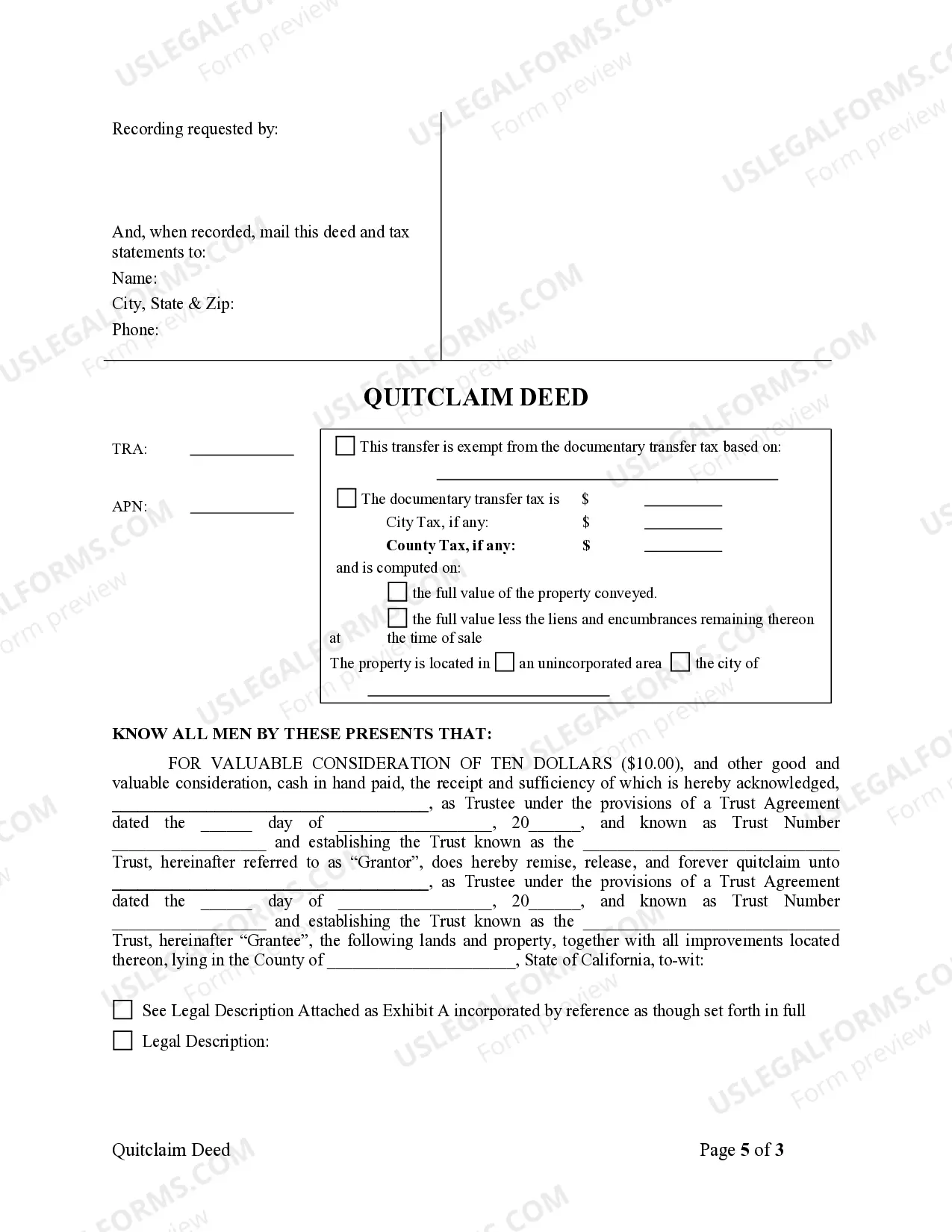

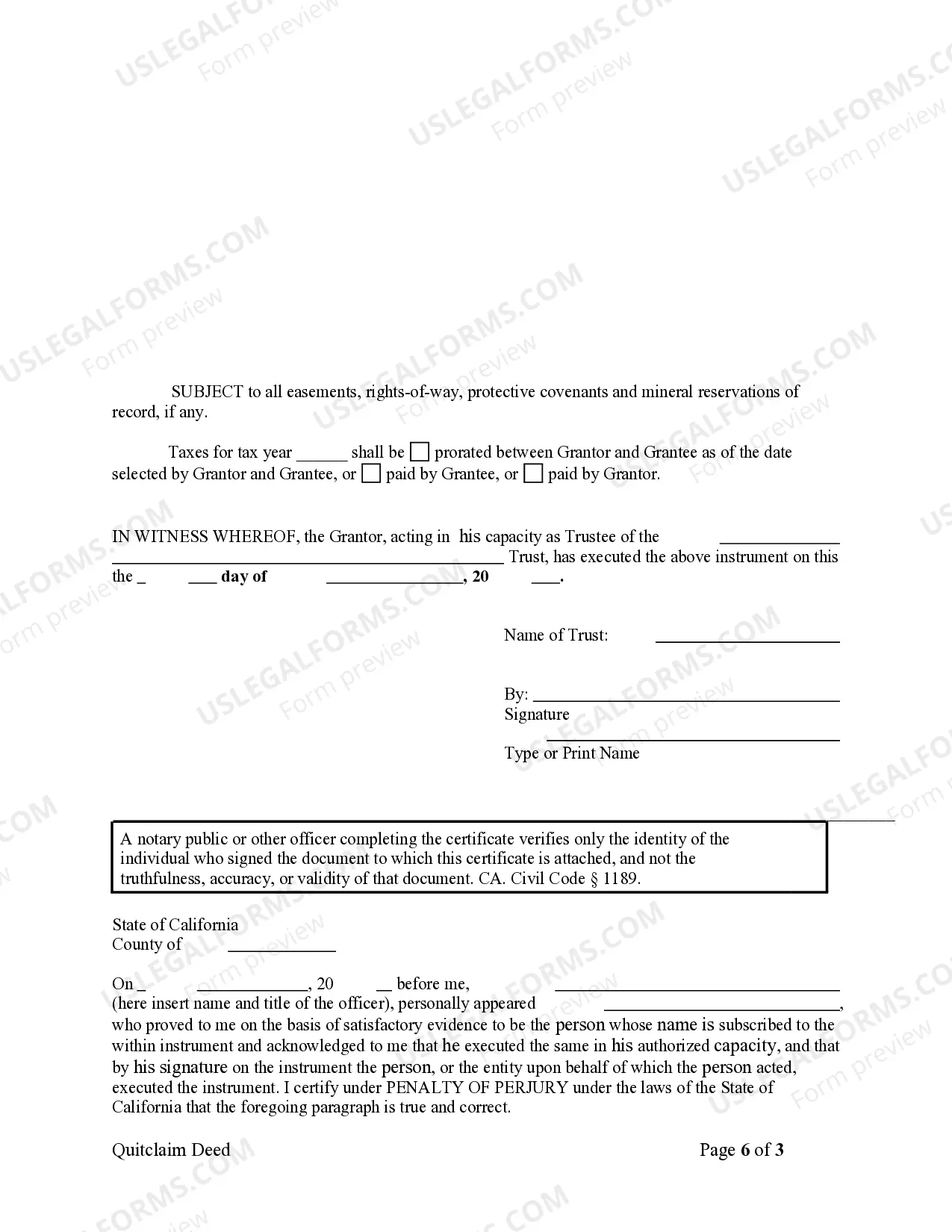

This form is a Quitclaim Deed where the grantor is a trust and the grantee is a trust.

A Downey California Quitclaim Deed for Trust to Trust is a legal document used in real estate transactions to transfer ownership of a property from one trust to another trust. This specific type of deed is commonly utilized when the primary purpose is changing the ownership or structure of a property held by a trust. The Downey California Quitclaim Deed for Trust to Trust involves the transfer of a property without any warranties or guarantees of ownership, implying that the property is transferring "as is." This means that the granter of the deed (the trust transferring the property) does not guarantee that they have clear title to the property, nor guarantee that the property is free from any liens or encumbrances. It is vital for both the granter and grantee trusts to fully understand the implications and consequences of using a quitclaim deed, as it is generally recommended for situations where the parties involved already have a high level of trust and certainty in the ownership chain and status of the property. Several types of Downey California Quitclaim Deed for Trust to Trust may exist, depending on the specific circumstances and requirements of the transaction. Some variations include: 1. Interviews Trust to Revocable Living Trust: This type of quitclaim deed may be used when a property is initially owned by an interviews trust (commonly known as a living trust) but requires transfer to a new revocable living trust due to changes in beneficiary designations or other factors. This allows for a seamless transfer of property ownership within the trust structure. 2. Living Trust to Special Needs Trust: In cases where a person with special needs has a property held under their living trust, but a special needs trust is established to protect their eligibility for various government benefits, a Downey California Quitclaim Deed for Trust to Trust can facilitate the transfer of the property from the living trust to the special needs trust. This ensures the appropriate structure is in place to safeguard the individual's financial well-being. 3. Family Trust to Charitable Remainder Unit rust: Often, families who wish to make a charitable donation of a property held in their family trust may use a quitclaim deed to transfer the property to a charitable remainder unit rust. This arrangement allows the family to receive income from the property during their lifetime while providing a significant contribution to a charitable organization. It is important to consult a qualified real estate attorney or a legal professional specializing in trust law to ensure the proper preparation and execution of a Downey California Quitclaim Deed for Trust to Trust. This will help to guarantee that the transfer of property ownership within the trust structure is legally enforceable and meets all applicable state regulations.A Downey California Quitclaim Deed for Trust to Trust is a legal document used in real estate transactions to transfer ownership of a property from one trust to another trust. This specific type of deed is commonly utilized when the primary purpose is changing the ownership or structure of a property held by a trust. The Downey California Quitclaim Deed for Trust to Trust involves the transfer of a property without any warranties or guarantees of ownership, implying that the property is transferring "as is." This means that the granter of the deed (the trust transferring the property) does not guarantee that they have clear title to the property, nor guarantee that the property is free from any liens or encumbrances. It is vital for both the granter and grantee trusts to fully understand the implications and consequences of using a quitclaim deed, as it is generally recommended for situations where the parties involved already have a high level of trust and certainty in the ownership chain and status of the property. Several types of Downey California Quitclaim Deed for Trust to Trust may exist, depending on the specific circumstances and requirements of the transaction. Some variations include: 1. Interviews Trust to Revocable Living Trust: This type of quitclaim deed may be used when a property is initially owned by an interviews trust (commonly known as a living trust) but requires transfer to a new revocable living trust due to changes in beneficiary designations or other factors. This allows for a seamless transfer of property ownership within the trust structure. 2. Living Trust to Special Needs Trust: In cases where a person with special needs has a property held under their living trust, but a special needs trust is established to protect their eligibility for various government benefits, a Downey California Quitclaim Deed for Trust to Trust can facilitate the transfer of the property from the living trust to the special needs trust. This ensures the appropriate structure is in place to safeguard the individual's financial well-being. 3. Family Trust to Charitable Remainder Unit rust: Often, families who wish to make a charitable donation of a property held in their family trust may use a quitclaim deed to transfer the property to a charitable remainder unit rust. This arrangement allows the family to receive income from the property during their lifetime while providing a significant contribution to a charitable organization. It is important to consult a qualified real estate attorney or a legal professional specializing in trust law to ensure the proper preparation and execution of a Downey California Quitclaim Deed for Trust to Trust. This will help to guarantee that the transfer of property ownership within the trust structure is legally enforceable and meets all applicable state regulations.