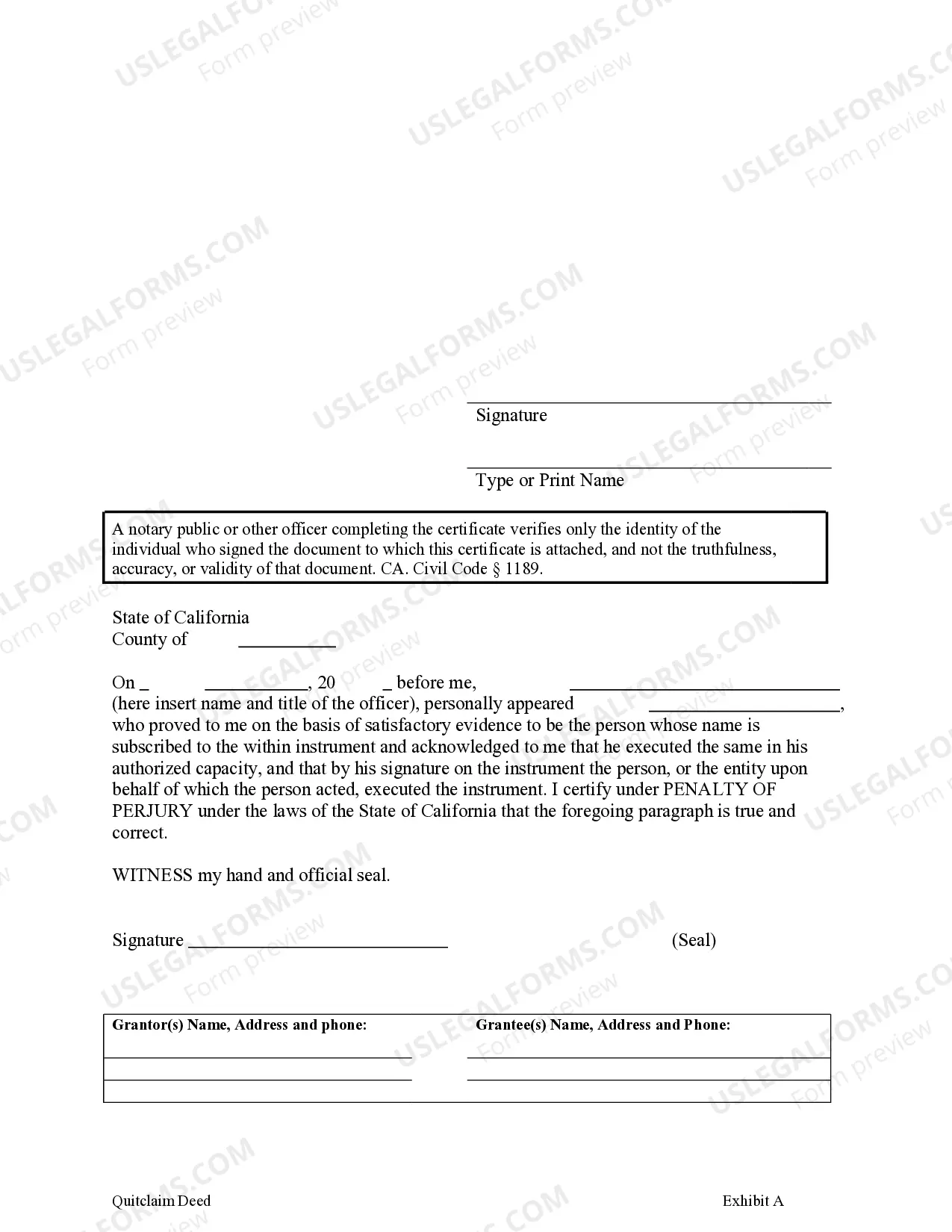

This form is a Quitclaim Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

A San Jose, California Quitclaim Deed from one Individual to Two Individuals as Joint Tenants is a legal document used to transfer ownership of a property from one individual (the granter) to two individuals (the grantees) in joint tenancy. This type of deed is commonly used when the granter wants to transfer their property rights to multiple individuals who will share equal ownership and have survivorship rights. Joint tenancy means that both grantees will hold an undivided interest in the property, with each having the right of survivorship. This means that if one of the joint tenants passes away, their share automatically transfers to the surviving joint tenant(s) outside the probate process. The quitclaim deed is a specific type of deed used to transfer the granter's ownership interest in a property without making any warranties or guarantees about the property's title. It simply conveys whatever interest the granter holds at the time of the transfer, if any. Unlike other types of deeds, such as warranty deeds or grant deeds, a quitclaim deed does not provide any assurance that the title is free from defects or encumbrances. There may be different variations of the San Jose, California Quitclaim Deed from one Individual to Two Individuals as Joint Tenants, depending on specific circumstances or requirements. Some possible variations include: 1. San Jose, California Quitclaim Deed with Right of Survivorship: This variation explicitly states that the transfer is intended to create a joint tenancy with the right of survivorship between the grantees, ensuring that if one passes away, their share automatically transfers to the surviving joint tenant(s). 2. San Jose, California Quitclaim Deed with Affidavit of Title: This version includes an affidavit of title, which is a sworn statement by the granter declaring that they hold clear and marketable title to the property being transferred. This provides some level of assurance to the grantees regarding the title's validity. 3. San Jose, California Quitclaim Deed for Tax Purposes: This type of quitclaim deed is used when the transfer is primarily for tax planning purposes, such as gift tax or estate planning. It may contain specific language related to these purposes and requires proper consideration of tax implications. It is important to note that while a quitclaim deed is a legally binding document, it does not provide the same level of protection or assurance as other types of deeds. Furthermore, it is generally recommended consulting with a real estate attorney or other qualified professional when preparing or executing a quitclaim deed, to ensure the transfer is done properly and to understand any potential risks or implications.