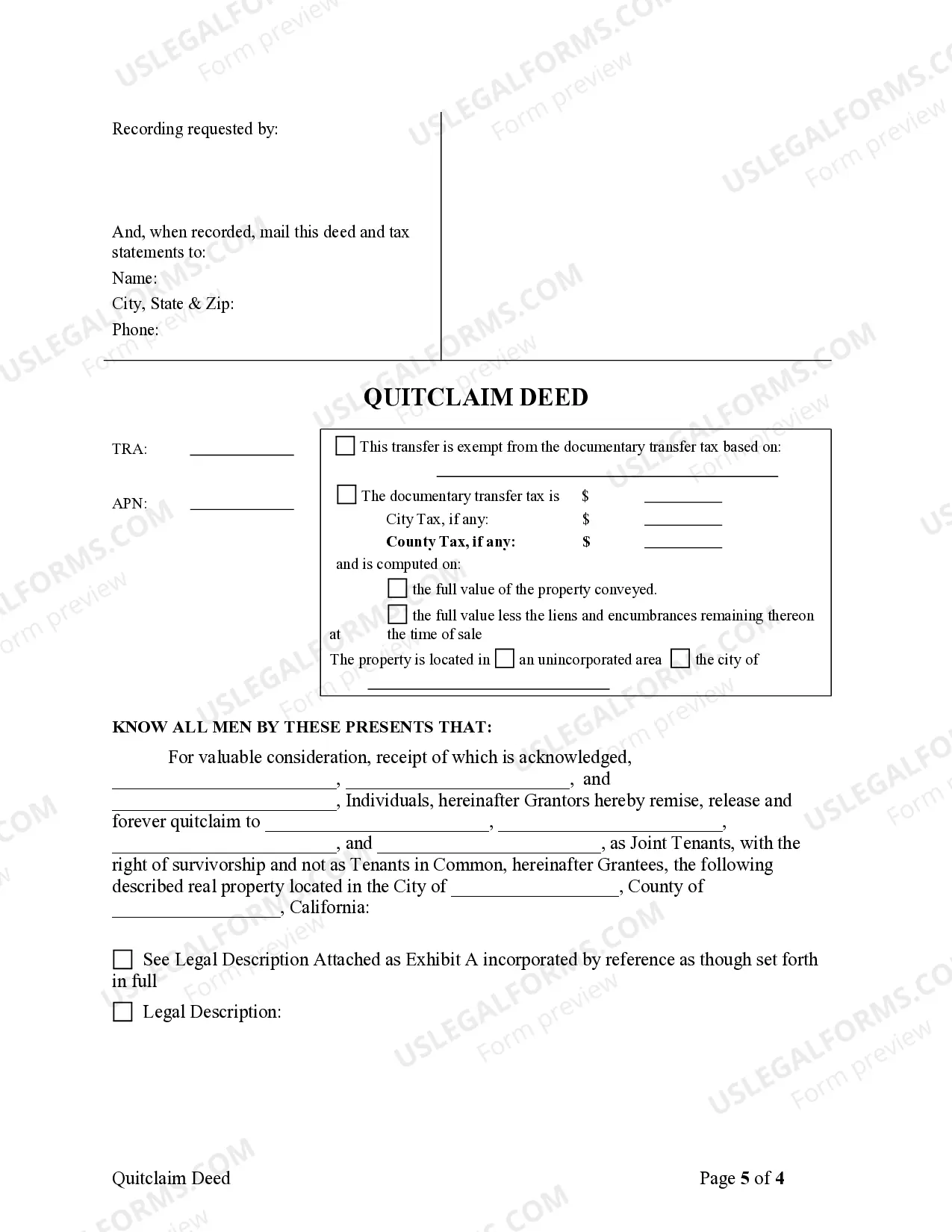

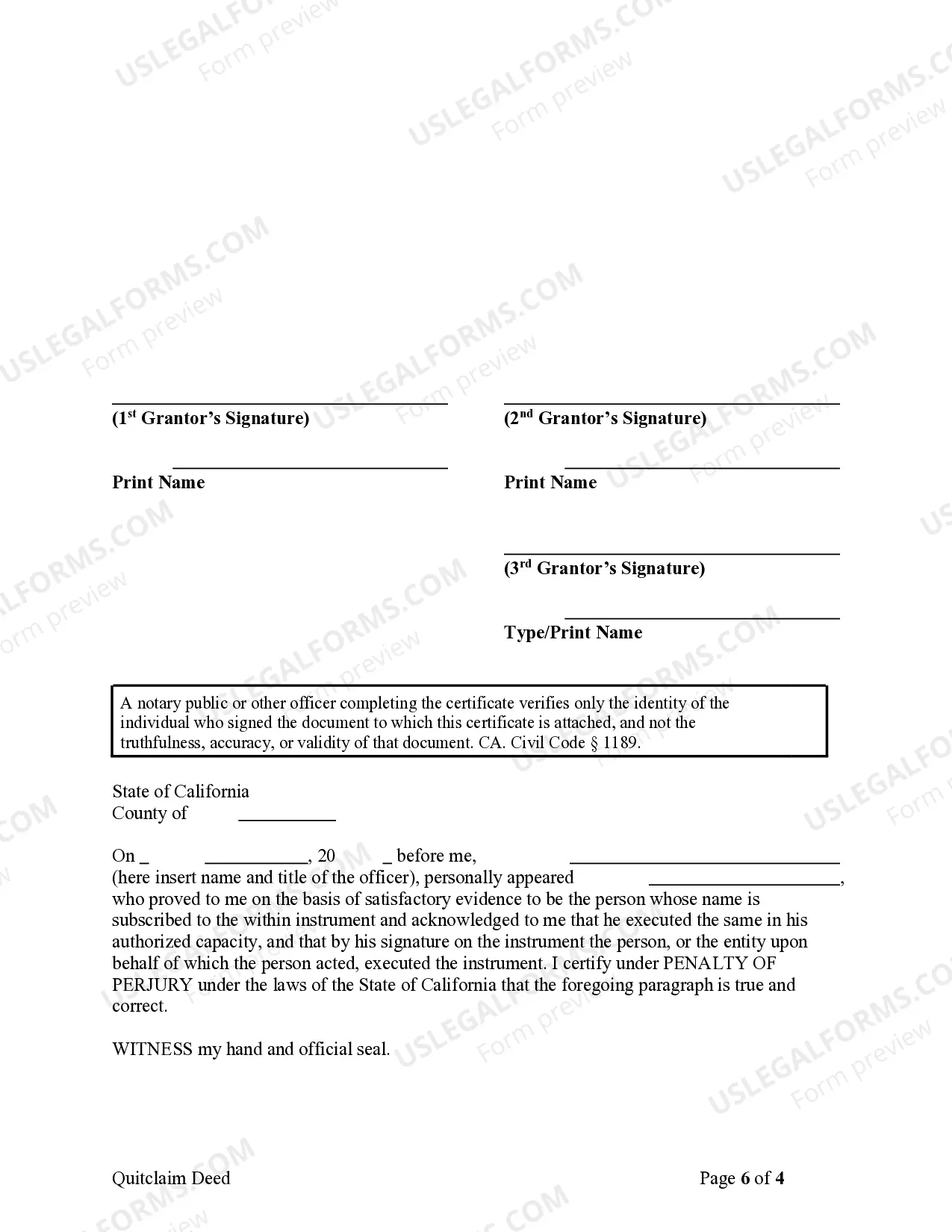

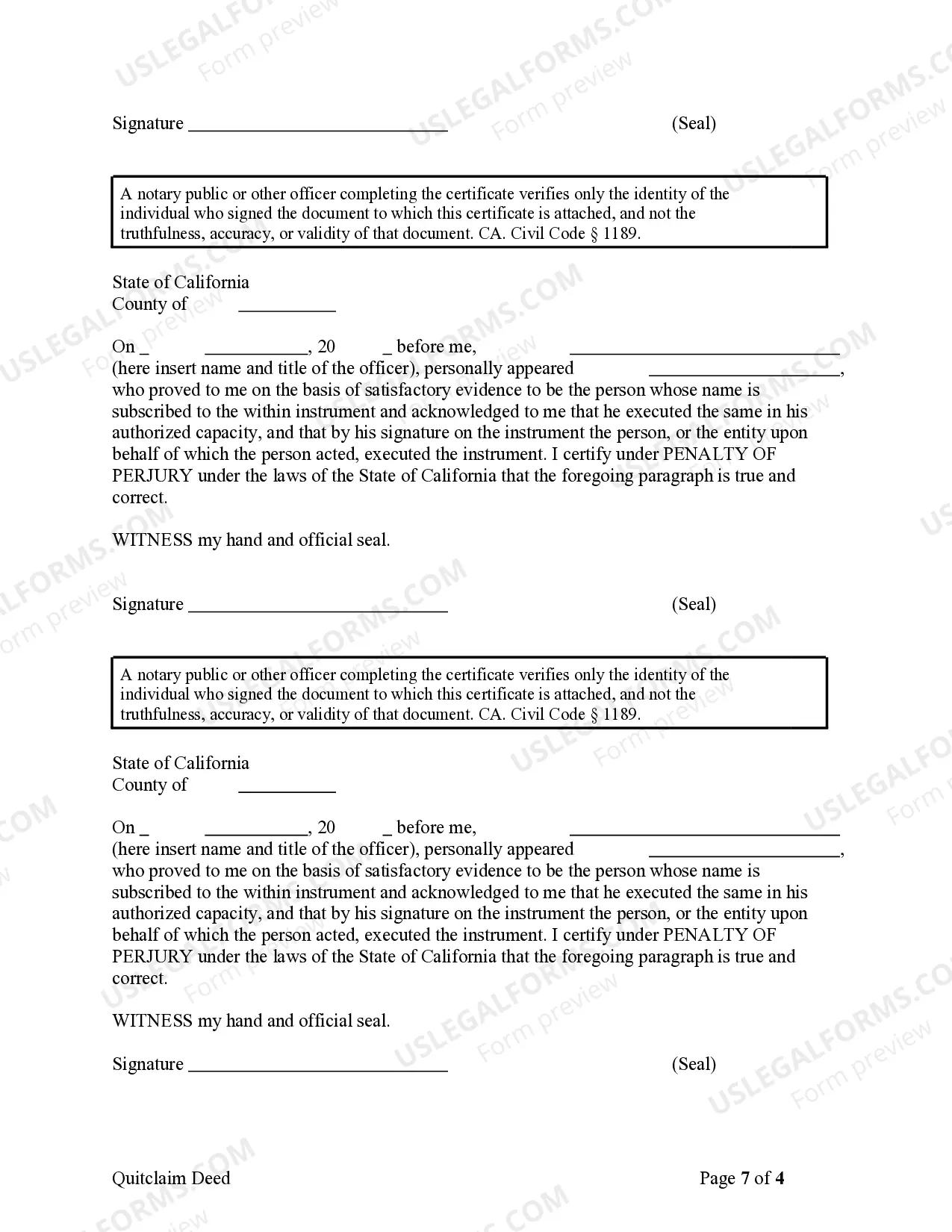

This form is a Quitclaim Deed where the grantors are three individuals and the grantees are four individuals holding title as joint tenants.

A Santa Clara California Quitclaim Deed for Three Individuals to Four Individuals as Joint Tenants is a legal document that facilitates the transfer of ownership from three individuals to four individuals, all becoming joint tenants in the property located in Santa Clara, California. This deed acts as evidence of the transfer and outlines the specifics of the transaction. Keywords: Santa Clara California, Quitclaim Deed, Three Individuals, Four Individuals, Joint Tenants, property ownership transfer, legal document, investment property. There are different types of Santa Clara California Quitclaim Deed for Three Individuals to Four Individuals as Joint Tenants, which may include: 1. Residential Property Quitclaim Deed: This type of quitclaim deed is used when the property being transferred is a residential dwelling, such as a house or an apartment building. 2. Commercial Property Quitclaim Deed: In case the property being transferred is a commercial building or land, this type of quitclaim deed is used. It ensures the transfer of ownership rights from the three individuals to the four individuals, with all parties becoming joint tenants. 3. Investment Property Quitclaim Deed: If the property being transferred is an investment property, such as a rental property or a vacation home, this specific quitclaim deed is used. It allows the transfer of ownership rights to the four individuals, who will collectively own the property as joint tenants. 4. Agricultural Property Quitclaim Deed: When the property in question is agricultural land or a farm, this type of quitclaim deed is employed. It enables the transfer of ownership from three individuals to four individuals, establishing them as joint tenants of the agricultural property. In all cases, the Santa Clara California Quitclaim Deed for Three Individuals to Four Individuals as Joint Tenants serves as crucial documentation in facilitating a legal transfer of ownership rights. It delineates the roles and responsibilities of each individual, establishes joint tenancy, and ensures clarity in property ownership dynamics.