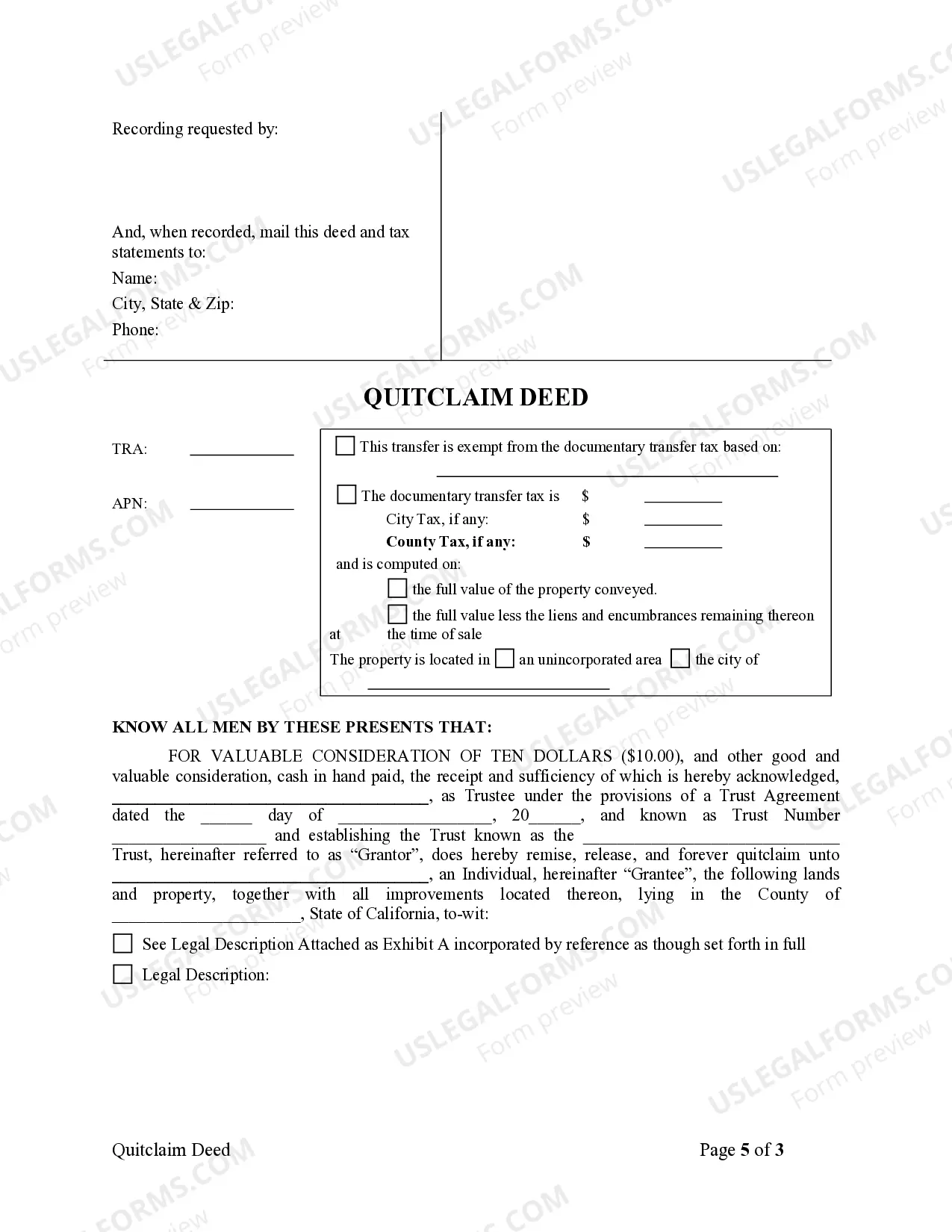

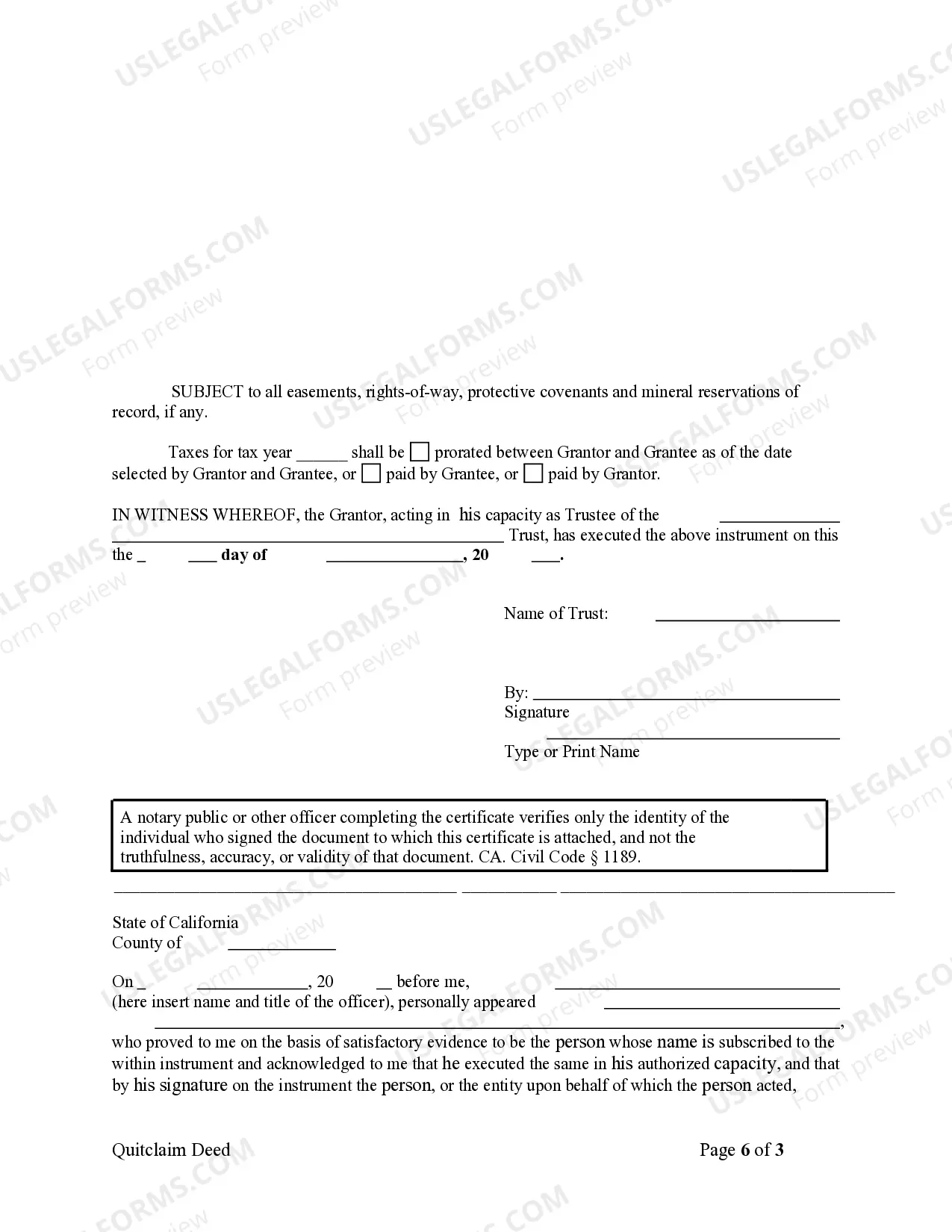

This form is a Quitclaim Deed where the grantor is a Trust and the grantee is an individual.

The Alameda California Quitclaim Deed — Trust to Individual is a legal document used to transfer ownership of real estate from a trust to an individual. This type of deed is commonly utilized when a property owner wishes to transfer the property to a beneficiary or remove it from the trust. It's important to understand the specific requirements and variations of the Alameda California Quitclaim Deed — Trust to Individual, as there may be different types available. Some common variations of this deed include: 1. Alameda County Trust to Individual Quitclaim Deed: This specific type refers to the transfer of property situated within Alameda County, California. It is crucial to mention the county in the description as certain requirements and procedures can vary from one county to another in California. 2. Alameda California Quitclaim Deed — Trust to Individual with Consideration: This variation includes a monetary consideration. This means that the individual receiving the property must pay a certain amount to the trust for the transfer to take place. The consideration can be in the form of cash, check, or promissory note. 3. Alameda California Quitclaim Deed — Trust to Individual without Consideration: Unlike the previous variation, this type of deed transfer occurs without any monetary consideration. It is often used for gifting property to family members or transferring property between spouses. 4. Alameda California Quitclaim Deed — Trust to Individual with Reservation of Life Estate: In this variation, the individual receiving the property does so with a reservation of a life estate. This means that the original property owner retains the right to live on the property for the duration of their lifetime. After the owner's death, the property fully transfers to the individual. When preparing an Alameda California Quitclaim Deed — Trust to Individual, it's essential to consult with an experienced real estate attorney who specializes in California law, especially in Alameda County. They can provide guidance on the specific requirements, legal obligations, and potential tax implications associated with the type of deed transfer being pursued. It's crucial to ensure that the deed is accurately drafted, signed, witnessed, and recorded in the appropriate county office to establish a valid transfer of property ownership.The Alameda California Quitclaim Deed — Trust to Individual is a legal document used to transfer ownership of real estate from a trust to an individual. This type of deed is commonly utilized when a property owner wishes to transfer the property to a beneficiary or remove it from the trust. It's important to understand the specific requirements and variations of the Alameda California Quitclaim Deed — Trust to Individual, as there may be different types available. Some common variations of this deed include: 1. Alameda County Trust to Individual Quitclaim Deed: This specific type refers to the transfer of property situated within Alameda County, California. It is crucial to mention the county in the description as certain requirements and procedures can vary from one county to another in California. 2. Alameda California Quitclaim Deed — Trust to Individual with Consideration: This variation includes a monetary consideration. This means that the individual receiving the property must pay a certain amount to the trust for the transfer to take place. The consideration can be in the form of cash, check, or promissory note. 3. Alameda California Quitclaim Deed — Trust to Individual without Consideration: Unlike the previous variation, this type of deed transfer occurs without any monetary consideration. It is often used for gifting property to family members or transferring property between spouses. 4. Alameda California Quitclaim Deed — Trust to Individual with Reservation of Life Estate: In this variation, the individual receiving the property does so with a reservation of a life estate. This means that the original property owner retains the right to live on the property for the duration of their lifetime. After the owner's death, the property fully transfers to the individual. When preparing an Alameda California Quitclaim Deed — Trust to Individual, it's essential to consult with an experienced real estate attorney who specializes in California law, especially in Alameda County. They can provide guidance on the specific requirements, legal obligations, and potential tax implications associated with the type of deed transfer being pursued. It's crucial to ensure that the deed is accurately drafted, signed, witnessed, and recorded in the appropriate county office to establish a valid transfer of property ownership.