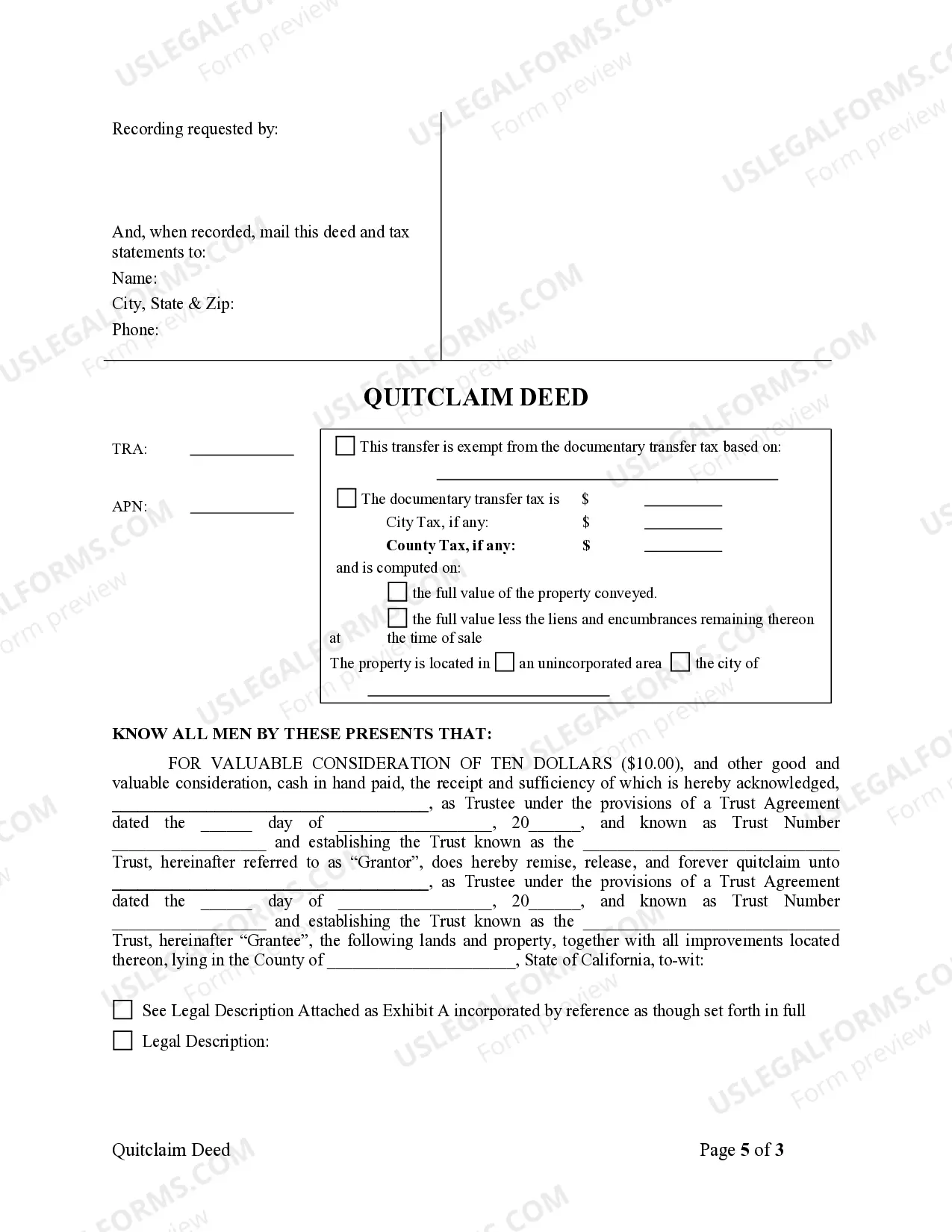

This form is a Quitclaim Deed where the grantor is a trust and the grantee is a trust.

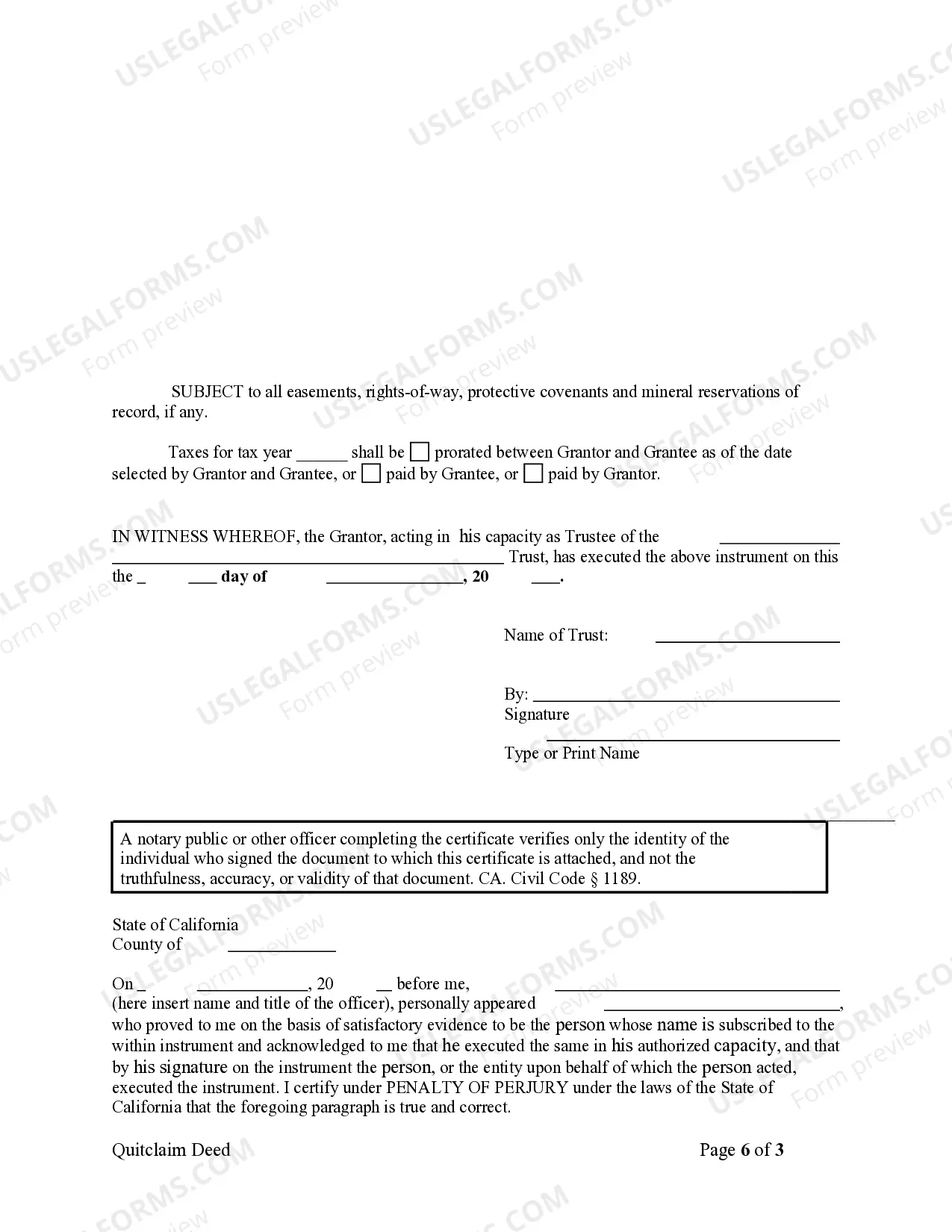

Palmdale California Quitclaim Deed for Trust to Trust: A Detailed Description A Palmdale California Quitclaim Deed for Trust to Trust is a legal document that allows the transfer of property ownership from one trust to another in the city of Palmdale, located in the state of California. This type of deed is commonly used when there is a need to transfer property ownership within a trust, ensuring a smooth transition. It is important to accurately prepare and execute this deed to comply with all legal requirements. The Palmdale California Quitclaim Deed for Trust to Trust includes several essential elements to ensure a valid transfer of property. Firstly, the document clearly identifies the parties involved, both the granting trust and the receiving trust. Detailed information about the property being transferred, such as the physical address, legal description, and parcel number, is also included. Furthermore, this quitclaim deed states that the granting trust transfers all of its right, title, and interest in the property to the receiving trust. It is crucial to explicitly state the nature of the transfer as a quitclaim, which means the granting trust makes no warranties or guarantees about the property's title or condition. Additionally, the deed should be signed and acknowledged by the trustee(s) of both trusts involved. Signatures should be properly witnessed and notarized. It is advisable to consult a legal professional or a real estate attorney to ensure the compliance of the deed with all relevant laws and regulations in Palmdale, California. Different types of Palmdale California Quitclaim Deed for Trust to Trust may include variations in their purposes or the specific trusts involved. Some common examples include: 1. Revocable Living Trust to Irrevocable Trust Quitclaim Deed: This type of quitclaim deed allows for the transfer of property from a revocable living trust, which can be amended or terminated by the granter(s), to an irrevocable trust, which typically is more permanent and provides certain benefits such as asset protection or tax advantages. 2. Family Trust to Charitable Trust Quitclaim Deed: Here, property ownership is transferred from a family trust to a charitable trust. This type of transfer might occur when the family wishes to donate a property to a charitable organization for a philanthropic cause. 3. Special Needs Trust to Supplemental Needs Trust Quitclaim Deed: This quitclaim deed facilitates the transfer of property from a special needs trust, intended to protect the assets of an individual with special needs while maintaining eligibility for public benefits, to a supplemental needs trust, which provides additional financial support to improve the individual's quality of life. Using the Palmdale California Quitclaim Deed for Trust to Trust ensures a legally binding transfer of property ownership between trusts, serving as a critical tool for managing the assets within trusts. However, it is crucial to seek professional legal advice before executing any such deed to ensure compliance with all applicable laws and regulations.