This form is a Quitclaim Deed where the grantor is a trust and the grantee is a trust.

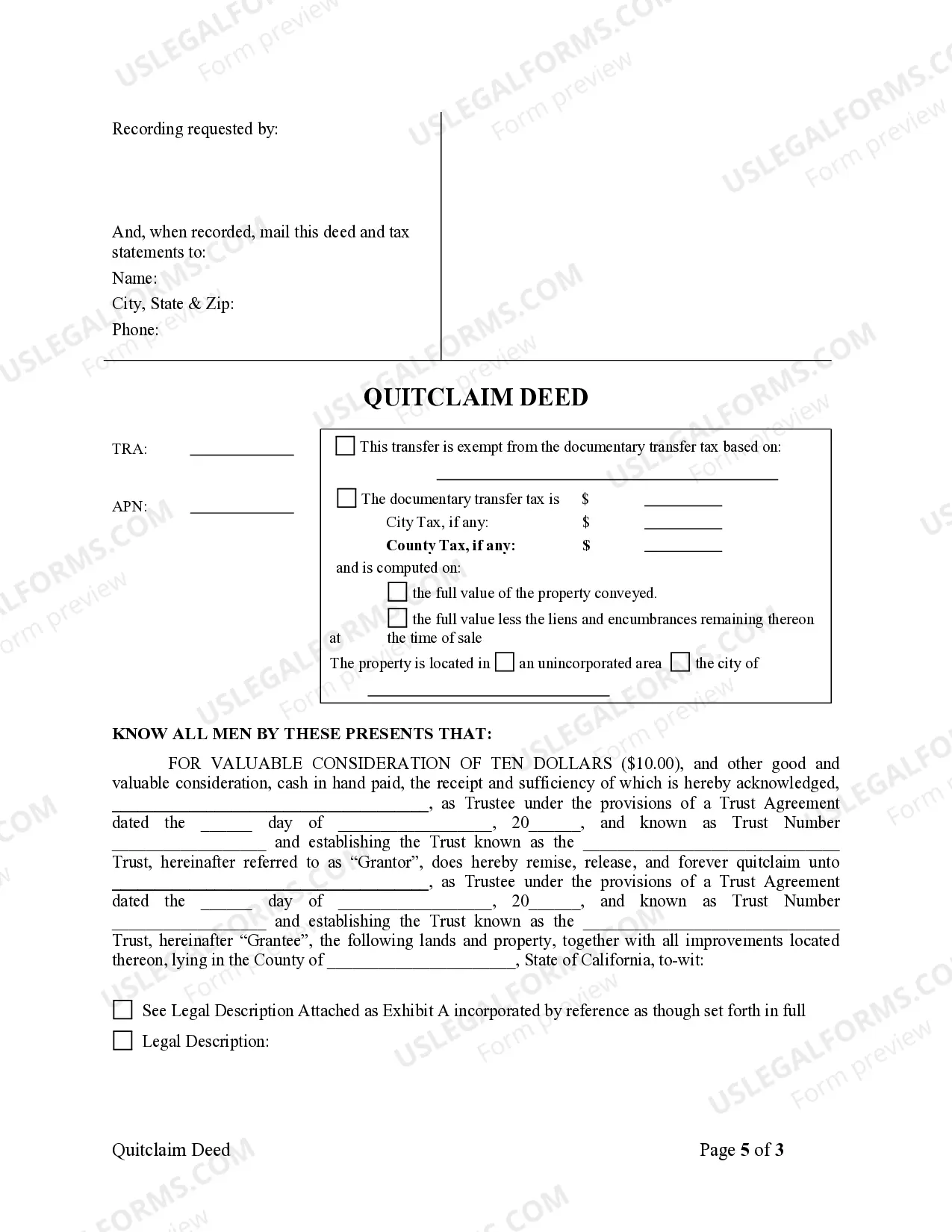

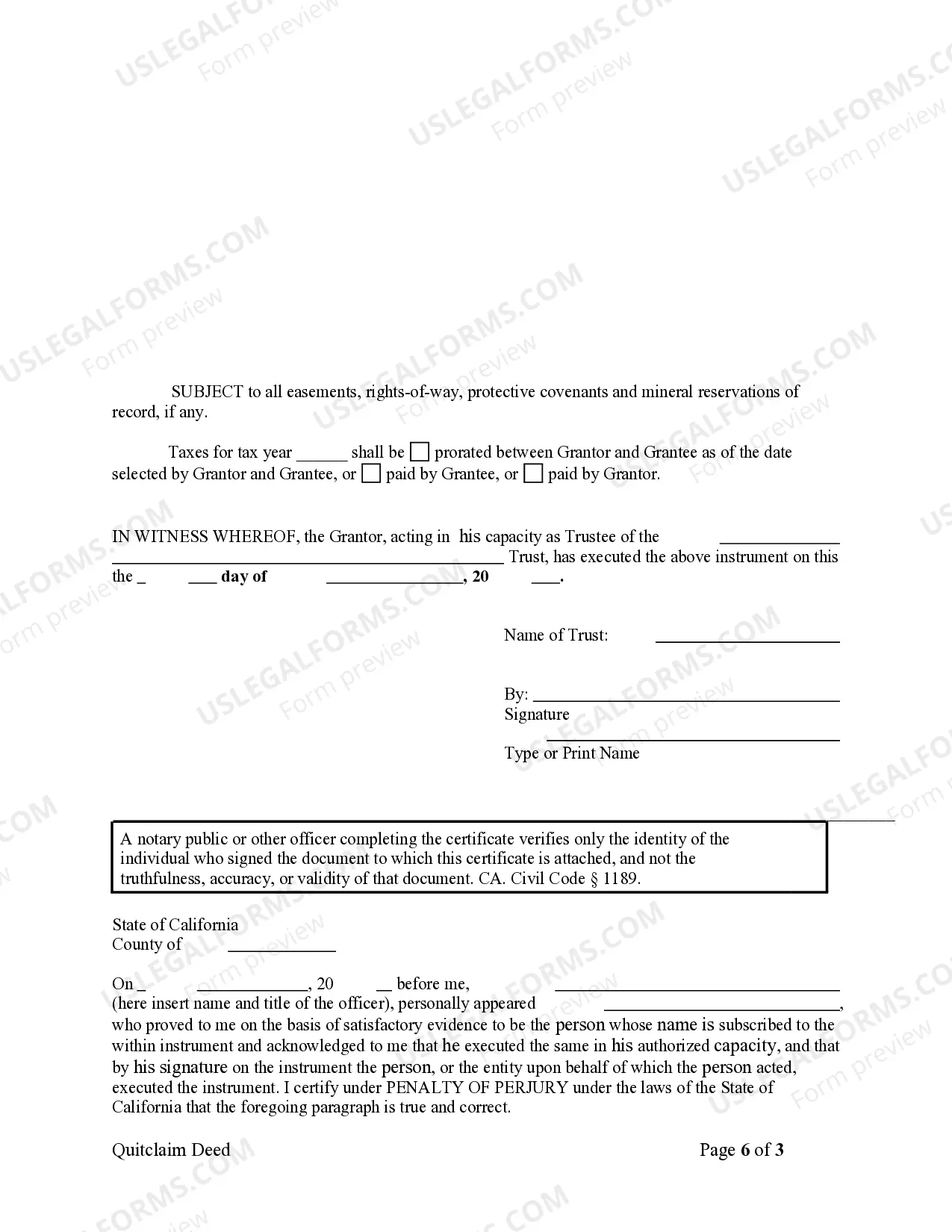

The Simi Valley California Quitclaim Deed for Trust to Trust is a legal instrument used to transfer property ownership between two trusts. It allows for a seamless transfer of property assets without going through the traditional buying and selling processes. This type of deed is commonly utilized in estate planning, asset protection, and business succession planning. Through a Quitclaim Deed for Trust to Trust, the granter (the current trust) conveys the property to the grantee (the new trust) without making any warranties or guarantees. It simply transfers the interest or claim, if any, that the granter holds in the property. This means that the grantee accepts the property in its current condition, with no assurances regarding potential liens, encumbrances, or other claims. Simi Valley, located in Southern California, boasts various types of Quitclaim Deeds for Trust to Trust that serve different purposes. These include: 1. Simi Valley California Inter Vivos Trust to Testamentary Trust Quitclaim Deed: This type of Quitclaim Deed serves the purpose of transferring property assets between an inter vivos trust (a trust created during the granter's lifetime) and a testamentary trust (a trust established through a will). 2. Simi Valley California Revocable Trust to Irrevocable Trust Quitclaim Deed: This Quitclaim Deed facilitates the transfer of property from a revocable trust (a trust that can be modified or revoked by the granter) to an irrevocable trust (a trust that cannot be altered or revoked without the consent of the beneficiaries). 3. Simi Valley California Living Trust to Special Needs Trust Quitclaim Deed: This specific type of Quitclaim Deed enables the transfer of property ownership from a living trust (established to manage one's assets during their lifetime) to a special needs trust (created to provide for individuals with disabilities in a way that doesn't affect government benefits they may receive). 4. Simi Valley California Family Trust to Charitable Trust Quitclaim Deed: This Quitclaim Deed permits the transfer of property between a family trust (designed to manage and distribute family assets) and a charitable trust (established for the benefit of a charitable organization or cause). In conclusion, the Simi Valley California Quitclaim Deed for Trust to Trust is an essential legal document used for intertrust property transfers. With various types available, individuals and organizations can strategically plan their asset management, estate planning, and philanthropic endeavors. It is recommended to consult with a qualified attorney or real estate professional before executing any quitclaim deed to ensure compliance with local regulations and to address any specific needs or concerns.