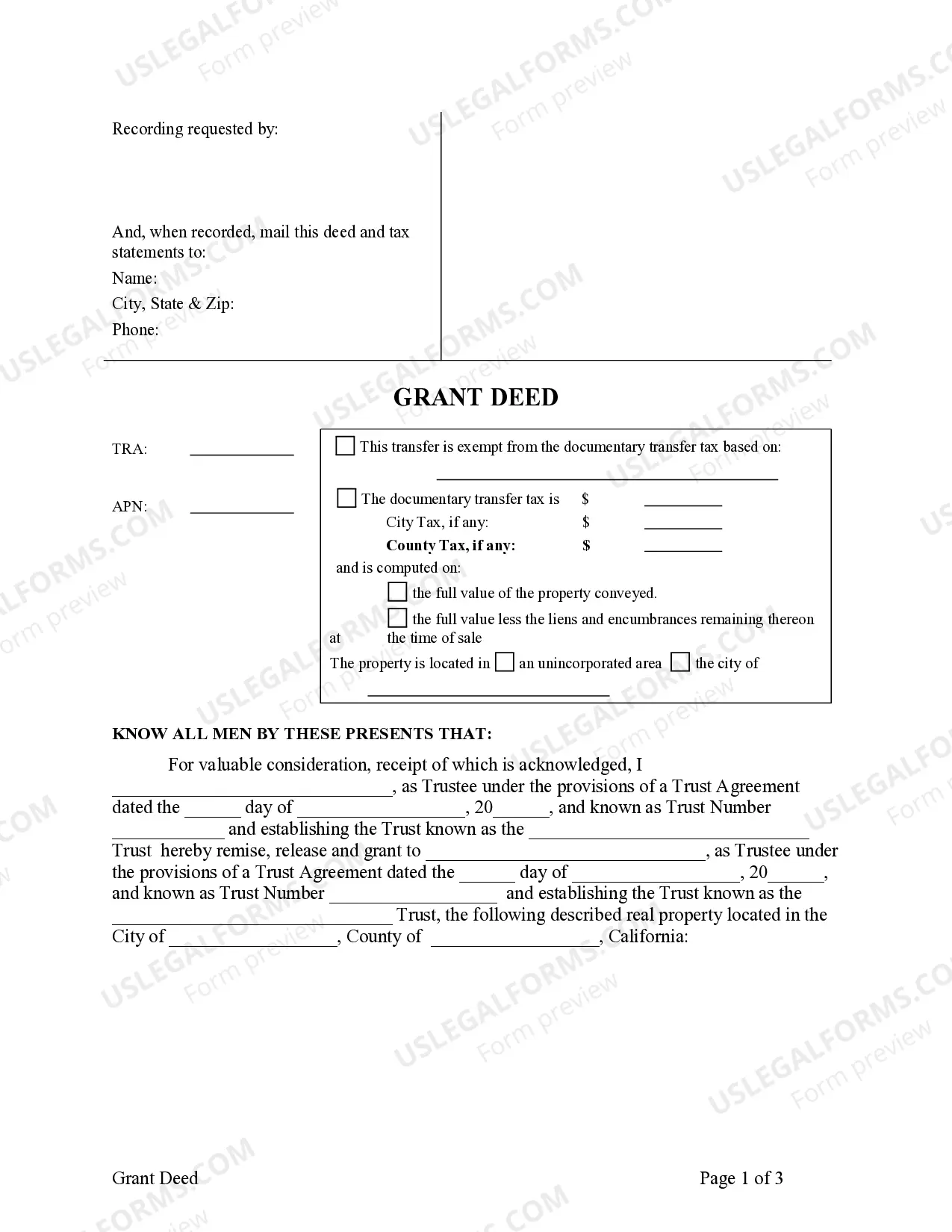

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

A Thousand Oaks California Grant Deed — Living Trust to Living Trust is a legal document utilized for transferring real property ownership between two living trusts in Thousand Oaks, California. It is an essential tool for estate planning and asset protection. This type of deed ensures a seamless transfer of property while maintaining the property's protection within the trust. The use of a grant deed provides legal assurance and prevents any misunderstandings or disputes regarding the transfer of ownership. Keywords: Thousand Oaks California, Grant Deed, Living Trust, real property ownership, estate planning, asset protection, transfer of property, legal assurance, disputes. Different types of Thousand Oaks California Grant Deed — Living Trust to Living Trust may include: 1. Revocable Living Trust to Revocable Living Trust: This type of grant deed allows the transfer of real property from one revocable living trust to another. The terms of the trusts can be modified, amended, or revoked by the granters, providing flexibility and control over the transferred assets. 2. Irrevocable Living Trust to Irrevocable Living Trust: Irrevocable living trusts are designed to protect assets from taxes, creditors, or potential lawsuits. This type of grant deed enables the transfer of property ownership between two irrevocable living trusts, ensuring the continued protection of the assets. 3. Joint Living Trust to Joint Living Trust: When a married couple creates a joint living trust to hold their assets, a grant deed can be used to transfer property ownership between the spouses' trusts. This type of grant deed allows for seamless transfers without affecting the protection and management of the joint assets. 4. Family Living Trust to Family Living Trust: Family living trusts are established to hold and distribute family assets effectively. The grant deed facilitates the transfer of real property ownership between different family trusts, thereby ensuring the continuity of asset protection and management within the family. Keywords: Revocable Living Trust, Irrevocable Living Trust, Joint Living Trust, Family Living Trust, asset protection, taxes, creditors, lawsuits, married couple, seamless transfers, management, distribution of assets.A Thousand Oaks California Grant Deed — Living Trust to Living Trust is a legal document utilized for transferring real property ownership between two living trusts in Thousand Oaks, California. It is an essential tool for estate planning and asset protection. This type of deed ensures a seamless transfer of property while maintaining the property's protection within the trust. The use of a grant deed provides legal assurance and prevents any misunderstandings or disputes regarding the transfer of ownership. Keywords: Thousand Oaks California, Grant Deed, Living Trust, real property ownership, estate planning, asset protection, transfer of property, legal assurance, disputes. Different types of Thousand Oaks California Grant Deed — Living Trust to Living Trust may include: 1. Revocable Living Trust to Revocable Living Trust: This type of grant deed allows the transfer of real property from one revocable living trust to another. The terms of the trusts can be modified, amended, or revoked by the granters, providing flexibility and control over the transferred assets. 2. Irrevocable Living Trust to Irrevocable Living Trust: Irrevocable living trusts are designed to protect assets from taxes, creditors, or potential lawsuits. This type of grant deed enables the transfer of property ownership between two irrevocable living trusts, ensuring the continued protection of the assets. 3. Joint Living Trust to Joint Living Trust: When a married couple creates a joint living trust to hold their assets, a grant deed can be used to transfer property ownership between the spouses' trusts. This type of grant deed allows for seamless transfers without affecting the protection and management of the joint assets. 4. Family Living Trust to Family Living Trust: Family living trusts are established to hold and distribute family assets effectively. The grant deed facilitates the transfer of real property ownership between different family trusts, thereby ensuring the continuity of asset protection and management within the family. Keywords: Revocable Living Trust, Irrevocable Living Trust, Joint Living Trust, Family Living Trust, asset protection, taxes, creditors, lawsuits, married couple, seamless transfers, management, distribution of assets.