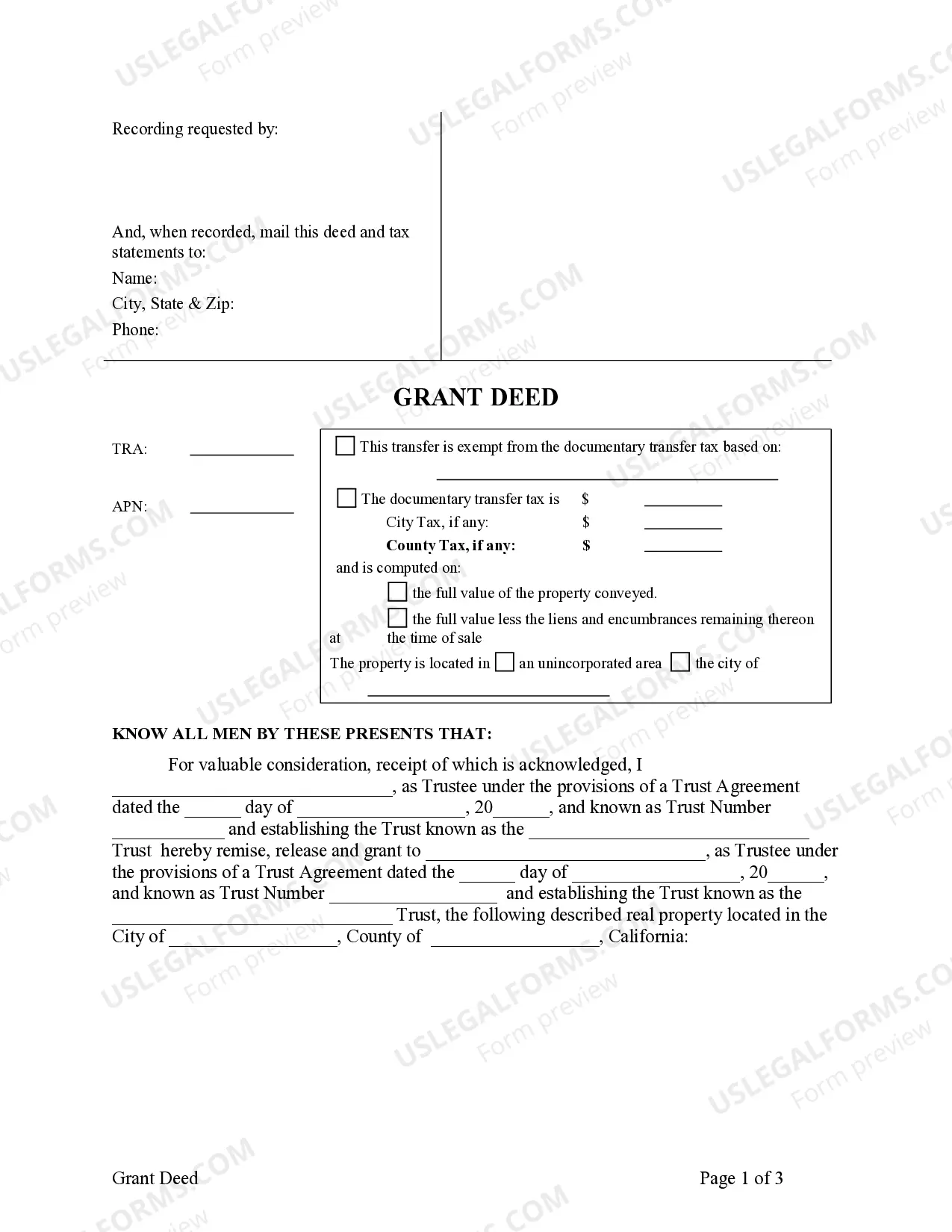

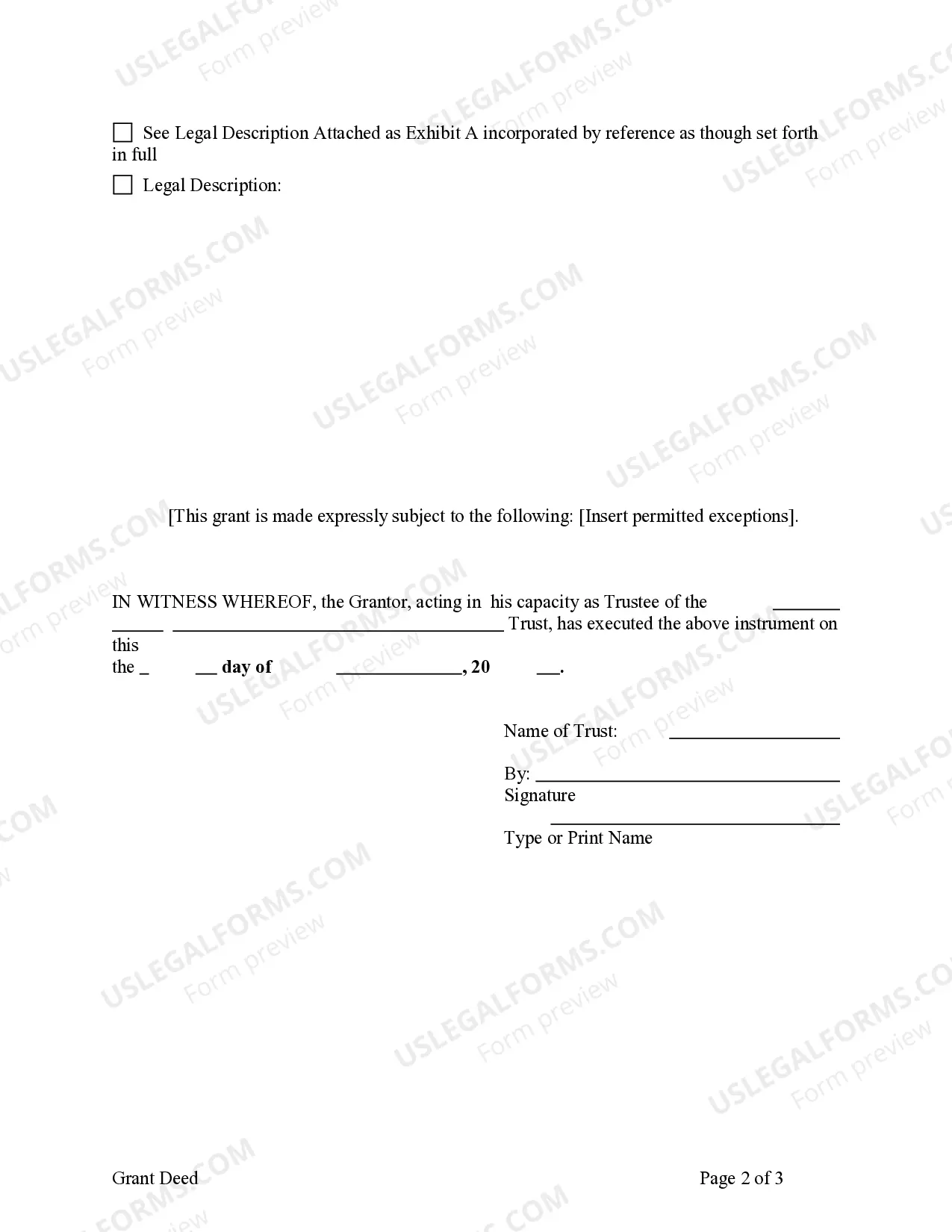

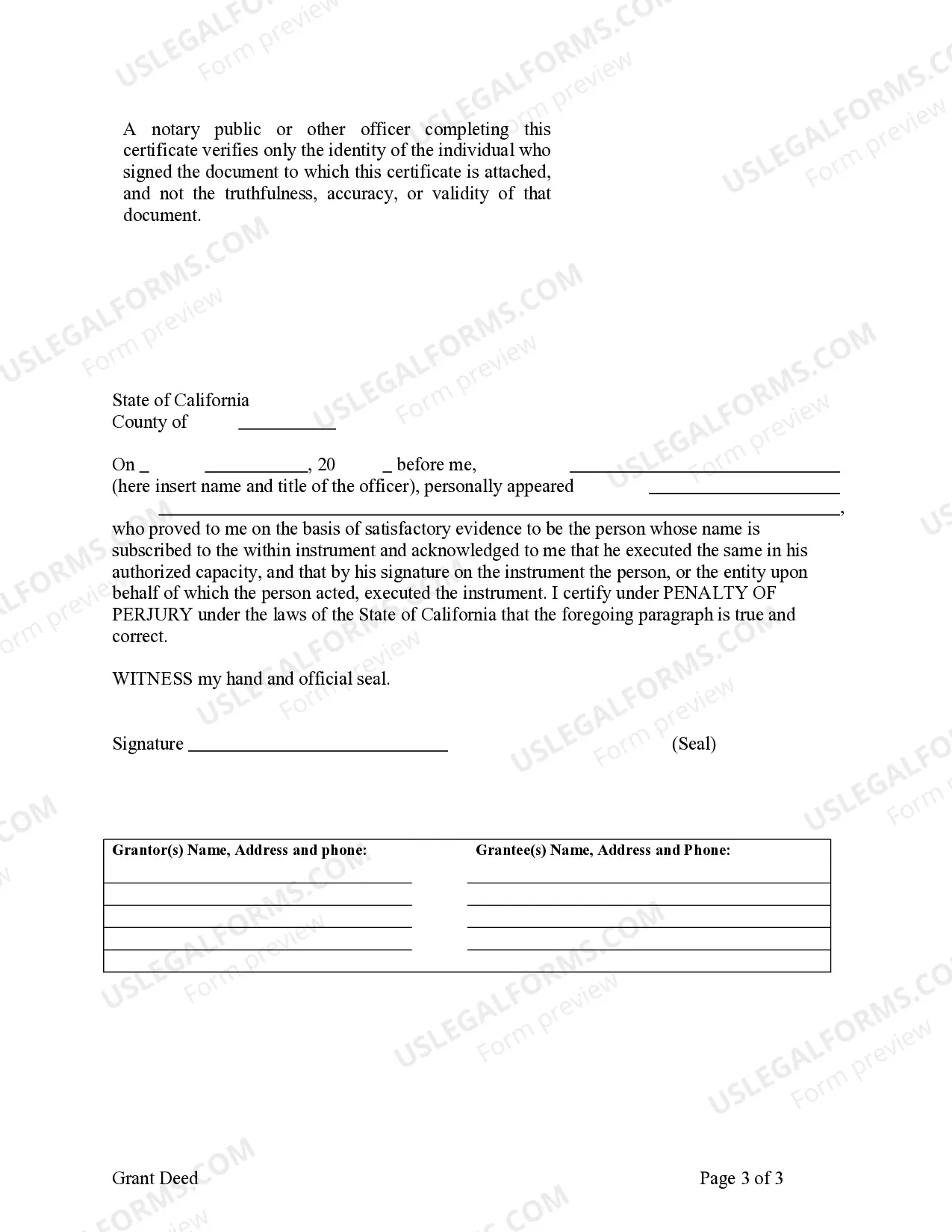

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

A Murrieta California Grant Deed — Living Trust to Living Trust is a legal document used to transfer property ownership from one living trust to another living trust in the city of Murrieta, California. This type of deed is commonly used in estate planning and is typically executed by individuals who have established living trusts as part of their estate plans. The Murrieta California Grant Deed ensures a seamless transfer of real estate assets between living trusts, allowing individuals to maintain control and management over their properties while achieving specific estate planning goals. By transferring ownership through a grant deed, the property is generally not subjected to probate proceedings upon the death of the granter (person transferring the property). Different types of Murrieta California Grant Deed — Living Trust to Living Trust may include: 1. Revocable Living Trust to Revocable Living Trust: This type of deed allows the transfer of property ownership between revocable living trusts. Revocable living trusts provide flexibility, allowing the granter to modify or revoke the trust during their lifetime. 2. Irrevocable Living Trust to Irrevocable Living Trust: In contrast to revocable living trusts, irrevocable living trusts generally cannot be modified or revoked once established. This type of deed transfers property ownership between two irrevocable living trusts, often used for long-term asset protection or Medicaid planning purposes. 3. Joint Living Trust to Joint Living Trust: A joint living trust is established by a married couple to manage their shared assets. With this type of deed, property ownership can be transferred between joint living trusts, ensuring seamless continuity of property ownership in the event of one spouse's death. 4. Family Trust to Family Trust: Family trusts are created by individuals or couples to protect and distribute their assets to their beneficiaries. A Murrieta California Grant Deed — Living Trust to Living Trust can be used to transfer property between different family trusts, providing efficient wealth distribution and management. Whether it is the transfer of property between revocable living trusts, joint living trusts, or family trusts, a Murrieta California Grant Deed — Living Trust to Living Trust ensures the legal validity and smooth transfer of real estate assets within Murrieta, California. Consulting with an experienced estate planning attorney is advisable to ensure compliance with local regulations and to customize the deed to suit individual needs.