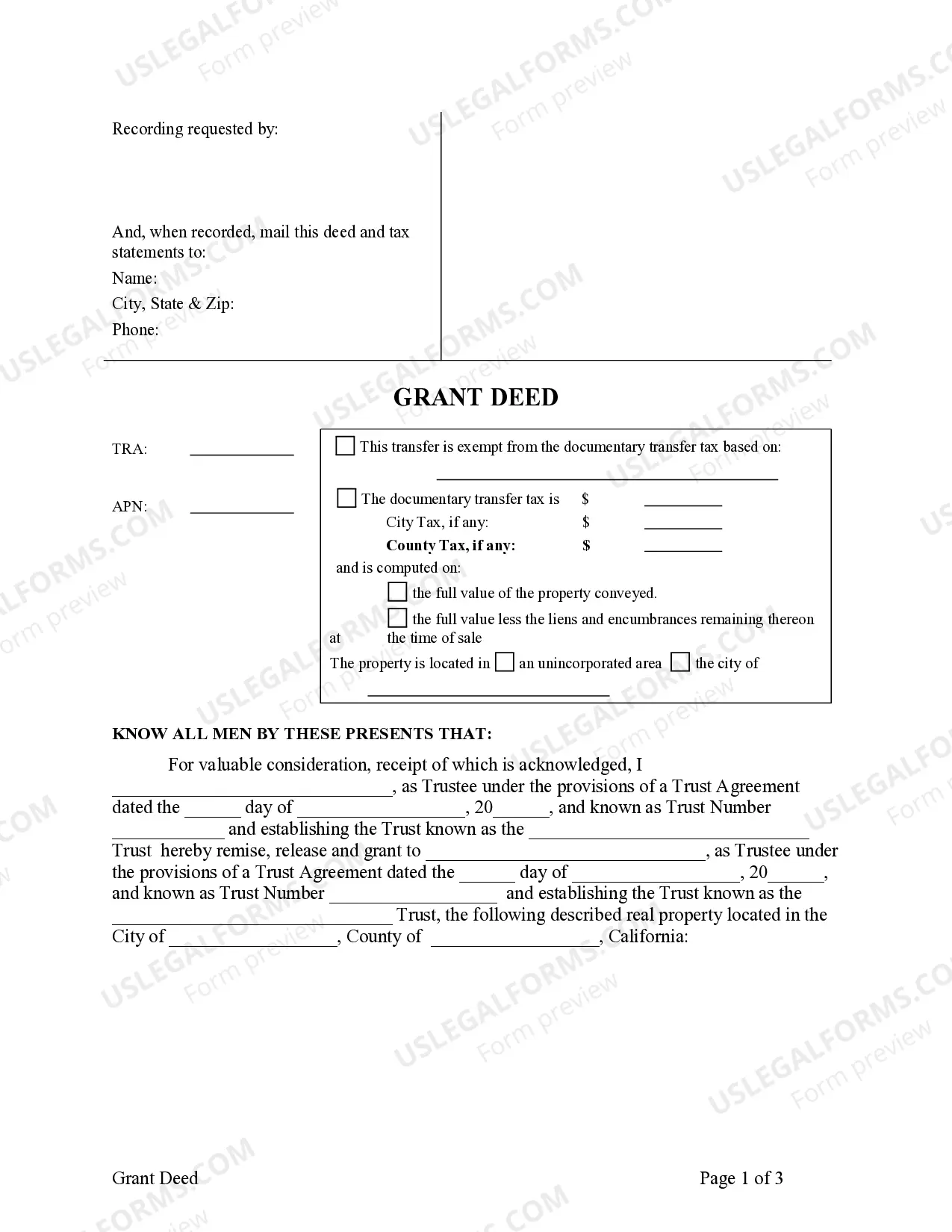

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

San Jose California Grant Deed - Living Trust to Living Trust

Description

How to fill out California Grant Deed - Living Trust To Living Trust?

We consistently endeavor to minimize or evade legal repercussions when handling intricate legal or financial issues.

To achieve this, we seek attorney services which are generally quite costly.

However, not all legal challenges are of the same complexity, and many can be managed independently.

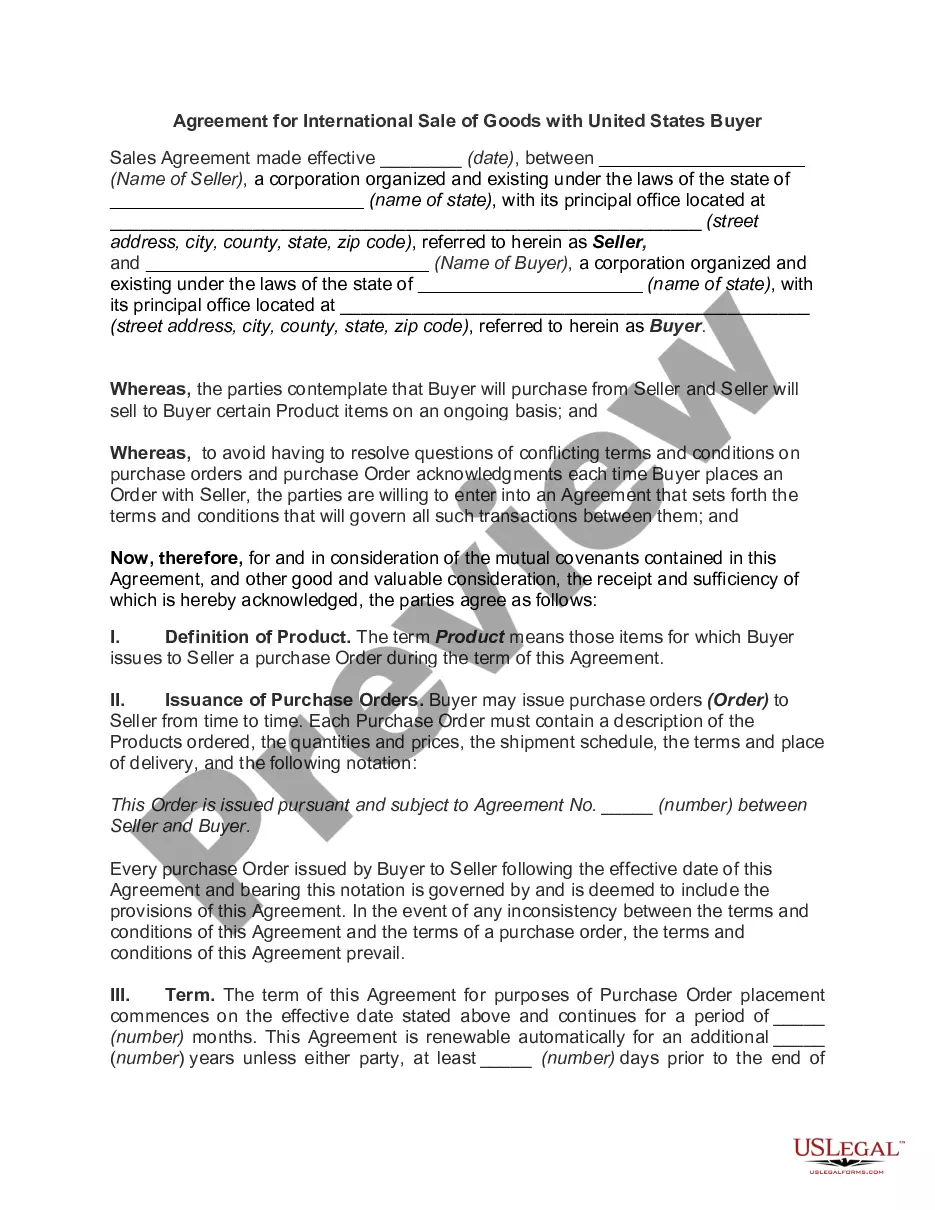

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions. Our collection empowers you to handle your affairs autonomously without the necessity of hiring an attorney. We offer access to legal form templates that are not universally available. Our templates are tailored to specific states and regions, which significantly eases the search process.

Ensure to verify if the San Jose California Grant Deed - Living Trust to Living Trust adheres to the statutes and requirements of your state and region. Additionally, it is crucial to review the form’s outline (if available), and if you notice any inconsistencies with your initial requirements, search for an alternate form. Once you confirm that the San Jose California Grant Deed - Living Trust to Living Trust is suitable for your situation, you can choose a subscription plan and proceed with payment. Afterwards, you can download the document in any offered format. For more than 24 years, we have assisted millions by providing readily customizable and up-to-date legal documents. Capitalize on US Legal Forms now to conserve time and resources!

- Utilize US Legal Forms whenever you need to locate and acquire the San Jose California Grant Deed - Living Trust to Living Trust or any other form conveniently and securely.

- Simply Log In to your account and click the Get button next to it.

- If you misplace the document, you can always re-download it from the My documents section.

- The procedure is equally straightforward if you are not acquainted with the website! You can create your account in just a few minutes.

Form popularity

FAQ

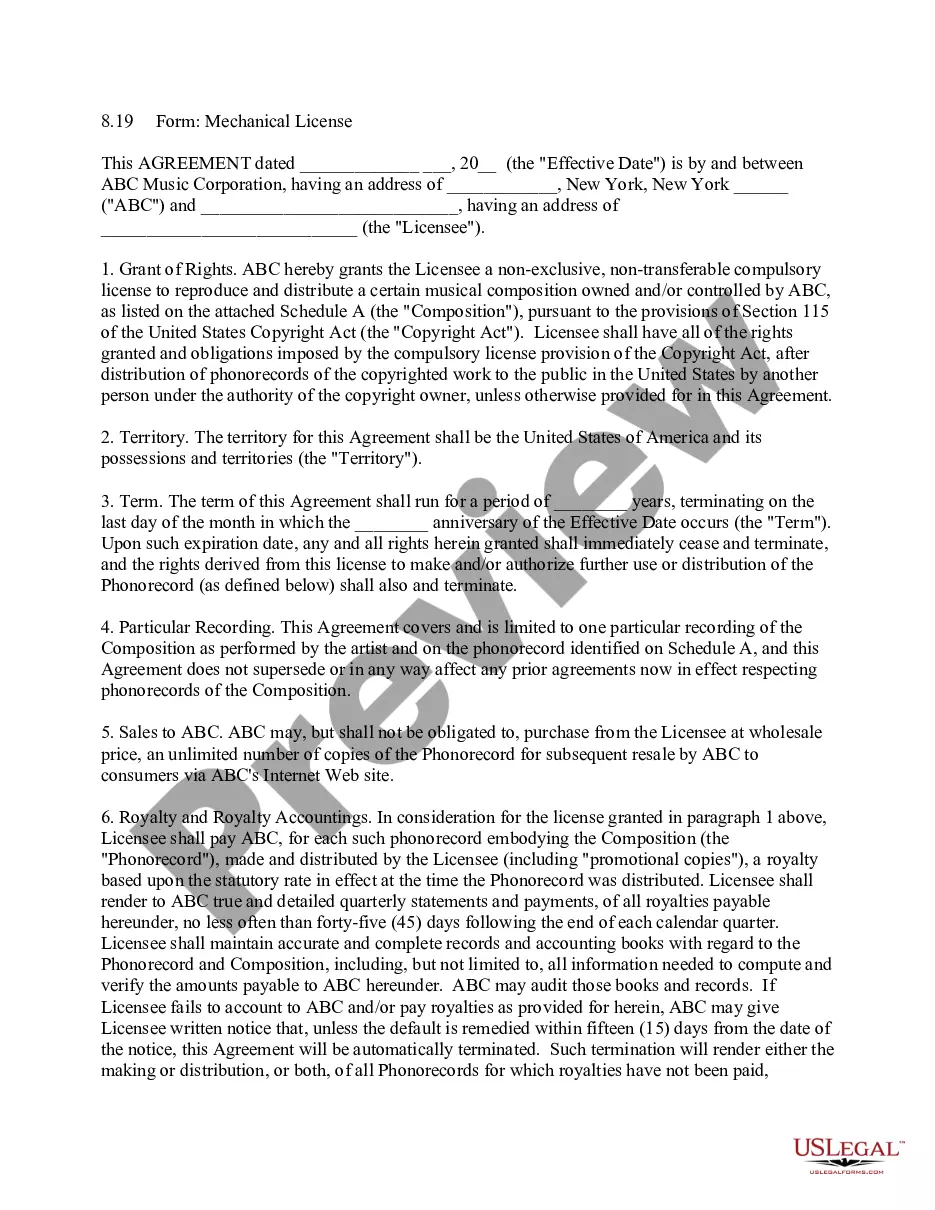

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

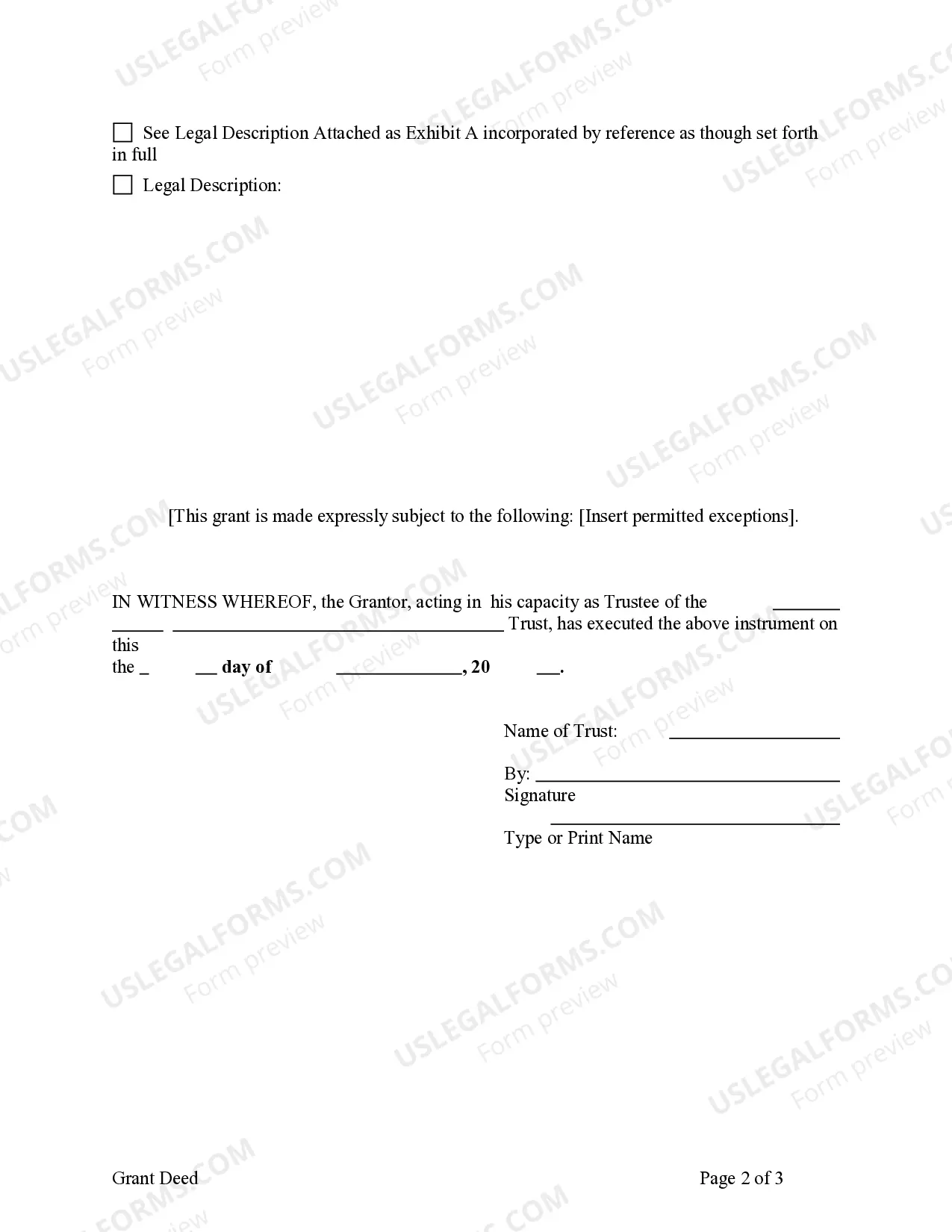

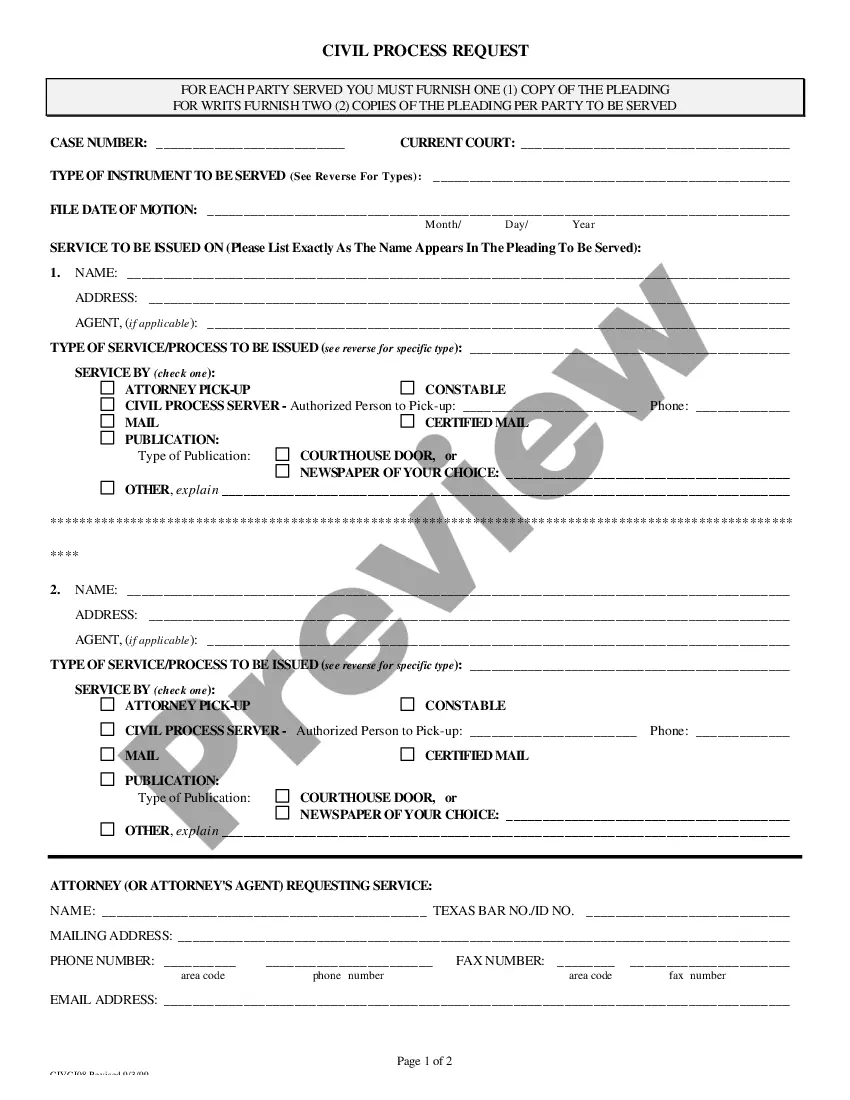

Transferring a real estate title in California is a straightforward process accomplished through the use of a property deed. After selecting the right type of deed for your transaction, simply fill it out, sign it and file the deed at the county recorder's office.

Both types of legal documents serve the same function of transferring ownership of real property. The fundamental difference between quitclaim deeds and grant deeds is the level of protection and warranty provided to the grantee.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.

A beneficiary can also transfer his interest in the trust property and every person to whom a beneficiary transfers his interest acquires the rights and liabilities of the beneficiary at the date of the transfer.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

To transfer ownership, you will need to obtain a title change form from your DMV and complete it, naming the trustee (as trustee of your trust) as new owner. Sales tax should not apply to the transfer and if the clerk tries to apply it, you will need to speak to a supervisor.

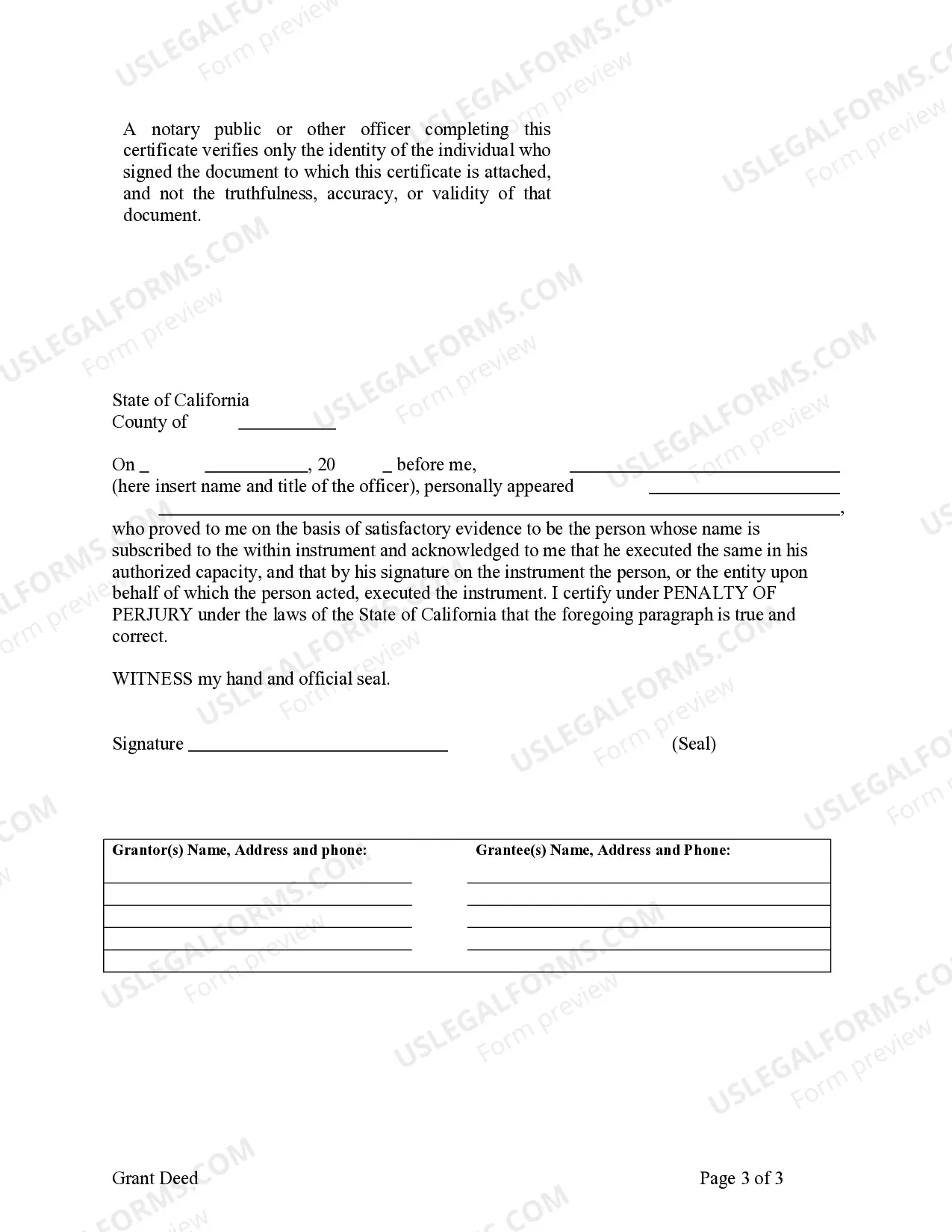

To make your trust valid in California, you simply need to sign the trust document ? that's it! You don't need to have your document witnessed or notarized to make it valid. However, many people choose to sign their document in the presence of a notary public to help authenticate the document.