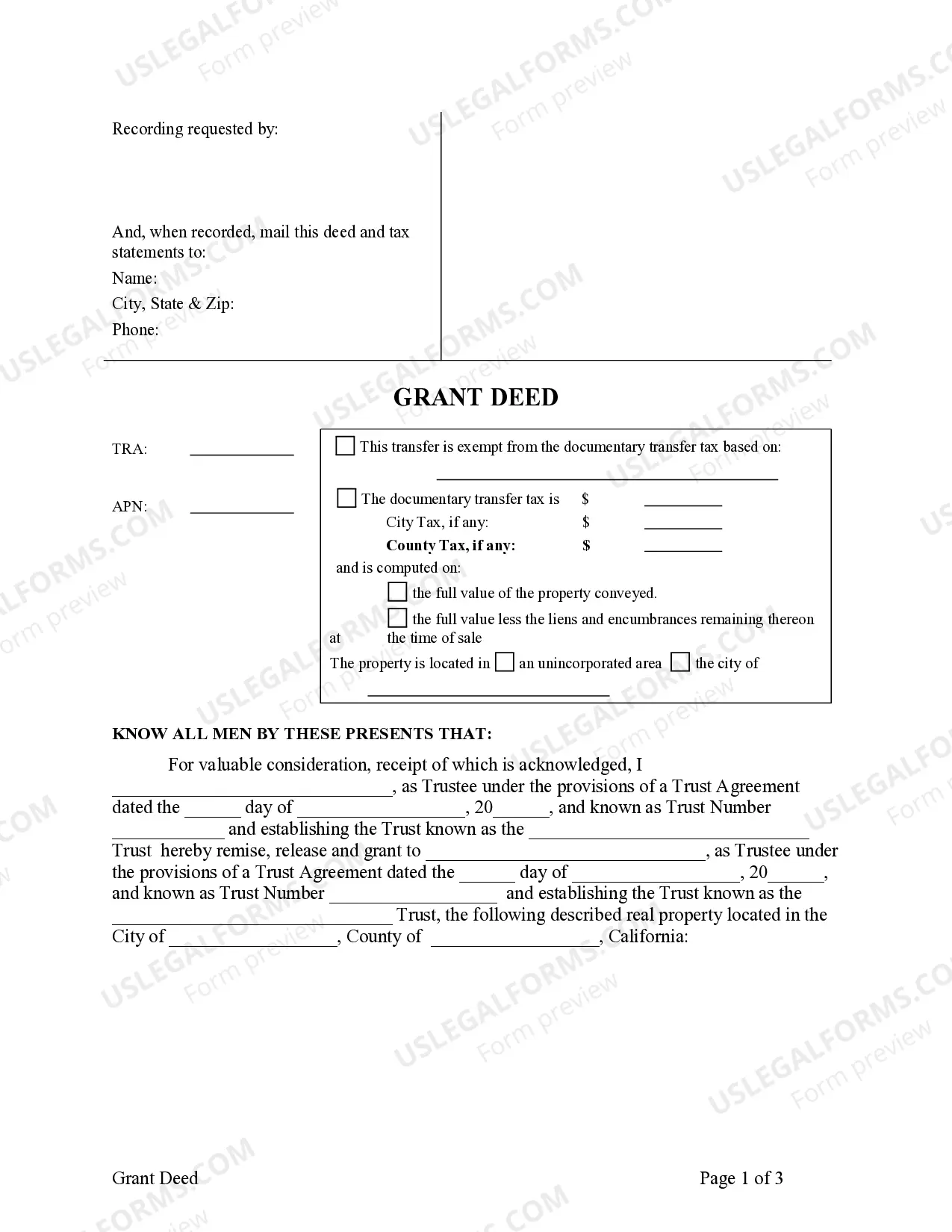

This form is a Grant Deed where the grantor is a living trust and the grantee is a living trust.

A West Covina California Grant Deed — Living Trust to Living Trust is a legal document that is used to transfer ownership of real property from one living trust to another living trust in the city of West Covina, California. This type of grant deed is specifically designed for individuals who have established a living trust and wish to transfer property into or between their trusts. One of the main advantages of using a grant deed to transfer property between living trusts is that it allows the transfer to occur without triggering a reassessment of the property's value for property tax purposes. This means that the property's assessed value for tax purposes remains unchanged, which can result in significant tax savings for the property owner. There are several variations or types of West Covina California Grant Deed — Living Trust to Living Trust, including: 1. Revocable Living Trust to Revocable Living Trust: This type of transfer involves transferring property from one living trust to another living trust, both of which are considered revocable as they can be modified or revoked by the trust creators (also known as granters) during their lifetimes. 2. Irrevocable Living Trust to Irrevocable Living Trust: This type of transfer involves transferring property from one living trust to another living trust, both of which are considered irrevocable as they cannot be modified or revoked by the trust creators once they are established. Irrevocable trusts are often used for estate planning purposes as they can offer additional asset protection and potential tax benefits. 3. Revocable Living Trust to Irrevocable Living Trust: This type of transfer involves transferring property from a revocable living trust (which can be modified or revoked) to an irrevocable living trust (which cannot be modified or revoked). This type of transfer is often done for estate planning purposes, such as minimizing estate taxes or protecting assets from potential creditors. Overall, a West Covina California Grant Deed — Living Trust to Living Trust provides a seamless and efficient way to transfer property between living trusts while maintaining the property's tax benefits and avoiding the need for the property to go through probate upon the trust creator's death. It is important to consult with a qualified attorney or estate planner to ensure that the transfer is executed correctly and in accordance with California laws.A West Covina California Grant Deed — Living Trust to Living Trust is a legal document that is used to transfer ownership of real property from one living trust to another living trust in the city of West Covina, California. This type of grant deed is specifically designed for individuals who have established a living trust and wish to transfer property into or between their trusts. One of the main advantages of using a grant deed to transfer property between living trusts is that it allows the transfer to occur without triggering a reassessment of the property's value for property tax purposes. This means that the property's assessed value for tax purposes remains unchanged, which can result in significant tax savings for the property owner. There are several variations or types of West Covina California Grant Deed — Living Trust to Living Trust, including: 1. Revocable Living Trust to Revocable Living Trust: This type of transfer involves transferring property from one living trust to another living trust, both of which are considered revocable as they can be modified or revoked by the trust creators (also known as granters) during their lifetimes. 2. Irrevocable Living Trust to Irrevocable Living Trust: This type of transfer involves transferring property from one living trust to another living trust, both of which are considered irrevocable as they cannot be modified or revoked by the trust creators once they are established. Irrevocable trusts are often used for estate planning purposes as they can offer additional asset protection and potential tax benefits. 3. Revocable Living Trust to Irrevocable Living Trust: This type of transfer involves transferring property from a revocable living trust (which can be modified or revoked) to an irrevocable living trust (which cannot be modified or revoked). This type of transfer is often done for estate planning purposes, such as minimizing estate taxes or protecting assets from potential creditors. Overall, a West Covina California Grant Deed — Living Trust to Living Trust provides a seamless and efficient way to transfer property between living trusts while maintaining the property's tax benefits and avoiding the need for the property to go through probate upon the trust creator's death. It is important to consult with a qualified attorney or estate planner to ensure that the transfer is executed correctly and in accordance with California laws.